My Financial Plan Step 2: Estimating Your Tax Bill

Avoiding getting caught off guard by estimating your tax bill

Welcome back to the series on the 10 steps of my 2023 financial plan. In the previous newsletter, I covered the first step: revisiting my goals and mission statement.

In today's newsletter, we will be discussing Step 2: Estimating Your Tax Bill

This step is all about being prepared and not getting caught unprepared. By estimating your tax bill now in January, you can avoid being shocked by a large bill when it comes time to file in April.

The FAANG FIRE newsletter helps FAANG workers reach financial independence. Written for tech workers by a peer who understands the ins and outs of how tech compensation, benefits, and perks work. Subscribe now to get the latest updates directly in your inbox.

Thank You! Now let’s jump into Step 2.

Step 2: Estimating Your Tax Bill

By estimating your tax bill now in January you can avoid the pain I felt when I was first shocked by a $50,000 tax bill due in less than 30 days. It will still be painful… but at least you will have a few months to prepare (both mentally and physically). I’ll also share what you can do to reduce the amount owed. Getting a large bill is extremely common in tech due to workers paid heavily in Restricted Stock Units (RSUs) have taxes under-withheld by default as part of their stock vesting. This leads to many in tech being shocked by their tax bills every April.

In this newsletter, I’ll show you exactly how I estimate my taxes so you can do the same. Keep in mind that I am only trying to get a ballpark estimate prior to actually completing my taxes in March/April (once I have all official documents on hand).

Step 2.1: Gather Your Documents

Don’t immediately close the window you are reading! I promise this isn’t going to be painful. All you will need is your final pay statement of 2022. You may also want to have your 2022 dividend payout totals and a rough idea of how much interest you earned from your cash savings.

Documents Needed:

Final Pay Statement of 2022

Taxable Dividend Totals

Interest Earned Totals

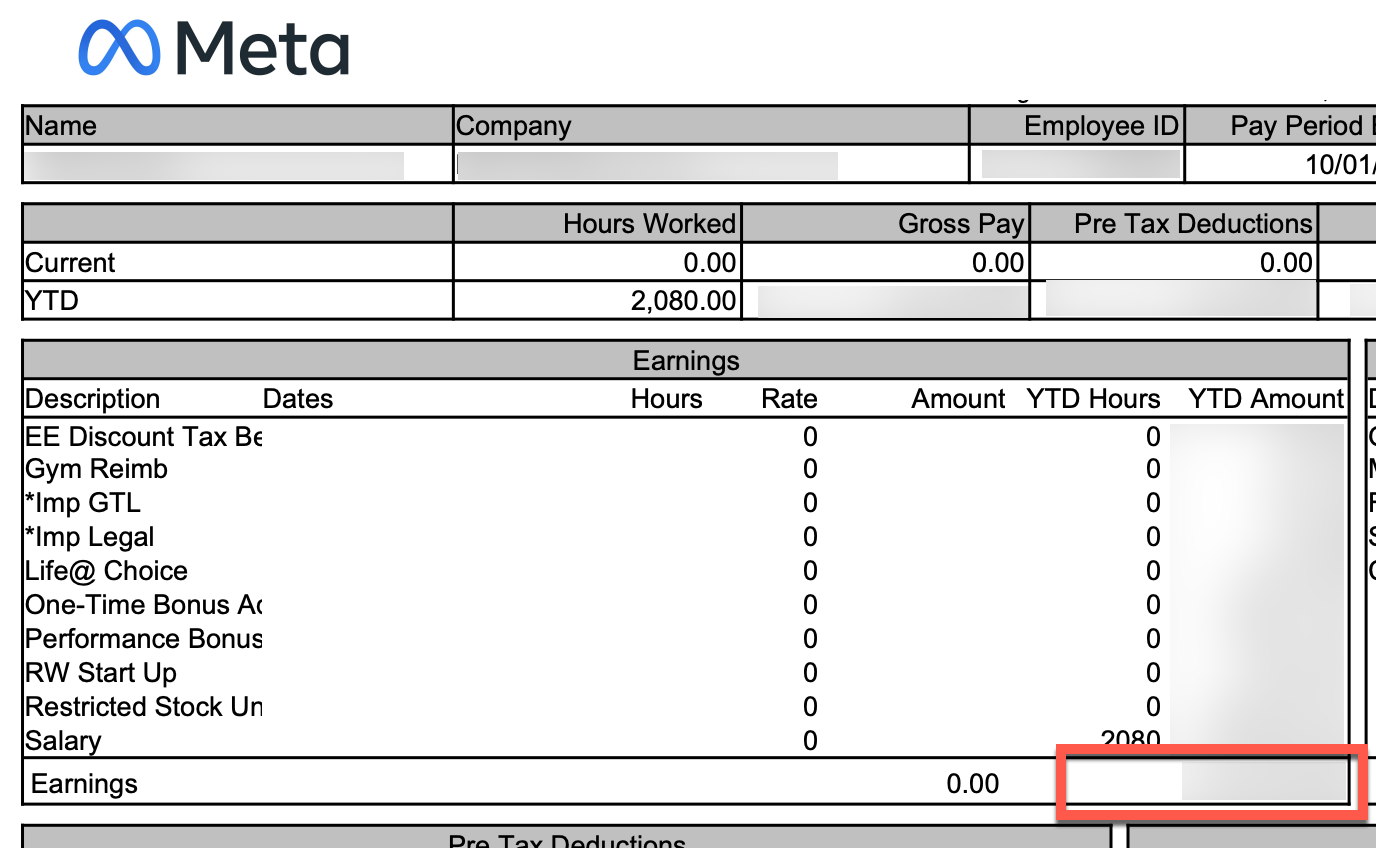

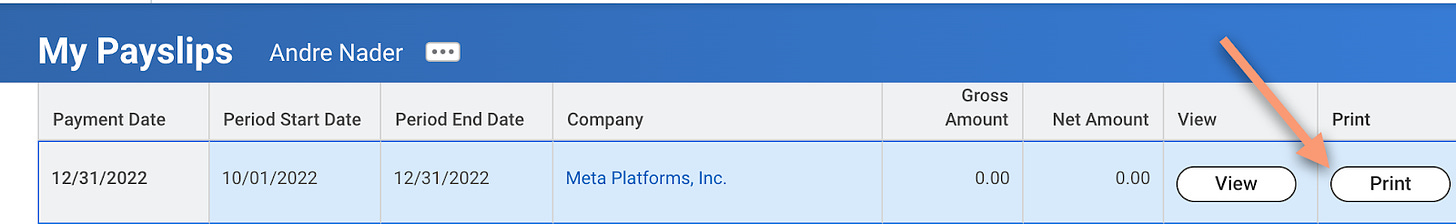

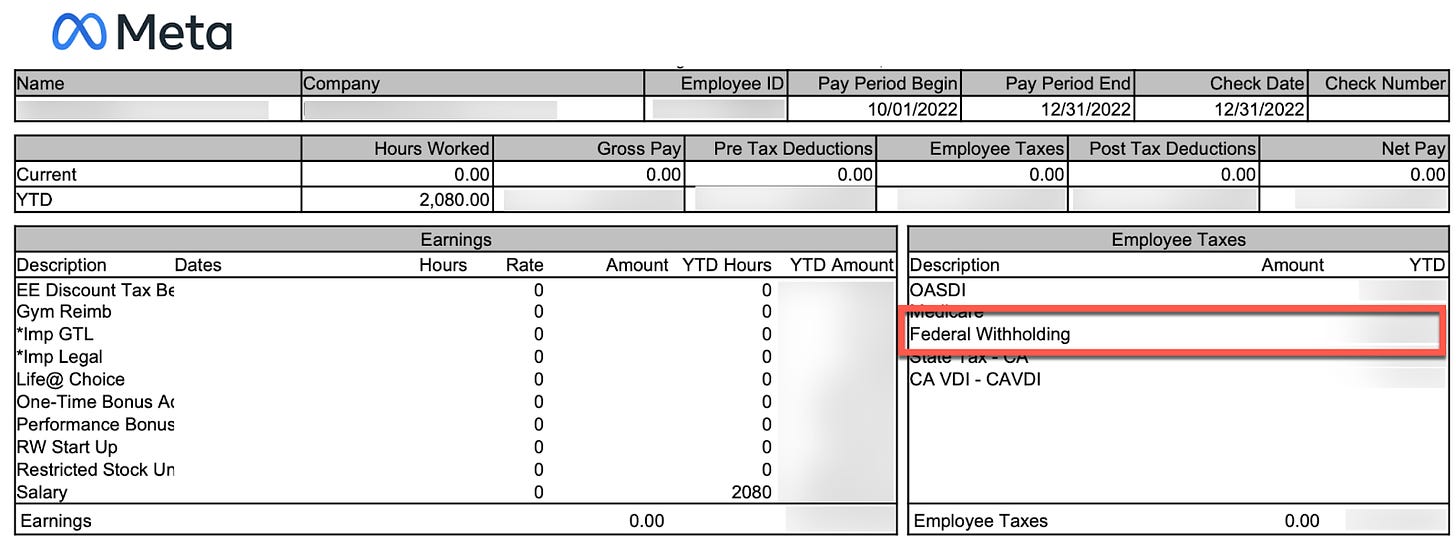

Meta Employees can quickly access their pay statements by using bunnylol (their internal search tool) “paychecks” which will take you directly into WorkDay. You will see a $0 pay statement with a payment date of 12/31/2022. I prefer the view of the pay statement you get when you click on “Print”. Uber employees can access the same through clicking on WorkDay within your single sign on portal.

Step 2.2: Use an Online Calculator to Estimate Your Bill

The tool that strikes a good balance of detailed enough without being complicated is TurboTax’s free estimator. It can sometimes be confusing knowing what numbers to put in each field so I will walk through the most important ones so you can follow along.

2022 Income Earned

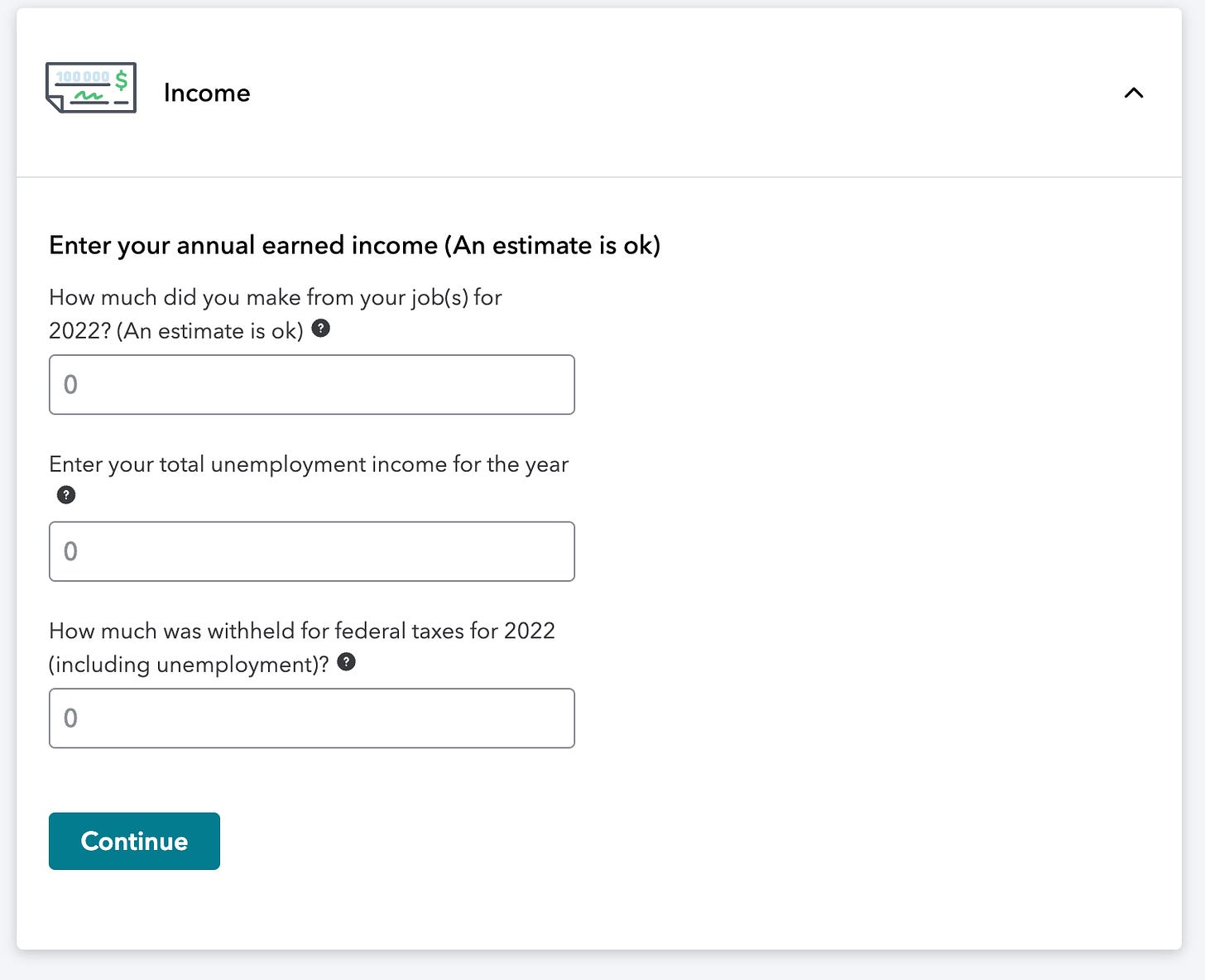

After finishing the “General info” section you will want to expand the “Income” section which looks like this:

In field titled “How much did you make from your job(s) for 2022” you will want to use the total “Year to Date Earnings” from your pay statement. It should be the number that includes all your Salary, RSU, Bonuses, and all other taxable benefits.

For the second box “How much was withheld for federal taxes for 2022” you will want to pull the “Federal Withholding” within the Employee taxes section of your pay statement as seen in the image below.

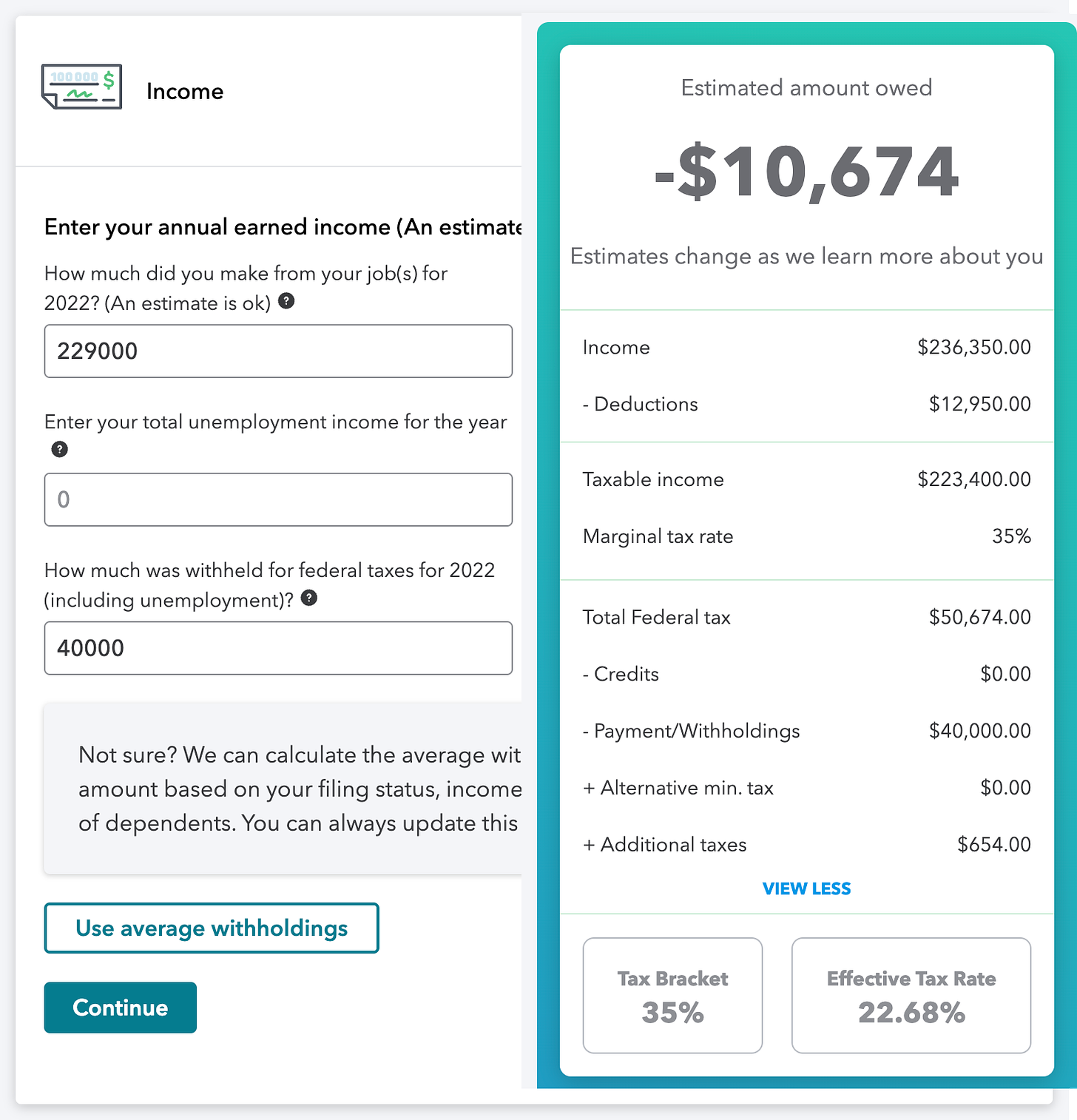

The calculator should look like this. If you don’t have any additional dividend or interest income then you are almost done! Just a few more boxes.

Other Income: Dividends, Losses, and Interest

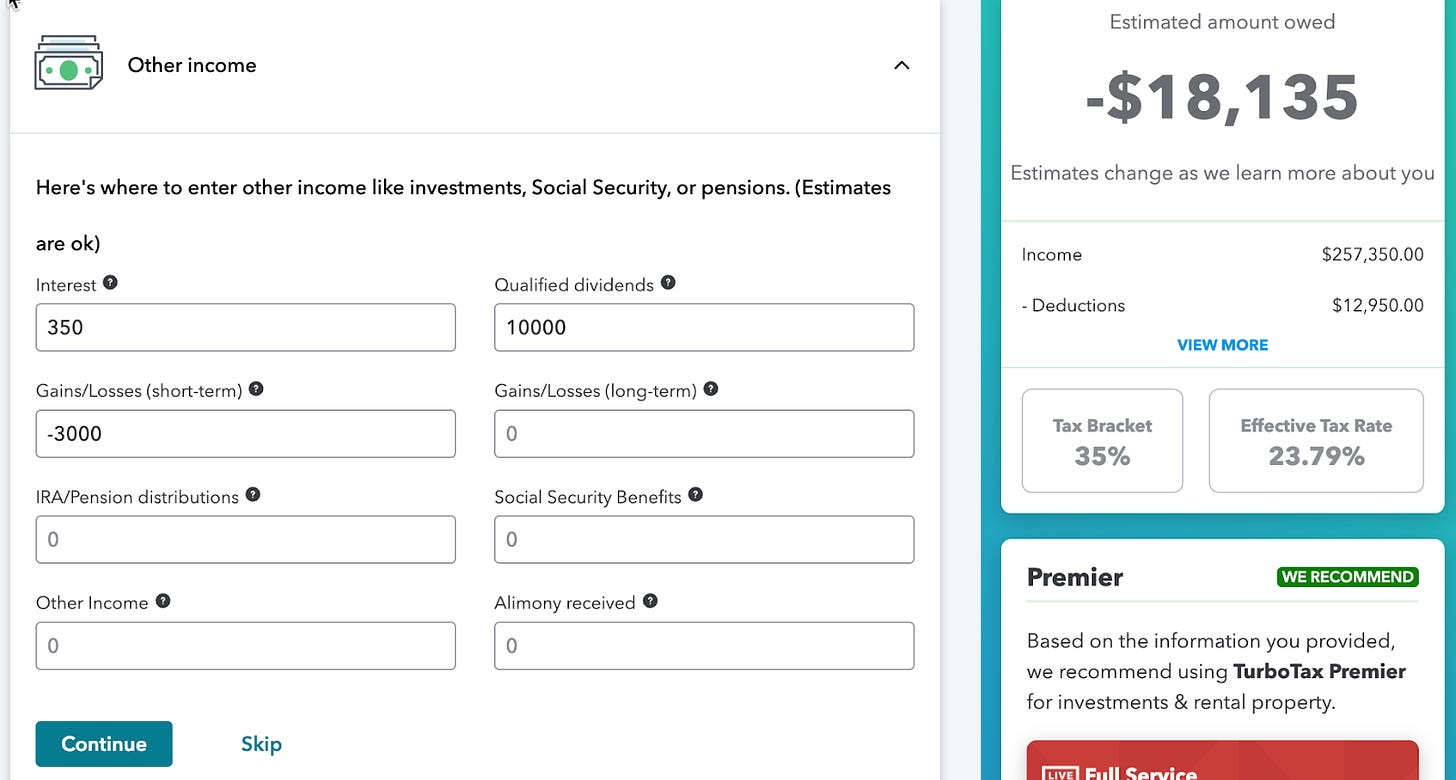

After completing the family section based go to the “Other Income” section. This is where you will want to include any dividends, gains/losses (you can just put -3,000 in any of the Gain/Losses section if you Tax Loss Harvested in 2022), and interest from savings.

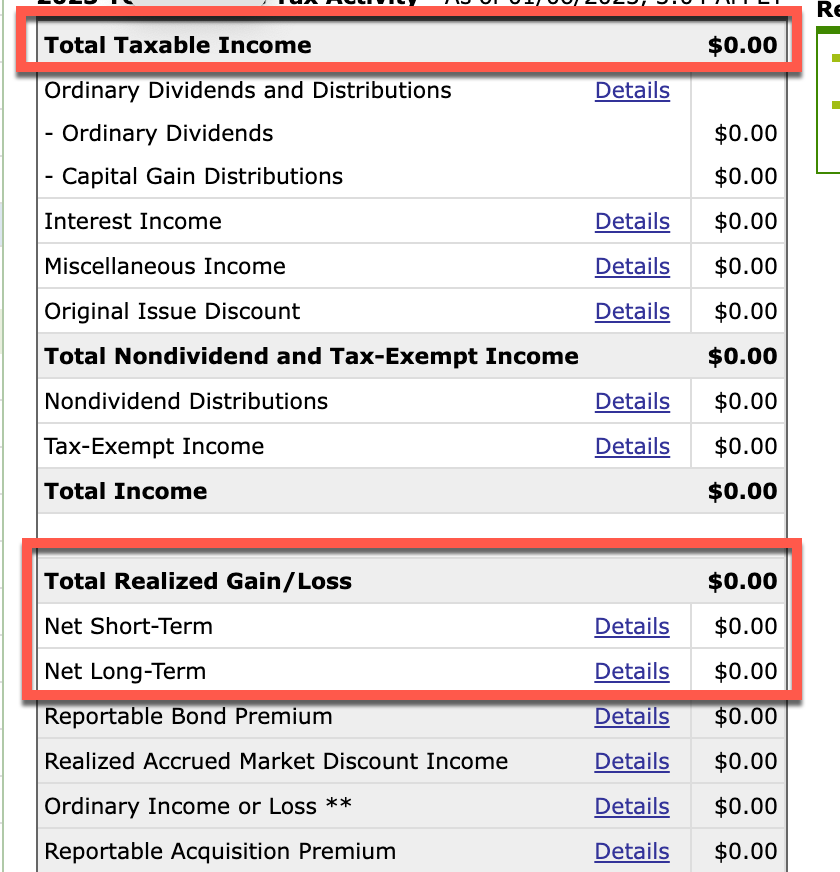

If you use Fidelity, you can access your dividend information by clicking into your taxable account, clicking the “more” section in the top header, and then “Tax Info (Year-to-Date)”. From there you want to make sure you change the drop down to 2022.

With this page you can now fill in your “Qualified Dividends” using the number in the “Total Taxable Income” for in Fidelity and the “Gains/Losses” using the “Net Short-Term & Net Long-Term” (I would just use -3000 in one of the fields if you had a large number of losses, that is the max to get the full benefit but a larger number shouldn’t impact things.

Your Other Income section should now look like this. If you have interest income you will still need to fill that out (which if you hold your emergency fund in a high interest earning account like the ones I will talk about in Step 3 you should).

Since interest rates in 2022 were extremely low, I wouldn’t expect many to have significant interest this past year. If you have multiple bank accounts like me it can be a pain to pull interest numbers across all of them. One of the paid tools I use is Quicken, which lets me quickly aggregate my total interest earned across all my accounts (I generally wait until the premier version is on sale for ~$40 prior to renewing).

I use Quicken Premier for net worth and investment/income tracking. For budgeting overall I would highly recommend You Need A Budget, you can see how I use it in my February Spend Report.

We are now finished with the income section which looks like:

Preliminary Summary

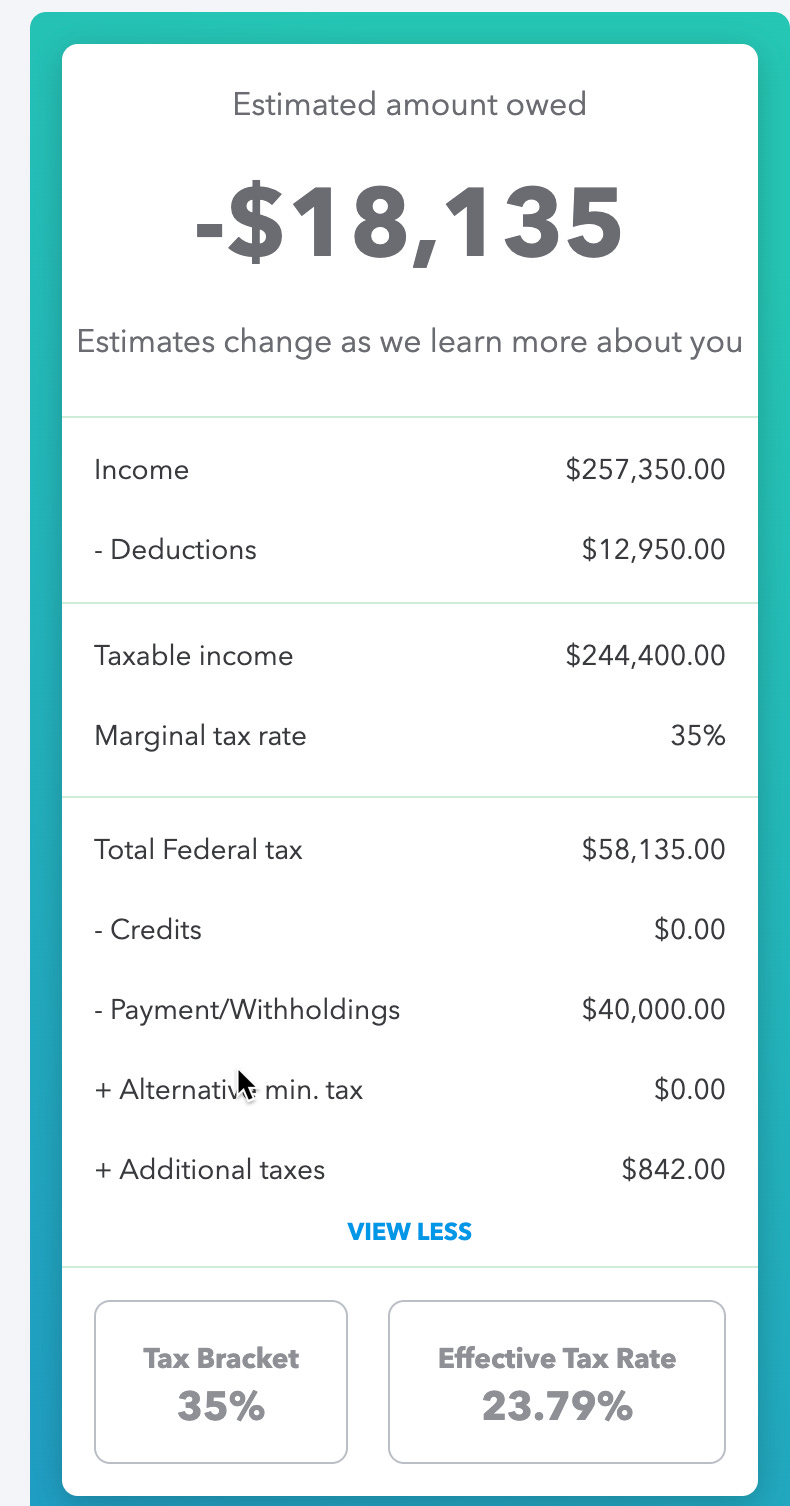

After you go through the other sections you will be able to expand the total on the right to give you your full summary.

Looks like for the data entered you would owe an additional $18k when you do your taxes in April.

Wait, I noticed that it left out the 401k contributions (it asked about retirement accounts but didn’t give the option to add traditional 401k. The main benefit of a traditional 401k is that it reduces your income by the investment amount. Considering we are at the 35% tax bracket in this scenario, this would have a large impact.

Let’s fix this manually.

Correcting for Pre-Tax Income Deductions

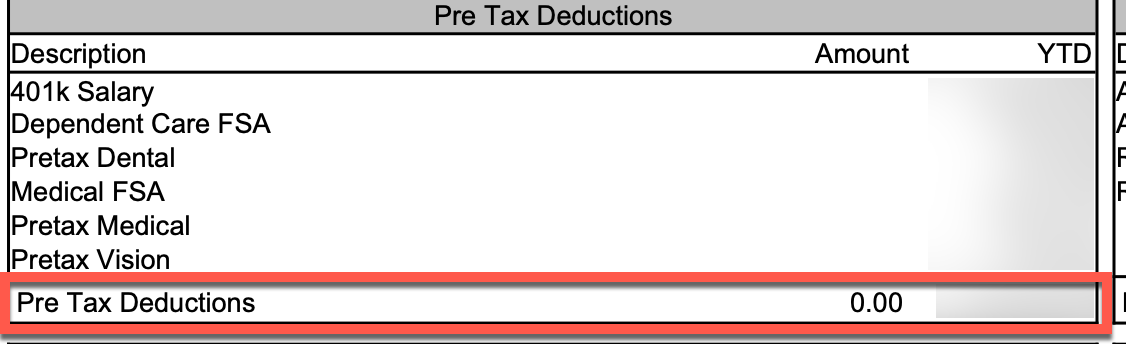

If you are like me you might have even more pre-tax deductions from FSA, HSA, DFSA, and other health care premiums. You will want to to is pull the total number from “Pre Tax Deductions” as shown below from your pay statement.

Go back to the income section and subtract the number above labeled “Pre-Tax Deductions” from the number you currently have in the “How much total did you make” box. In the example I am using we started with $250,000 in income, contributed $20,500 into a 401k and $500 into an FSA leading the new total income to put in the field as $229,000. This gives us the more correct estimate of $10,674 owed.

You should now have an estimate of how much you will owe in federal taxes. Remember this is just an estimate to give you some time to prepare. It doesn’t include many of the deductions you may be eligible for and a glaring omission of any state taxes for those who have state income taxes. I’ll sometimes use a simple California specific tool to get an estimate of how much overall I should have paid to give me an idea. One I like for this is Smart Asset’s State Tax Estimator (it is very simple but can be helpful). Just compare the number input there against the “State Tax” row in the “Employee Taxes” section on your pay statement.

Owing money to the IRS isn’t that big of a deal. In many cases you might not even owe any additional fees, and if you do the fees are mostly small. That said it is worth understanding why the large bill happens and if you want to prevent. You can see my “Shocked by Your Tax Bill” post with all the details. The only addition I’ll add is that Meta employee’s now also have the ability to change the withholding amount on their RSU’s to anywhere from 22 to 37% through workday (View Profile -> Job -> Additional Data Tab -> Click edit next to “RSU Supplemental Tax Percentage”).

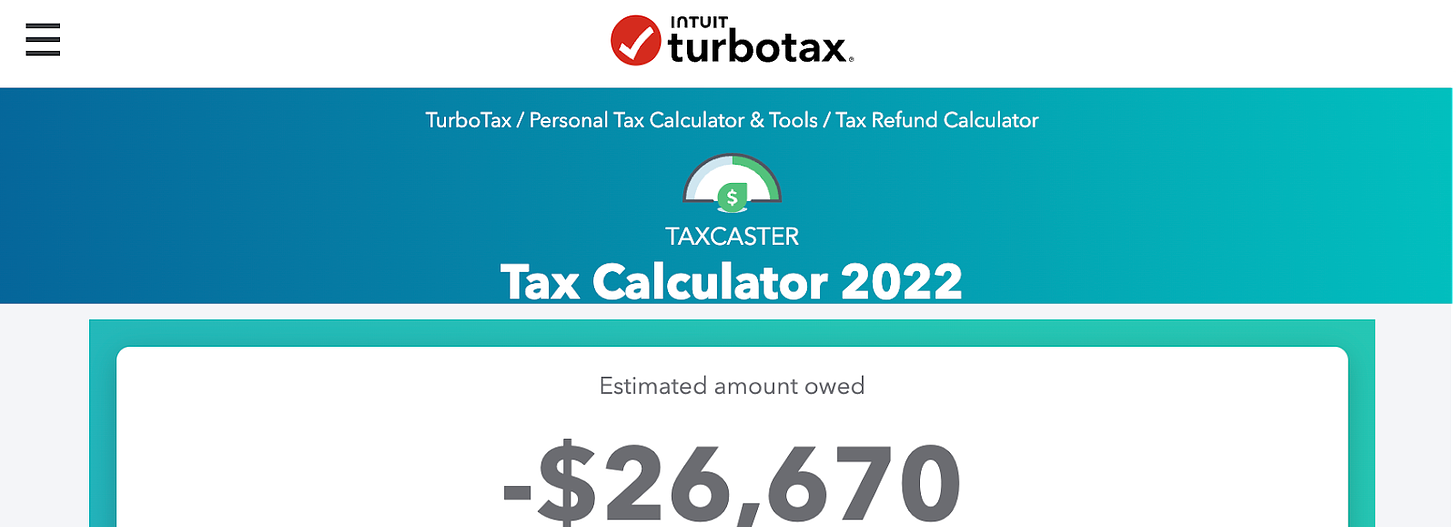

My Personal Results

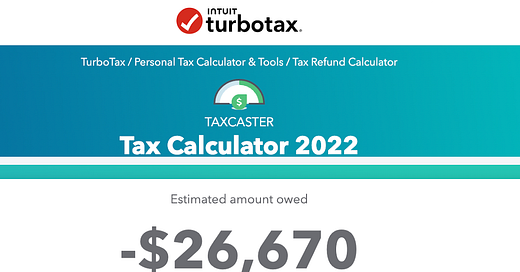

It looks like I’ll owe $26k, much less than before!

The steps I took this year to bring that number down was through contributing $600+ per paycheck in supplemental withholdings on my W4 as well as increasing my RSU Supplemental withholding to the full 37% (this feature was only added in Q4 so I can likely reduce my W4 withholding rate). If that withholding rate sounds high… it is! I increase the withholdings and RSU supplemental taxes on my personal Meta salary so my partner at Uber doesn’t need to mess with theirs.

Next week I’ll be sharing Steps 3 and 4 of my Financial Plan. Specifically, how I am optimizing my emergency fund to generate >$2,500 and my strategy around front loading my 401k contributions to max all my employer accounts in the next few months.

Let me know how you liked this style of post. It turned into a more step by step walk though since paycheck/tax terminology can be complicated. I had hoped to do a video recording walking through the steps but I managed to lose my voice this week!

Shortcut - just use the "Federal Withholding - Taxable Wages" amount which represents how much wages are subject to federal tax (i.e., after pre-tax deductions).

curious how this factors in the tax underpayment penalty, especially in the years when income is less predictable (with volatile stocks)

https://www.irs.gov/payments/underpayment-of-estimated-tax-by-individuals-penalty