Hey FAANG FIRE!

I just scrapped a nearly finished 2,000 word newsletter on Asset Allocation and Asset Location. The truth is that these topics fill entire books and research papers and I didn’t think I could do it justice. Instead, I am just going to show you my asset allocation and asset location and explain some of my thought process behind my decisions.

Why should you care?

If you are working at a FAANG and aggressively saving for FIRE, then you will end up with significant assets across your 401k, Roth (via mega backdoors), as well as your taxable account. Without needing to change what you are invested in, but simply changing where you hold each asset, you have the potential to generate additional portfolio gains, “research has shown effective asset location strategies can add 20-50+ basis points of "free" value to annual returns”. That translates to $2,000-$5,000 for every million you have in investments per year, for “free”. But is this “Free value” real?

This is a good time to remind you that I am not a registered investment professional, make sure to do your own research or consult with a fiduciary who can give you specific guidance based on your unique situation.

Interested in better understanding your own asset allocation across all your accounts? I use Empower’s free dashboard to help me easily track my asset allocation. I like that Empower’s asset allocation tool allows me to manually classify the allocation of holdings that don’t have traditional ticker symbols. Within both Meta and Uber’s 401k, there are State Street funds which don’t have tickers associated with them. With Empower I am able to manually adjust the classification to ensure everything is tracking correctly. While I have personally used Empower for nearly a decade (previously Personal Capital), I do want to disclose that I am an affiliate partner of Empower and may earn a commission from new sign ups.

These affiliate commissions in addition to the FAANG FIRE paid subscribers allow me to keep the entire archive of FAANG FIRE free and without paywalls.

Asset Allocation

Asset Allocation is the process of dividing your investments across different asset classes. This could be as simple as Stocks & Bonds. Slightly more complex would be breaking stocks down further into Domestic Stocks, International Stocks, and Bonds. You can make it as complex as you want further subdividing each bucket into ever more sub-categories. I would not be opposed if you wanted to add a category for Real Estate (either via REITS or direct rentals) as well as alternative investments (gold, crypto).

My Current Asset Allocation

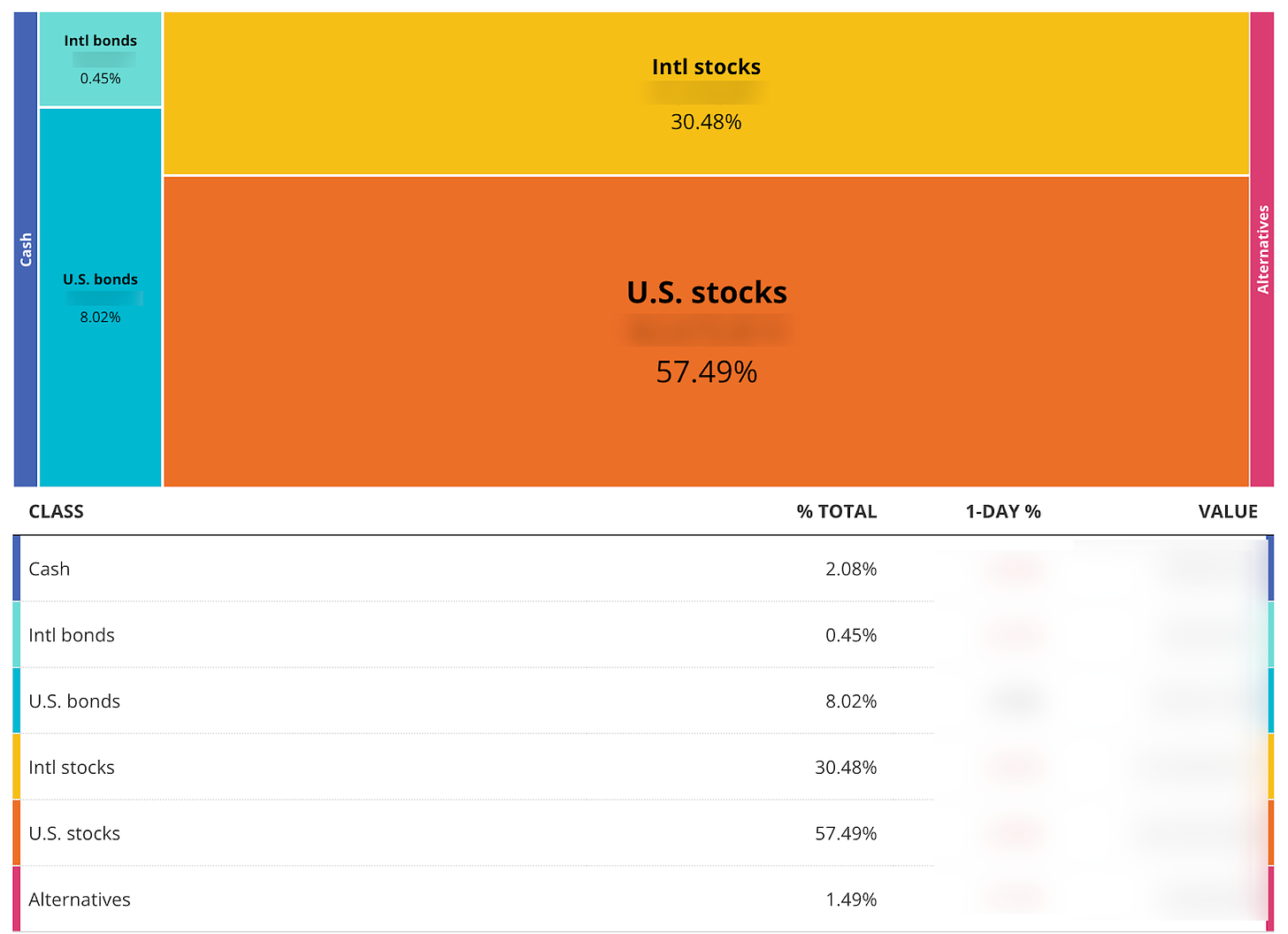

This is the current asset allocation across all my investment accounts.

When describing my asset allocation overall I would say my allocation is 60/30/10. Which stands for 60% US equities, 30% International Equities, 10% Bonds.

Due to 90% of my investments being in equities, this would generally be described as a more aggressive portfolio. However, it is a rather vanilla asset allocation, and mirrors the asset allocation for my age that Vanguard uses for their Target Date funds as seen below.

The specific investments within each asset allocation are primarily low fee index funds. I tend to buy both Fidelity and Vanguard index funds while pairing multiple similar funds within my taxable account to make tax loss harvesting easier.

Top US Stock Holdings: FSKAX, FXAIX, VTI

Top International Stock Holdings: VXUS, FPDAX, State Street ExUS Index1

Top Bond Holdings: State Street Bond Index, VTIFX

If you are just starting out I would highly recommend researching Boglehead’s Three Fund Portfolio. Simple low fee index funds from Fidelity, Vanguard, and Schwab (plus many others) are all really really great options to explore.

Asset Location?

While asset allocation is about the split across asset classes, Asset Location is about deciding where to hold each type of asset. This is important because there are very different tax implications with each asset type as well as different tax treatments of different accounts.

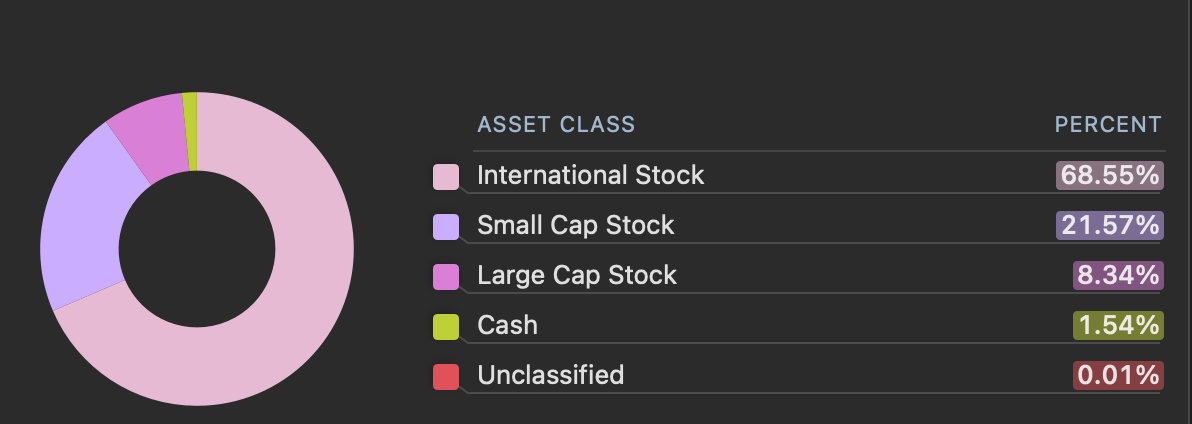

Let’s look at the Asset Allocation of my Traditional 401k as an example here:

As I showed earlier, my overall asset allocation only includes 10% bonds. Yet my 401k is rocking a 75% bond allocation. If you were to judge me based on my 401k’s asset allocation, you would think I was a very conservative 70 year old man.

Now let’s look at my primary taxable account, which for reference holds ~50% of my overall investments.

My taxable holds roughly 80% US Stocks and 20% International Stocks with 0% allocated to bonds.

If you look at my Roth accounts, you will again see a different asset allocation.

Why the difference? Primarily Taxes!

Bond Funds tend to generate interest which is paid out monthly. These monthly interest payments are taxed at ordinary tax rates at the federal and state level —treated just like normal income. There are some exceptions here, for example Municipal Bonds are not subject to federal taxes or state taxes (in most states). US Treasuries are also exempt from state taxes.

US and International Stock funds tend to pay quarterly or annual dividends. If you have held the index funds for >60 days all dividends will be taxed at a lower qualified dividend tax rate as seen below.

Quick Note: It is possible for Stock Funds to pass on Capital Gains to fund holders which can be taxed at ordinary income tax rates. This is what many who held Vanguard Target Date Funds saw in 2021 which caused an unexpected spike in capital gains leading to higher tax bills for many.

In addition to taxes on dividends, anytime you sell a mutual fund (regardless of type), you will also be subject to capital gains taxes if you are selling for more than you originally paid. If you held the assets for <1 year you will be subject to ordinary tax rates, while if you held for >1 year you will be subject to long term tax rates which are the same tables seen above capping out at 20%. This selling and buying, which could come from typical portfolio rebalancing, is referred to as “turnover”.

Most of you reading this will also be subject to the net investment income tax which adds a 3.8% tax to all capital gains, dividends, and interest for those earning more than $200k if single or $250k if married. For those in California, all investment income is treated as ordinary income and subject to state taxes too!

Now… none of the above taxes apply if your holdings are in a “tax advantaged” account. This would include your 401k, Traditional IRA, Roth IRA, HSA, 529. All dividends paid from funds held in these accounts are subject to no taxes. All gains from sales, regardless of how large, no taxes. These accounts are referred to as “Tax Advantaged”.

It is important to remember that all Traditional 401k and Traditional IRA funds entered into these accounts “Pre-Tax”. In retirement, when you access funds from these accounts, the amount withdrawn will count as ordinary income. You might think you can easily avoid these taxes by delaying accessing these funds… but the IRS eventually wants you to pay taxes on this money. One key mechanism is Required Minimum Distributions (RMDs) which force you to make withdrawals after age 73.

Roth accounts on the other hand are “After-Tax”. They are able to grow tax free and when you access the funds in retirement (after age 59.5), you will not owe any additional taxes. You can also access your contributions at anytime without additional taxes owed.

The mix of different tax efficiency on different assets combined with the different tax advantages of different types of investment accounts is why Asset Location matters.

“research has shown effective asset location strategies can add 20-50+ basis points of "free" value to annual returns” -Kitces

This has generally led to a simplified rule of thumb that states “Tax inefficient bonds should go in tax advantaged accounts like IRAs”.

Simple as that — right?

The reality is never as simple. Taxes are only part of the story. A few more factors can come into play. Each asset class historically has grown at very different rates over different holding periods. Stocks generally have higher average returns coupled with a higher variation year to year vs the slower growing but more consistent bonds.

Kitces has an excellent article on asset location where he ran multiple scenarios that highlighted the importance of factoring in taxes as well as expected returns over longer time horizons.

“The greater driver of the outcome is actually the difference in the final value of equities; whether held in the taxable account or the IRA, the compounded value is the same before taxes, but the fact that the IRA is taxed at ordinary income rates while the taxable account is subject to preferential long-term capital gains rates leads to a “tax rate arbitrage” benefit for stocks to be held in the lower-tax-rate account”.

This tends to be even more important if you are in a FIRE scenario with much longer time horizons for the tax drag to really be a growing factor.

Kitces ends the article with a great summary

“The bottom line, though, is simply this: the idea that the preferred asset location of equities is “always” a brokerage account to take advantage of favorable long-term capital gains rates, while tax-inefficient bonds would be placed in an IRA, is not always correct. In reality, the outcomes are sensitive not only to the expected returns and the tax-efficiency of the investments, but also to the time period for investing. And over multi-decade time horizons (and with IRAs that can be stretched, the time horizon could be multi-generational!) the benefits of tax-deferred compounding growth can outweigh the tax rate differential. In fact, with almost any level of turnover, the ideal asset location strategies change entirely, with stocks perform better in the long run in an IRA... and especially when there is a substantial dividend and/or any level of turnover (which could be triggered by rebalancing alone!).”

Where does that leave us?

For those pursuing FAANG FIRE like me you will end up with significant assets across Taxable, Pre-Tax, and After-Tax accounts. In my case I have ~50% of my investments in taxable accounts and 50% in tax advantaged (across Roth, Traditional 401k, HSAs). Working to optimize where you hold your assets has the potential to generate a real tax “alpha”.

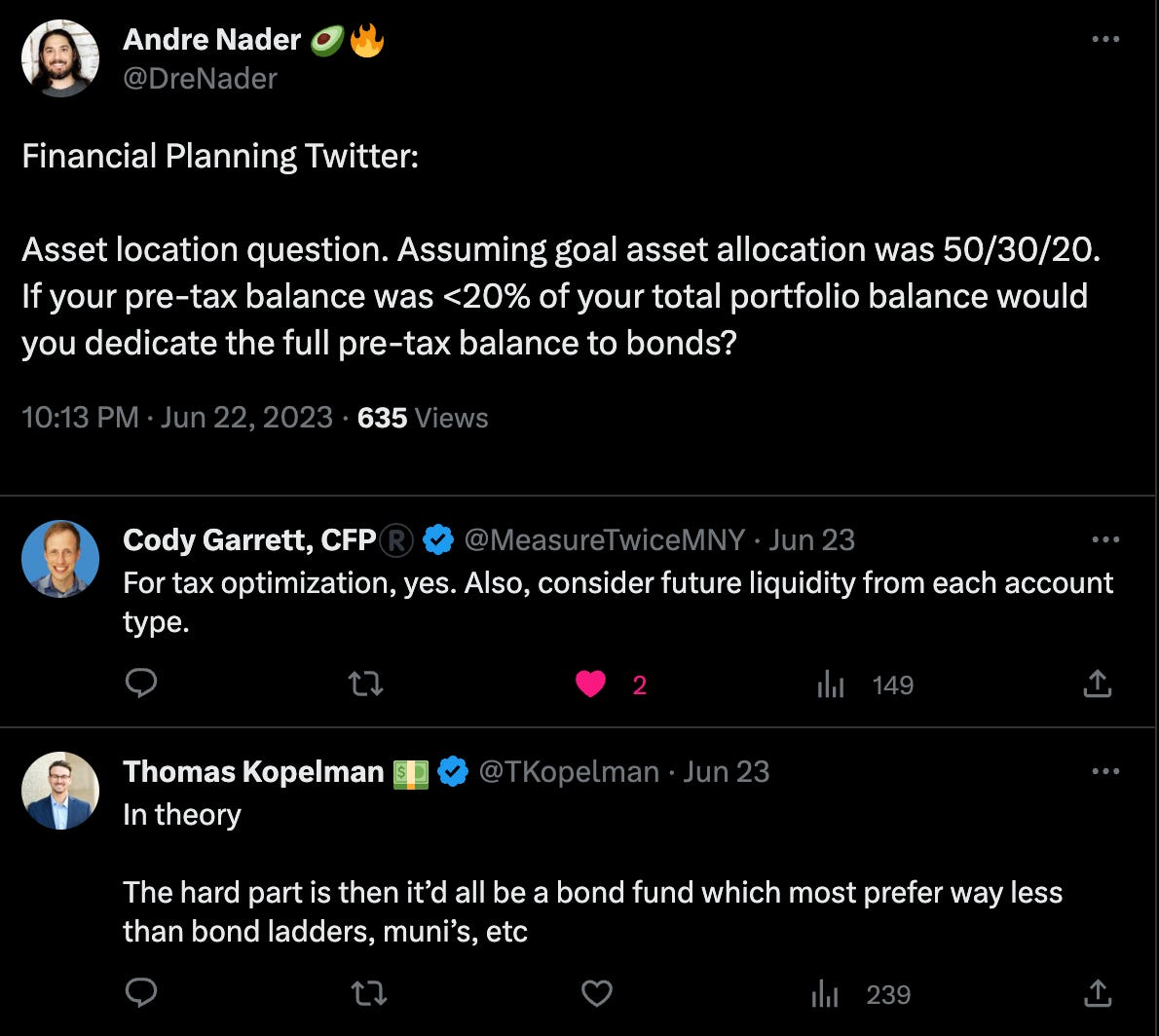

Honestly, I am still evaluating my current asset location strategy. My current asset location has led to me filling up much of my Traditional 401k space with bonds following the conventional wisdom of “Bonds don’t belong in taxable accounts”.

The very long time horizon that goes with early retirement means that higher equity returns and the associated capital gains taxes could favor holding more of my stock allocation within my tax advantaged accounts. Add to that, things like rebalancing, future Roth conversions, and eventual RMDs… it can get complicated.

I’ll end with a quote from Early Retirement Now on the same subject:

I almost feel sorry for writing such a long post to establish the really trivial insight that no asset location rule of thumb, neither the conventional wisdom (“stocks in taxable!”) nor skeptics claim (“stocks in Roth!”) can ever be universally optimal.

What do you think? Are you taking into account asset location when you break out your overall asset allocation? Are you even tracking your asset allocation?

-Andre

Additional Links and Reading on the Topic:

https://www.kitces.com/blog/yield-split-asset-location-tax-drag-alpha-efficiency-index-funds/

https://earlyretirementnow.com/2020/02/05/asset-location-do-bonds-belong-in-retirement-accounts-swr-series-35/

https://earlyretirementnow.com/2017/09/13/the-ultimate-guide-to-safe-withdrawal-rates-part-19-equity-glidepaths/

https://www.whitecoatinvestor.com/asset-location/

https://www.kitces.com/blog/asset-location-for-stocks-in-a-brokerage-account-versus-ira-depends-on-time-horizon/

https://www.troweprice.com/personal-investing/resources/insights/asset-allocation-planning-for-retirement.html

https://www.financialsamurai.com/the-proper-asset-allocation-of-stocks-and-bonds-by-age/

The State Street Funds don’t have direct tickers but are low fee index funds within Meta and Uber’s 401k offerings.

I think while in an asset gathering stage (still working), bonds in 401k with stocks in taxable accounts works fine. Because you can rebalance with contributions (somewhat.. considering you don't necessarily want to decrease your 401k allocation).

But for rebalancing once you're not working, I think you still want bonds + international + US in all major categories (Roth, 401k/IRA, taxable), for rebalancing purposes. While small movements don't matter a lot, we've had some major asset class movements recently. And you can only truly rebalance if you can sell one asset class & buy another (once you don't make major contributions).

Another way to rebalance is to use withdrawals as a rebalancing strategy. I think that's reasonable in general, but I've found that assets get *far* more out of balance than withdrawals will be able to fix, if your savings get high enough :)

How do you manage rebalancing? Currently my portfolio was small enough to focus on my pre-tax account, where I set up automatic rebalancing. As I start earning more and other accounts get bigger, I'm not sure whether to bother with a custom allocation that I have to manually rebalance, or simply use a target-date fund.