Welcome back to the series on the 10 steps of my 2023 financial plan.

Thus far we have covered:

Step 2: Estimating Your Tax Bill

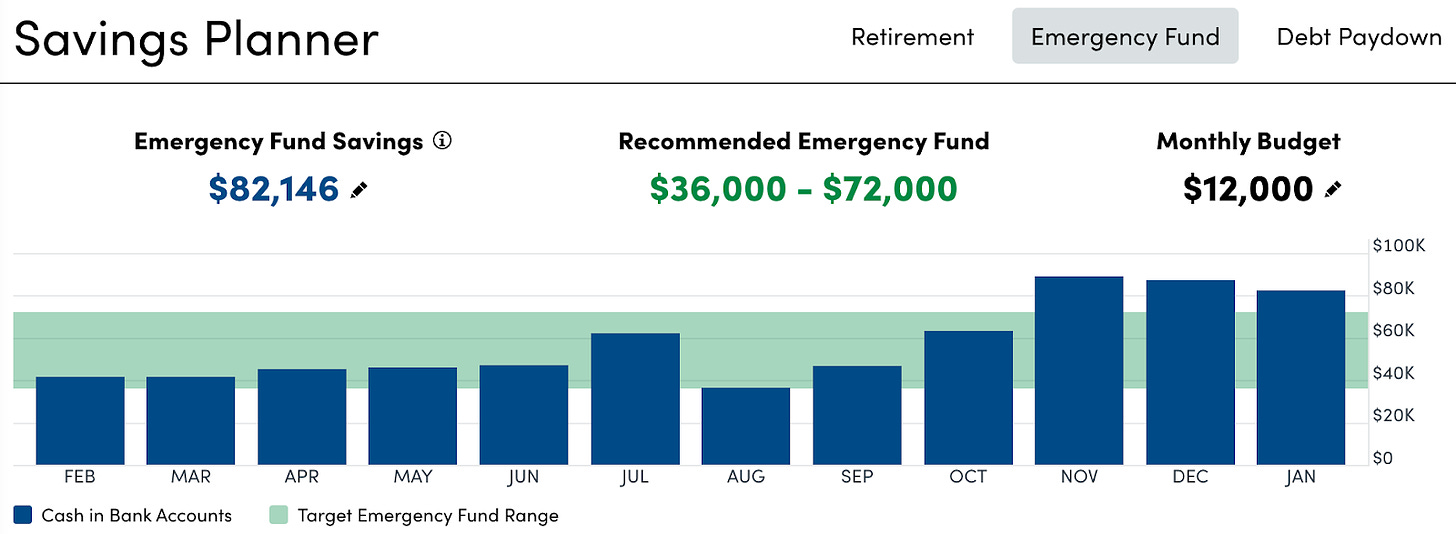

Step 3: Optimizing My Emergency Fund

This brings us to Step 4, one of my favorites: “Configuring my 401k Contributions to front load my contribution limits”

I’ll be going over exactly how I set up my Meta 401k and my partners Uber 401k. It involves what I call “Budgeting Hard Mode” and an over excitement about receiving $0 paychecks.

Annual Financial Goals Related to 401ks

In the first post of this series I included my financial goals for the year. First among them were maxing out the two 401ks available in my household. This involves $132,000 across all available 401k accounts.

My Meta 401k:

$66,000 towards maxing out my Meta 401k + After Tax.

$22,500 to Traditional 401k

$11,250 Meta 401k Match. They match 100%, dollar for dollar, up to 50% of the 401k limit (22,500/2= $11,250)

$32,250 After-Tax 401k which gets auto-converted to the Roth 401k in Meta’s plan.

My Partners Uber 401k

$66,000 towards maxing out my partner's Uber 401k + After Tax.

$22,500 to Traditional 401k

$0 Match, Uber does not have a 401k match

$43,500 After-Tax 401k which gets auto-converted to a Roth 401k

General guidance on prioritization if you are not able to fully max out contributions. Contribute to your 401k up to your company match, get your emergency fund in a good place (3-6 months expenses), continue contributing to your 401k up to the max, after-tax 401k. If you have any consumer debt, focus on that before worrying about maxing out your 401k.

Wait, What is “After-Tax” 401k?

Sometimes referred to as the “Mega Backdoor Roth”, After-Tax contributions into your 401k allow you to save beyond the default contribution limits of $22,500. The IRS lets you contribute a total of $66,000 into your 401k, so after subtracting out your maximum $22,500 contribution + your company match, the remaining can be contributed into your After-Tax. This is different than a Roth 401k which is subject to the same $22,500 limit. The magic happens when you convert the after-tax 401k into a Roth 401k or Roth IRA. Some companies, like Meta, allow this to be done automatically without doing anything. Others like Uber require a call into your 401k broker to help make the conversion. It doesn’t make sense why congress and the IRS just standardize this process… but this is the way it is today and it is by far the best way for high income workers to get significant money into a Roth account. Fidelity has a good explainer if you want to learn more.

Different 401k Funding Strategies

I have a few strategies I could employ to reach my goal of maxing out my 401k + After Tax. I am able to be aggressive here since I already have my emergency fund optimized. I’ll lay out a few different approached that all lead to the same end goal, taking full advantage of your employers tax advantaged retirement accounts.

Even Pacing Throughout the Year

This strategy involves spreading contributions out over the course of the year. For example if you wanted to max out your traditional 401k you could just divide $22,500 by your salary to determine what % of your income is needed to contribute to max out over the course of the year. Then simply set your % contribution to that amount and sit back for a predictable drawdown over the year. This could be the preferred strategy particularly if your employer only matches on contributions made over the year and doesn't include a “true up” provision.

Bonus Heavy

This is the one I like to encourage newer savers to try an adopt Most 401k plans allow you to set the % of contribution differently across base pay and bonus pay. A Bonus heavy strategy would involve maxing out the %’s in the bonus contributions. This will result in most/all of your bonus payout going towards your 401k contributions. This is a good forcing function to accelerate your savings without impacting your monthly spending.

Switching Employers

I touched on this in my article covering how to financially optimize a mid-year job switch. This scenario can also be applied for those recently let go but still have a few remaining paychecks before your official separation date.

If I knew for certain that I was going to be leaving Meta for another company who also had a great 401k match this is what i would do:

I would make sure to first contribute to my traditional 401k up to the match. Then go as hard as possible to hit my limit on After-Tax 401k. If I do this when I go to the next company i’ll be able to contribute $11,250 to the new 401k (hitting the annual limit between 401ks) and hopefully getting most/all the company match. Then I can still max out the new after-tax 401k. Essentially double dipping since after-tax is tied to the employer and now the individual.

Budgeting “Hard Mode”: 401k Front Loading

Front loading is all about trying to get all your 401k contributions into your account as quickly as possible. There is research that consistently shows that “time in the market is greater than timing the market”. Which would point to lump sum investing beating out to dollar cost averaging.

This definitely wasn’t the case in 2022 though. Everyone, like me, who front-loaded likely saw larger decreases than those who had split contributions over time. My thoughts are that, honestly, it doesn't matter that much in the big picture. If you are maxing out your account, you are doing awesome. There might be a marginal benefit to front-loading but to the amount you can contribute annually to your 401k, I wouldn't stress over it. The likely worst option is switching back and forth based on what worked in the previous year. I would try to come up with a plan and stick to that plan each year. If you front-load, always front-load, if you pace things out, always pace things out.

Why do I front load?

Honestly, I think it is funny to see $0 paychecks.

It also forces me to really be on top of my budgeting. Towards the end of my front loading I am starting to get uncomfortable. But it is a great way to start the year with extra forced motivation and discipline. If things were ever to get too tight I can always adjust the contribution percents to something more reasonable.

Should You Do This?

First. Please don’t do this unless you have a strong emergency fund. Even if you have a strong emergency fund, notice how I intentionally over fund my emergency fund towards the end of the year. This is because I have planned this out. Particularly now as tech companies are counting with layoffs, it would be foolish to do this without that emergency fund as a foundation.

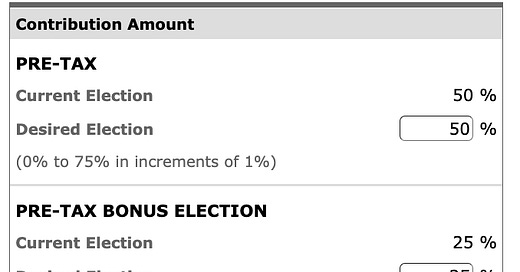

My 401k Contribution Settings

This is how I have my contributions setup today. These settings, in addition to my FSA, DFSA, and additional W4 withholdings lead to consistent $0 paychecks without me needing to make any modifications throughout the year. (Note: For Meta employees who really want to optimize getting as much money into the market as possible as fast as possible you can make adjustments to focus more on pre-tax first. I just prefer to set it once and leave it alone, even if it takes me an extra paycheck or so to max out my 401k match).

You can see that the Meta 401k plan has the great feature where I can not only contribute to an After-Tax, but there is a dropdown to select automatic “Daily Roth In-Plan Conversions. This means, without doing anything else, all my after-tax contributions magically show up into my Roth 401k.

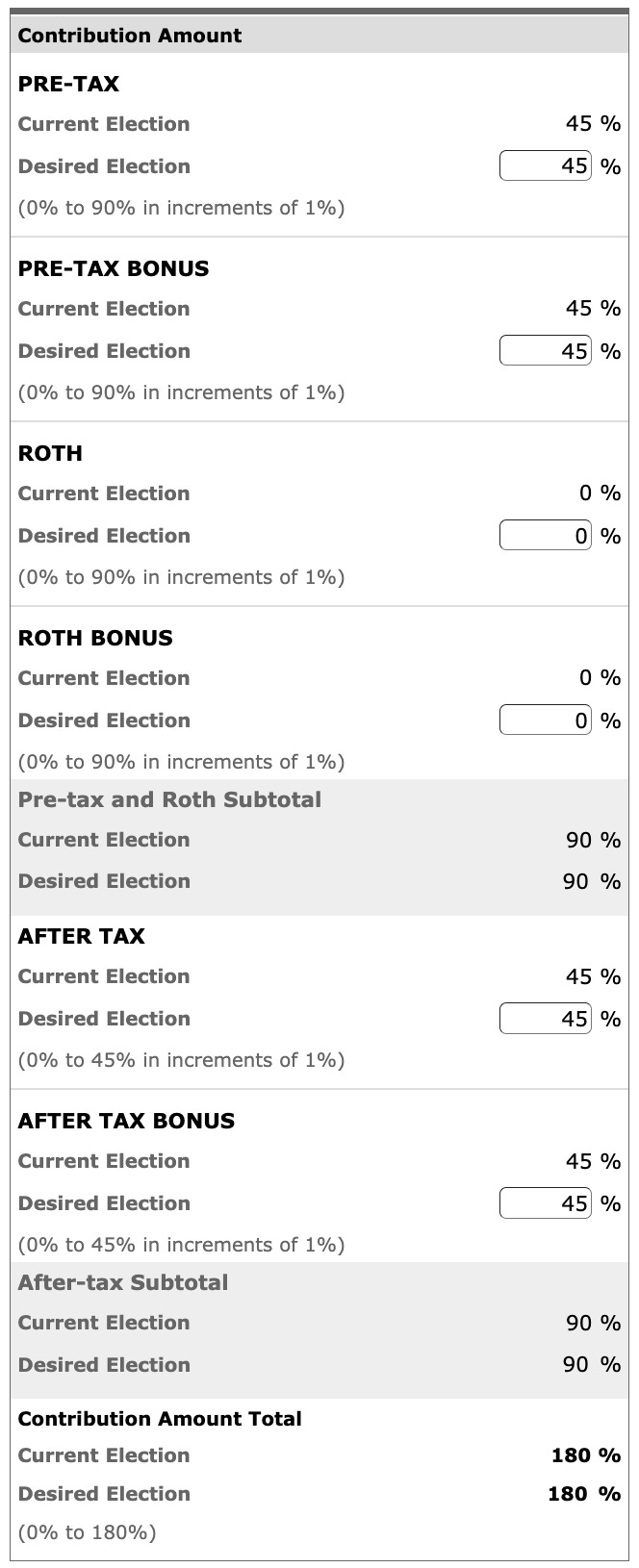

This is different than my partners Uber After-Tax, even though it is also with fidelity. In the case of Uber’s plan, we need to physically call Fidelity every month or so and request that they “roll over the after-tax contributions to my Uber 401k into my separate Roth IRA”. A bit of a pain, but there is no better way for a high earner to get significant amounts of money into a Roth account than the After-Tax 401k.

Below is what my partner’s Uber contributions look like to also yield $0 paychecks.

401k Fund Options

Both Meta and Uber offer an excellent selection of low fee funds, target date funds, and access to Brokerage link (which allows you to essentially buy any stock/fund within your 401k).

These are my current holdings in my 401k, you should not copy my selections! My desired asset allocation is 56/34/10 (US/International/Bonds). Bonds overall are very tax inefficient, they constantly spit out distributions that would be subject to ordinary income tax rates if held in a taxable account. So I stash the. majority of my bond holdings within my 401k. I was getting a few questions on why I am buying so many bonds! I want to emphasize that I am only holding <10% overall bonds.

In Step 9 I’ll go into more detail here, and might need to move this up to step 5 to get it out of the way!

Tech Layoffs Continue into 2023

I also wanted to recognize that this week has been another tough week in tech. Google let go 12,000 people today, Microsoft 10,000 Wednesday. In addition to layoffs happening at Wayfair, Capital One, WeWork, and Riot, just to name a few. Adding up to 190k tech layoffs since the beginning of 2022 per layoffs.fyi.

From a FIRE perspective, if you are given a solid severance and already have an emergency fund. I would explore whether your final paychecks can be used to max out your 401k match. For those with very strong emergency funds or partners still working, maxing out our After-Tax 401k could also be something to explore. It is the one benefit that you can double dip if and take advantage of again when you get another job that offers the benefit. See the section below on strategies when “Switching Employers”.

Are you using a different strategy do max out your 401k?

Until the next step,

Andre

Can you do a blog covering the mechanics of getting laid off? A lot of tech companies have a notice period when you're let go (don't have access to internal systems) but still on payroll and a severance period when you're off payroll but still getting severance. What documents will you need to get while you're still technically employed? At which point is it appropriate to file for unemployment?

Does Meta match after-tax 401k contributions? That is, if I forgo pre-tax contributions and only do after-tax, will they make matching contributions into my pre-tax account?

I ask because I was laid off earlier this year after having already maxed out my pre-tax 401k and my former employer's match. My former employer matched any contributions: pre-tax, Roth, or after-tax. I'll be starting at Meta before the end of the year and would like to take advantage of their matching as well.

Alternatively, I may be able to over-contribute, get the match, and then withdraw the over-contribution, but I'd rather avoid the hassle if possible.