The Real Cost of a FAANG Relocation from California

The financial costs of going remote at FAANG

I have spent nearly 8 years in San Francisco. I really love so much of what this city provides (oceans, parks, forests, museums, rich diversity, weather, lack of mosquitoes, weather). But I keep thinking about my analysis into leaving San Francisco. Leaving this city that I love feels inevitable. I am in the incredibly fortunate position to not only have a well paying FAANG job but my partner also has a well paying FAANG adjacent job. I think San Francisco is better than most cities… but is it so good that I would spend 5-10 more years working in order to spend the rest of my life here?

My original Financial Independence Retire Early plan was to keep working until I hit my FIRE number and then move to a medium cost of living city somewhere else. Because of covid the possible sequence of events has flipped a bit. There is a new reality where I can maintain much of my Bay Area FAANG salary without needing to be in the bay area. I could essentially glide into early retirement in my desired location years earlier.

In this post I wanted to spend a little more time into some of the actual income and tax implications of what happens when a current FAANG employee transitions to fully remote. I am not going to focus so much on the cost of living this time (or the weather), but don’t worry I am wrapping up an update to my original analysis in the next month. Be sure to subscribe to be the first to get access!

Major Costs of Going Remote

Let’s break things down into two primary categories:

Income: Each of the FAANGs have a slightly different philosophy into adjusting salary based on the location one chooses to live. Let’s take a closer look at how each is approaching it.

Taxes: The first thing many people think of when trying to factor in leaving California or New York is no longer needing to pay such high taxes to these states. Many people overlook that the lovely state of California will stay in your life as long as you are vesting shares given to you while you worked in the state! We will take a look at how to calculate this and I created a tool to help you do the same.

FAANG Income Compensation Philosophy (US only):

Facebook/Meta:

Meta is adjusting salaries based on where you choose to work remotely. From what I have seen is that it can vary from 0-15% not only based on location but also level. With more senior employees seeing less or even no reductions for many directors regardless of location.

Salary adjustment is only on your base salary. It doesn’t seem like any adjustment is made to the equity refresher equations (which depend directly on level and performance review ratings). Bonuses are a function of your base salary so those would also be impacted.

From bloomberg: “any Facebook employee can request to work from home, the Menlo Park, California-based company said Wednesday in a statement. If those employees move to a lower-cost region, their salaries will be adjusted accordingly”

Apple:

Only allowing 4 weeks remote per year without the option to transition to fully remote.

“We are committed to giving you more flexibility as we move forward. In addition to the option of working remotely twice a week on Wednesday and Friday, we announced this summer that team members would be able to work remotely for up to two weeks per year with a manager’s approval. I’m pleased to share that we’re increasing the amount of time you can work remotely to a total of four weeks per year.”

Amazon:

Seems to vary by team with the broad guidance of “ we want most of our people close enough to their core team that they can easily travel to the office for a meeting within a day’s notice”

Netflix:

Seems to vary by function with many being remote friendly. Pay adjusted based on location anywhere from 0-20% adjustments.

Google:

"Our compensation packages have always been determined by location, and we always pay at the top of the local market based on where an employee works from,"

Varies from 5-25%. Austin is again around 10%

The Tax Implications of Leaving California Behind

If your plan is to peace out of California to avoid the VHCOL and taxes on your appreciated stock vests… well you might be in for a surprise. The California Franchise Board (think of this as the IRS for California) won’t let you off the hook that easy. They will want every single dime that can tie back to when you lived and worked in the sunshine state.

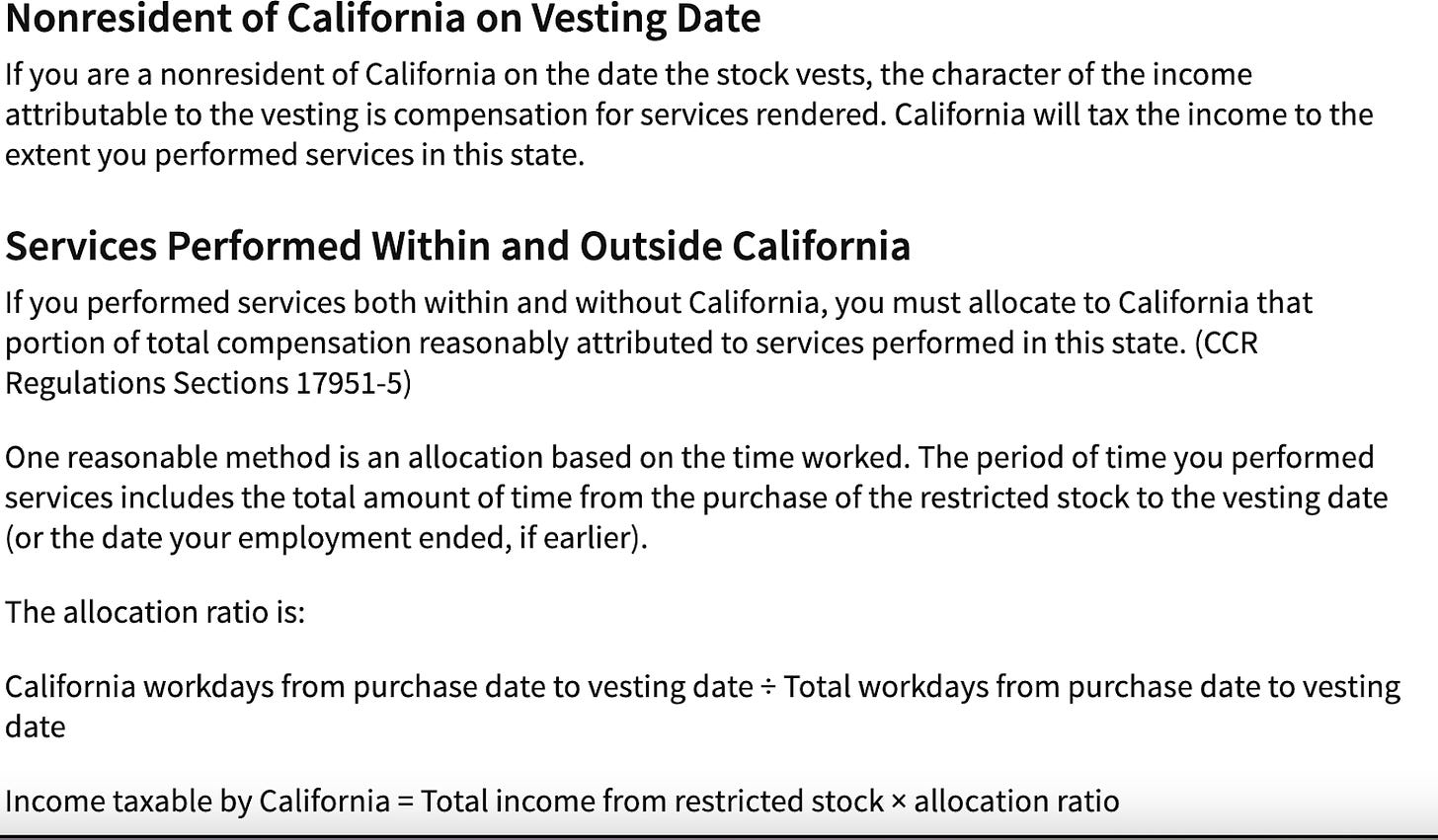

Sure, you can move to Texas where there is no state income tax. You will no longer pay any additional state income tax on all your base pay and bonus going forward. Did you notice I left out a key piece of your FAANG comp? Your equity of course. California will still want a piece of that sweet sweet equity, every unvested share that they can tie back to when you worked in CA. How much of your grants is subject to California taxes after you leave is based on this ratio: “California workdays from purchase date to vesting date ÷ Total workdays from purchase date to vesting date”. So for each grant you will need to compute what % of the time you were in CA and pay CA taxes for that amount.

“California workdays from purchase date to vesting date ÷ Total workdays from purchase date to vesting date”.

Sample Relocation Numbers

The new hotness seems to be relocating from San Francisco to Austin (or Miami will work equally well for this). Let’s take a look at what it might look like for a Meta E4 who decides to move from San Francisco, CA to Austin, TX this June 1st 2022.

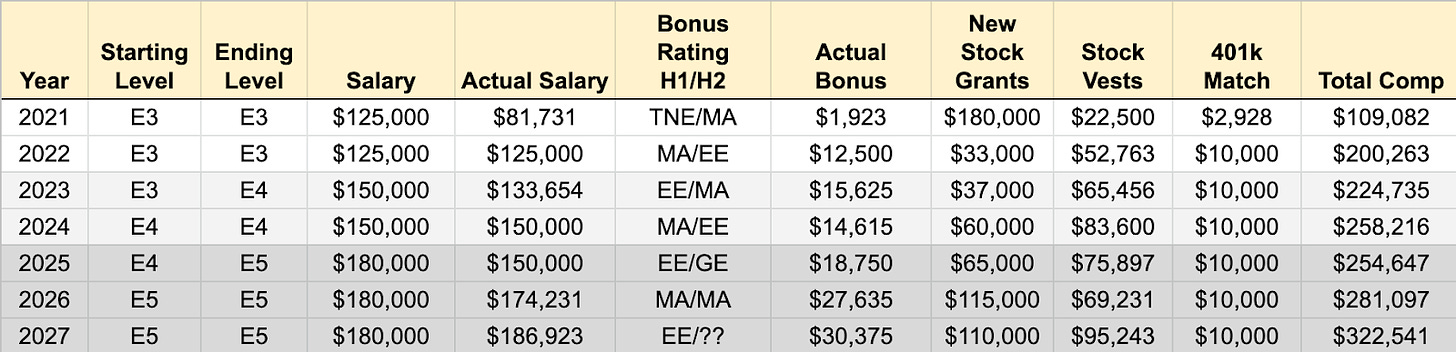

We can reuse data from Jane, the hypothetical engineer we were modeling out FIRE for.

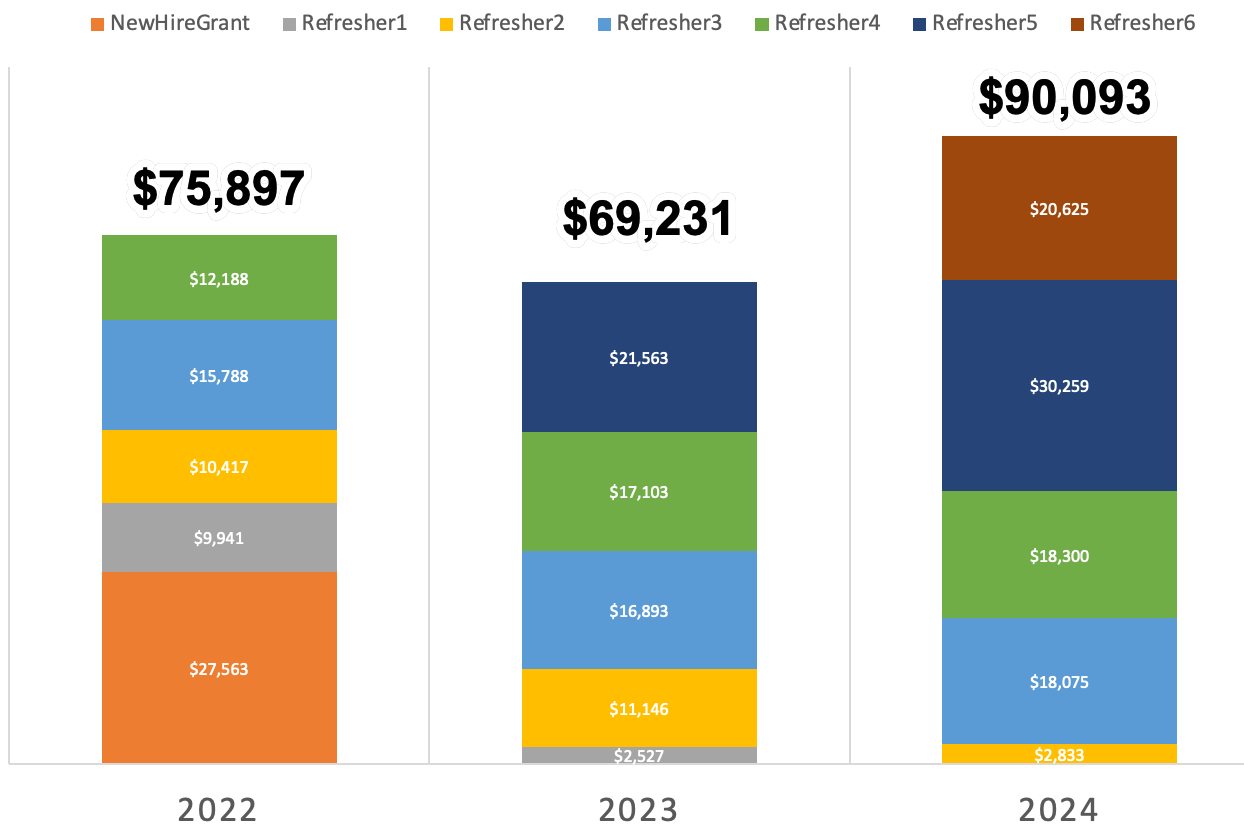

A quick recall of Jane’s lifetime Facebook stats. To make things a little more interesting let’s actually treat Jane as a 5 year veteran and start at the Year 2025 (just pretend that 2025 in the below chart is our new 2022) This way we can look at the impact moving to a no state income tax state impacts the different existing grants.

Total Comp Adjustments

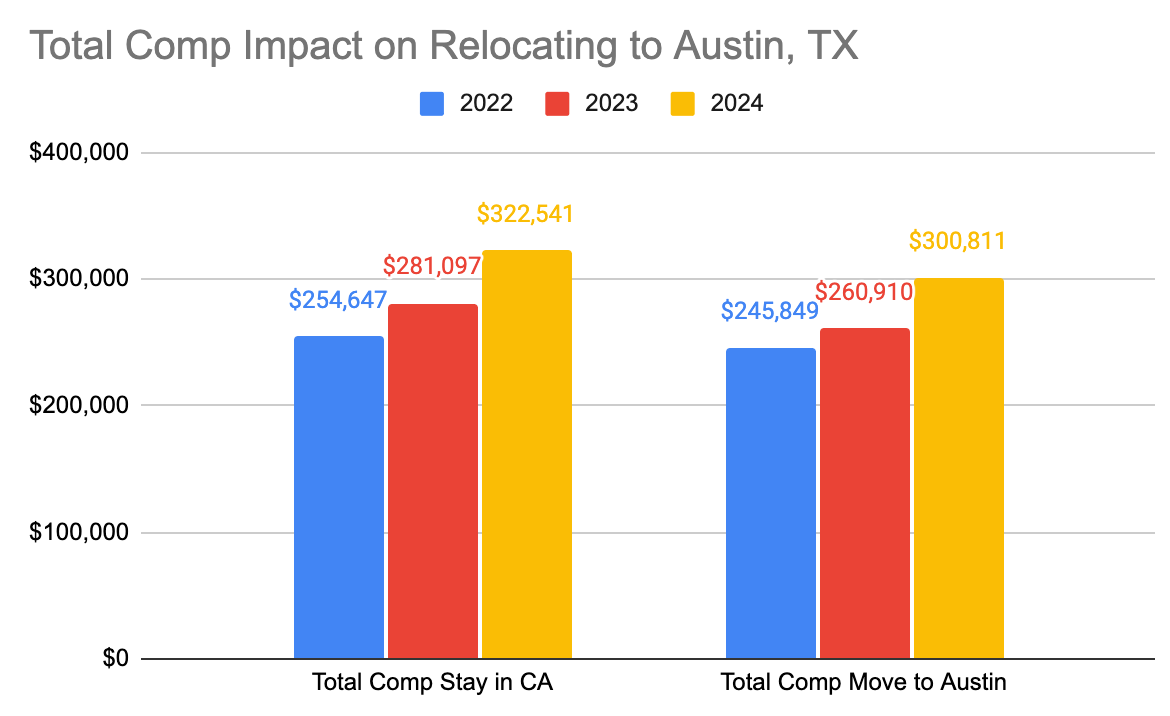

This is the more straightforward part of the computation. From the outlines above we know that most companies adjust salaries for Austin, TX down 10% when relocating from the Bay Area. We just go through and adjust down all salary and bonus equations down by 10% keeping equity equal (which is the case for Facebook). As you can see in the graph below because the 10% reduction doesn’t impact equity grants, Jane’s actual total comp reduction is closer to 7%. But this is just part of the story.

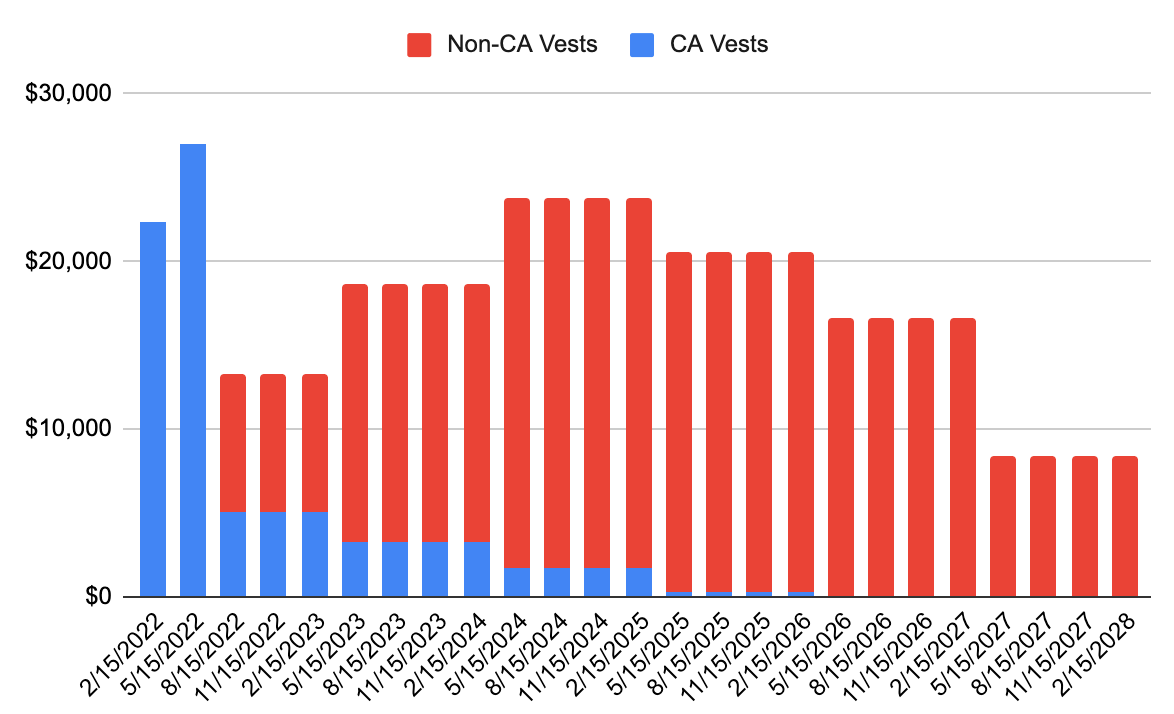

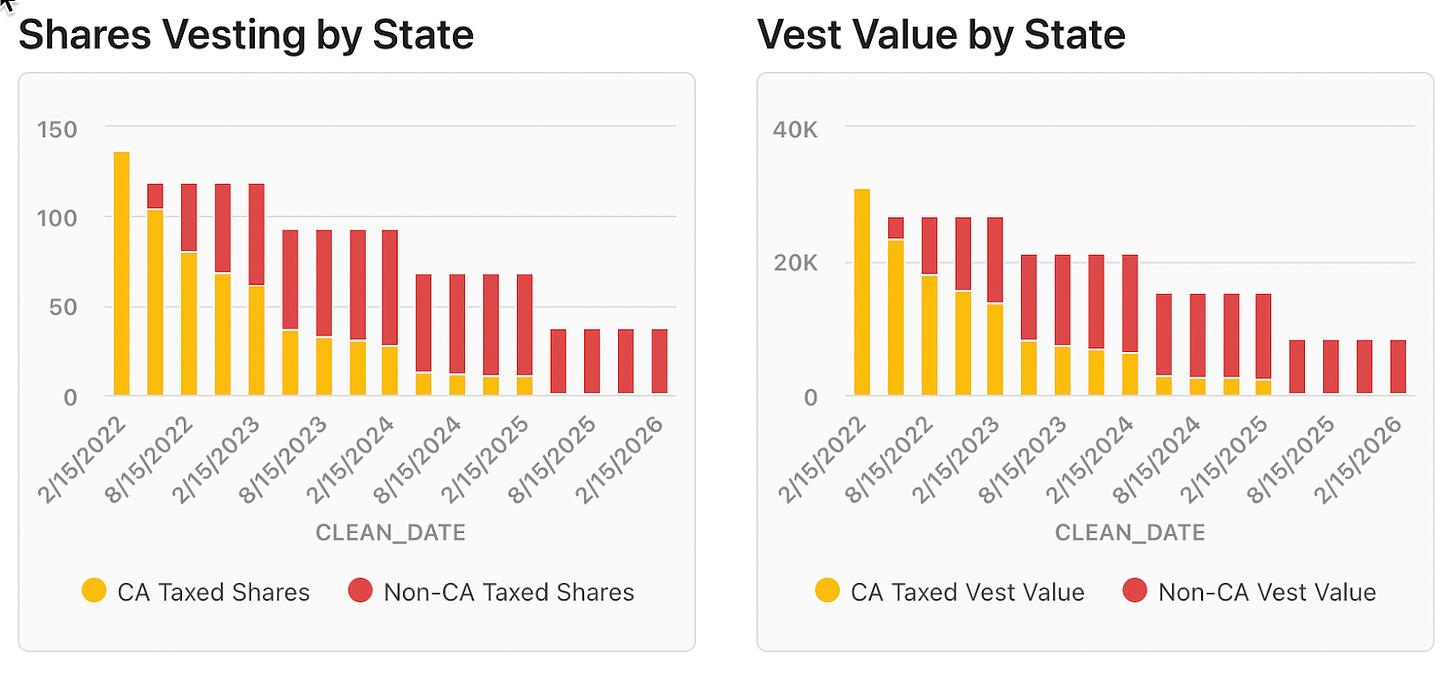

Splitting Equity Vests for California Taxes

Next we need to deal with the equity. There isn’t any adjustment to equity at Meta when you are working remote from within the US. We do need to split out each vest into what % of each grant will be subject to CA taxes.

“How much of your grants is subject to California taxes after you leave is based on this ratio: “California workdays from purchase date to vesting date ÷ Total workdays from purchase date to vesting date”.”

Here are all the equity grants Jane still has in our scenario as she moves to Austin, TX.

We now need to work on splitting up the grants based on what percent Jane was in California for and we will end up with something like this.

So in Jane’s case the CA vests quickly become a small amount and a small annoyance for the next 5 years Jane does their taxes. This could look drastically different depending on the makeup of your own equity. This scenario was based on completely flat stock performance, Jane hit their new hire equity cliff in the first year they were remote, and the post-promo refresher landed while 100% in Texas and not subject to CA taxes.

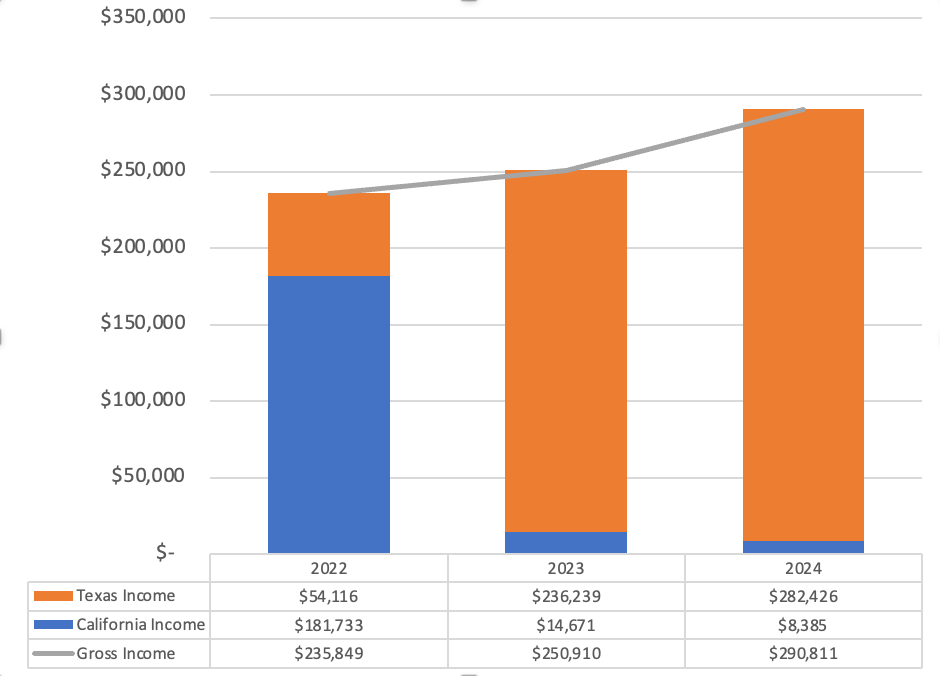

Gross Income by State

This gives us the ability to calculate gross income by state.

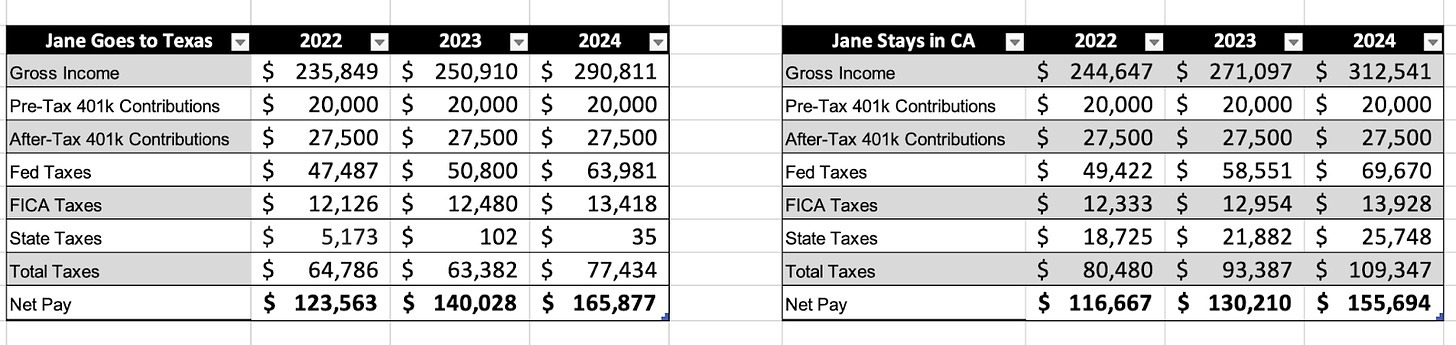

The Final Results

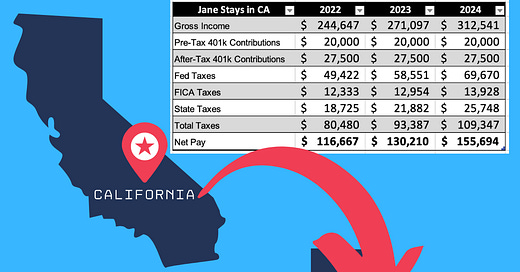

You should already know Jane is very FIRE focused. They max out all 401k + after tax offerings Meta provides. So while Jane needed to drop their salary by 10% to make the move, because their past equity in addition to Facebook not changing equity refreshers based on US locations, Jane will actually net out more money in Austin. This is even before factoring in any differences in cost of living! These specific numbers should apply to any city in a no state income tax state since they don’t even factor in actual cost of living differences (yes I know Austin is getting expensive… but still not San Francisco expensive just yet).

Want to Calculate How Much Equity CA Wants from YOU?

If you are interested in some of the calculations behind computing what percent of your equity vests will continue to be taxed I created a little calculator on Coda that you can make a copy of and play with. You can add your vests and the doc will calculate what portion of your vests California will want a piece of! Right now it is only configured for Meta’s vesting cycle of 4 year grants vested quarterly without a cliff. If there is positive feedback I can look into expanding functionality, or you can make a copy and hack at it yourself!

Looking for 1:1 FIRE coaching?

Partner with me to identify your FIRE goals and create an action plan on how to achieve it. https://practice.do/me/andre-nader

Wow! I didn't know that CA taxes unvested equity that was granted while you were in the state. But all of this is moot (IMO) when you factor in other variables such as the weather tax, the liberal culture tax, etc. Waiting for an update to your post next month. Good luck crunching the numbers!

Do you find that your w2 accurately divides up your rsu income between CA and the other states you moved to?

Im filing multistate returns for the first time with RSUs, and the numbers look way off from an allocation perspective but my company refuses to correct.

If not, do you have any tips on how to file this correctly using like a turbotax?