The New Grad FAANG Engineer's Path to FIRE

Financial Independence Retire Early FAANG Engineer Edition Part 1: The Setup

Welcome to a new series that walks a new grad software engineer joining Facebook (or another FAANG1) on how to set themselves up to be able to reach Financial Independence with the ability to Retire Early (FIRE). It will be broadly applicable to other FAANG companies as well as other roles beyond eng with varying degrees of differences in compensation structure. I have worked at Facebook more than 7 years, so i’ll be able to go deeper into everything from promotions, equity grants, bonuses, and the particulars of their 401k options. Despite not being one myself, I chose software engineer as it was one of the job roles with the most publicly available salary information (using levels.fyi).

I am laying out one path that a new grad fortunate enough to be joining Facebook (or any other FAANG+) could take to fully achieve FIRE. If you find yourself as a newly graduated from college software engineer joining Facebook you really have what I would consider FIRE easy-mode. That doesn’t mean it is easy, just that you have a huge leg up as your starting salary right out the gate puts you in the 95th percentile in the entire USA. I’ll also try and lay out the steps for automating as much of the savings process as possible to remove the need for iron will power.

I forecasted a fictional career month by month for 6+ years. This includes projecting all bonus ratings, equity refreshers, promotions, 401k contributions, after tax roth (mega backdoor), taxable brokerage contributions, emergency funds, and even checking account balance. In order to calculate all of this I made a month by month projection of what their actual paychecks would look like… again for the full 6 years.

If you know a first year engineer I would appreciate sharing this series with them (and tell them to subscribe!)

Meet our fictional new grad! Let’s call them Jane.

Jane earns the average compensation package of a new grad working from Facebook headquarters in Menlo Park, CA. They graduated college without any debt. I am going to go year by year to color the start of Jane’s path to FIRE. I’ll lay out income, budgets, taxes, and investments. Ready to go?

Here are Jane’s Starting Stats:

Start Date: 5/3/2021

Starting Level: E3

Base Salary: $125,000

Starting Equity Grant: $180,000 (vesting quarterly over 4 years)

Bonus Level: 10% (additional multiples based on performance)

Job Location: San Francisco/Menlo Park, California

Now before I go further I want to call out that I am making a number of assumptions2. I can’t predict the future. In fact Facebook changed their 401k match half way through me writing this which made me need to recalculate everything. Scroll to the bottom of the post to see all assumptions listed out.

With that out of the way let’s jump in. Jane is fresh out of college joining at the level of E3 (Engineer Individual Contributor Level 3) starting May 3rd, 2021. Since Jane is starting in May they will receive 17 paychecks over 2021 (Facebook pays bi-Weekly).

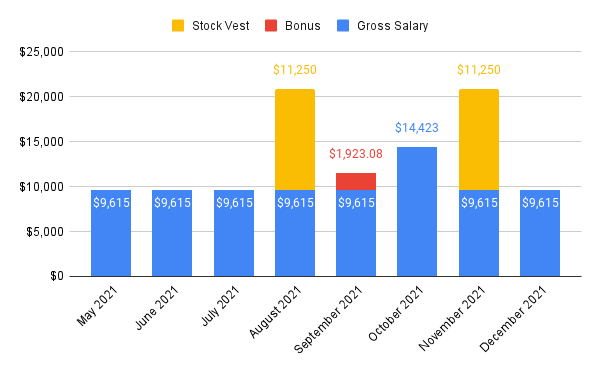

Here is a snapshot of Jane’s Monthly Gross income from her base salary, stock vests (FB stock vests quarterly and doesn’t have a cliff), and bonus.

Annually that comes out to:

$106,154 overall gross salary

$81,731 Base Salary

$22,500 Equity Vests

$1,923 Bonus (This is a bonus for the first half of the year which Jane was only there for 2 months of. It also comes with a default “Too New to Evaluate” rating which gives you 100% of the bonus.)

Obviously these totals don’t go straight into Jane’s bank account untouched. Uncle Sam and the lovely California Franchise Tax Board will want their cut in addition to 401k contributions which further reduce the actual take home.

Everything up until this point was all the required setup to get to the actual promised “path to FIRE”. The rest of Year 1 will come out later this week and by the end of the series Jane will have nearly $1,000,000 invested towards their FIRE goals. If you have made it this far you are vested in this. Go ahead and subscribe👇.

Looking for 1:1 FIRE coaching?

Partner with me to identify your FIRE goals and create an action plan on how to achieve it. Over the course of 4 sessions we will outline your personal goals, how to make a plan to reach those goals, create a 2 year projection of your income and savings personalized for you.

Next up: Jane’s first year

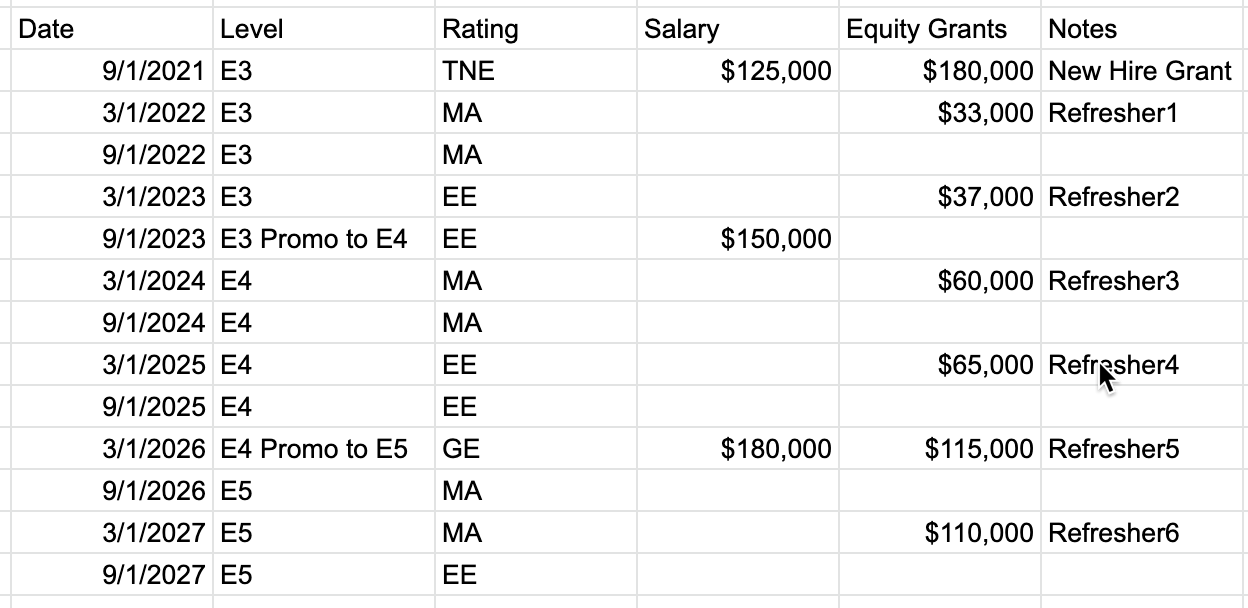

Feeling impatient? Here are Jane’s next 5 years at Facebook. For non-facebookers i’ll explain this more later.

FAANG: Acronym used for Facebook, Apple, Amazon, Netflix, and Google. I would include at least Microsoft, Uber, Stripe and other companies paying in the top percentiles for talent.

Assumptions:

I am simplifying things a little bit and assuming zero relocation, zero sign-on bonus, zero student loan debt (average student loan debt is in the ~$30k range so you can pretend they tossed all their sign-on towards their debt).

7% Investment Growth including FB equity grants (again, who knows what the next 5 years will look like. Hopefully FB outperforms the broader market, but the broader market could also decrease over the entire 5 year period)

All FB Stock is sold immediately on vest and re-invested in index funds (although since I am using a fixed 7% for each it doesn’t make a difference)

Roth includes direct roth (only applicable in year 1), back door roth, and after tax

Promotion from level E3 to E4 needs to happen within 24 months

Promotion from E4 to E5 needs to happen within 33 months (E5 for engineering is the first terminal level; a level you can keep performing well in without needing to advance to remain employed)

Base salary will only change with promotions (in reality there are raises annually even without promotions)

Facebook historically has two performance reviews per year. With those come two bonuses per year. They are updating it for 2022 to only have 1 performance review each year. I am using the old method since all the details of the new plan have not been shared.

Facebook Bonus calculations have a multiplier based on company performance, I am not including this.

No employee cost for healthcare/vision/dental