Actions to Take in a Bear Market + Personal Updates

Dealing with bear markets, remote work, and where I'll live in 2023

The mighty BEAR market is here

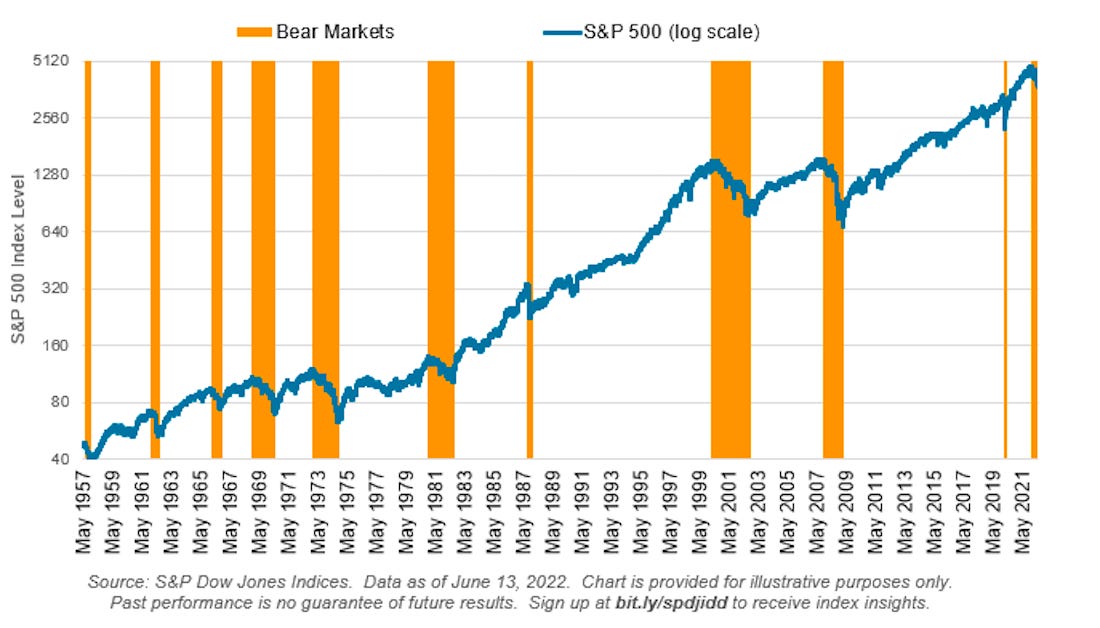

A Bear Market is defined as a 20% drop from prior market highs. In today’s case the bear market officially started on 1/3/2022 after we reached -20% mark on 6/13/2022.

A potential recession is looming around the corner. LinkedIn is inundated by layoff post after layoff post. Those still employed are seeing their annual compensation drop due to 50%+ drops in RSU values. Inflation near all time highs, the FED increasing interest rates, mortgage rates approaching 6%. Fear, Uncertainty, and Doubt seem everywhere. What are you supposed to do!!

You might be tempted to cut your losses and sell everything to wait till things recover. But this is actually one of the worst things you could do. Some of the highest return days tend to be those shortly after large corrections while volatility is very high. It turns out that those high return days really matter in terms of overall portfolio performance. If you were to sell and wait till things looked better and missed just 5 of the best days you could end up cutting your overall growth in half.

Take a step back and zoom out.

We are pretty much exactly where we were a little more than a year and a half ago. Bear markets happen. It can still get worse. It will also happen again! According to SeekingAlpha’s research “Based on historical data, the average length of a bear market is 289 days. Bull markets, on the other hand, average 991 days. There is an average of 3.6 years between bear markets.” The good news here is that the current bear has already been going for 5.5 months (that’s how statistics work right? /s).

It is a good opportunity to reassess your goals. Are you really as risk tolerant as you thought? Or maybe realizing some of your investments were more gambling than you initially realized? No judgment from me, I did the same thing back in 2018 when I got margin called more than a dozen times before I learned my lesson.

What Am I Doing

#1. Emergency Fund Audit

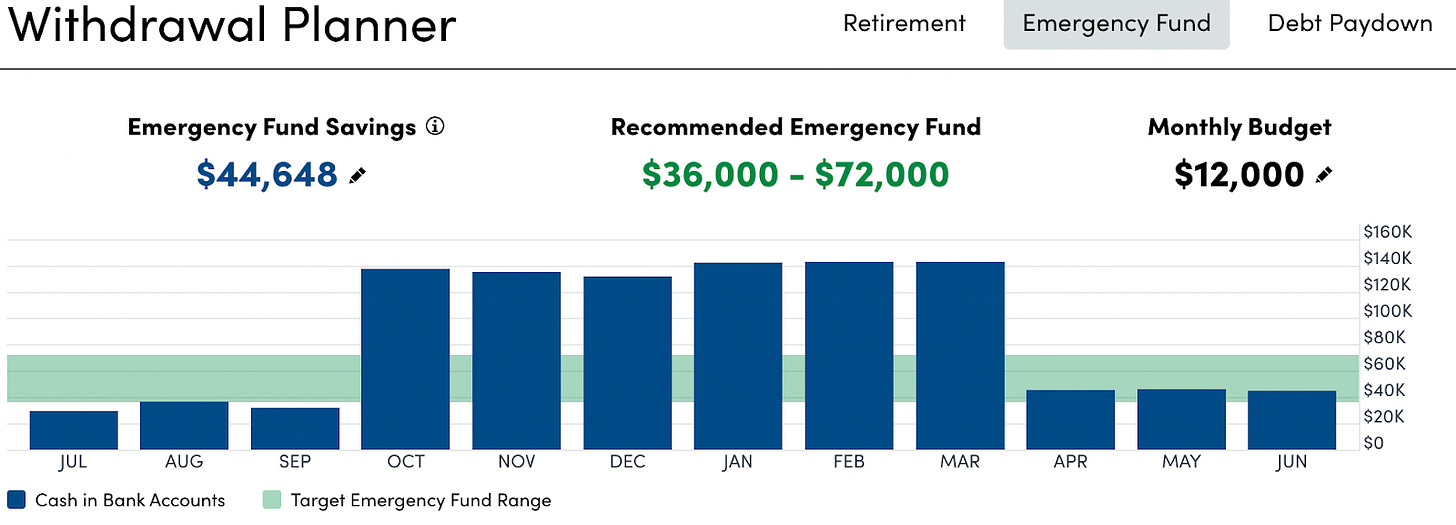

I always try to keep at least 6 months of core spending in a savings account. I have never felt like my job security was a concern but that doesn’t stop me from preparing for the worst. I shared my February spend previously which was $13,600. Some of that is heavily discretionary so in an emergency I could cut it out (sorry Avocados and Amazon). My “Core” monthly spend is closer to $10k and could be cut down more in a real emergency if both members of my household were to lose their jobs at the same time. Please, please, please prioritize your emergency fund. It doesn’t need to be 6 months, 3 months is a great start. (Personal Capital makes it very simple to track this automatically).

#2. Tax Loss Harvesting

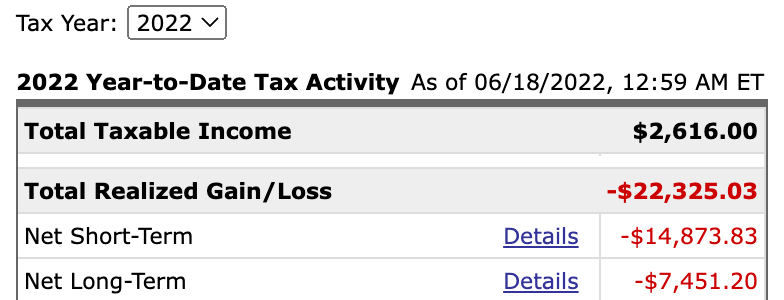

This is more optional than anything else. Tax Loss Harvesting is the act of selling the lots of stocks you have lost money on and “harvesting” them to offset gains (either now or in the future). This can offset your ordinary income by up to $3,000 per year and can carry forward into future years. The important thing here is that I am selling the lots in my taxable brokerage and then buying a different mutual fund or ETF. I mostly exchange between similar items like selling FZROX (fidelity’s zero fee fund tracking the total us market) and then buying VTI (vanguards etf that tracks the total us market). They are similar, but not the exact same. You can’t just sell your losses in VTI and then turn around and buy more VTI, that would be a wash sale which would prevent you from realizing the full loss at that time. Guide from schwab on the basics of tax loss harvesting. Fidelity guide on avoiding wash sales. You can also read about wash sales straight from the IRS in p550.

#3. Continue Investing

I invest nearly every month. I don’t typically try to time the market by investing more when things drop like they have. Step #1 isn’t just to make sure I have enough saved for my emergency fund, but equally about ensuring I am putting all the excess savings into the market. I am not doing anything drastically different. I am continuing to buy low fee index funds/ETFs to get me to ~55/35/10 (US Equities, International Equities, Bonds). I tend to primarily rebalance as I contribute throughout the year without stressing too much about a few % difference.

Things I have already done: Max out all retirement accounts for the year. For me this includes pre-tax 401ks, after tax 401ks, and backdoor roths. Max out my household iBond purchases. You can save $10k per person per year in inflation protected bonds through treasurydirect.gov.

Personal Update

I am officially a fully remote Meta employee. The way it works at Meta is that you need to apply to go remote, receive VP approval, and finally the remote status is processed twice per year. One of those processing times was this past May.

Even before being fully remote, the most common question I get when talking with people is “Where are you moving?” Apparently when you write multiple articles about relocation, the benefits of leaving CA, and how you can make more money in Texas, people get the idea that you are planning on leaving. It isn’t like I wrote a piece titled “The Analysis into leaving San Francisco” or anything. I almost feel obligated to leave San Francisco at this point! But the city can’t get rid of me that easily. I have renewed my rental lease until July 2023.

Factors that contributed to my decision to stay in San Francisco for another year were:

My 4 year old goes to an awesome school. I have 1 more year until I need to worry about kindergarten. The entire reason my lease ends in July 2023 is because that is when the school year will end.

I still have not nailed down where I would want to move. Although multiple cities in North Carolina continuously top my personal lists.

San Francisco is so god damn hard to leave.

Moving sucks.

I have more thoughts on the pros and cons of transitioning to fully remote but that will have to come another day.

Some of what I read last week:

Enjoying your writing Andre. Thanks for the reminders and tips.

Btw - we are leaving SF and moving to NC on July 1.

Recently stumbled on your profile! I am wondering how do you rebalance your portfolio from time to time? More insights on that?