Hey FAANG FIRE,

Mint.com is shut down and migrated users to Credit Karma in early 2024. As someone who uses/has tested dozens of tools, here is my take if you are looking for a replacement.

Executive Summary:

Top Free Tool: Empower. If you are looking for a free alternative to track your overall net worth Empower (formerly Personal Capital) is my recommendation. Great investment tools and net worth tracking, more lack luster if you want granular spend tracking, and budgeting.

Top All-In-One Paid Tool: Monarch. If you care about strong categorization of your spending, goal setting, smart automation, good design, and are willing to pay Monarch is an easy option to recommend (Use Welcome30 for 30% off their first year, $99 normally).

Top Paid Budgeting Specific Tool: You Need a Budget aka YNAB. If you really want to go deep into your cashflow, to change your behavior, to actually budget, are willing to put up with an opinionated way of giving every dollar a job, and don’t care about overall net worth tracking YNAB is really hard to beat. I recommend this for people who want to really get on top of their spending (something I think everyone should do for at least a year to help baseline your FIRE/enough number).

Wildcard Option #1: Quicken Classic is still going strong. It is clunky and requires downloading software, but has a lot of advanced reporting capabilities. I really like being able to compute 1099 estimates on dividends, interest, and even capital gains at any time.

Disclaimer: This post isn’t sponsored but does include affiliate links as well as referral links (YNAB, Monarch). I personally use and have paid for all the tools included over multiple years. Empower Personal Wealth, LLC (“EPW”) compensates FAANG FIRE for new leads. FAANG FIRE is not an investment client of Empower Advisory Group, LLC.

Mint Shutting Down

Mint was founded in 2006 and revolutionized how millions of people tracked their personal finances. They brought online budgeting with credit card and bank aggregation to the modern internet with their focus simplicity.

I have been a Mint user since March 2009 when I signed up during my final months at the University of Texas. In 2011, shortly after getting engaged to my now wife I created a second joint Mint account to help us better understand out joint finances (How I Approached Couples Finances). Even though I rarely log in anymore, feature development really stagnated after being acquired by Intuit, Mint still holds a soft spot in my heart.

Mint will be “migrating” some features to Credit Karma as well a few years of net worth history. I am actually a fan of Credit Karma’s free credit score tools and welcome the actual investment from Intuit instead of letting another acquisition lay stagnate. That said, Intuit has said there wouldn’t be any budgeting, instead you will only see category level spend data (seems like budgeting would be an easy add, but what do I know).

Mint Alternatives

As someone who personally has tested and currently uses a number of different tools I thought I would add my thoughts on the pros and cons of some of the major alternatives that I have personally used.

This isn’t intended to be a detailed review of each product (let me know if you would want to read something like that), but a run down of the key pros and cons based on real world usage.

The End of Free Tools?

Running online budgeting tools is expensive. Tech workers like you and I are not cheap. Aggregators like Plaid charge for every single bank and credit card connection. When you are signing up for a “free” product you should really understand how they are able to make the service free and whether that model is sustainable.

Mint was originally free primarily due to earning affiliate revenue from Credit Cards they would recommend to you. Intuit was also able to use Mint.com as an acquisition source for their TurboTax products. Unfortunately Intuit decided the resources to maintain Mint were better allocated elsewhere.

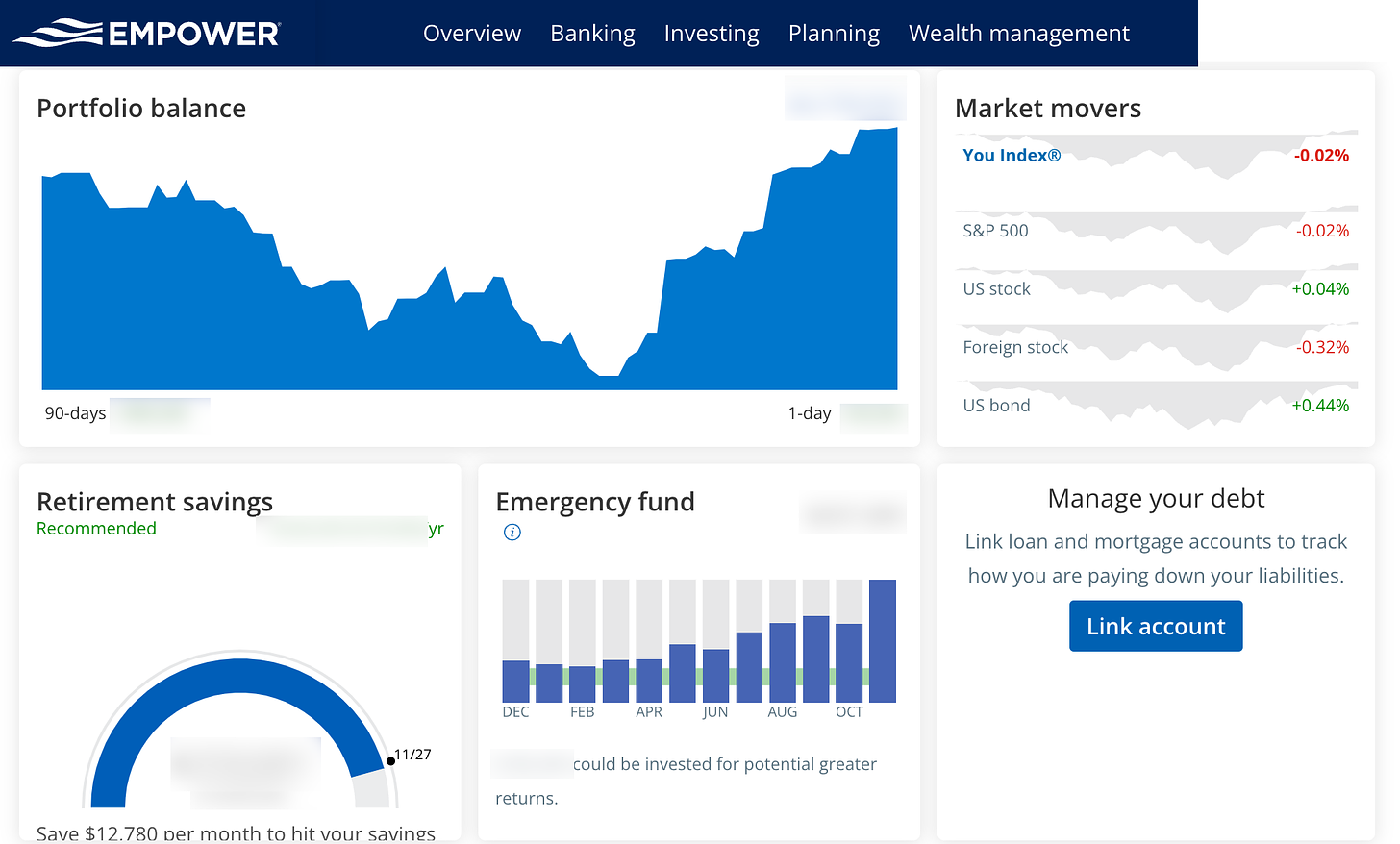

Empower Personal Dashboard (Free)

That brings us to the only free tool on my list; Empower Personal Dashboard fka Personal Capital. It is by far my favorite free tool that I will recommend all day long.

Personal Capital was founded in 2009. They used their “free” net worth dashboards as a way to attract users to their wealth management + robo-advisor products. Their big differentiator was that they combined the best of robo advising while also giving you access to an actual human (vs Betterment/Wealthfront’s robo offerings).

In 2020 they were purchased for $1 billion by Empower, a big player in the retirement plan administration game with over 82,000 companies using Empower to manage their 401ks. In 2022 they fully flipped the branding of Personal Capital to Empower but have not really made too many significant changes beyond that.

How Is It Free?

Independently Empower Personal Dashboard monetizes through their wealth management and robo+advisor services similar to Wealthfront/Betterment (but with the addition of humans). The free dashboards are a way to bring in and self-qualify good candidates for upselling to Empower’s wealth management services. You are never required to use their managed products but will get upsells to schedule a call with an advisor as well as quarterly phone calls from their sales team. They have always been extremely friendly and never aggressive in my experience.

Risk of Shut Down?

Empower is the 2nd largest Retirement Plan provider in the United States. It purchased Personal Capital for $1 billion in 2020 and consolidated everything under the Empower brand in 2022. The acquisition greatly increased the technical capabilities and that Empower can use to enhance their existing products as well as brought in a new wealth management/robo advisor into the fold. Empower seems to be heavily investing in it’s new “Personal Wealth Division” with many senior PM roles open with descriptions that lead me to believe they are dedicated to growing their new consumer products.

Why I Like Empower

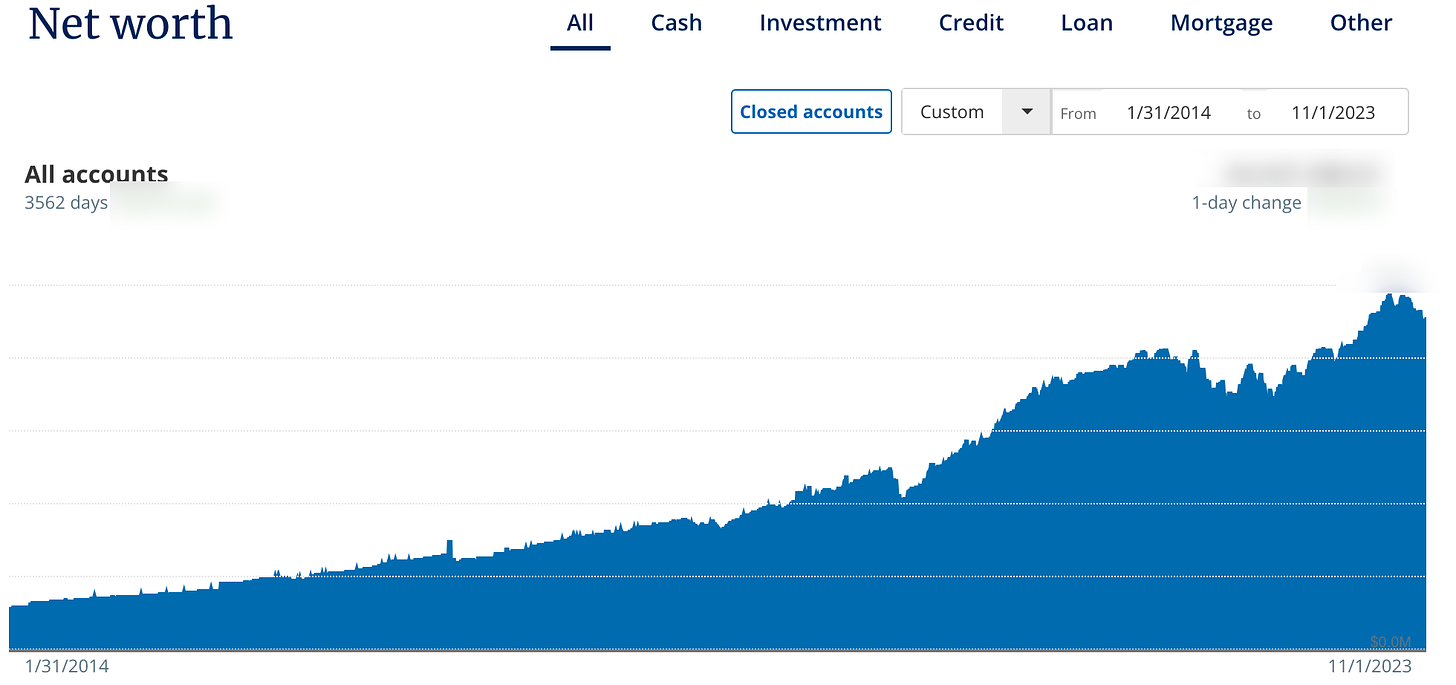

Empower is hands down one of the best tools, free or paid, when it comes to overall net worth tracking, investment tooling, and retirement scenario projections available to consumers.

Other than YNAB all of the services recommended are good for tracking your overall net worth. But I have found Empower to be one of the most consistent when it comes to correctly syncing across my dozens of account types. The accounts I frequently have troubles with: Fidelity, Treasury Direct, Solium are all able to sync mostly without issue into my Empower Dashboards (fidelity is a constant pain in the ass across aggregators).

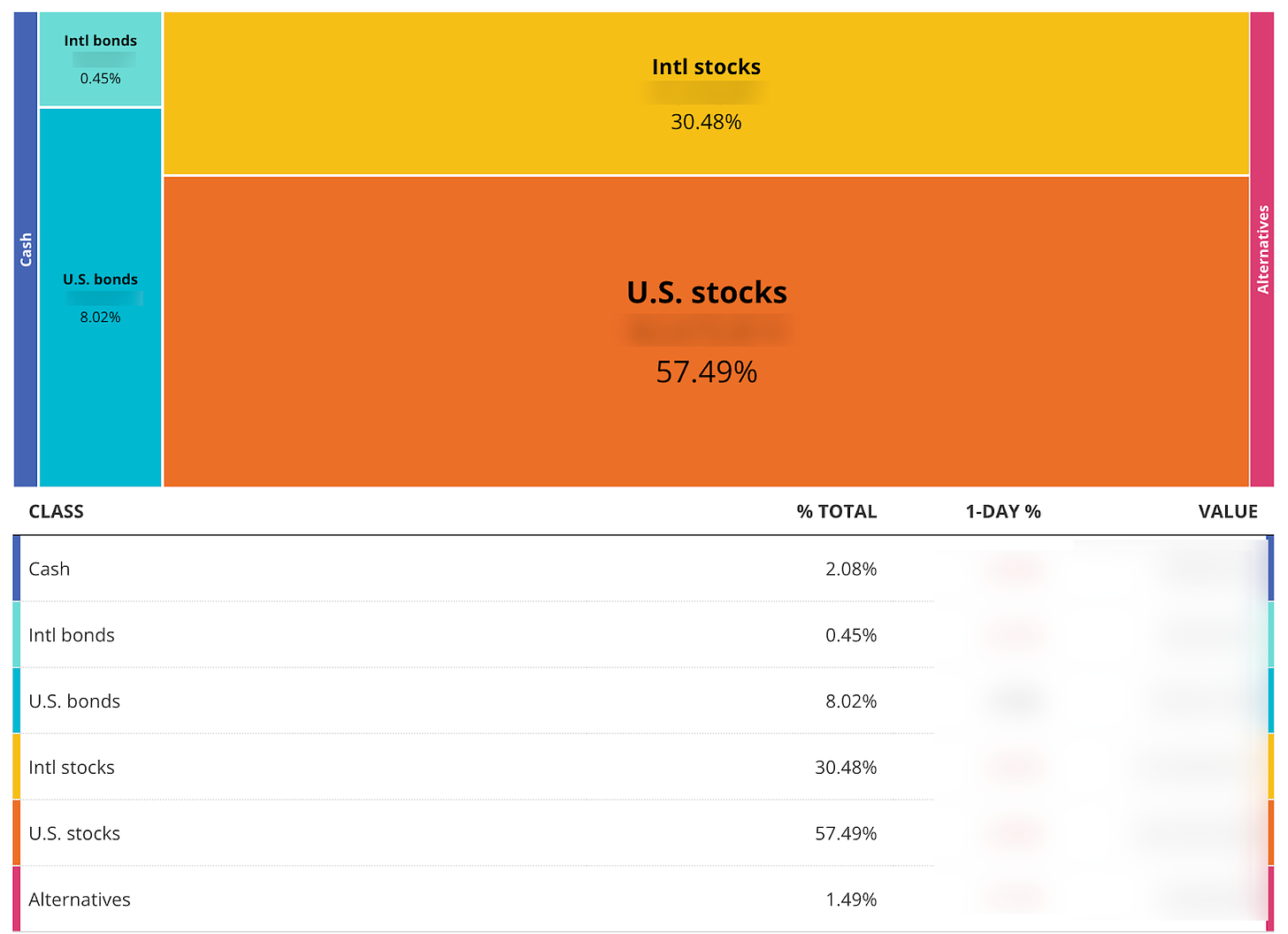

Where Empower really shines though are in its investment views, investment checkup tool, fee analyzer, and retirement projections. They allow me to easily view my overall asset allocation, customize asset allocations of unknown funds (for example Meta’s 401k has a few State Street funds that don’t have tickers, Empower lets me manually set the asset allocation at the fund level to correctly track my overall asset allocation), and assist with what needs to changes I need to make to match my ideal asset allocation.

Things They Could Do Better

Budgeting is Clunky and Hard to Use

Categorization is Manual

No Cost Data for Investments

Single Player Only, No Ability to Invite Family/Partners

You will get upsells to their paid services

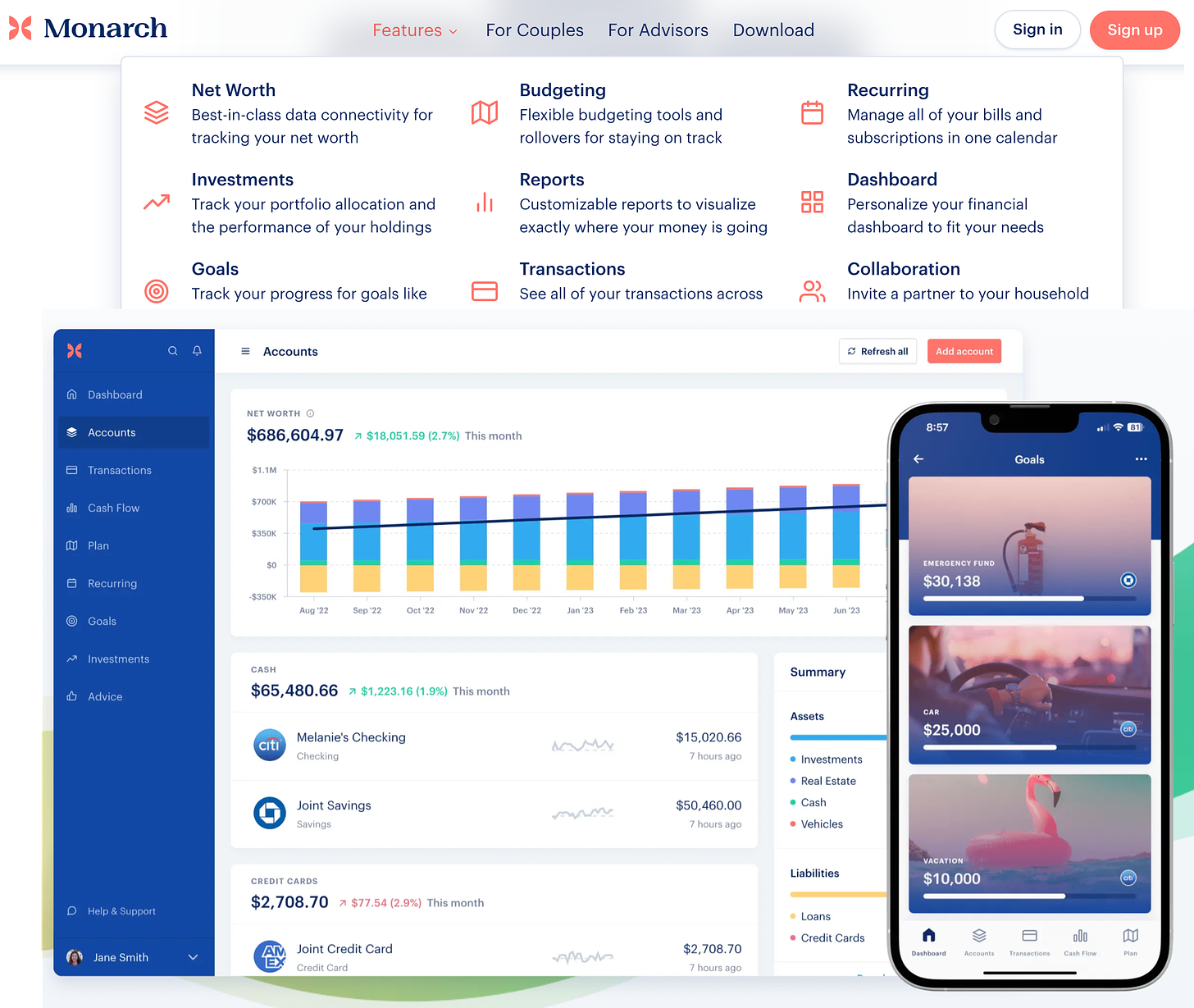

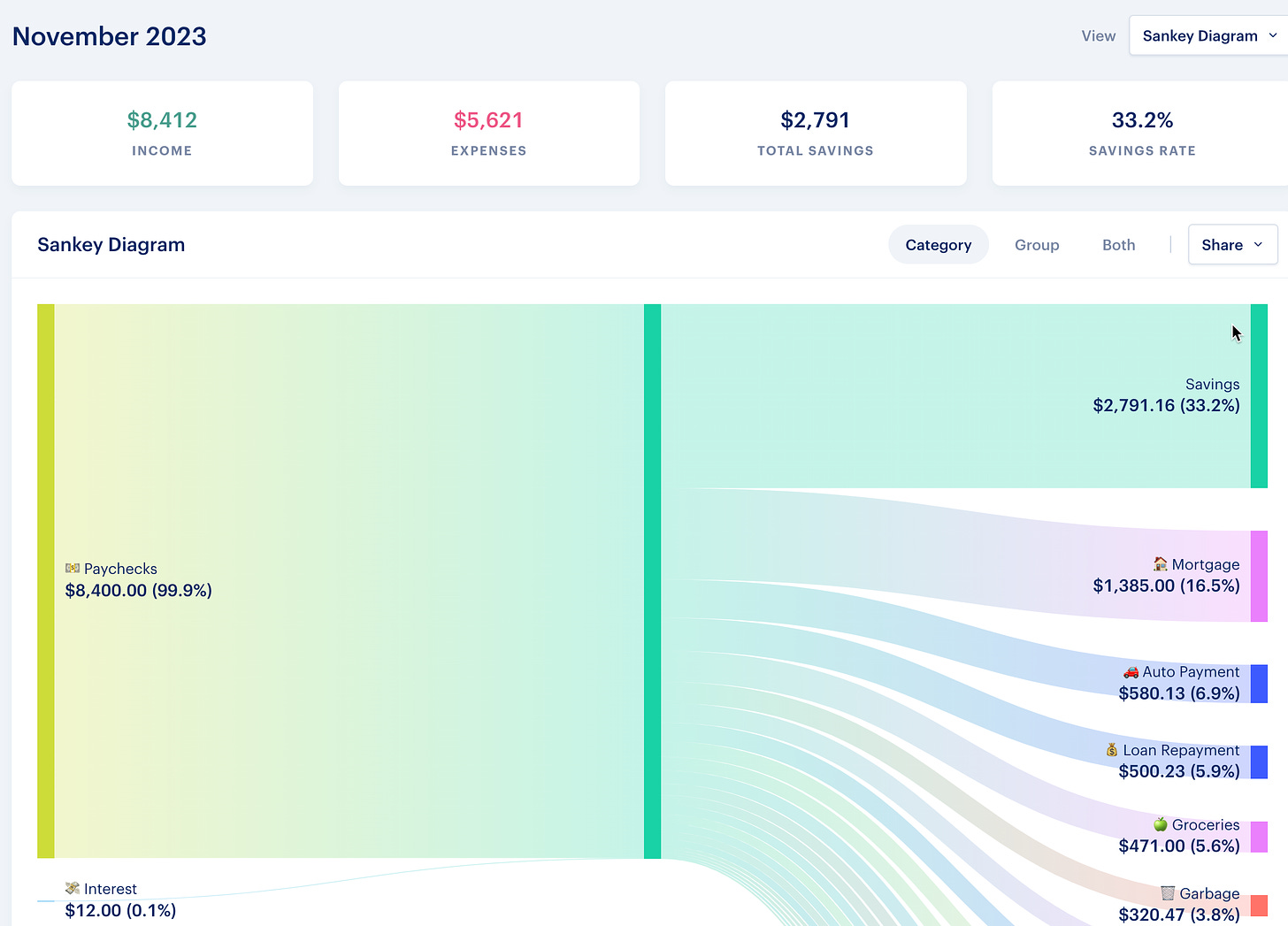

Monarch Money ($99.99 billed annually)

When it comes to paid services Monarch Money simply does the vast majority of things really really well. It is very easy to recommend and those migrating from Mint will honestly be delighted with the switch. They were founded by an early Mint Product Manager who didn’t want to compromise the product in the way Mint needed to make it Free (via ads and Credit Card recommendations).

They are also aggressively catering to the Mint crowd with a 30% off offer for the first year in addition to tools to migrate your account history. A Monarch subscription is included as part of my Ongoing FIRE Coaching plan.

Why I Like Monarch

Really Simple to Use and Great Mobile App

Mint Export Extension

Cashflow + Budgeting Tools

Great Support for Collaboration across Multiple Users (including assigning transactions to review).

Robust Categorization With Rules Based Automation and Smart Category Recommendations

Support for Multiple Goals

Can Personalize Dashboard Widgets

Automatically Tracks Recurring Expenses in a Calendar View

Active Feature Development and Visible Backlog

Very Beta AI Integration

Robust Community on Reddit

Things They Could Do Better

Investment Tools are not as robust as Empower.

Can’t view asset allocation data

Can’t customize allocation of funds without tickers

Can’t Categorize Transactions Within Investment Accounts

Can’t Categorize RSU Vests as Income

Can’t Track Dividends

I wish they could import and categorize Amazon and Costco transactions at the item level

YNAB ($99 billed Annually)

You Need A Budget is a service I love to recommend but will be very quick to make several caveats. It is really a tool that I think everyone should use for a year to force yourself to deeply understand your cashflow to really ground your FIRE number in reality. It is intentionally manual and very opinionated. It wants you to give every dollar a job, similar to the envelop method for those familiar with that. For the FAANG FIRE crowd this is a great forcing function to not let cash just accumulate in your checking account as well as explicitly earmark your Emergency Fund.

I am also a big fan of their 34 day free trial, you really need to use YNAB over a month to really start understanding it.

If you test out YNAB my recommendation is to only add your checking, savings, debt, and credit cards. DO NOT add your investment accounts. DO NOT try and add historical data unless you enjoy pretending you are an accountant reconciling cashflow.

Why I Like YNAB

Builds a Deep Understanding of Spending that can lead to actual behavior change

Forces You to Live of Last Months Income

Excellent Customer Support and Training + Lessons

YNAB Together allows you to invite 5 different people to create their own budgets independently as well as collaboratively

Can Function Without Account Syncing

Very Active Development, Recently Added Sub-Categorization of Amazon + Costco

Cult Following and Very Active Community Across the Web (140k on reddit)

Community has built custom tools and ways to access your data

Things They Could Do Better

Has a steep learning curve

Doesn’t Function as a Net Worth Tracker

Adding Investment Accounts to Track Breaks Things

Need to Manually Approve Transactions

Categorization is Manual

Very Very opinionated. No going into the future to budget money you have not earned yet.

Much of the Reporting Requires 3rd Party Browser Plug In

Fidelity Cash and Credit Cards Frequently Don’t Connect/Sync (Fidelity is a pain)

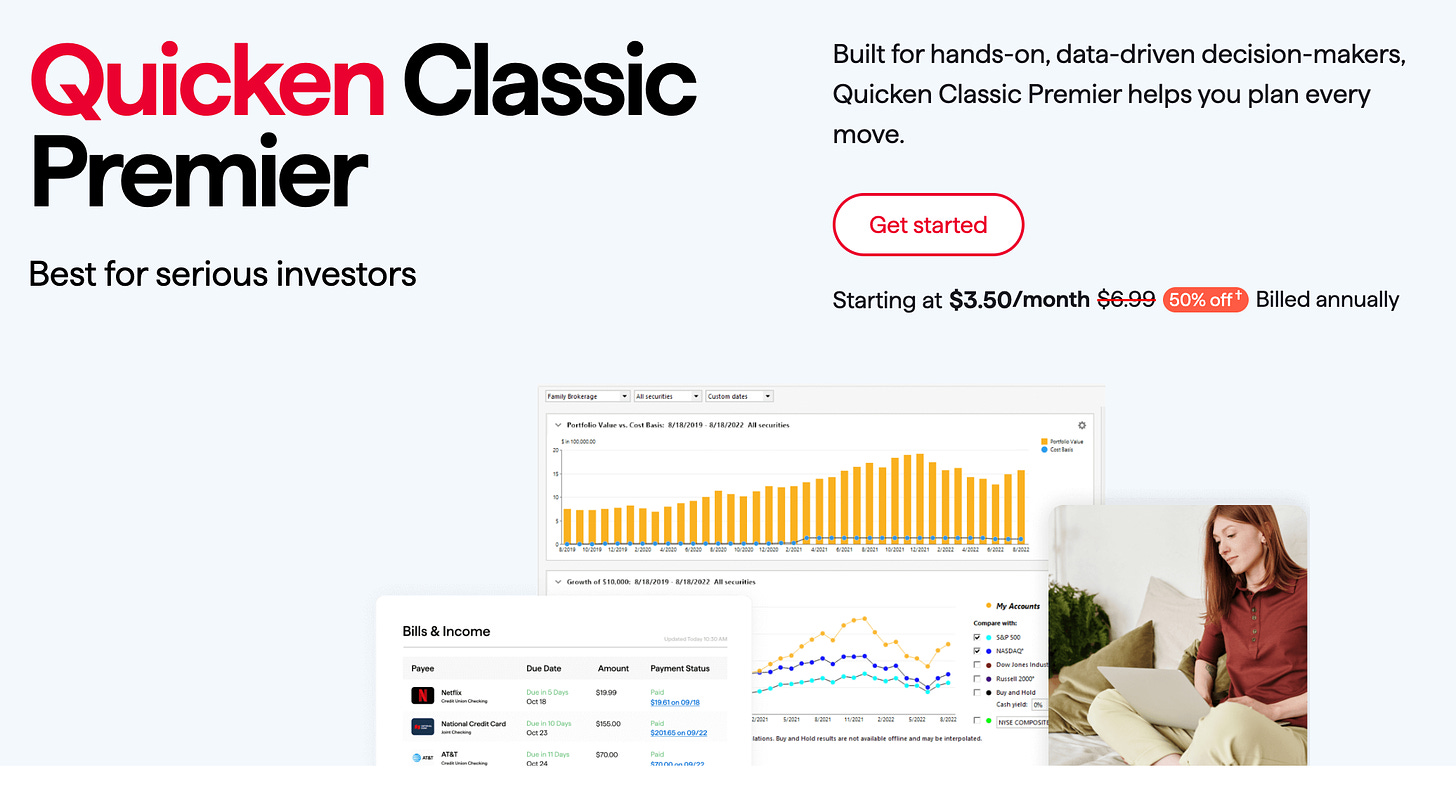

Quicken Classic ($84, Frequently Available w/ Discounts)

You might not even realize Quicken still exists. Back before there was Mint.com the two major players in this space were Intuit Quicken and Microsoft Money. While Mint and Credit Karma were acquired from Intuit, Quicken was born within Intuit and in 2016 was sold to private equity group HIG Capital. Since then Quicken has continued to invest in their personal finance and investment tracking products. Although most of their focus seems to be on Simplifi, my sleeper favorite paid tool is their clunky downloadable Quicken Classic.

Quicken Classic is also available online and on a mobile app... although I would primarily recommend using the downloaded version. It is very much a desktop first program. It comes in a few flavors, I use the Premier myself. It is frequently on sale across the web for almost 50% off (as of writing this it is currently available 50% off direct from Quicken.

I really like Quicken Classic’s ability to track investments at the individual lot basis, track capital gains/losses, dividends, and create tax reports on the fly.

Why I Like Quicken Classic

Robust Custom Reporting

Very constant stream of product improvements

Can track investments to the individual lot level (although maintaining accuracy can be a struggle)

Can track income broken out by Base, RSU, Bonus, Business, and all Stock Based Income

Granular Asset Allocation Data with the ability to customize unknown investments

Ability to create and manage a budget and custom historic data views

Easy to export data out

Access to live customer support along with a robust help center

Can Pay Bills directly within the app including eBills which connect direct to some provisors

Things They Could Do Better

I don’t even bother using this on Mobile or Web, the Syncing across Interfaces isn’t consistent

Single Player Only

Requires a lot of manual involvement to get per-lot information and even more to maintain

You have to use many creative work arounds to account for RSU income

It feels like you are using your grandpa’s accounting software

What About Product X, Y, and Z?

I know, I didn’t include every budgeting app out there… but these are the ones I use, pay for, and can easily recommend. For those on iOS I have head positive things about CoPilot, the DIY spreadsheeter cohorts really like Tiller Money, and there is always someone trying to get me to use Fidelity’s Full View (it is too painful to use).

Closing Thoughts

The reality is that with a FAANG salary you don’t need to budget in the traditional sense. You might even have the opposite problem most consumers using budgeting tools run into, you have too much cash accumulating in your checking account. I still foundationally believe in understanding your entire cash flow picture, from your total compensation down to your spending. You don’t need to be stressing over every single expense, but it is worth getting an accurate reflection of your true spend so you can accurately project how much money you need to FIRE and reach your Enough Number.

It is all about adding some personal logging into your life.

-Andre

p.s. You can see all the tools I use in my FIRE stack, including free ones that I created on the FAANG FIRE Tools page.

I love Empower, but one thing I struggle with is how to think about the topline net worth it reports vs. what my net worth would be if I actually liquidated my portfolio (due to tax on capital gains). I'm curious if there's a convenient way that you've found to think about that easily (e.g., is there a tool/platform that aggregates/estimates this), or is the only real way to manually calculate your cost basis from your investment accounts?

Great recap. I personally have remained on Excel sheets but there’s definitely a trade off in terms of it being more manual. Although that has helped make my numbers stick better in my head by doing everything by hand.