I just celebrated ten years of marriage. Having a partner who shared aligned financial goals has been one of the greatest cheat codes towards fast tracking my FIRE journey, even more so than a FAANG salary (although those definitely help). One thing that I attribute to creating this alignment is how we approached our finances together and evolved that approach as our relationship evolved.

Our finances experienced 5 stages so far, this is as a dating couple over 4 years followed by 10 years of marriage. It evolved over those years much as our relationship evolved. If you are not interested in all the relationship specifics please at least scroll down to Stage 5, the information on Living Trusts can save your family a lot of money.

Typical Financial Arrangements

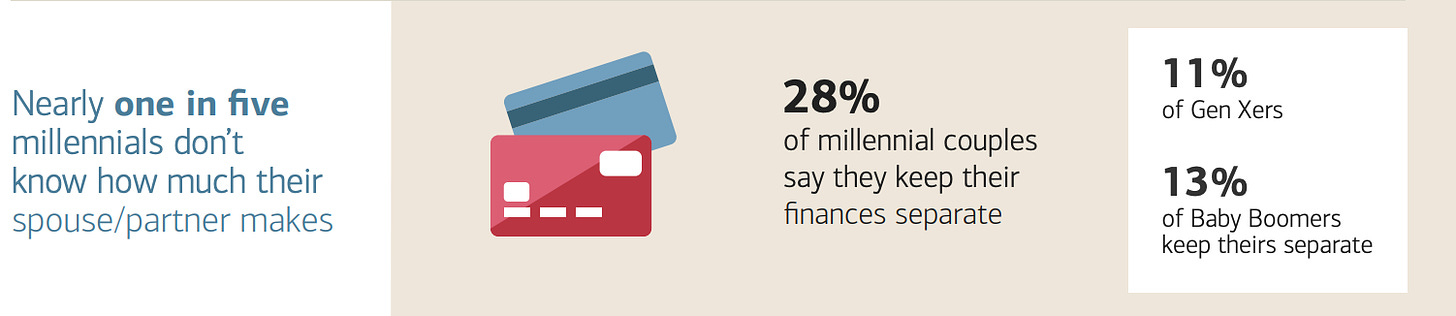

Before diving into how I went about tackling my household finances I was curious what everyone else did. Based on what I learned the most common ways most couples arrange their finances fall into 3 buckets:

Keep All Accounts Separate (28% of millennial couples)

Combine All Accounts, Everything is a Joint Account

1 shared account and the rest separate and hidden

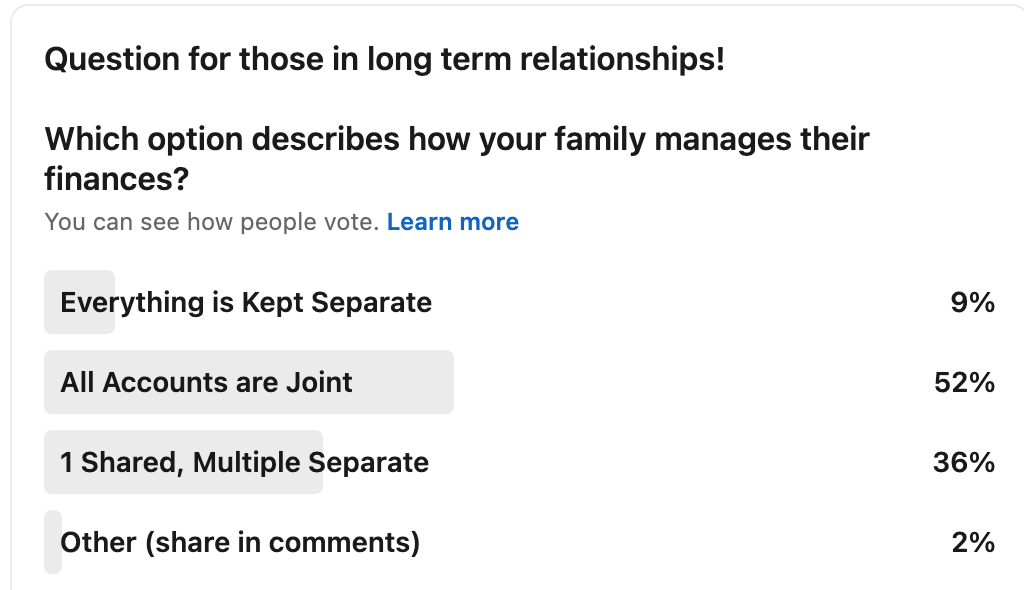

I also created a poll on linkedin to get a breakdown among primarily FAANG connections and received nearly 100 responses.

I personally struggle with each of these options. The idea of full separation is foreign because I center so much of my planning around having “logging” in place to track spending across all accounts. Having everything joint was always complicated due to the number of bank accounts I have accumulated from collecting sign on bonuses.

For me it seems like a sensible middle ground would be for married couples to at least have shared logging across all accounts while not needing to physically connect the accounts ( tech translation: each partner has full read access to the others accounts but not necessarily write access). This means having all accounts pulled into an aggregator like Personal Capital1 or Mint where each person can have a view across the family’s financial landscape. This does require an open line of communication between partners on spending.

As you accumulate wealth and start adding kids my opinion quickly changes. Neither partner should have significant assets in their own name, Everything should be owned by a living trust that both parties control equally!

How Our Family Finances Evolved

Stage 1: Initial Courtship + Dating

Stage 2: Moving In

Stage 3: Engagement

Stage 4: Marriage + House

Stage 5: Kids and Living Trusts

Stage 1: Initial Courtship + Dating

I met my wife while attending the University of Texas. While we had different majors in addition to being a few years apart we found ourselves in a class together. One of my all time favorite classes from college, “Working in Virtual Worlds”. The class was centered around a deep immersion into Second Life with half the class time spent in person and the other half in what was the metaverse of its day.

The first time we talked was in Second Life. It was fairly easy for me to match her avatar to reality… being that there were only 2 women in the class. Luckily we were able to migrate the conversation into the real world where I asked her out on our first date over chips and queso. I picked up the bill since I was the one that asked her out. I may have picked up a few more of the bills but one of the key elements of our early relationship was a shared values around equality and fairness. This came with the mutual understanding that we would both share all responsibilities, including dinner bills. We just switched off who picked up the tab. There was never a formal arrangement, it just happened organically. We stayed in this first stage for nearly two years.

Stage 2: Moving In Together

This is a major step in any relationship. At this point we had been dating for 2 years, both graduated, and gainfully employed in our first jobs. We could now begin to start unlocking the DINK (dual income no kids) level of our lives!

Now instead of nights out to split bills we had a myriad of shared expenses. Everything from Rent, Internet, Groceries, Electricity,.....

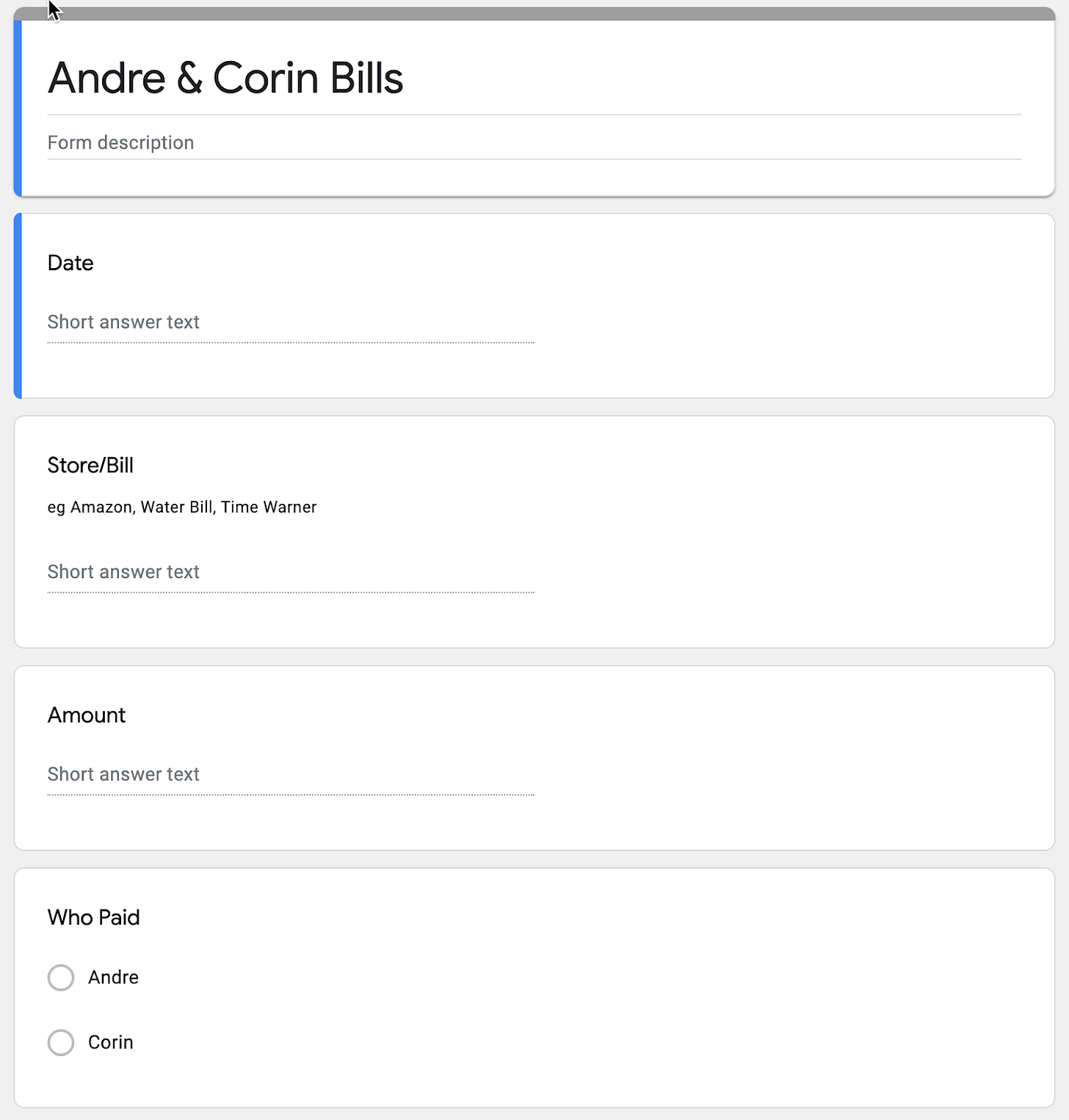

My obvious solution to this was to create a spreadsheet. This probably wasn’t the first spreadsheet to enter our relationship but was definitely one of the more used. It was powered off a simple Google Form which would populate into a google spreadsheet. So one lesson you can take away already is that one of the keys to a successful relationship is lots of spreadsheets.

The Form:

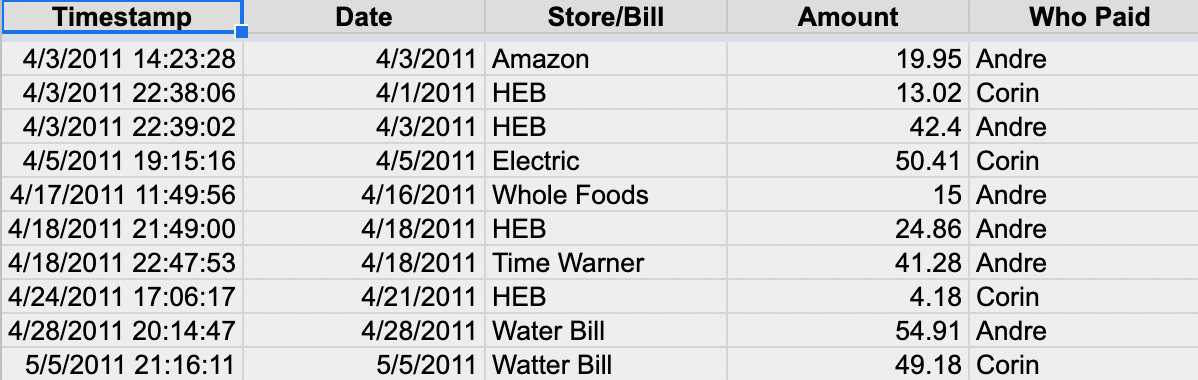

Output of the Form:

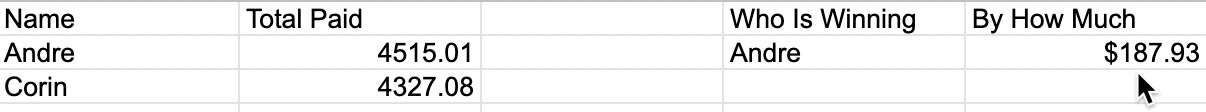

Which would power the summary table to determine “Who is Winning” (probably not the best choice of wording in retrospect).

The non-”Winning” person would be responsible for the next set of bills until the universe was once again in balance.

This reinforced the expectation we had built up around the importance of equality. The fact that she put up with filling out a google form after every shared expense also reinforced to me that she was a keeper.

At one point I was “winning” by more than $200 and Corin wanted to zero things out and just gave me $200. Some of you may have just caught the error here. The $200 represented a shared expense, so in reality she should have only needed to give me $100 to even things out. I caught this bug two months later and apologized for embezzling $100 from her based on the authority of the spreadsheet.

Her response: “I don’t care. I’m still not even sure why we keep a spreadsheet in the first place. Things seem to always even out in the end.”

Our relationship survived me stealing $100 and her questioning the value of spreadsheets. Which brings us to Stage 3!

Stage 3: Engagement

After 4 years of dating and some metaphors about cows and the price of milk that I never really understood… we decided to get married. The engagement portion of this represents the shortest financial stage but it felt like a distinct evolution.

This was an entirely new level of commitment we were about to embark on. How would our finances change? For one, the spreadsheets (or at least that spreadsheet) went away. It was replaced with some new logging! A joint Mint.com account. At this point no finances were combined but by creating a combined Mint account we were able to have a full aggregated view of all our spending and savings for the first time.

Stage 4: Marriage + Home Purchase

After we were married we still kept all our personal accounts separate at first. This was primarily driven by me viewing marriage as my opportunity to start doubling up on every single bank sign on bonus available. I had upwards of a dozen different personal bank accounts in addition to her having a handful.

At this point we used our shared savings to buy a 2/1 house in Austin (back in 2011 when home ownership was still possible). We bought the home in both our names, this was our first ever officially joint asset!

At this point it became practical to be able to have a way to quickly transfer money between each other's accounts where our individual paychecks were deposited (vs just having view only access via mint). So each of us added the other to a bank account we both already had at the same bank. We still had a dozen more individual accounts that we both had full visibility through the shared Mint.com account and later Personal Capital.

Stage 5: Kids and Living Trusts

This brings us to the current day, we now find ourselves with a 4 year old kid, 10 years of marriage under our belt, and over 14 years total together. What is different about our finances now?

The main difference is that most of our primary accounts have their ownership not by either myself or my wife, but by our family living trust. I set up the living trust for free utilizing Meta’s legal benefit that was offered (many of the other FAANGs have some flavor of this either free or as a paid benefit). What the living trust does is that it allows for both of our assets to seamlessly flow to the other person if something were to happen to either (or both) of us. Along with a Will the living trust allows us to set rules for how our assets will be dispersed in addition to important things like who should get custody of our child, who is executor of the estate, who controls my medical directive (unplug me).

From the pure financial side another major benefit to a living trust is that it will help your estate avoid probate. If you live in California and have a family you should 100% understand how probate works. If you have a decent estate you are very likely to leave this newsletter to immediately reach out to an estate lawyer (hopefully through a free benefit provided by your employer) and set up your own living trust or whatever equivalent will help you in your situation.

Two things to know about probate in California:

On average it takes 1.5 years to complete2. All this time your family may not have access to a significant number of your assets.

There are significant fees mandated by California for some reason.

So if your estate has assets totalling $2M (assets, not total value) the impact of probate could be:

4% of the first $100,000 = $4,000

3% of the next $100,000 = $3,000

2% of the next $800,000 = $16,000

1% of the next $9M = $10,000

Bringing your total probate lawyer costs to $33,000.

These fees are set by the state of California. Again, they are based on asset value and don’t factor in debt (ie that $2M house with $1.8M mortgage debt still counts at the full $2M in the fee calculator).

The other kicker? The fee’s above are only the lawyer fees. You also need to pay the mandated executioner fees which are the equivalent to the lawyer fees.

So now your heirs need to wait 1.5 years to access all your accounts on top of needing to pay $66,000. All because you didn’t set up a living trust. Go now, set up that trust!

Advice and Future Stages

I would encourage you to be intentional with how you and your partner approach your shared finances. Be open to evolving the approach as your relationship evolves. Have open conversations about your financial goals and how you can work together towards those. Appreciate that it is a partnership and your own personal goals will very likely shift as your life with your partner changes your plans.

I am not sure what future stages will look like for us. I can see some new dynamics coming into play as we think about relocation and eventual FIRE once we hit our enough number. There is also the possibility that one of us decides they want to continue working instead of FIREing, how could that change things? The only thing I know for certain is that there will be more open conversations and likely more spreadsheets to facilitate!

What has worked in your relationships?

This website earns an affiliate commission from new signs ups to Personal Capital.

https://trustandwill.com/learn/california-probate-fees

Thanks for sharing - definitely cool to see how you have traversed finances with your partner!

A question that my SO and I would love insight into:

- when sharing accounts, how do you go about determining spending? would love to hear how you all work through this! (if not, totally okay)

(A quick example of our system: my partner and I have insight into all accounts (shared accounts, Personal Capital) and we have a joint budget. However, we also set aside equal money each year to ourselves, to spend as we please - she might buy more stylish clothes, while I could spend it on a personal trip.)