As we head into February and outlook lets you know that your W2’s are ready, many of you over achievers will be trying to get a jump start on filing your taxes. The past year saw a large number of IPO as well as lots of equity appreciation for much of the FAANG group. This could mean that many of you in for a big surprise when you file your taxes, particularly those new to having large portions of their W2 income come from RSU/equity vesting. I know I personally was shocked my first year filing taxes after joining Facebook and being caught off guard by very sizable 5 digit amount owed to the IRS.

I’ll explain why this might have happened to you and what you can do to avoid this in the future (or at least minimize it). **Quick disclaimer, this is not to be used as tax advice. I am not a tax professional. I also don’t think most of you will need to run out and hire a CPA if you are just earning W2 income, there isn’t anything magically most of you can do.

The two biggest sources of a surprise tax bill for a FAANG W2 worker:

You have a substantial amount of your W2 income coming from RSU vests

You set up your W4 incorrectly

First thing I want to get out of the way. All W2 income is essentially taxed the same regardless of whether it comes from base, bonus, or equity vests. However they can be withheld at different rates. The base/bonus will be influenced by what you enter into your W4. Your equity however could receive a completely different treatment. Many companies, Meta/Facebook included, withhold equity vests at the “supplemental rate” which is a flat 22%. This means regardless of whether you are a VP earning millions or a new IC3 with a little less, all your RSU vests will automatically withhold 22% for taxes (technically supplemental withholdings for those earning >$1M jumps up to 37%).

Federal Tax Explainer

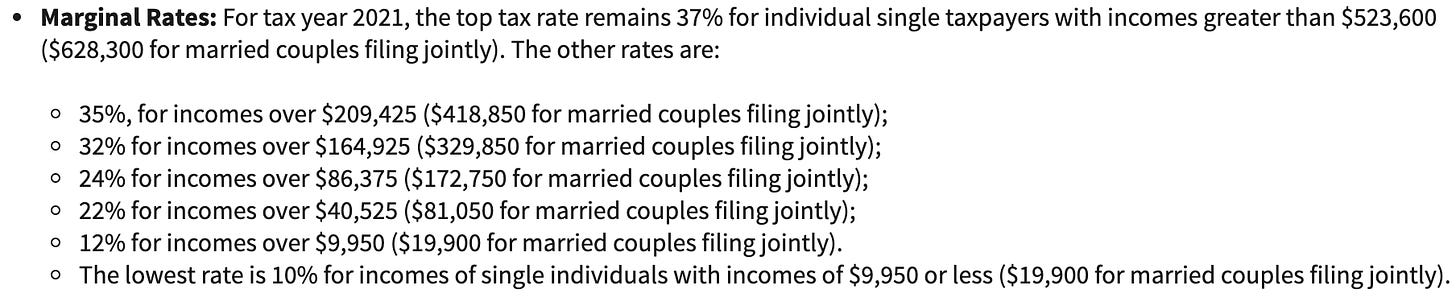

Let’s take a look at tax brackets where income above $86,375 ($172,750 for married filing jointly) is taxed at more than 22%.

A brief note that I need you to understand (because I have been surprised by how many people are not aware of this). Federal tax rates in the United States are broken up into “brackets”. You pay the tax rate for income in each of those brackets.

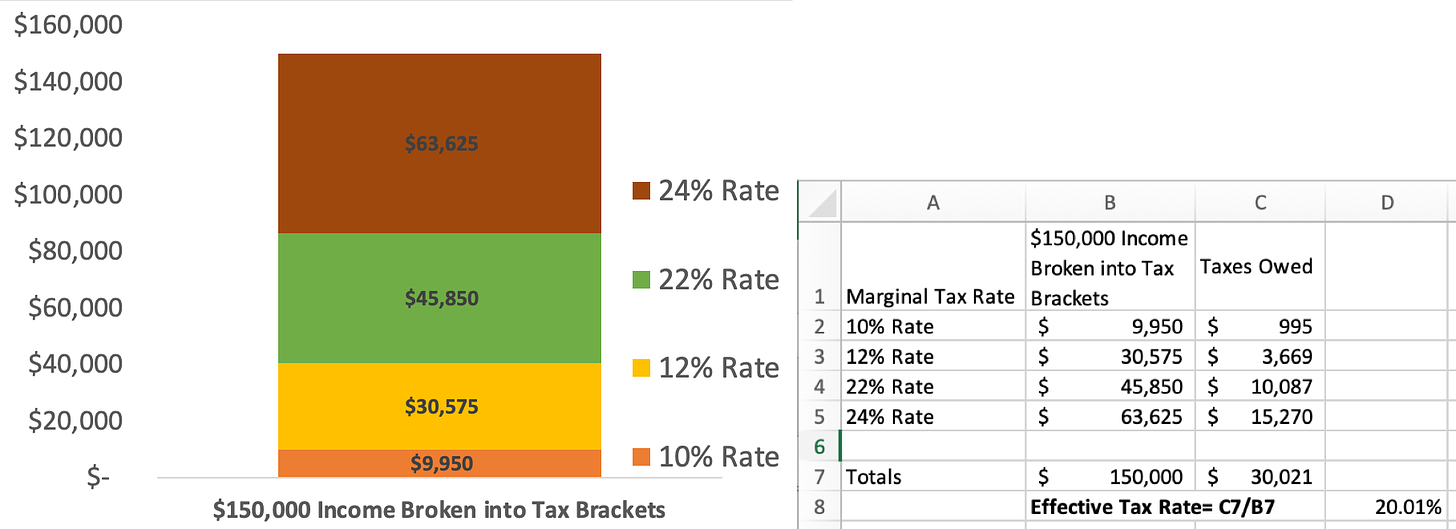

So if you are a single filer earning $150,000 the tax rate breakdown would look like this:

In this case you would say you are in the 24% tax bracket, but your actual effective tax rate is 20%. This is simplified, only federal taxes, and doesn’t factor in standard deduction or any reductions in gross income due to things like 401k contributions. If you at least understand this, you are ahead of the game! The next time someone tells you they pay 50% in income taxes living in California, they either must make $2.5M per year or not understand how marginal taxes work.

As I showed in my “E3 Guide to FIRE”, a single new grad engineer is already past those marginal thresholds. Remember though, the gap should primarily come from your equity grants. Those will often only be withheld at 22%. So most of the surprise tax bill comes from the difference between your top marginal tax rate and that 22% automatic withholding.

Do I Owe Penalties?

Outside of the shock of owing a large sum to the IRS it isn’t that big of a deal. You may not even have any additional fees! Congrats, you got an interest free loan from the US government. Although don’t take this too far, because there are actual under withholding penalties. The IRS has this to say on under withholding penalties: “Generally, most taxpayers will avoid this penalty if they either owe less than $1,000 in tax after subtracting their withholding and refundable credits, or if they paid withholding and estimated tax of at least 90% of the tax for the current year or 100% of the tax shown on the return for the prior year, whichever is smaller.”

But Andre... I owe $50,000 and I don’t have that money lying around. The good news is that you probably have more time than you think. Taxes are due April 18th however you can file an extension if you need more time. The IRS will charge you interest on the amount owed though.

How Do I Avoid A Tax Bill?

There are three primary ways to avoid a large tax bill going forward.

Method 1: Update Your Supplemental Withholdings

You know and understand that the cause of your tax bill is due to the default 22% supplemental withholding rates. Luckily, many of you will be able to directly change this default.

Meta, Google, Apple, Uber all let their employees directly update their supplemental withholdings anywhere from 22-37% manually.

Meta Employees can change this in workday, search Life@ for "Federal supplemental tax rate election for RSUs" (Equity → Compensation)

Google Employees can access their settings by going to go/supplementalwithholdingelection

Uber Employees can update through Solium (Only available quarterly I believe)

If your employer doesn’t allow you to make this update; ask them to! Reach out to your benefits/RSU/payroll teams to let them know more and more companies are allowing their employees to update their supplemental withholding rate. They may not even be aware this is an issue and/or there is a way for them to add the functionality.

What to Change Your Supplemental Withholding Rate To?

The short answer: more than 22%. A good starting point would be to use your effective federal tax rate based off your current taxes (or at least prior years taxes).

Effective Federal Tax Rate: Total Annual Federal Taxes Owed / Total Annual Income (less deductions). If you used the Tax Bill Estimator I updated it to include this quick calculation based on your provided data.

Method #2: Add extra withholdings to your W4.

A W4 is essentially a set of instructions that your company uses to calculate how much to automatically pay the IRS on your behalf. If you only had base + bonus you wouldn’t have a problem at all, but because equity is taxed differently we need to be make some adjustments. You will be able to update your W4 through your payroll provider (workday for meta folks). There is a field for “Extra Withholdings” that you can enter an extra amount to have your employer send to the IRS for you. So if you owed $20,000 and anticipated your salary/bonus/equity to be the same next year you could simply calculate how many paychecks remain in the year and divide $20,000 by that number (ie if there are 24 remaining paychecks you could enter $833 in the extra withholding).

Method #3: Manually Pay Taxes Quarterly

Instead of having the amount withheld from your paycheck, you can send the IRS payments for the exact amounts 4 times per year. You can pay online or mail the IRS a check. Here is a good guide from turbotax if you choose to go that route: https://turbotax.intuit.com/tax-tips/self-employment-taxes/a-guide-to-paying-quarterly-taxes/L6p8C53xQ

Closing Thoughts

It is February 1st, slow down! I am a big fan of being prepared and starting taxes, just don’t get too far ahead of yourself. Many brokers and banks are slow at sending out all the forms you will need and there has been more than 1 time in the past decade where I receive corrections to either my W2 or a 1099. So even if you finish things up early, I would hold off on actually filing until closer to April 18th.