Happy V+1 day. The quarterly vest for my Meta RSU’s is February 15th. But if you were to logged into your account yesterday you might wonder where your shares are! That is because you will only actually see the shares land in your account on your vest day + 1 business day, hence the happy V+1 day the first day you can actually sell your shares!

This brings us to Step 6: “Sell every upcoming META and UBER vest and invest into diversified index funds within my taxable account”.

If you are new to the newsletter, I am walking you through the ten steps I am taking in 2023 to set myself up to Avocado FIRE.

But First, RSU Tax Myth-busting

When it comes to RSU taxes I hear this all the time:

"I am waiting 1 year to sell my RSUs because I was told it is better for my taxes".

This isn't true!

Let's clear this up!

When your RSUs vests, you immediately will see the value of the vest in your pay statement. It is treated just as if it were income (with some slight differences in withholding, but at the end of the year it is exactly equal).

You pay taxes on gains! If the value of your RSUs are flat when you sell, there are no gains. If they go down, they are now losses1. If they go up in value, NOW we have gains.

Only the gains are taxed. So if your Stock vested at $180 and increased to $200 before you sold, you will need to pay taxes on the $20 (per share).

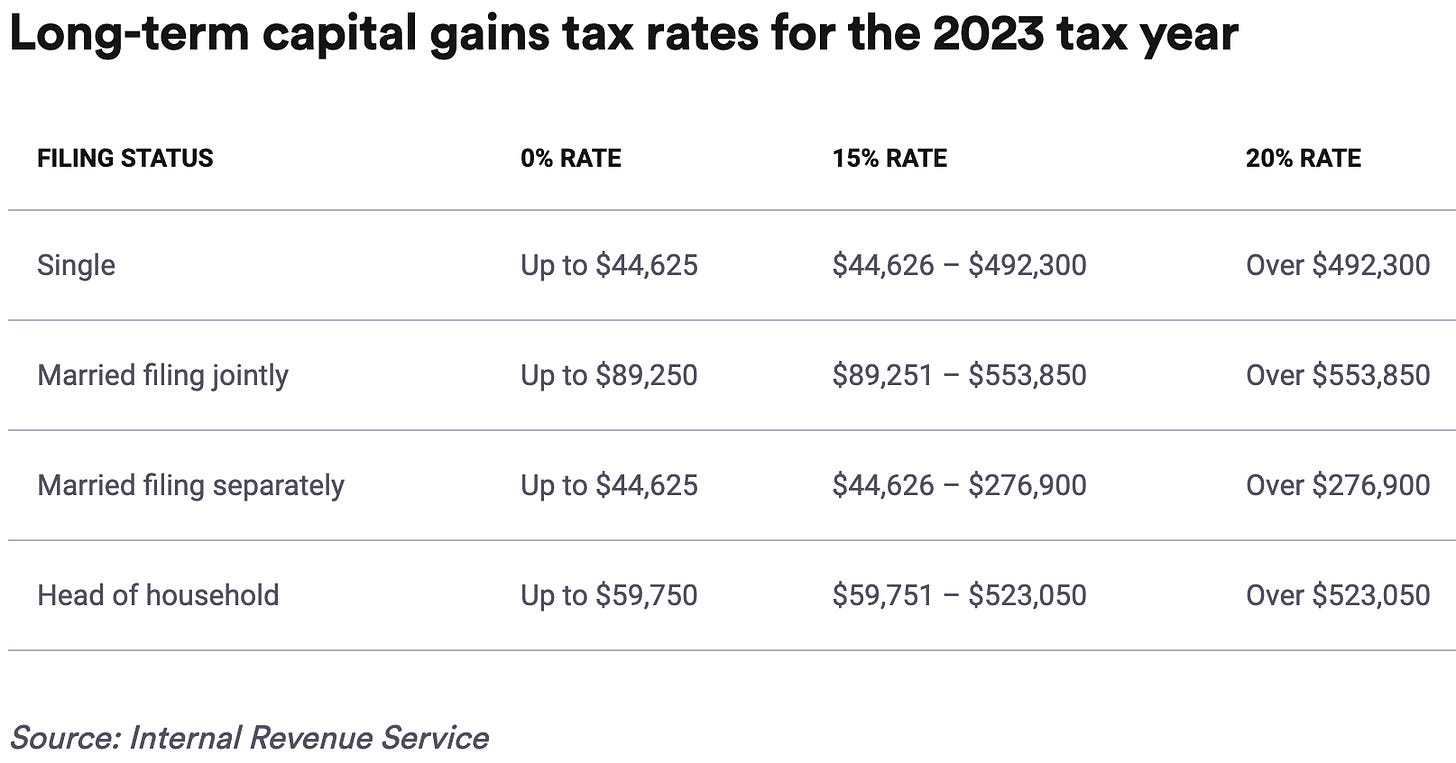

This is where the confusion comes in. The $20 gain mentioned above. If it has been less than 1 year since your RSU has vested, it will be taxed as "ordinary income" which is a fancy way of saying at the exact same rate as your salary. If it has been more than 1 year you pay Long Term Capital Gains rates which depends on your income but generally ~15% or 20% for most with FAANG salaries.

Conclusion: Taxes are only against gains. If you sell your RSU shortly after they vest there are near $0 in gains (most the time).

Please note that I am not an accountant. There is a lot of nuance and gotcha’s in the US tax system. Always make sure you understand the tax implications of your decisions and if needed consult a qualified professional.

Step 6: Selling My Upcoming RSU Vests

Today is the first day that I can sell both my latest Meta Shares.

I don’t stress selling right away. As long as I sell before the blackout period starts I am happy. In most cases the handful of percentage points the stock moves (up or down) during the open period won’t matter over the long term.

Since the only Meta shares I own are from the most recent vest I can sell all the shares without too much thought.

But what if I didn’t always sell my vests as soon as I received them?

If I had multiple lots of Meta shares from past vests and wanted to sell in order to diversify I would do is this:

First, ignore taxes. Determine how much Meta shares I want to sell.

Determine the most tax efficient way to sell those shares.

In most cases the most tax efficient way would be to sell the shares with the largest losses. But wait, won’t that trigger a wash sale? Yes, yes it would.

Wash sales prevent you from claiming a loss on a security if you buy that security within 30 calendar days both before or after the sale. The gotcha here is that the act of vesting is treated as a purchase in the eyes of the IRS. It is important to note that the loss isn’t fully gone, you get to reduce the cost basis of your new vest by the invalidated wash. The second gotcha that you might run into is that your broker may not keep track of all of this for you (or worse, do it incorrectly).

However, if I were to also sell my newest Meta vest as well, I would undo the wash sale. This is why understanding the mechanics of the wash sale is important. Because a wash sale changes the cost basis of the newly purchased shares, when you then sell the shares that caused the wash sale it cancels everything out.

I have a confession to make

While I have been diligent in selling all my Meta vests, I have not been following my own advice with my partners Uber shares. One of my goals this year is to start correcting this. Before I jump into my plans it is worth highlighting two key differences between Meta and Uber regarding their RSU vesting schedules, and a key reason why I ended up in this situation.

Meta shares vest quarterly. Uber shares on the other hand vest monthly. You might think that the monthly vesting schedule is better. Yes, you are getting portions of your vest sooner, but they come with a significant downside. It is nearly impossible to sell shares at a loss without losing the ability to claim the loss due to a wash sale.

That next vest is always around the corner again next month! Add to that blackout periods, additional ESPP purchase dates, and this is one of the big reasons I have accumulated more Uber shares than I would like.

This is a classic case of me letting the tax tail wag the dog. I made a non-optimal financial decision just to avoid complicated tax issues. But it really is such a pain in the ass!

So what am I going to do with my Uber shares? If I follow my usual advice I immediately run into a wash sale.

Leave a comment and tell me what you think I should do in this situation?

My Plan

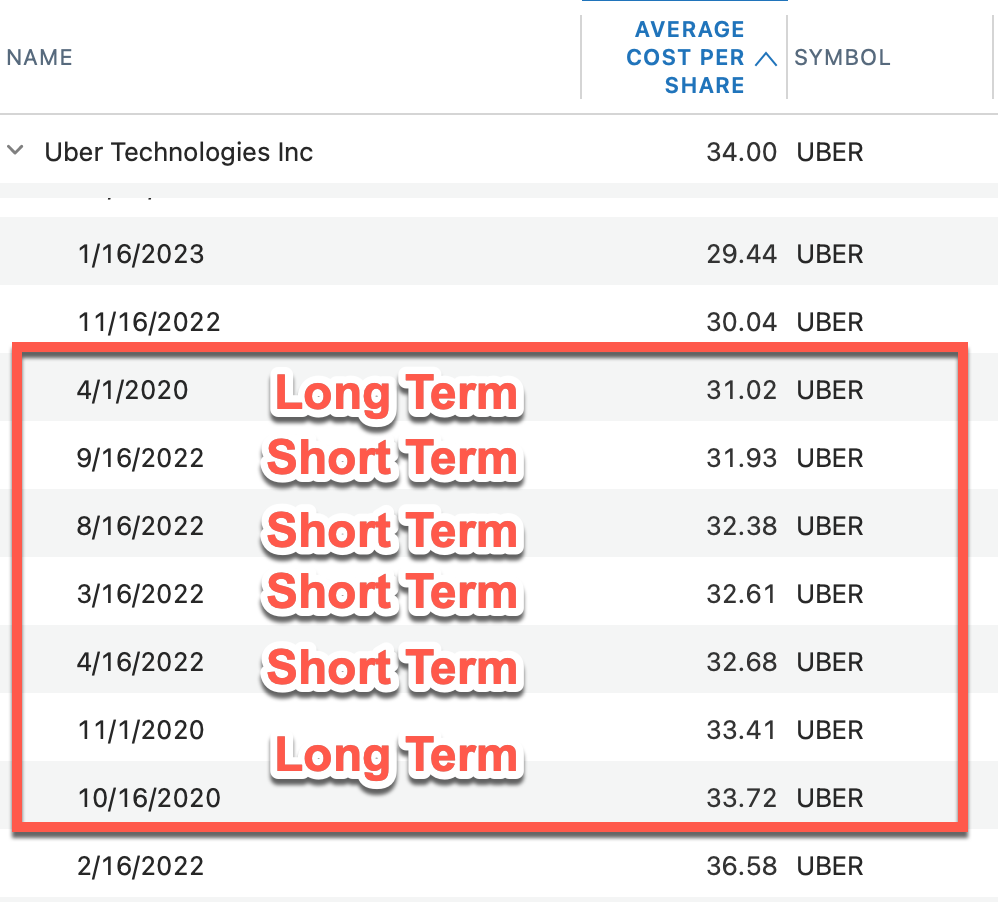

What I think I am going to do it start selling off individual lots of Uber shares with the least amount of gains (but not losses!). So if Uber is trading at $36, I would try and sell lots that are just under $36 (or as close as possible).

I would preference shares that I have held for more than 1 year so the gains would be subject to Long Term Capital Gains Tax rates instead of my marginal tax rate.

Let’s look through an example. I can see in the image above that there is one vest from 10/16/2020 that is at $33.72 that matches my criteria.

This would result in owing Long Term Capital Gains tax on the gain of $2.28 per share ($36-$33.72).

That would be a maximum LTCG tax of 20% at the federal level +3.8% from the net investment income tax.

On top of that California treats all gains as any other income, so add on 9.3-12.3% depending on your specific bracket.

So when I do my taxes in April 2024 i’ll owe ~.80 for each share. Leaving me with $35.20 per share after taxes to diversify into index funds.

If we were dealing with short term gains the gains could be cut in half, owning $1.14 in taxes per share or $34.86. Remember, you only pay taxes on the gains!

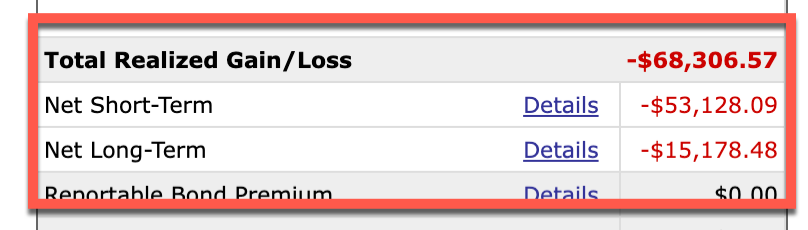

But… I could actually pay $0 in taxes, even if I had some gains.

If you remember from my post on Tax Loss Harvesting, I have nearly $70k worth of losses that get carried over into this year that can be used to offset any gains!

That should be more than enough to let me bring my total Uber holdings to a more acceptable % of my net worth.

This specific case is a really good example of what I think is an optimal use of tax loss harvesting, it is allowing me to diversify out of a position without any tax consequences (while I am in the highest tax brackets).

The moral of the story is that Monthly vesting kind of sucks.

It is possible that the losses would cause a wash sale.

Hi Andre, thanks again for a high quality post with timely reminder to sell my newly vested Meta shares. So I was looking at Schwab right now and using the specified lots feature to sell the vested shares from yesterday, and I dont see the latest lot from yesterday. I only see the lots from previous vests. It also says in info that 'Note that lots established today are not eligible for assignment'. So I usually sell the next day when this new lot becomes available. Curious how you are able to sell your shares today itself?

Thanks once again for the high-quality content you have been generating! Regarding sales triggering wash sales: am I correct in assuming that in most cases we will be doing tax harvesting loss sales at the end of the year so February vest sales triggering wash sales is typically not a big concern?