Welcome my friends. In today’s TEDtalk I will demonstrate how you can take the same approach to your financial life as you would to a product growth problem.

Like all Product Growth problems will rely on Facebook’s tried and true “Understand, Identify, Execute” framework. Today’s talk will primarily focus on the Understand phase.

Understand/Identify/Execute at a high level

Understand: What Is Your Goal? Why does it matter?

Identify: Where are the best opportunities for you to achieve your goal?

Execute: If you have identified the opportunity now it is time to make things happen. Execute perfectly, keep yourself accountable, regularly track and report on progress

But first you need to start with your mission.

My FIRE Mission: The mission for this exercise is to become Financially Independent (and be able to retire early)'

This is a deeply personal thing. It is about providing yourself the gift of choice: whether that is to work, retire, travel, or do whatever it is you love. It is about having the ability to spend my time without being controlled by costs.

Understand

Stated Goal: Save Enough Money to be Financially Independent

Why does it matter? In order to achieve my mission of becoming financially independent it will require me to have a nest egg saved.

How much is “Enough Money”? We need to go deeper into the understand to better set accurate goals.

What is the Topline Metric?

Total $$ in my investment and retirement accounts. Investable Assets.

Simple, Moveable, and Important! Also fairly hard to legally game.

Typically excludes the value of your primary residence

The next step is to establish the right data to measure and track your goals health. This means we will need to add logging! Investing in logging will be key in this phase.

Need to make sure I am logging my topline correctly.

Need to ensure accurate logging of Spending, Income, and Contributions into my topline

Need to properly categorize sources of income, sources of spend, allocation of investments

Suggestions: I don’t have access to a personal data engineering team to add this logging for me. Fortunately there are a number of excellent free and paid tools out there that will help establish a baseline for you.

Mint.com: One of the original free personal finance apps. Aggregates all your spending across accounts. Has some light budgeting tools but has not seen any real improvement in years. Good place to start if you have nothing.

https://www.personalcapital.com/ for tracking/logging investments

YNAB (youneedabudget.com, $85 per year, you can sign up here for a free 34 day trial): This is an amazing tool for really going deep into your budgeting. It will automatically aggregate your accounts like all the others... but the real magic is that it isn't passive at all. It forces you to allocate every dollar you have (concept of giving every dollar a job). I find this intentionally manual process is needed for really changing behaviors.

I also have been using Quicken for the past year… and it is ok (~$50) as an all in one investments + budgeting tool.

Understand 1.5 Goal Setting

This assumes you have completed step 1 and added logging. If you have a few months worth of logging you should have a rough sense of how much you spend per month.

This is the shockingly simple math that will give you a ballpark figure of how much you need to have invested to Retire Early.

Take your Monthly Spend and annualize it (multiply times 12), now Multiply it by 25, write that down. Take your annualized spend again, this time Multiply it by 33.3. If you wanted to retire early, living the exact same lifestyle, spending the exact same amount you are right now you will need somewhere in the range between those two numbers.

Example:

Current Monthly Budget: $5,000

Annualized Monthly Budget: $5,000 x 12 = $60,000

25 x Annualized Monthly Budget: $60,000 x 25 = $1,500,000

33.3 x Annualized Monthly Budget: $60,000 x 33.3 = $1,999,800 (Lets call it an even $2M)

Amount Needed To Retire Early: $1.5M - $2M.

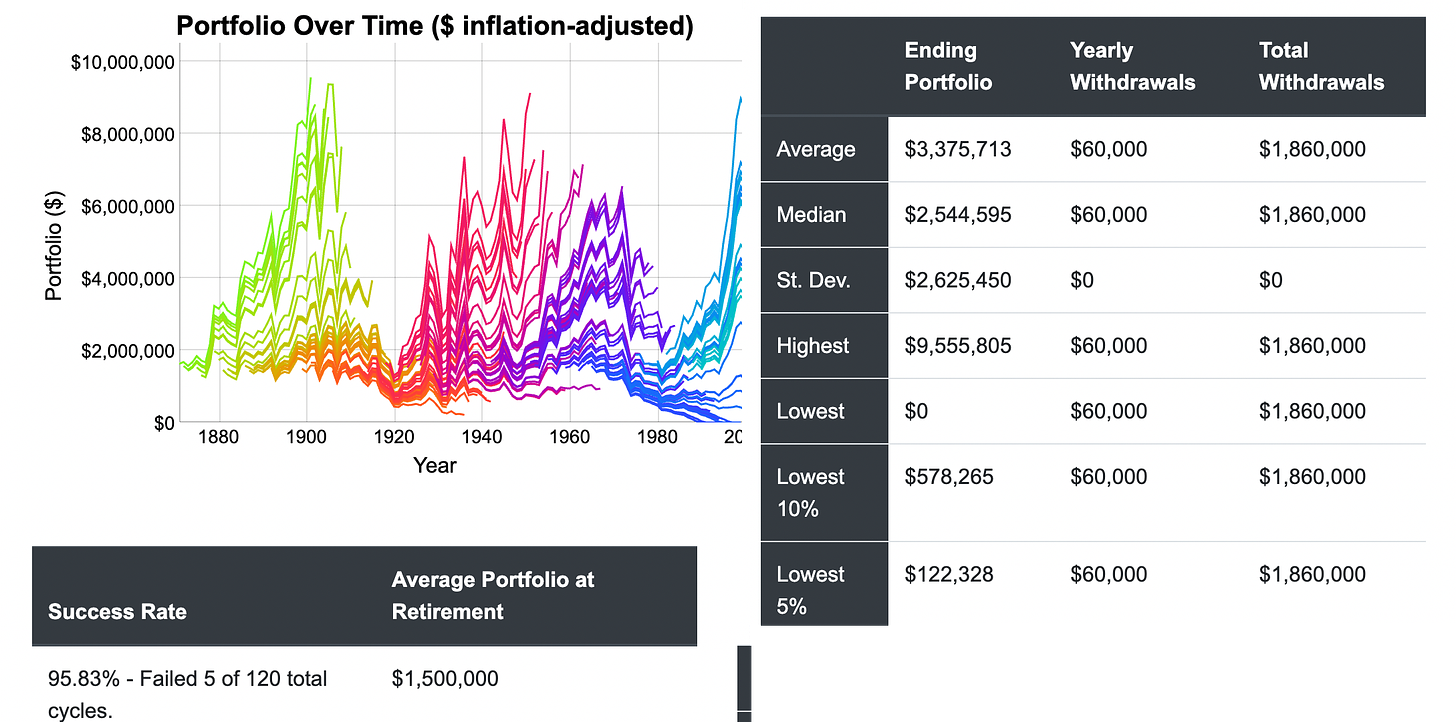

Where did 25x and 33.3x come from? The 25x is derived from what is often referred to as the “4% rule”. The 4% rule states that you can withdraw 4% of your starting portfolio, adjust the amount annually for inflation and almost never run out of money before 30 years (5% failure rate and assumes a portfolio of equities and bonds). The typical retirement age in the United States is ~65 so a 30 year run is all you need. In the past 116 years there has only been 5 30 year stretches where a retiree would run out of money early. In fact, the median ending balance after 30 years was actually 66% higher than the starting balance (these are in real dollar terms). Look for yourself on Cfiresim, a site that allows you to run different withdrawal scenarios.

We are talking about Early Retirement though. Instead of 30 years we are talking 50+ years of this money needing to last. Let’s run that same simulation on 50 year periods! Well, now you run out of money early nearly 20% of the time. That does mean that 80% of the time you are successful, with the median this time a whopping 180% higher than your starting balance (cfiresim link)! This is one of the reasons why you often will read about people using the 4% rule even for longer durations. It is also important to remember that the 4% rule is just a rule of thumb and not a law. In reality with some flexibility in changing your spend you could drastically reduce your failure rate. (Also take a peak at the years that failed, they all have something in common)

Ok what about the random 33.3x part? Well, 33.3x is derived from 3% instead of 4%. The magic here is that there isn’t a single period in US history where the 3% rule has ever failed. Here is the simulation for 50 years.

You can see the median is a wild 456% higher than the starting balance (again, real dollars). This means that 33.3x represents an extremely conservative (many would say too conservative) estimate of an upper bound you would need.

So now that we have our topline metric, a range for our goal we can finally move on to the identify phase. Make sure to subscribe to be the first to know when the next two phases are published.

Resonated well with my current thinking too, just that I factored in inflation and taxes to come up with my retirement $$ amount. Btw, I couldn't find the Parts 2 & 3 in this series. Didn't write them?😎