February 2022 Spend Report

A view into my typical monthly spend (2 tech workers with 1 child in SF)

Have you ever been curious how much 2 tech workers with 1 kid spends in San Francisco? I wanted to share one of the tools I use as well as how I view the act of tracking your spend as a foundational exercise. I am going to pull the curtains back a little bit and show my February spend and share one tool I use to track my spend.

As I mentioned in “My Enough Number” post, a crucial element that every FIRE devotee needs to know is how much they spend. I find it impossible to meaningfully plan for an eventual early retirement without knowing how much you actually need. I determined my “Enough” number by taking 33.3 times my planned annual spend. Regardless of how you calculate how much you need, the first step is baselining your current spending.

Tracking vs Budgeting

Tracking: Having your spend logged and categorized

Budgeting: Explicitly assigning a fixed amount of money to a spend category

Most of the people reading this newsletter are higher earning tech workers. They also tend to get an allergic reaction to the word “budget”. For this reason I like to separate out the action of tracking your spend, which to put into tech terms can be viewed as ensuring you have adequate logging in place just as if your personal spend was a tech product you work on. Without logging you can’t know whether what you are building is effective in the same way as without tracking your budget you can’t properly understand how much you need to FIRE.

I do think the act of explicit budgeting is still a valuable exercise for everyone to do. Even just for a few months, regardless of income and net worth, to help set a baseline.. It really helps you better understand the breakdown of your discretionary and non-discretionary spending.

I recommend utilizing 3rd party tools to “add logging” to your personal finances which you can later utilize to explicitly budget or at the very least allow you to understand overall financial trends. Most good budgeting tools will involve tracking. Not all good tracking tools do a good job with budgeting. Understanding your goals for the tool and which tool best aligns with those goals is going to be important. It seems like there are new tools popping up each month and I am always looking for new ways to improve my personal finance tech stack. I like my current setup but I think there is plenty of room for improvement.

What I use for Tracking and Budgeting

My current tech stack is: YNAB, Personal Capital, Mint, Quicken, SigFig, Wealthfront, NewRetirement and I am constantly testing new ones. Today i’ll be sharing my February spend through the lens of YNAB, one of my favorite tools for very explicit budgeting (for overall net worth and spend tracking I greatly prefer Personal Capital).

YNAB

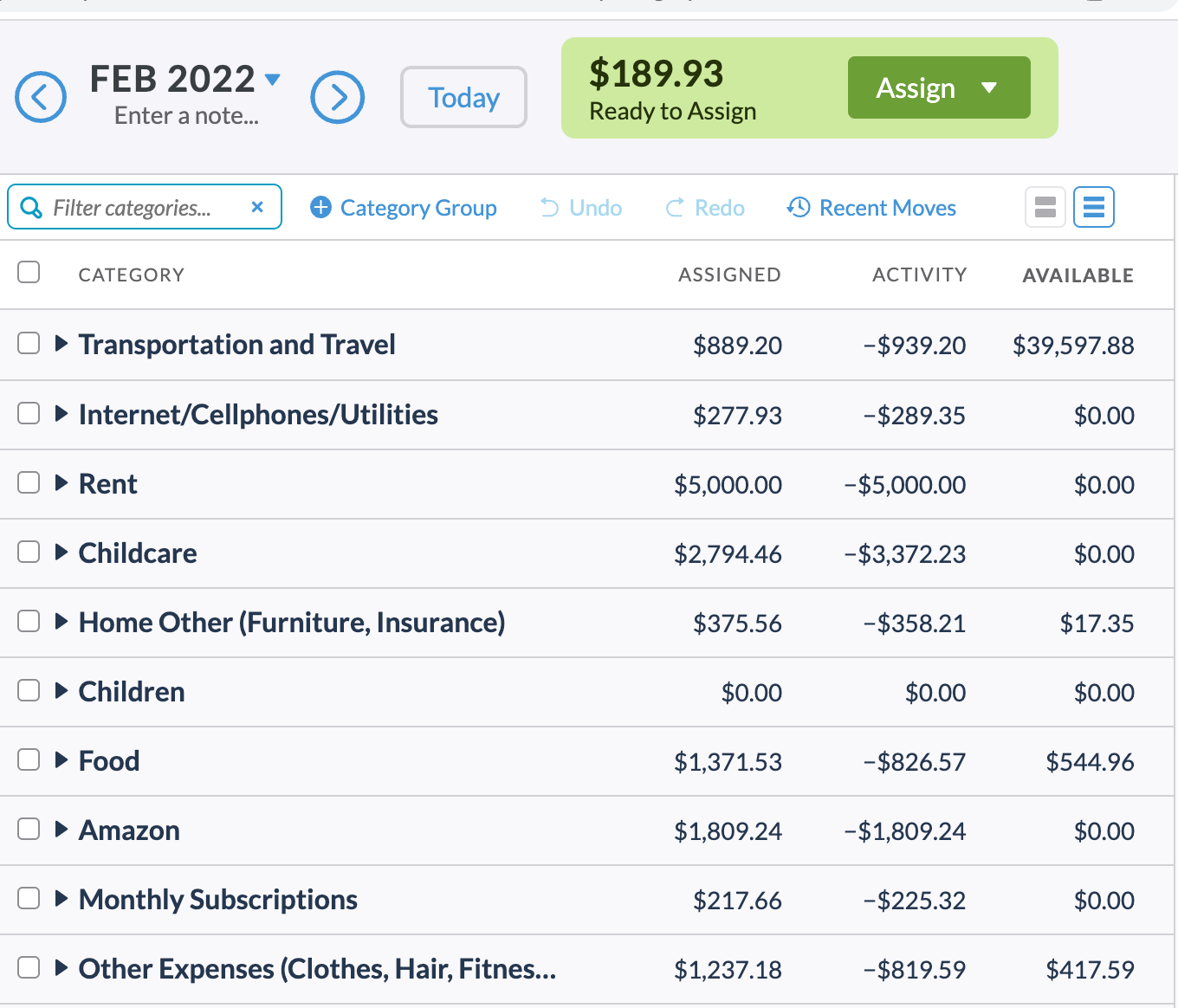

YNAB: You Need a Budget*1 I have always found most budgeting tools to be extremely passive. This results in very little behavioral change. YNAB takes a different approach and is explicitly manual in many ways. It still automatically pulls in your spending from your accounts but it forces you to go and approve as well as set up budgets each month. If you overspend in YNAB, you need to physically move that overspent amount from another budget category. They take it a few steps further by forcing you to assign every single dollar you have, even if it is just an “Emergency Fund” bucket. You can see in my screenshot below that I have $189.93 in my account that needs to be assigned somewhere. There is also the category “Fancy New Car” with $39,597.88 available. In the case of the “Fancy New Car” I have the amount available to pay off my car but it is sitting in a savings account earning more than the current loan rate.

YNAB does cost $99 per year which is on the higher end of tools but I definitely think that a year of using YNAB will alter your spending in a way that is >$99. You can use the link above to try it out for 34 days (enough to overlap an entire month).

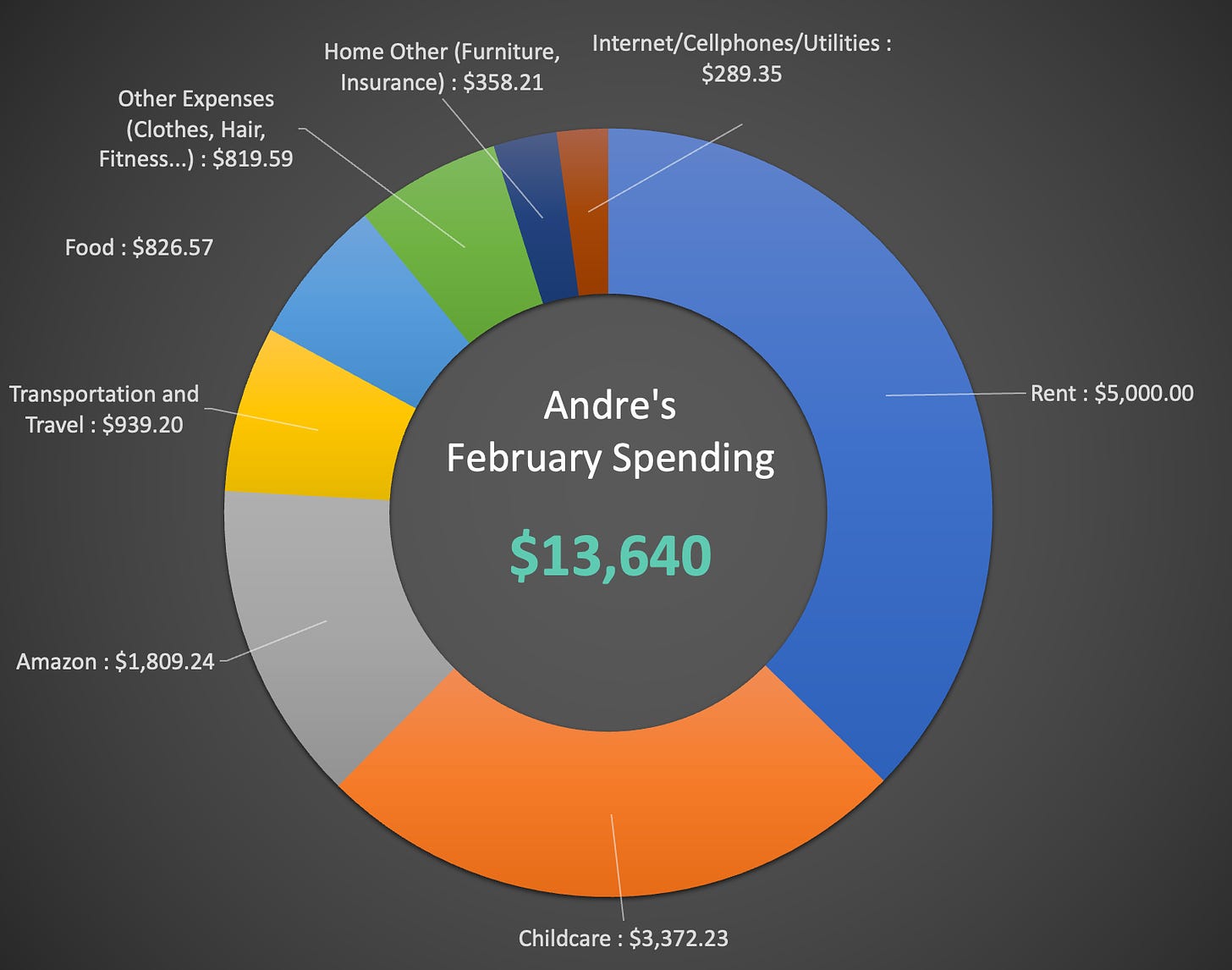

My February Spend

Remember in my “Enough” post where I outlined that my desired spend was $8,333 per month? You may be surprised to find out that I am currently blowing that out of the water. Don’t get too concerned for me though. My Enough spend didn’t include housing and as my daughter grows older public schools could drastically cut back on childcare expenses. 60% of all my monthly spend is housing and childcare, Bay Area in a nutshell.

After Rent and Childcare my next highest expense is Amazon. Followed by Transportation and Travel, the majority of which is on a car payment. As shown previously I have the balance to pay off the balance but am currently earning more than the 1.9% rate on the loan. I admittedly splurged a bit more than I planned after going 7 years without a car. Normally my Food budget comes in at #2/3 but the pandemic and having a child drastically cut back on my restaurant consumption and I must have gone to Costco on January 30th to cut my grocery spend in February.

YNAB Spending Summary View

Exported into Excel for more Customization

Hopefully this shines a little light into my process of tracking → budgeting → estimating spending needs. As you can tell there is a lot of discretionary spending as well as a healthy buffer between my planned spend and current spend (when you remove housing and childcare). The biggest anticipated spend in FIRE that isn’t represented in my current budget is avocados healthcare. But that my friends is the topic for another post.

The last 2 posts have been a bit more personal in nature. I am curious to hear whether you want to see more like this or if you would prefer that I stick to broader generalizable tools and analysis.

Signing up for YNAB through this link will gives me one free month of YNAB.

Andre - first I have to say that I love your analogies. The logging, your "tech stack" - it's so true. You're really inspiring me to seek out more product parallels in how I think about financial planning... and use my familiarity with that framework to shed light on what more I could be doing to foster my financial situation. So thank you!

Also, I agree wholeheartedly about YNAB. I LOVE it and its mindful approach to spending so much. Money, in a sense, is irrelevant to budgeting, and instead it's about understanding your priorities and using money as a means of satisfying them. Such a beautiful and sustainable mindset. It has truly changed my life over the last year that I've actually been "giving every dollar a job" and not just expense tracking. I agree 100% that it is worth every penny. They should hire us to do their commercials. Have you played around with different category structures in YNAB? What about your current structure do you like and why?

> Most good budgeting tools will involve tracking.

I'm curious which one(s) you've found that don't, and what they do instead?

I agree that YNAB's charting functionality is a bit minimal. But they do seem to have a decent API. I've been thinking about messing around with it and some D3 - have you had any ideas for visualization, tooling, or views that you wish it supported?

I'm new to your blog but can't wait to keep reading. I'm getting ready to take some time off work, so I'm really looking forward to your forthcoming healthcare post. I think the personal natured posts are helpful for others to realize they're "not alone" in asking these types of questions. They can inspire people who "get an allergic reaction to the word 'budget'" to see that it really should be approachable and could not be more opposite from the "restrictive" reputation it has, when you're really doing it right.

Thanks so much for your thoughtful and honest writing!

I used to have an Amazon category, but why is Amazon special? It's just a store. You don't track your groceries by what store you buy it at, do you? I do get Amazon Subscribe & Save groceries - so that's how I categorize those! If it's clothes, it goes in that category. If it's hard to find a category because it's something "neat" on Amazon, I try not to buy it!