Welcome back to the series on the 10 steps of my 2023 financial plan.

Thus far we have covered:

Today we will be diving into Step 3: Optimizing My Emergency Fund.

I had hoped to be past step 4 already, but for those of us at Meta, this week marked the end of annual performance review writing and the start of the calibration process for determining ratings and promotions.

And a special thank you to those that became paying subscribers — I'm deeply grateful for your support. I will be hosting the first subscriber virtual “FIRE-side” chat over zoom Friday the 27th to talk through live the 10 Steps of my 2023 financial plan. Looking forward to getting to speak with all of you live.

Step 3: Optimizing My Emergency Fund

Why Have An Emergency Fund

I want to plead with you for a minute. Please, please, please have an emergency fund. In 2021 you might have felt good about being 100% invested. It was common for FIRE articles to advocate for just using your ROTH as your emergency fund. After all if you lost your job you could just sell your investments. Well, welcome to 2023 where your company stock is down 50% and your other investments are still down from their highs. It is the worst time I would want to sell off investments to fund an emergency.

There is an incredible amount of uncertainty in the US economy right now. More and more tech companies are starting the year with additional layoffs. Having an emergency fund is crucial, particularly in times like these. To end this plea on a more positive note, it does seem that most large technology companies are providing generous severance packages to affected employees. But I wouldn't want to count on this.

My Emergency Fund

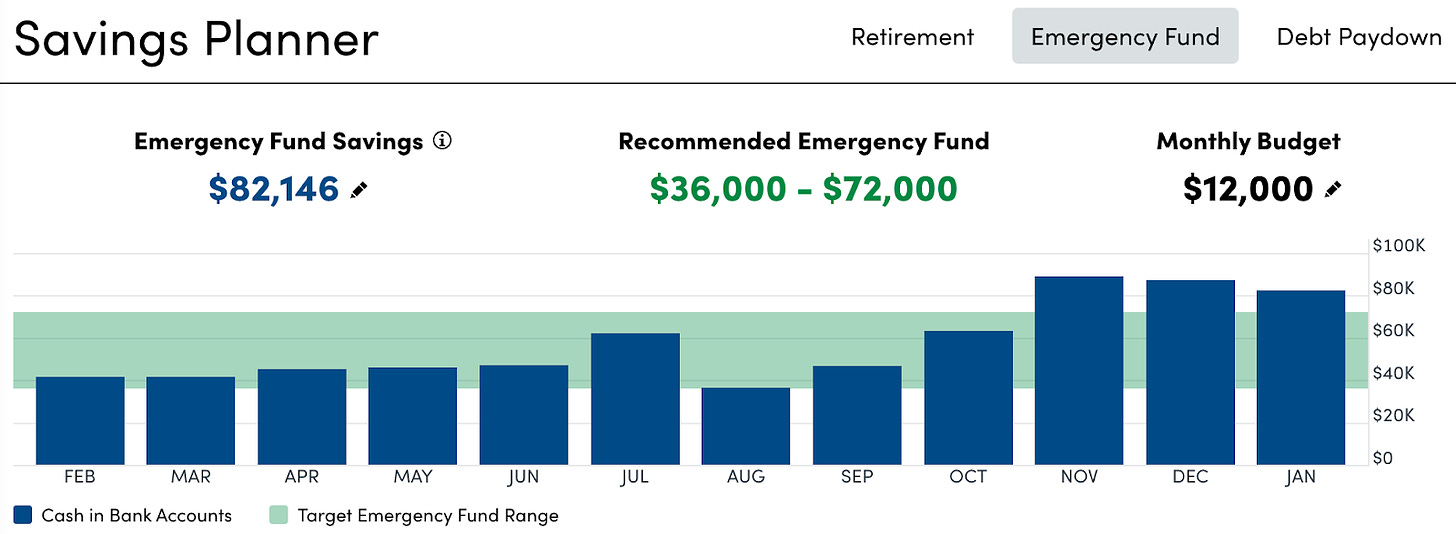

My goal is to always have around 6 months of non-discretionary spend (rent, avocados, steaks, childcare). For me that amounts to ~$60,000 in reserve. This is based on really tracking and having logging in place for my spend.

You can see from my Personal Capital1 savings planner, I am pretty consistent at staying right around there. Occasionally it will dip to closer to 3 months (as in August) but rarely without a plan. In August, my emergency fund balance dipped as I moved some cash into my taxable investment account in anticipation of an upcoming RSU vest.

I seem to currently be holding too much cash! I intentionally inflate my cash position at the end of the year year to allow me to front loan my tax advantaged investments (401k + After Tax) in the new year. I’ll be going into more detail on why and how I do this next week.

The 3 Tiers of My Emergency Fund

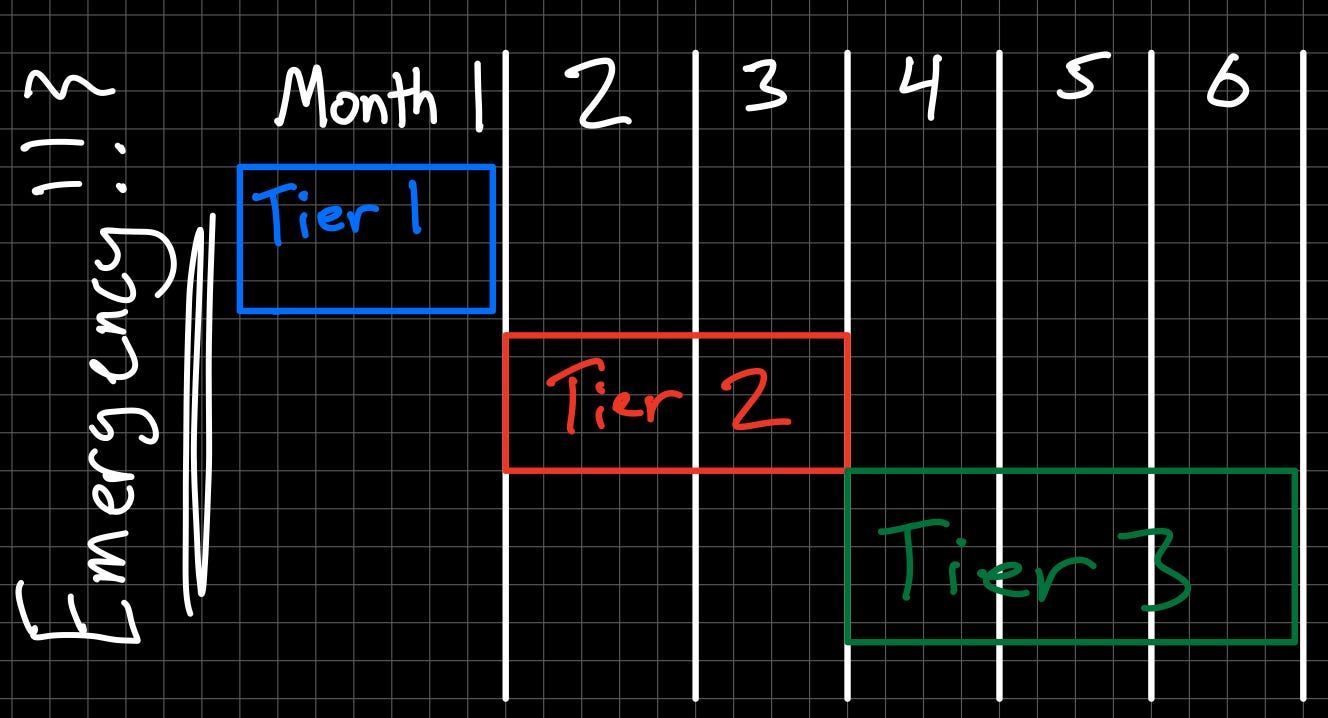

I approach my emergency fund in a tiered way.

Tier 1 (1 month of spend): Very Liquid Sitting in a Checking Account

Tier 2 (2-3 months of spend): Still Very Liquid, just in a dedicated High Interest Savings Account

Tier 3 (3+ months of spend): Moderately liquid ladder of CDs, Treasury Bills, and iBonds earning higher interest with staggered payout periods

There are optimizations I like to make at each tier and I am constantly tweaking my approach.

Tier 1: Very Liquid Emergency Fund

In addition to the current month’s expenses I will have ~1 months of my emergency fund in the primary checking account I use. There doesn’t need to be anything special about this account. I would’t open up a new account and instead use the one you already have.

Ideally it would be a higher interest paying account, but that should be secondary. The main optimization should be around ease of access.

Mine is currency in a Fidelity Cash account with the FDIC Cash Sweep. I am not chasing interest rates here( although the yield isn’t bad at 2.12%). The important thing here is that it is available where you normally spend from.

Tier 2: Still Liquid, Dedicated High Interest Savings Account

I keep 2-3 months in the highest interest savings account I have access to. I currently have more bank accounts than is normal due to previously being very into taking advantage of sign up bonuses for banks and credit cards. This makes it easy for me to always be near the current high rates. I don’t go crazy chasing every last %, but with interest rates finally high enough to matter, I like getting close.

I am currently earning 3.8% with Wealthfront. They also currently have a promo where if you invite a friend the interest rate increases to 4.3% for 3 months (here is the invite my friend). They have been one of the more aggressive banks at increasing interest rates on a regular basis. That said if you already have an account somewhere earning >3.3% I would stick with that unless there was a decently large incentive to encourage you to open up an account.

Other banks you may have already that could fit the bill:

Ally: Savings Account 3.3%

American Express: 3.3%

Capital One 3.3%

If you want to chase rates BankRate or SaveBetter is where i would go to compare. I would also cross check Doctor Of Credit for bank sign up bonuses to go along with them (and calculate the bonus as part of the interest rate).

Tier 3: Less Liquid but Accessible on a Rolling Basis

This last bucket holds the majority of my emergency fund, >3 months at any given time. I anticipate that I would rarely need to access Tier 3, the 3 months available in the first 2 Tiers should get me through most emergencies (particularly in my 2 income household). This means that for Tier 3 I am looking for the highest return, while still keeping risk near 0. This means iBonds, CDs, and T-Bills. I previously held various municipal bond funds, but with rates moving and the underlying bond funds value decreasing I have moved away from funds for my emergency fund.

Certificates of Deposit (CDs)

You may be familiar with CDs, or certificates of deposit. You typically earn a higher interest rate in exchange for your funds being locked up for a fixed period of time (anything from 1-month to 10+years). Most have significant fees for early withdraw, but there are also those with “no penalty” which don’t at the expense of lower interest rates. Lately I have been buying “brokered CDs” directly through Fidelity which are paying up to 4.65% right now. The one thing to look out for is that some brokered CDs are “Callable” which means the bank can pay you out before the term is finished. I stick with those that are call-protected (meaning they cannot be called before the maturity date).

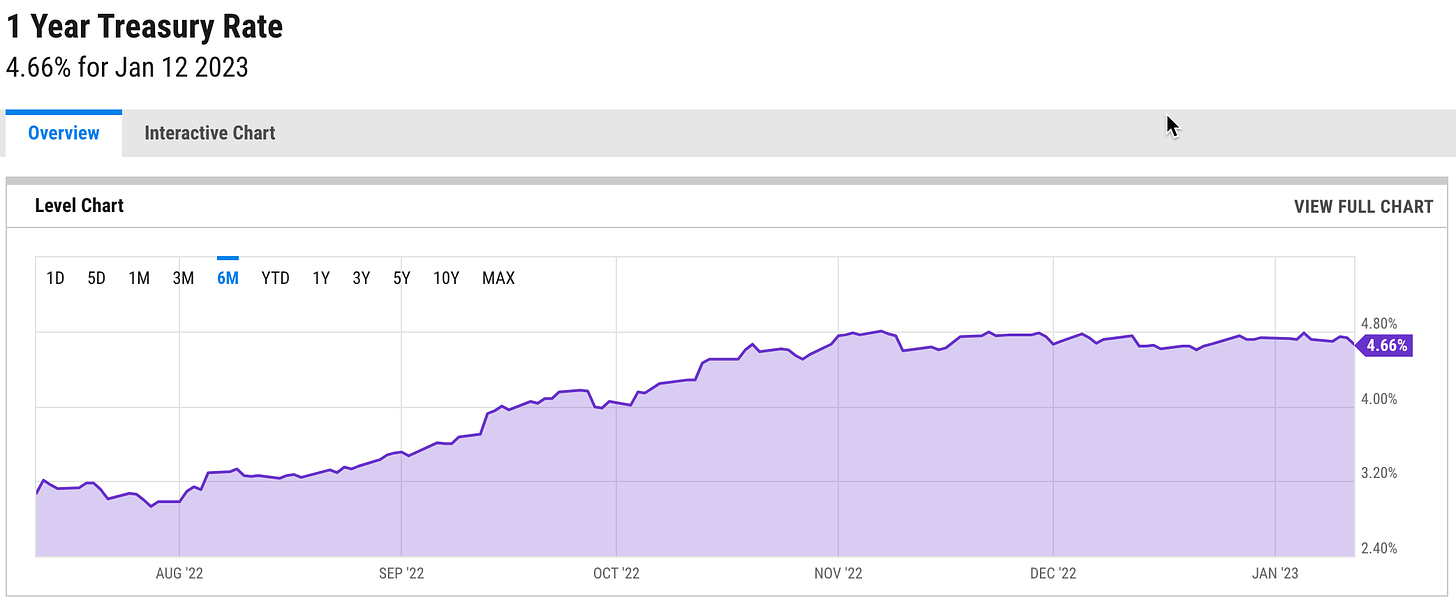

Treasury Bills (T-Bills)

The current 1-year Treasury Rate is 4.66%. They are free from state/local taxes, there isn’t a limit to how much you can buy, and it is backed by “the full faith and credit of the United States Government”. I am currently shifting most of my tier 3 into T-Bill durations. You can buy them through Fidelity, Vanguard, or Treasury Direct on the secondary market or through the auctions. The Financial Buff did an excellent job on the mechanics of buying T-bills which can be a little different since they are sold via “auctions”.

Series I Saving Bonds (iBonds)

2022 was the year of the iBond. With high inflation also comes higher interest rates on iBonds. Currently paying 6.9% APR over the next 6 months. The simple way to think about iBonds is to assume you will get the guaranteed rate for 6 Months and then 0% for the next 6 months. With a limit of $10k per year that means $345 in interest (10,000 x .069 / 2). You are required to hold iBonds for a minimum of 12 months and the penalty for selling prior to 5 years is 3 months of interest. If you hold it past the 9 month mark you earn $345 or >4.5%. The next rate change is in May, it is likely to be reset much closer to 0%. Because this rate is so close to T-Bills, I would recommend sticking with T-Bills until we get more signal in April at what the new rates are likely to be. The only way to purchase iBonds is through the 1995 Treasury Direct website. . The limit is $10k per Social Security number per year.

Tier 3 Ladder

Each of the investment options in tier 3 tend to have a fixed duration before you can access the funds penalty free. In a true emergency, I wouldn’t be concerned over losing out on the interest penalty for accessing my tier 3 funds early. However, with careful planning, you can avoid it without sacrificing too much upside by instituting a Ladder.

A Bond/CD ladder is a strategy that involves investing into fixed income investments that reach maturity at different times. For example, an you could create a CD/bond ladder by purchasing 1 Year T-Bills/CDs each month for the next year. Now going forward you will always have a new portion of your emergency fund accessible. As each bond matures, you can buy another 1 year bond, keeping the ladder balanced (you can automate this with Fidelity Auto Roll). This allows the you to have a steady stream of access to tier 3 funds while also earning a higher amount of interest.

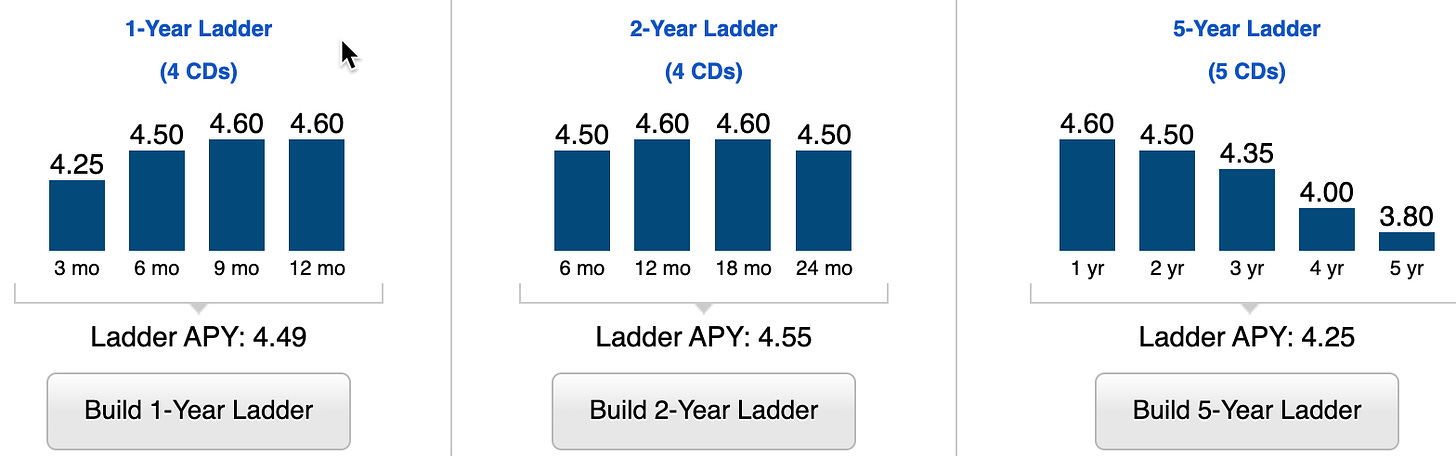

If you are starting from scratch today you can have a larger buffer in tier 2 until the first of your tier 3 funds start maturing, or purchase an out of the box ladder which starts at a smaller duration (3 Month, 6 Month, 9 Month). Fidelity again has some out of the box options but you can also build your own.

Boring is Better than Nothing

Having an emergency fund is the key thing I want you to take away from this. If the tiers, ladders, and bonds are overwhelming. Just stick with what you know. Interest rates are starting to get interesting though so I would encourage having a dedicated high interest savings account for these funds.

Step 4 Sneak Peak

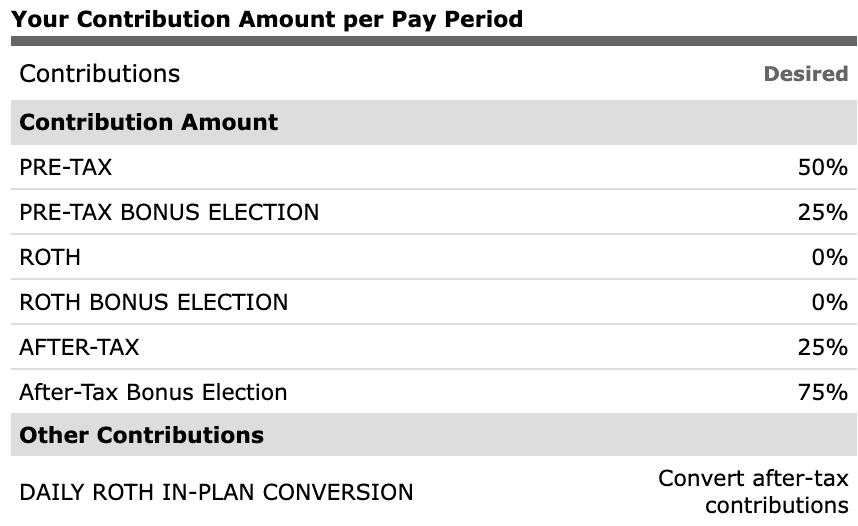

Step 4 is one of my favorites! “Configuring my 401k Contributions to front load my contribution limits”. I’ll be going over exactly how I set up my Meta 401k and my partners Uber 401k. It involves what I call “Budgeting Hard Mode” and an over excitement about receiving $0 paychecks.

Let me know what you think of the series thus far along with the increased cadence of emails that have gone along with it.

FAANG FIRE is an affiliate partner with Personal Capital Advisors Corporation (“PCAC”) and I earn a commission from new sign ups.

Andre, as I waited for this article I wondered what new and different can one do to optimize a simple liquid investment and you didn't disappoint. Thank you. It's good to know of all these options. I've always had my 6-mo emergency fund invested in 6 CD's one for each month so I don't have to cash them all out at once: 3 No-penalty CDs and 3 5-yr CDs. But with the recent Savings yield being higher than my 5-yr CD I recently cashed them out and with a 5-mo penalty! I've since had the funds in my HYSA as the rates keep increasing. I will now consider some of your options to maximize them. Please clarify:

1. You probably have a lot of different accounts for each of your Emergency Fund tiers and FIRE investments. Isn't it difficult to manage them if you are opening and moving funds around often? And where's your primary account for monthly expenses?

2. Is your liquid Emergency Fund part of your 90:10 bonds allocation? When you max out your iBonds limit for your Emergency Fund, where do you invest the 10% bonds portion of your FIRE investments? And do you prefer retirements/non-retirement accounts for FIRE investing in bonds?

3. You didn't talk about municipal bonds here. Was that intentional? Wouldn't it help saving taxes if you used munis?

"In August, my emergency fund balance dipped as I moved some cash into my taxable investment account in anticipation of an upcoming RSU vest.", can you explain this strategy? What do you get out of this?