Andre's End of Year Tasks 2023

Hey FAANG FIRE!

This is the final post of 2023, I head off to Texas and Florida later this week!

What a freaking year. This newsletter goes through my end of year routine as well as some personal reflections on the year as a whole. 2024 will be the first time I start the year without a W2 income since ~2009! Thank you for being on this journey with me.

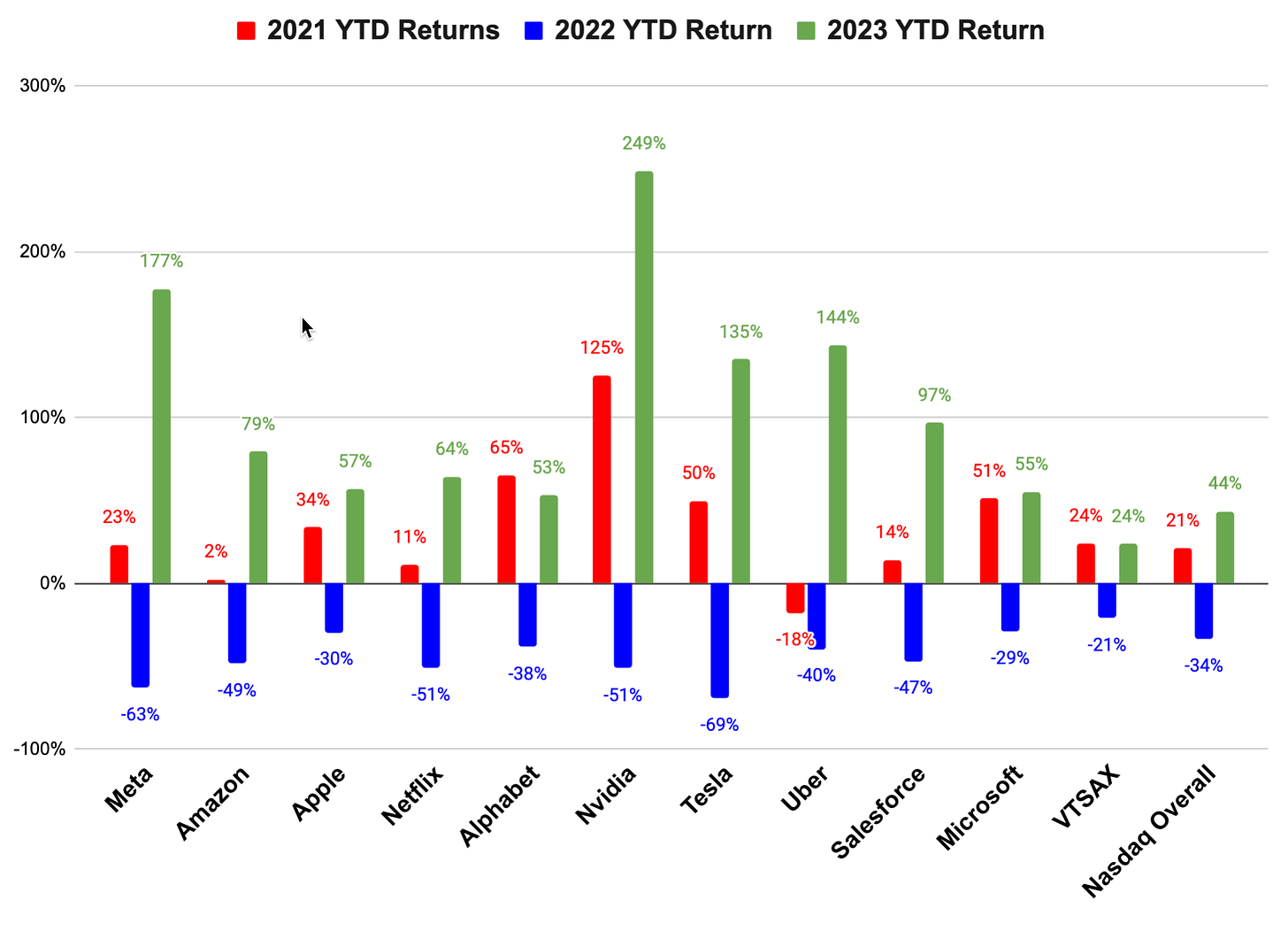

Seriously, look at this year vs the past two years. My neck hurts from the whip lash.

End of Year Tasks

Step 1: Estimate Your Tax Bill (Seriously)

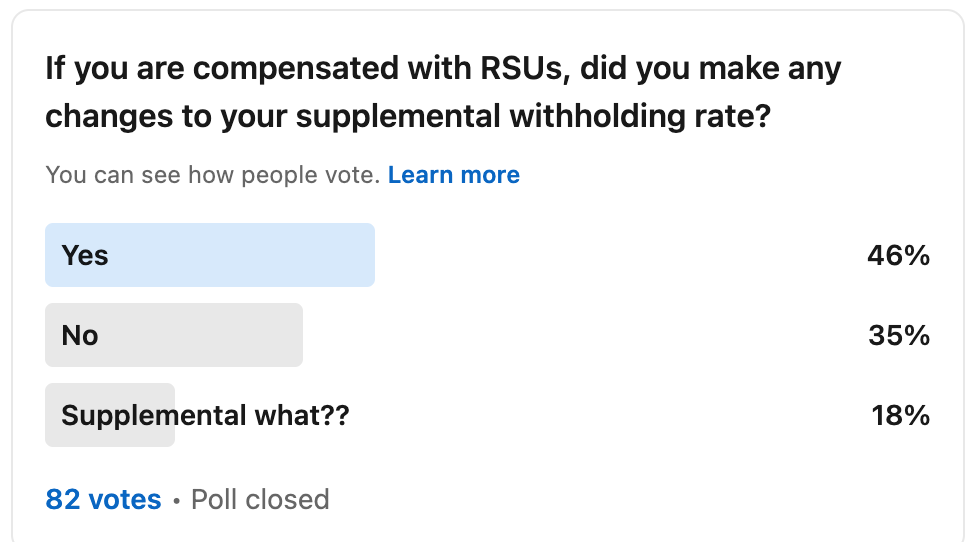

Most of you with W2 incomes have at most 1 paycheck left in the year. You already have the vast majority of information you need to quickly estimate your tax bill. I created a simple tool to estimate your federal taxes. If RSUs make up a significant portion of your income, and you don’t know what supplemental withholdings are, this is extra important. Which according to my linkedin poll is many of my readers!

Step 2: Look at Calendar Year Based Investments

Backdoor Roth IRA: It might be too late to make adjustments to this years 401k but you can still contribute to a Back Door Roth (please don’t do this if you have a traditional IRA with a balance, it will lead to a pain in the ass other wise known as the Pro Rata Rule). You can contribute $6,000 in 2021.

iBonds: As mentioned previously I am not purchasing iBonds in 2023. I like to include them here though since many people do like buying their $10k annual limit.

Step 3: Look for Tax Gain/Loss Harvesting Opportunities

The following is not tax advice! Things can get a little hairy, make sure to do your own research, and even consult a tax professional who understands this stuff.

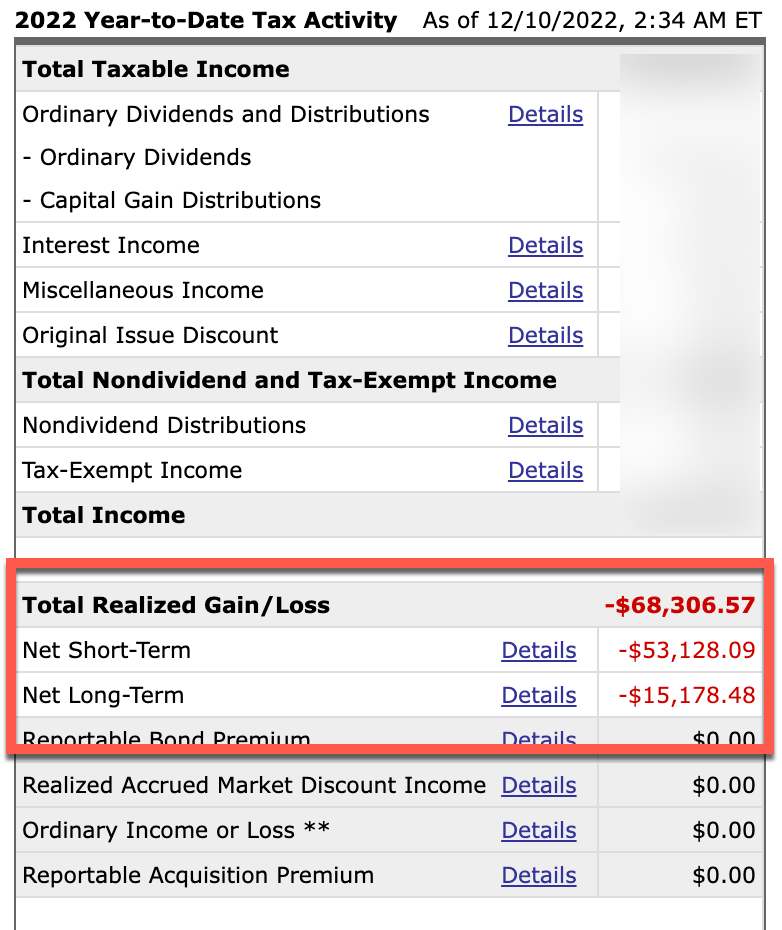

In 2022 I was able to harvest nearly $70k in losses. This offset any capital gains I had that year, in addition to reducing my taxable income by $3,000. This amounts to more than a $1,400 savings for a California couple earning > $500k. You can read in detail how I approached this last year in “Is Tax Loss Harvesting a Waste of Time?”.

This is 2023 though, and I don’t have many losing positions in my taxable account. However, I do have way too much Uber stock for my partner’s RSU + ESPP. I always sold my entire Meta shares on vest, but my partner’s Uber shares ended up accumulating. The reason is that Uber vests monthly in addition to twice a year ESPP events. This can lead to an annoying cascade of wash sales that I was wanting to avoid.

In 2023, Uber’s RSU plan started allowing the ability to auto-sell new vests immediately. This still left me with the existing Uber shares from prior vests, which are up 144% YTD. This is where tax gain harvesting can come in. In this case I am going to use the losses that I carried over from last year to offset the gains from the sale of my Uber shares that have large gains. Assuming I have $60,000 in carry over losses from last year, I can sell as much Uber as possible to get me to $60,000 in gains without any tax impact.

To find out how much carry over loss you have, pull up last years tax return. Go to your Schedule D Page 2, you are looking at line #16 minus line #21 to give you your total carryover.

Worth remembering that the losses you previously carried forward can offset up to $3,000 in income. So it may make sense to ensure you still have enough losses available to get that full benefit.

I want to remind you that you shouldn’t let taxes keep you in an un-optimized position. However, I definitely encourage you to understand the tax ramifications of every thing you do and find the optimal way to sequence things.

Step 4: Check Your Asset Allocation/Potentially Rebalance

I like to check my asset allocation a few times a year and make adjustments primarily through new contributions (rebalancing). Sometimes though, the market moves so quickly that new contributions alone make it hard to get back to your goal allocation.

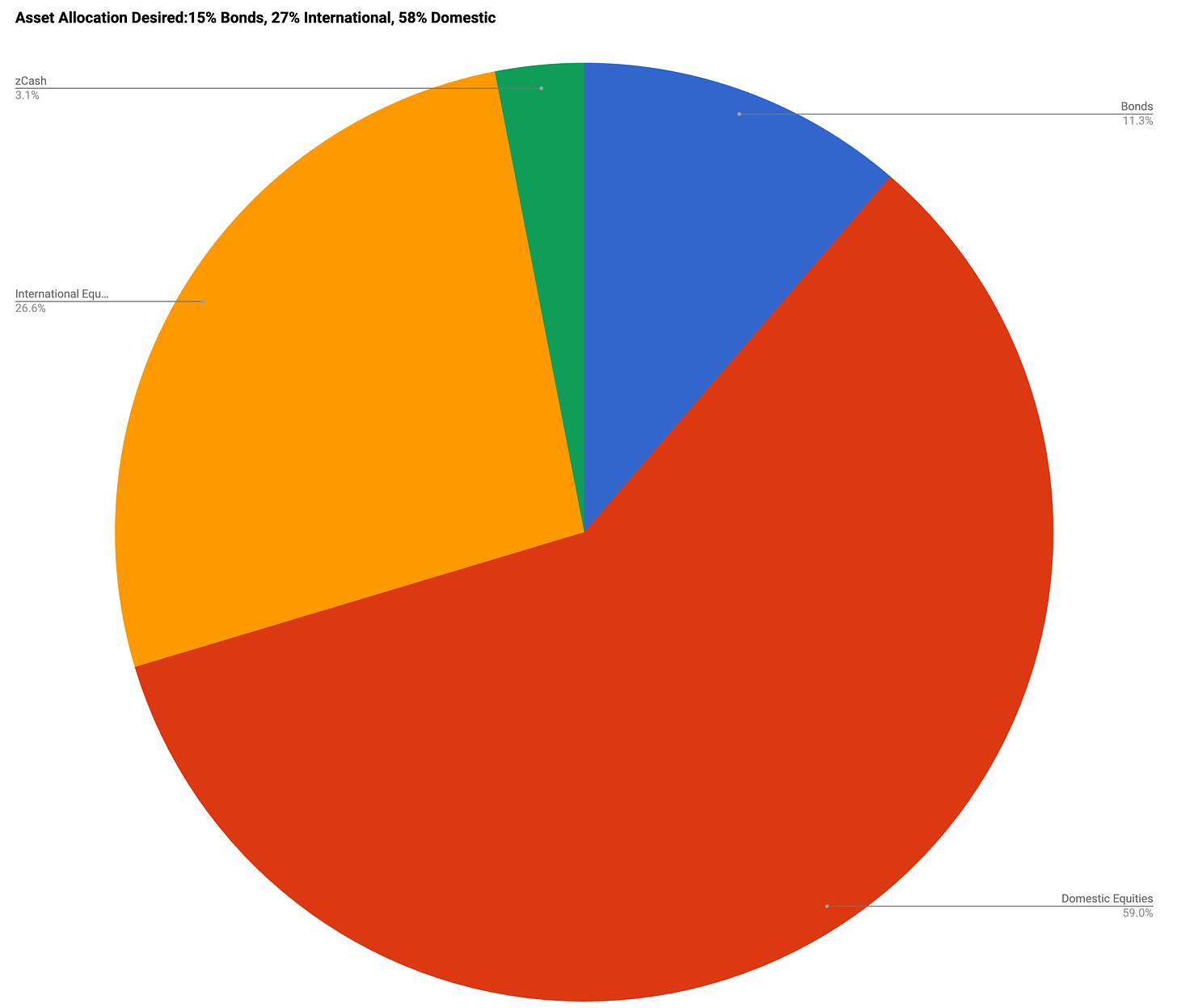

When I wrote about my asset allocation previously, I described my asset allocation overall I would say my allocation as 60/30/10. Which stands for 60% US equities, 30% International Equities, 10% Bonds.

If your current allocation has drastically shifted from your goal it would be good to correct it on a regular basis. I would come up with a plan of how often you do this and try to stick with it. Some use a time based approach, ie quarterly. Others add in a “drift” factor, where if there allocation drifts by more than 5%, they will rebalance things at that time.

Don’t forget to take into account tax implications of any sales you use to rebalance. I would typically start any rebalancing within my retirement accounts to avoid needing to worry about tax impacts.

I personally am in the process of shifting my portfolio from 60/30/10 to 58/27/15 with the primary goal to make my overall portfolio slightly more conservative. This is where I currently stand as part of that process. If you bundle cash into Bonds, I am pretty much there :).

Step 5: Check Company Perks, FSA, Gym, Medical, Choice Benefits

FSA: If you contributed to an FSA in 2023 you can roll over up to $610 this year. Anything above this amount vanishes into thin air (or into your company’s pockets).

DFSA: While the FSA allows $610 carry over. If you setup a dependent care fsa, it is all use it or lose it. Be sure to submit those childcare, camp, afterschool care expenses to cash out this pre-tax benefit!

Vision Benefits: I have Meta’s VSP plan through the end of the year (as well as in January). Make sure to order contacts/glasses before the end of the year to utilize your benefit’s tied to the calendar year. One special perk of the Meta plan is that you can get 2 pairs of free sun glasses up to ~$200. VSP’s online store www.eyeconic.com can verify all your benefits and has a decent selection.

Meta Specific Benefits: I made sure to use all of these prior to the end of my severance period. For those still at Meta, be sure to use those Choice Benefits. You have $2,000 to use each year for an extensive number of things (including Financial Coaching). Many other companies have versions of this specific to Gym or Childcare.

Step 6: Start Budgeting and Tracking Your Investments

Do future you a favor and start tracking your expenses and investments. If you get things setup in the next few weeks you will start 2024 with a full clean slate! I am personally going to be re-starting from scratch with YNAB. Sometimes even an old budget with a lot of history can benefit from a fresh start. Quick excerpt from my longer post on Mint Alternatives (includes affiliate links as well as referral links (YNAB, Monarch). I personally use and have paid for all the tools included over multiple years).:

Top Free Tool: Empower. If you are looking for a free alternative to track your overall net worth Empower (formerly Personal Capital) is my recommendation. Great investment tools and net worth tracking, more lack luster if you want granular spend tracking, and budgeting.

Top All-In-One Paid Tool: Monarch. If you care about strong categorization of your spending, goal setting, smart automation, good design, and are willing to pay Monarch is an easy option to recommend (Use mint50 for 50% off their first year, $99 normally).

Top Paid Budgeting Specific Tool: You Need a Budget aka YNAB. If you really want to go deep into your cashflow, to change your behavior, to actually budget, are willing to put up with an opinionated way of giving every dollar a job, and don’t care about overall net worth tracking YNAB is really hard to beat. I recommend this for people who want to really get on top of their spending (something I think everyone should do for at least a year to help baseline your FIRE/enough number).

Wildcard Option #1: Quicken Classic is still going strong. It is clunky and requires downloading software, but has a lot of advanced reporting capabilities. I really like being able to compute 1099 estimates on dividends, interest, and even capital gains at any time.

Look-back on 8 of the 10 Steps Completed

I started the year with the 10 steps I was planning to take for a financially successful year. As with all things personal finance, things change! A key part of successfully managing your financial life is being able to roll with the changes and adapt your approach, and just be flexible.

The 10 8 Steps I Took in 2023

Configure my 401k Contributions to front load hitting contribution limits

Max out iBondsFigure out where to live and build out a “Moving Expense” buffer into my budget

The two that I didn’t complete:

Maxing out iBonds

I didn’t max out my iBonds this year. Interest rates in my Wealthfront account were high enough, that the return on hassle of dealing with TreasuryDirect’s website just wasn’t there.

Figure out where to live and build a “Moving Expense” buffer

Considering my first ever post was on “The Analysis into Leaving San Francisco”, I get asked when I am leaving a lot. The answer: Maybe in 5 years?

I am still renting the same condo in San Francisco that I have been for the past 3+ years. My lease is month to month, so I have the flexibility to move if I want. In August my daughter started Kindergarten at a nearby public elementary school that we are actually very happy with. This could potentially mean staying in San Francisco for the next 5.5 years through 5th grade. This is the longest forward looking view I have ever taken in San Francisco.

This year is particularly significant as it marks the point where San Francisco has become the city where I've resided the longest, accounting for 26.25% of my life.

End of Year Personal Reflections

"You can't really know where you're going until you know where you have been." -Maya Angelou

We started 2023 with a few lessons learned in 2022. A few key quotes to help remember the mood:

I still want to Avocado FIRE in the next 5 years. 2022 wasn’t kind on the progress against top-line goals. That said, at least as of now, I am still on track with my 5 year timeline.

My overall net-worth saw a drop of 9% year over year. My Avocado FIRE balance is down 11.5%.

It has been one of those years where it feels like you are struggling to keep your head above water.

No amount savings could turn those net worth graphs green.

Most people under 37 years old are probably looking at the first (post college) year of negative year over year net worth growth.

I graduated during the “Great Recession”. But I was starting at $0 at that point. This is the first decline where I actually had a decent amount of money saved and invested.

I ended the year without making any major changes. I felt good about my approach.

I also feel optimistic about 2023. If anything I have renewed confidence in my financial plans even if things continue to decline.

We all end 2023 in a very different place.

VTSAX, Vanguards total market mutual fund, is up 24%. The tech company heavy Nasdaq is up 44%. Then there are the FAANG+ group. Google only grew 53% while Meta rocketed 177%.

It clearly wasn’t all sunshine and rainbows though.

On May 24th at 4:07am I received the news that I was part of Meta’s latest layoff.

I was one of 259,703 tech workers (as reported by layoffs.fyi) who lost their jobs in 2023. I have been out of the workforce since May while my severance continued to pay me through August.

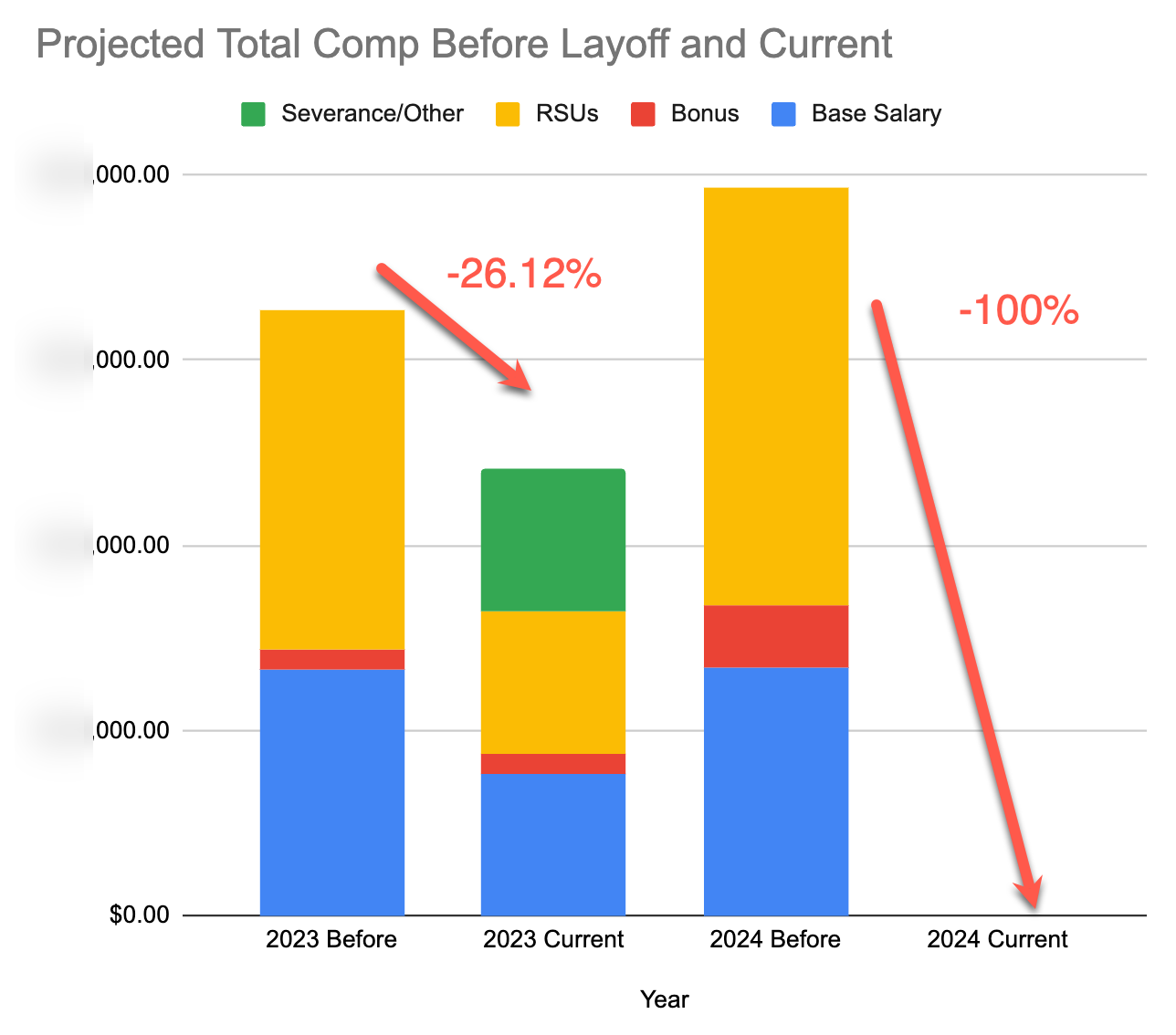

Having been there for over 9 years, I received a lump sum severance payment equivalent to 30 weeks of base salary. This was calculated as follows: 16 weeks' base, plus 2 weeks for each of the 9 years of service, minus 8 weeks of WARN Act pay, plus 20 days of unused PTO. On top of that, Meta covered all COBRA payments through the end of the year, extending into January 2024.

Overall, my total W2 compensation for 2023 will be 26.12% lower than if I hadn’t been laid off. Honestly, receiving only a 26.12% reduction in total compensation while working just 5 months of the year isn't too bad. For 2024, my projected W2 total compensation is down by 100%.

Other Highlights

My daughter got into a public elementary school in San Francisco we are very happy with. I can see us sticking around through 5th grade. This is the longest forward looking time I have ever pictured myself in San Francisco.

Took my daughter skiing for the first time… and got stuck in Tahoe for the first time

Overall net worth is at an all time high.

RSU’s at Meta and Uber were up more than 100% for the year.

FAANG FIRE Subscriber Count Grew 457% (from 1,414 to 7,875)

I’ve held 70 1:1 Financial Coaching sessions (includes discovery calls and FAANG FIRE member calls)

6 Live FIRE side chats w/ Paid & Free Substack Subscribers

Went on 2 podcasts with Sam aka Financial Samurai and The Long Game with Thomas Kopelman

Built the Total Compensation Dashboard (refreshing in January for 2024) and a Tax Bill Calculator

“I need to know where I'm heading, 'cause I know where I've been” 50cent

I’ll post a more detailed “self review” as I kick things off again in 2024 with task #1 again “Revisiting my Mission Statement and Goals”.

Thanks again for being here. I am wishing you a happy and financially confident 2024.

-Andre