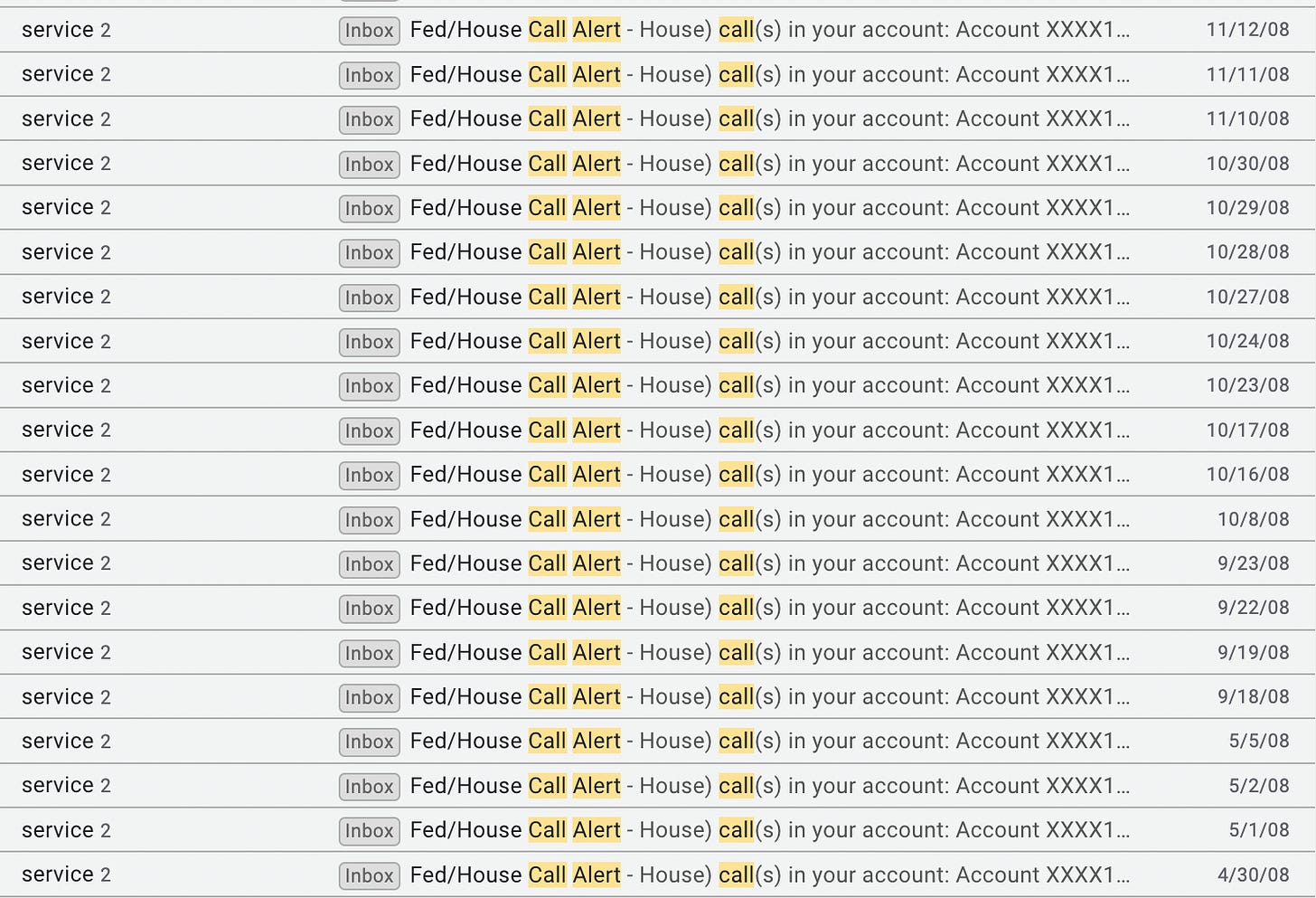

In the summer of 2008 my phone wouldn’t stop ringing. To make things worse, the calling started while the CEO of the company where I had my summer internship invited me out for a 1:1 lunch to see how things were going. I knew who was calling without even needing to look at my Blackberry. It was TradeKing. You may not know who tradeking is (they have since been purchased by Ally Bank) but at the time their $4.95 stock trades were the cheapest on the block. They were calling me to let me know my account was about to be liquidated on a margin call if I didn’t add funding or close out positions. It was the first of many of these calls over the next year. I didn’t accept my losses and kept doubling down.

The market was regularly seeing 5-10% swings in different stocks. The volatility was everywhere. The prospect of “catching the bottom” was too alluring. I didn’t know what I know now about index funds, it was more akin to what you would find in /r/wallstreet bets. We are talking about straight gambling. I tossed all my internship money + any student loan money I could get my hands on + margin. I was trading weekly options on extreme leverage. Getting margin called left and right. The new school year comes around and I was able to refill my brokerage with even more student loans. But all my attempts to outsmart the market ended in more losses.

In total I lost ~$20k as a 21 year old still in college. If I had access to more money I am sure the losses would be even higher. At the same time I wouldn’t be where I am today if it wasn’t for the Great Recession. My career in tech has surpassed anything I could have imagined while in college.

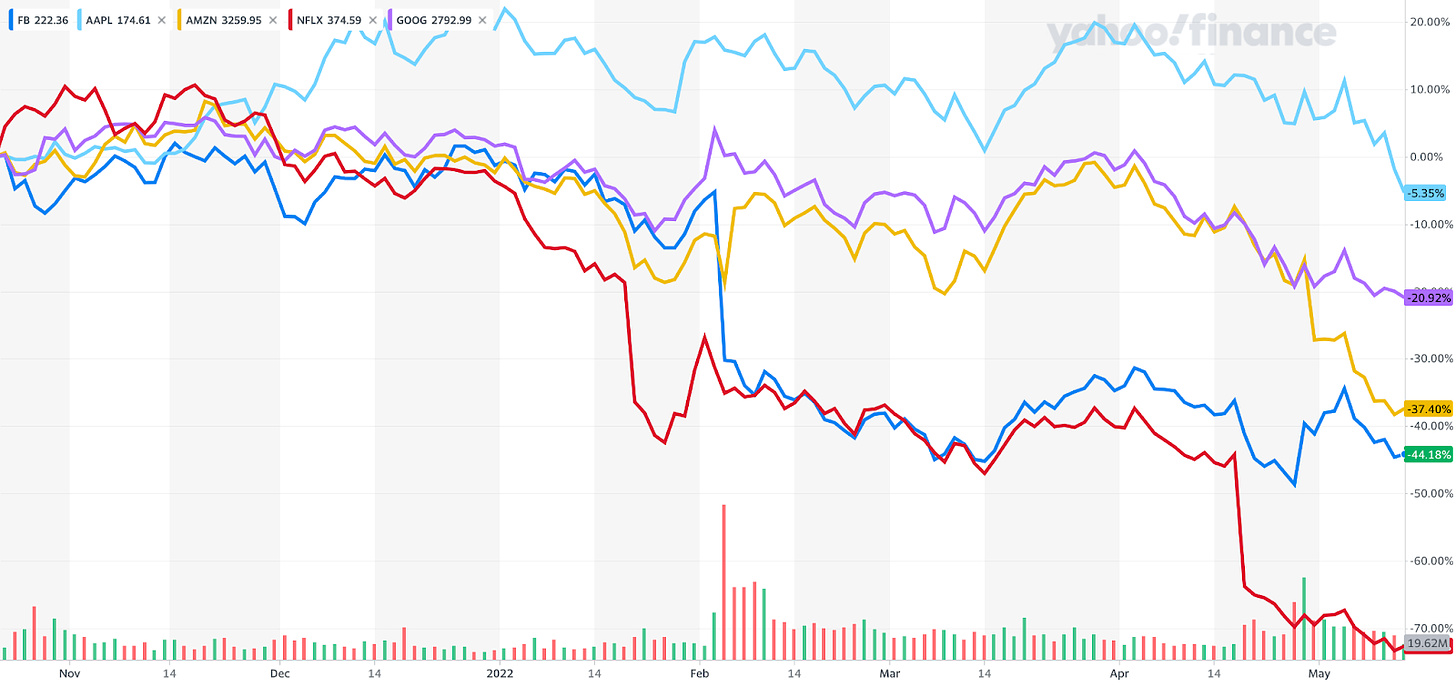

Losing that $20k so early in my career was the best thing that could have happened to me. It forced me to accept that I wasn’t investing. I was just gambling. I was chasing fast money and got burned. This pushed me into the world of boring index funds and ultimately started me on my FIRE journey. Many people are going to be learning this lesson for the first time. Their equity grants down >70%, crypto portfolios getting destroyed, and the margin calls… so many margin calls will happen. Not to mention hiring freezes, companies tightening their belts, and some even losing their jobs. Make sure you have empathy these coming months, you would be surprised who could be feeling this the most.

2022 feels similar to 2008 for me. 2008 was rough. It wasn’t just the stock market either. Housing was in a free fall, hiring freezes, layoffs, one thing after the other was just collapsing. I was an Economics major going into my senior year at the University of Texas. I had planned to try and get a banking job in New York because at the time that was the sexiest way to quickly get a high income job straight out of school. Unfortunately the Great Recession had other plans for me. The career fairs were barren, but luckily I casually chatted with a recruiter present about an “Online Marketing/Business Development” internship they had available. I figured the word “Business” was in the title so it was worth a shot and that turned out ok for me.

So here we are in 2022 and my household total comp is probably down ~15% for the year and YTD net worth balances down hundreds of thousands of dollars. Both META and UBER shares down >50%. Every single FAANG is down.

In times of uncertainty it is helpful to fall back on your goal. Your goal and the plan you have in place to reach your goal.

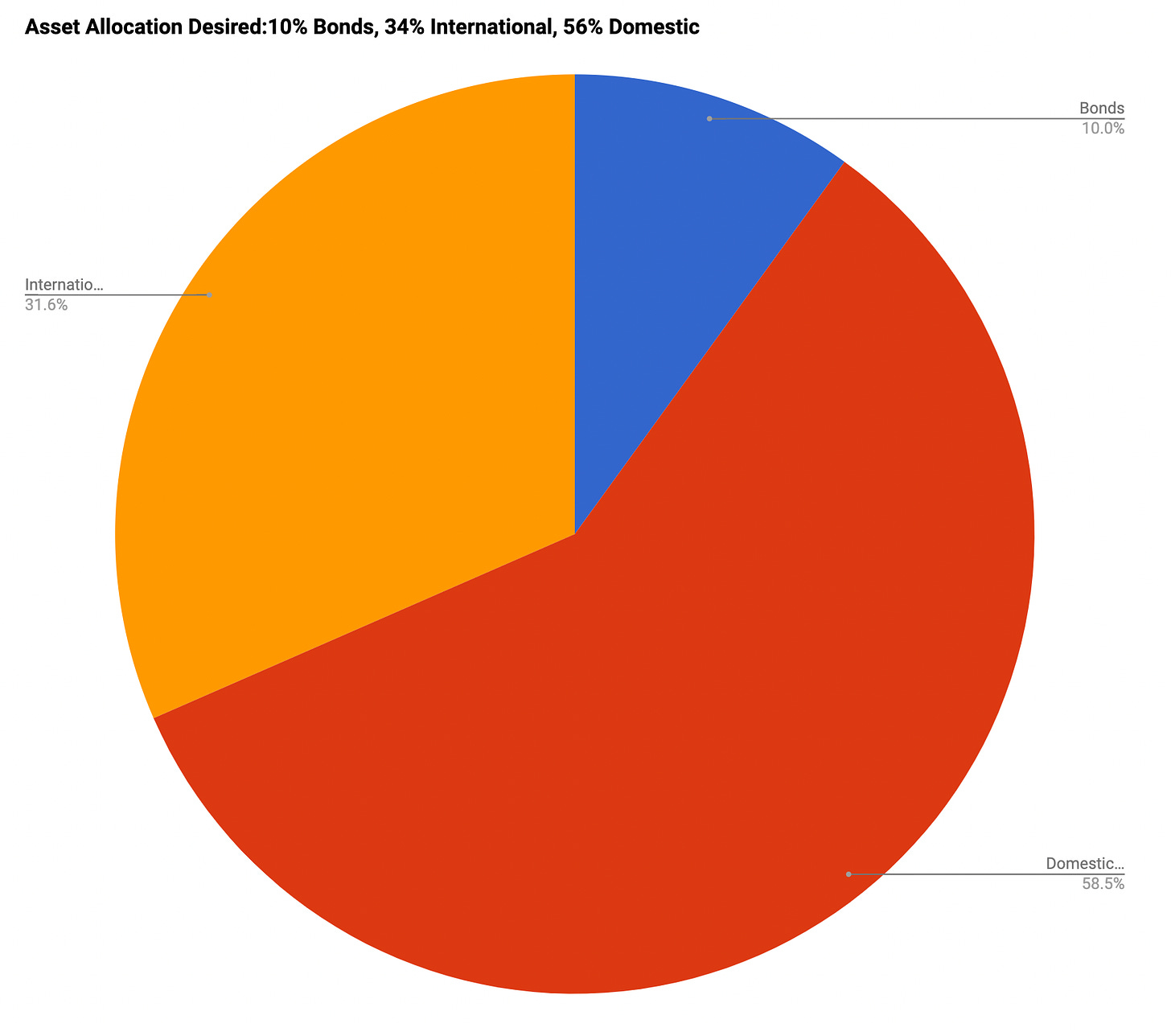

I have my 6 months of emergency fund primarily in cash just in case shit continues to hit the fan. I used the downturn in bonds to fix some inefficiencies I had in their asset location. Essentially I was holding my bonds in my taxable account and with the monthly payouts they are much better suited for my 401k. Manually doing some tax loss harvesting by swapping mutual funds/etfs, I sold some FXAIX and bought VTI (just two different total market funds). Each paycheck I continue to invest and work to keep my desired asset allocation in place with each new investment.

Just remember that “the market can remain irrational longer than you can stay solvent”, proceed cautiously and avoid trying to catch a falling knife. The next 10 years may not look like the past 10 years. However over long periods of time as the global economy grows the market overall marshes upwards. Individual companies may fail but in their wake new ones emerge. This is why I default into index funds and owning a piece of the entire market without chasing individual winners.

Good post. If someone’s equity compensation is now down 70%, would you recommend them jumping ship to another company?

Thanks Andre for the post. qq: can we do tax loss harvesting by selling FXAIX and buying VTI within 30 days?