What is an “Enough” Number?

When I refer to an “Enough” number, I am talking about the amount of money where you can hang up your keyboard and never need to earn another dollar. I took the concept of “Enough” from Jack Bogle’s book by the same title as well as a quote from Joseph Heller which Kurt Vonnegut included in Mr. Heller’s obituary: “Yes, but I have something he will never have . . . Enough” ( Jack Bogle also used it in a commencement speech to bring it full circle).

That felt a little pretentious to write, but the concept of “enough” is a key principle to how I approach personal finances. I grew up in a household that experienced extreme household wealth volatility and I never want to experience that again. The pursuit of financial stability and understanding “enough” is deeply personal. Similarly, how I approach calculating my enough number may vary to how you calculate your own. With all things personal finances, they tend to be deeply personal. These numbers are inclusive of me, my partner, and our 3.9 year old.

Approach to Withdrawal Rates

I wrote a high level overview of coming up with a FIRE number within the Understand portion of “A Product Growth Approach to FIRE”. In that post I explained how I was using a 3% withdrawal rate, which is a more conservative approach than many in the FIRE community take. The more commonly seen FIRE shorthand often uses a 4% withdrawal rate which originated w/ Bill Bengen and later a team of researchers at Trinity university. They concluded that with a portfolio of the S&P and Bonds (50/50 split), a retiree withdrawing 4% of their original portfolio balance and then adjusting that amount for inflation each year would not run out of money after 30 years (95% success). Mr Money Mustache has a very user-friendly primer on the power of the 4% rule.

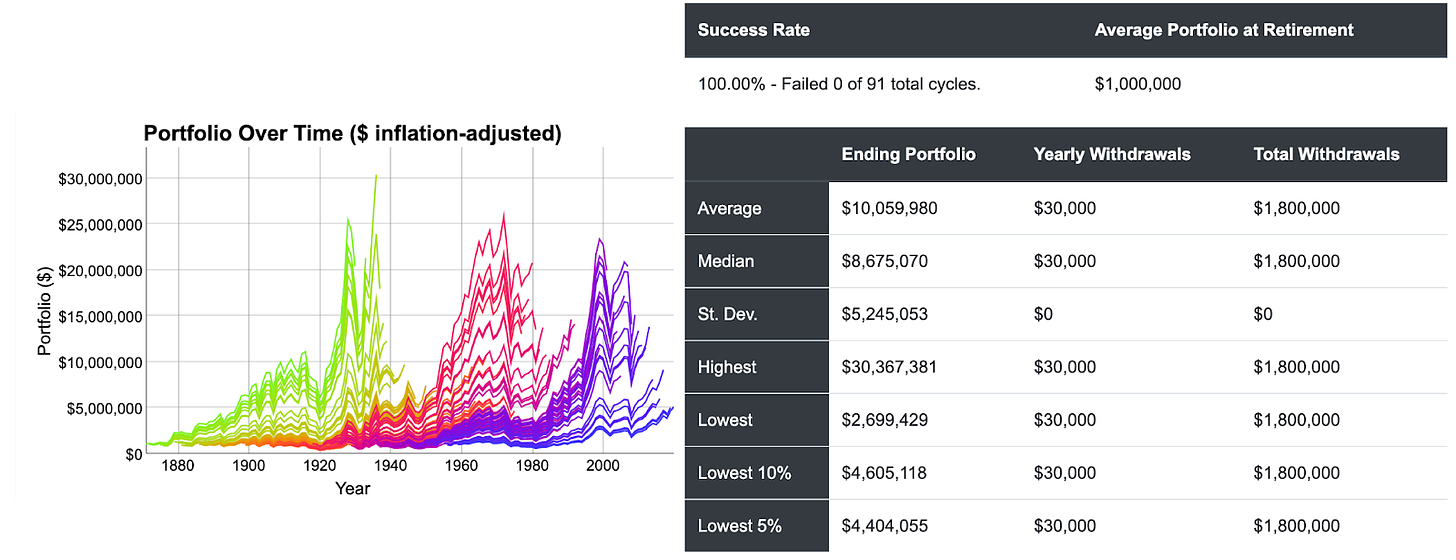

I am personally much more conservative with my 3% withdrawal rate goal. The desire for financial stability is one element driving this, but with an early retirement pushing 60 years I would rather work a few more years than risk a fail state. Another way to calculate a 3% withdrawal rate would be to multiply my desired spend during FIRE by 33.3. The magic here is that there isn’t a single period in US history where the 3% rule has ever failed. Here is a simulation courtesy of one of my favorite FIRE tools, cfiresim.

The above graph is showing how this strategy would do in every single 50 year period in US history. Where the initial withdrawal amount is 3% of the initial investment portfolio value. In this case that is 1,000,000 x .03 = 30,000. Each subsequent year the initial withdrawal amount is adjusted for the inflation of that year. So if inflation is 3% in year 2 the amount that would be withdrawn from the portfolio is now $30,900. As you can see, 3% is incredibly conservative and far lower than most. This is also a simple rule of thumb and in reality flexibility in FIRE would allow for much less conservative estimates. I highly recommend geeking out on withdrawal rates by digging into ERE’s withdrawal rate series. His analysis on sequence of return risk opened my eyes into how important the first 5 years of early retirement are to your portfolio’s success.

33.3 x desired spend gets me 80% of the way to my full “Enough” number.

Getting to my number

There are countless articles out there that will say things like “You need $2 million to retire” or “$5M” You know the problem with these? “You can’t do anything with five”.

No, it isnt’ that. It is the fact these numbers are meaningless and there is no way to know whether they could apply to your situation. Key piece being “your situation”. This is why I am a proponent of basing how much you need on how much you plan on spending. Without this data you are just guessing.

The simple math with the not so simple assumptions

Making the calculation is simple. Take your expected Monthly Spend and annualize it (multiply times 12), now Multiply it by 33.33, write that down. Boom, that's your number.

The issue is how the hell do I come up with my expected spending? Of course I am tracking my current spend using 5 different apps… but that only tells me how much I am spending. It is absolutely a great starting point but isn’t exactly how much i’ll spend after FIRE. Key expenses that will drastically change: Cost of Living, Childcare, rent, rent, oh did I mention rent? I live in San Francisco after all. My FIRE number if I wanted to live in the city would be drastically different than if I wanted to go to a medium cost of living city (MCOL) like Raleigh, NC.

My current, broad overarching goal is to be able to spend $100,000 per year in retirement.

The traditional 4% rule would tell me that I need $2.5M in investable assets (quick math here is 25 x 100k = 2.5M). But as I mentioned previously, I am aiming to be more conservative using 3% or 33x spending. So that gives us 33 x 100,000 = $3,300,000.

The other 20%

As mentioned above this is only contributes 80% of my overall Enough number. The other 20% after the $100k per year is taken care of is having a paid off house and 4 years of college fully funded for my toddler.

Housing

I was originally thinking it would cost me $400k to purchase a house in a MCOL area… but things seem to have been going a little wild and I am bumping this up to $600k. In reality I wouldn’t pay in cash depending on rates. I’ll also highly likely move to a new city and work remote prior to fully retiring early.

College Costs

After taking care of housing the only thing to add are the college costs I plan to help with 16 years from now. So let’s add in college costs. Using Personal Capital’s excellent retirement planner1 it tells me if I superfund a 529 plan with $70,000 this year it should cover 4 years of state college, tuition, room and board. I have yet to fund a 529 due to the chance I leave San Francisco for a state with a tax break on contributions. In the spirit of bring conservative I bump it up by another $10k to $80k total.

Recap of My Enough Number

That brings my “Enough” number to 3.3M + 600k + 80k = 3.98M… or let’s make it an even $4M.

$4,000,000

$3.3M invested into broad based index funds which will provide $100k spend per year, $8,333 per month (excludes housing)

$600k additional liquid to allow for paying off a house

$80k invested in a 529 to fund 4 years of college for currently 4 year old child

This will put me solidly in AvocadoFIRE territory. What is your “Enough” number?

If you are still too early to calculate an “Enough” number I highly encourage you to start to add logging to your finances. Personal Capital is by far my favorite free tool for tracking and has some of the best projection tools available. It is one of the longest tenured pieces of my FIRE tool stack. Disclaimer: If you sign up I’ll receive an affiliate commission. I’ll break down my $100,000 budget, my approach to taxes, and how I think about healthcare during FIRE in a future post.

Looking for 1:1 FIRE coaching?

Partner with me to identify your FIRE goals and create an action plan on how to achieve it. Over the course of 4 sessions we will outline your personal goals, how to make a plan to reach those goals, create a 2 year projection of your income and savings personalized for you.

This website earns an affiliate commission from Personal Capital on new account sign ups.

I also used a 3% number for "safe", and quit Amazon at 2.5%, which I labeled as "ultra-safe". :)

In our case, our home was paid off, and if we ever move, we'll likely move somewhere cheaper. So I ignore the home (value & future cost) in calculations. Property taxes should also be equivalent or cheaper elsewhere, so they're just part of our annual expenses.

Unexpectedly, my newsletter now pays for more than our annual expenses, so our withdrawal rate for the last 2 years has been 0%. Strange things happen in life.

Love this breakdown. Would 8300/month be enough with ~1300/month and ~8000 deductible/year in health insurance costs (for a family of 4)?