Hoping you had a good labor day weekend. I am excited to share this week’s newsletter updating the current status of Jane, our hypothetical E3 who joined Meta back in May of 2021.

Jane Recap

As a recap; Jane wanted to start their career with a clear guide on reaching financial independence. Their total compensation and net worth projections were created through the rose tinted lenses of 2021.

This should also serve as a good partial reflection for real new-grads who joined mid-2021.

Jane’s Starting Stats:

Start Date: 5/3/2021

Starting Level: E3

Base Salary: $125,000

Starting Equity Grant: $180,000 (vesting quarterly over 4 years)

Bonus Level: 10% (additional multiples based on performance)

Job Location: San Francisco/Menlo Park, California

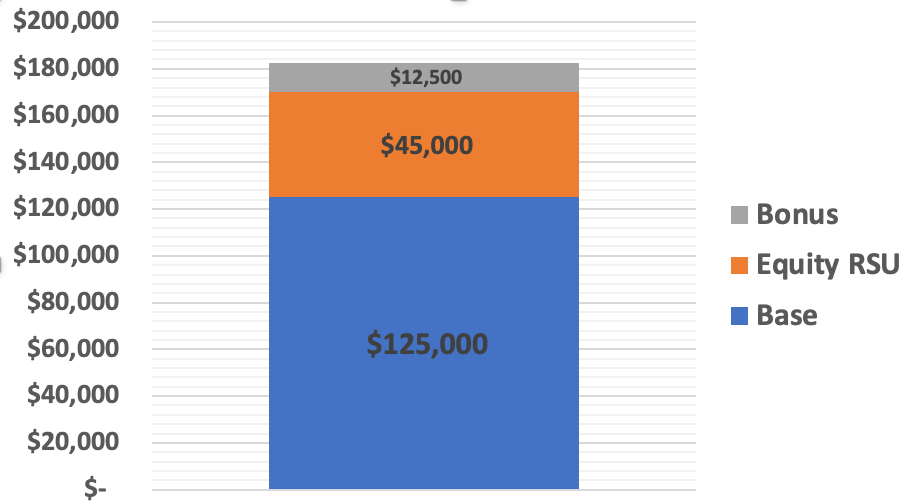

Blind Style Annualized TC or GTFO #: $182.5k1* (180000/4)+125000+(125000*.1)

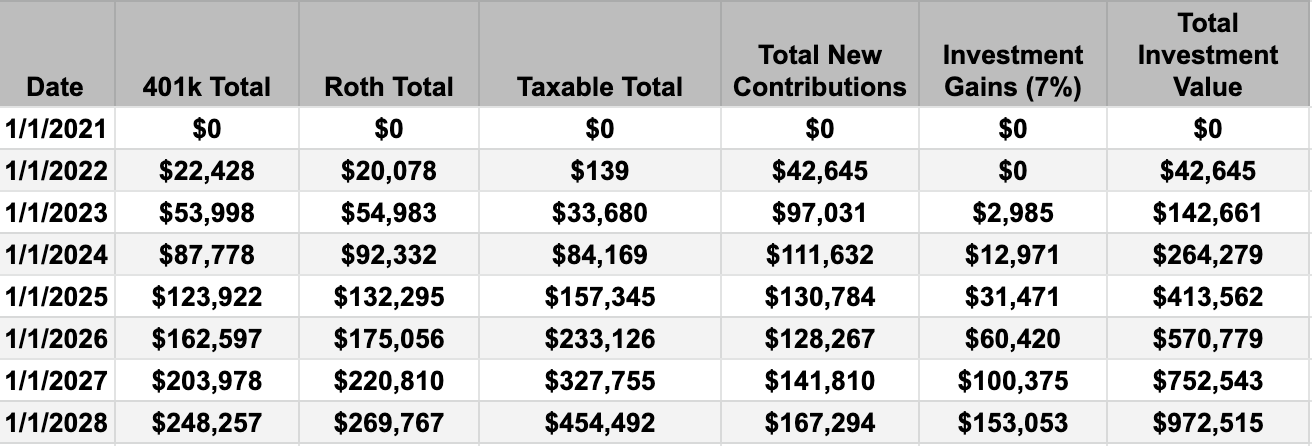

Original net worth and earnings projections for Jane.

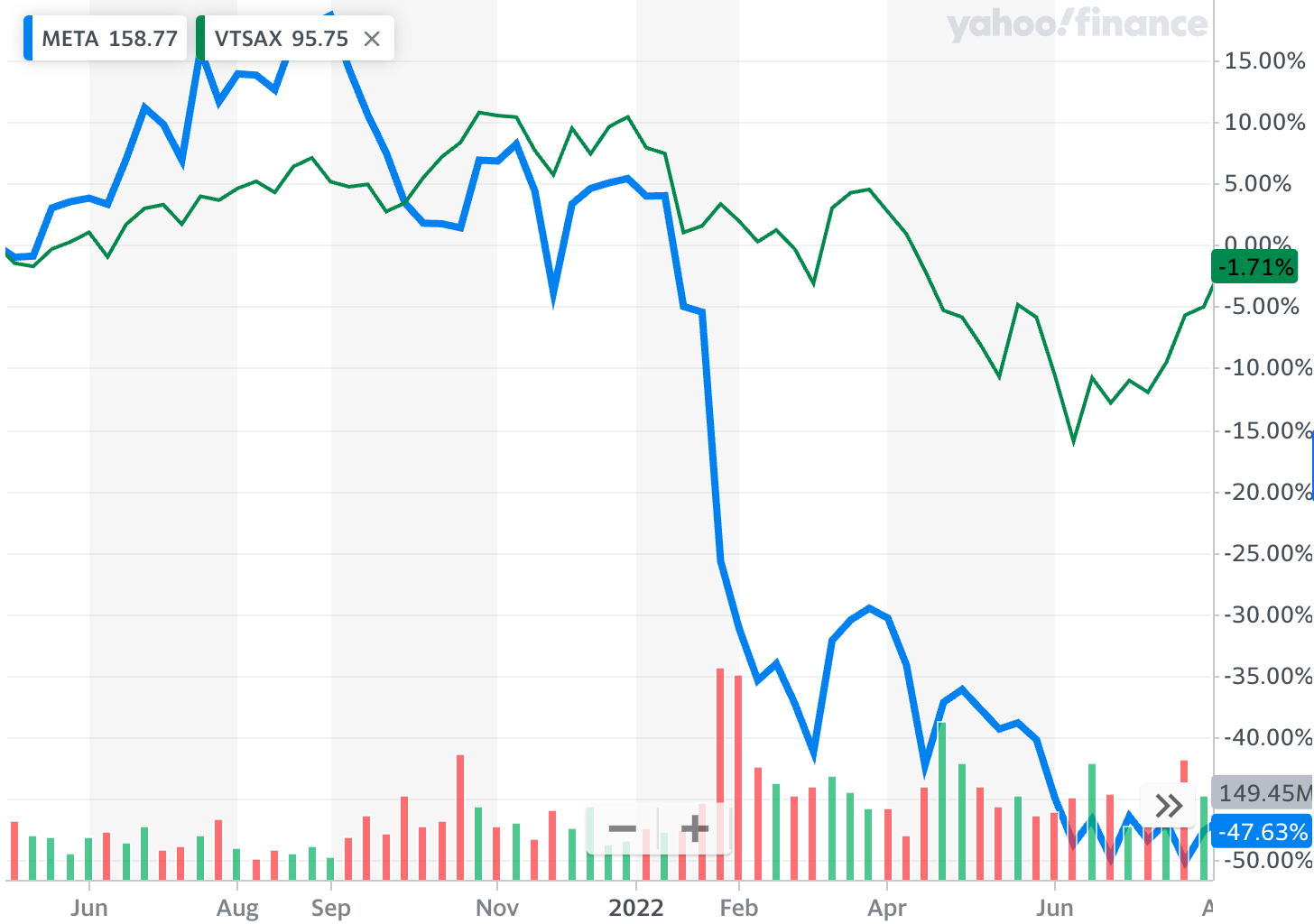

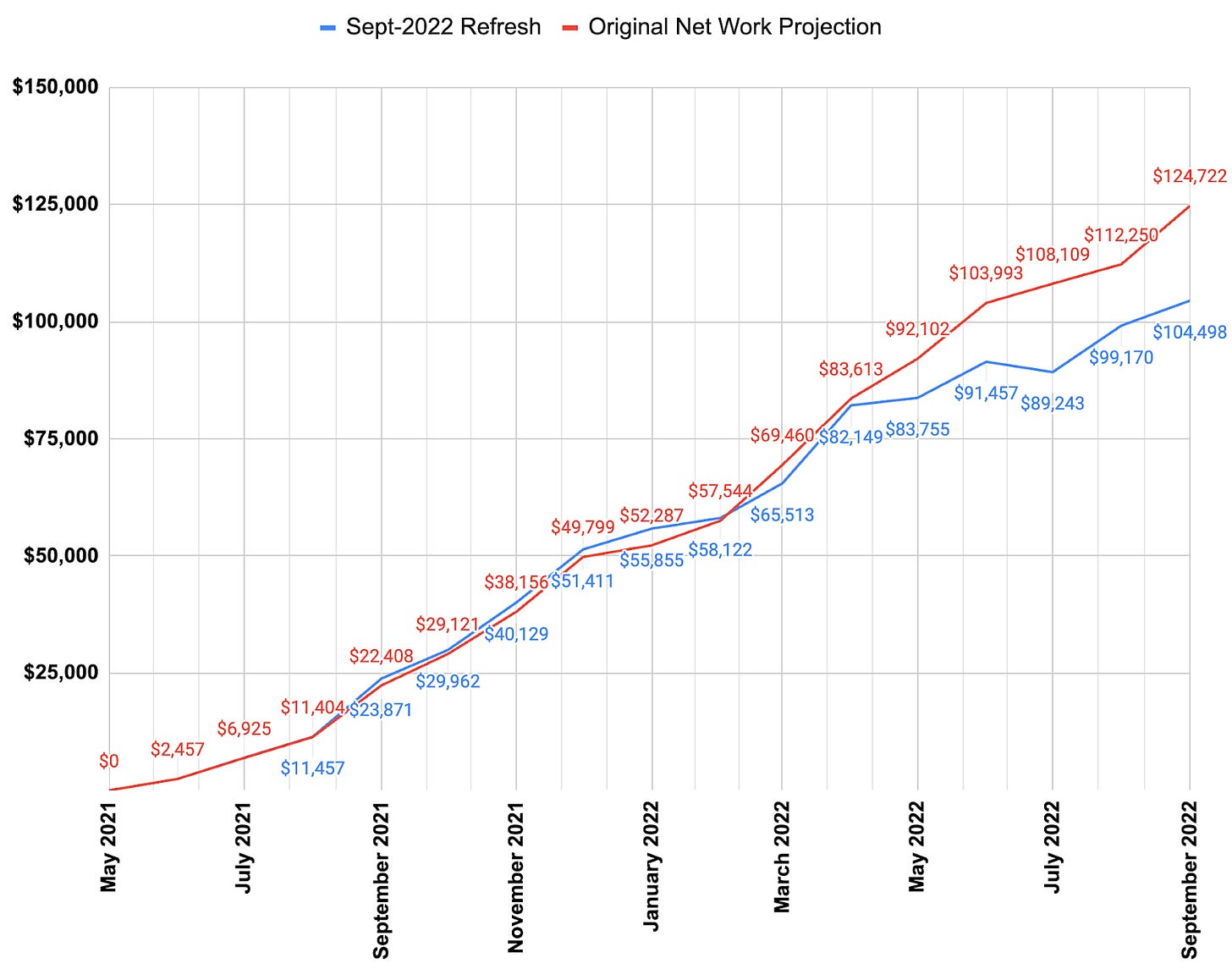

If you didn’t know, 2022 has been the year with drastic total compensation drops across tech. I had originally projected a smooth 7% increase per year for both the overall market and Meta stock. Unfortunately for both META and the overall market, reality has been much different. From Jane’s first day to today Meta is down 47% and the diversified total market index VTSAX also down -1.71%.

So how did this end up impacting Jane?

Over Jane’s current career, start date through September 1st Jane’s cumulative earnings were $9,593 lower (-4%) than originally projected. Their overall net-worth is lower than projected by $20,000 or -16%.

Cumulative earnings are from projected monthly paychecks calculated by adding base salary + bonus payouts + RSU vests (valued at date of vest).

A good reflection here is that this didn’t impact Jane’s lifestyle at all. They maintained the exact same budget. Over the course of Jane’s career this will very likely have only a marginal impact on their path to FIRE. If I were talking to Jane I would tell them “You are killing it! You crossed the first major net worth milestone of $100k! Don’t overly focus on the short term fluctuations. Make decisions based on what will be best in 5 years and not over optimize around the immediate short term.”

Want a deeper look into where this “Gap to Goal” came from? Of course you do. You are a subscriber to this newsletter after all.

Gap to Goal Analysis

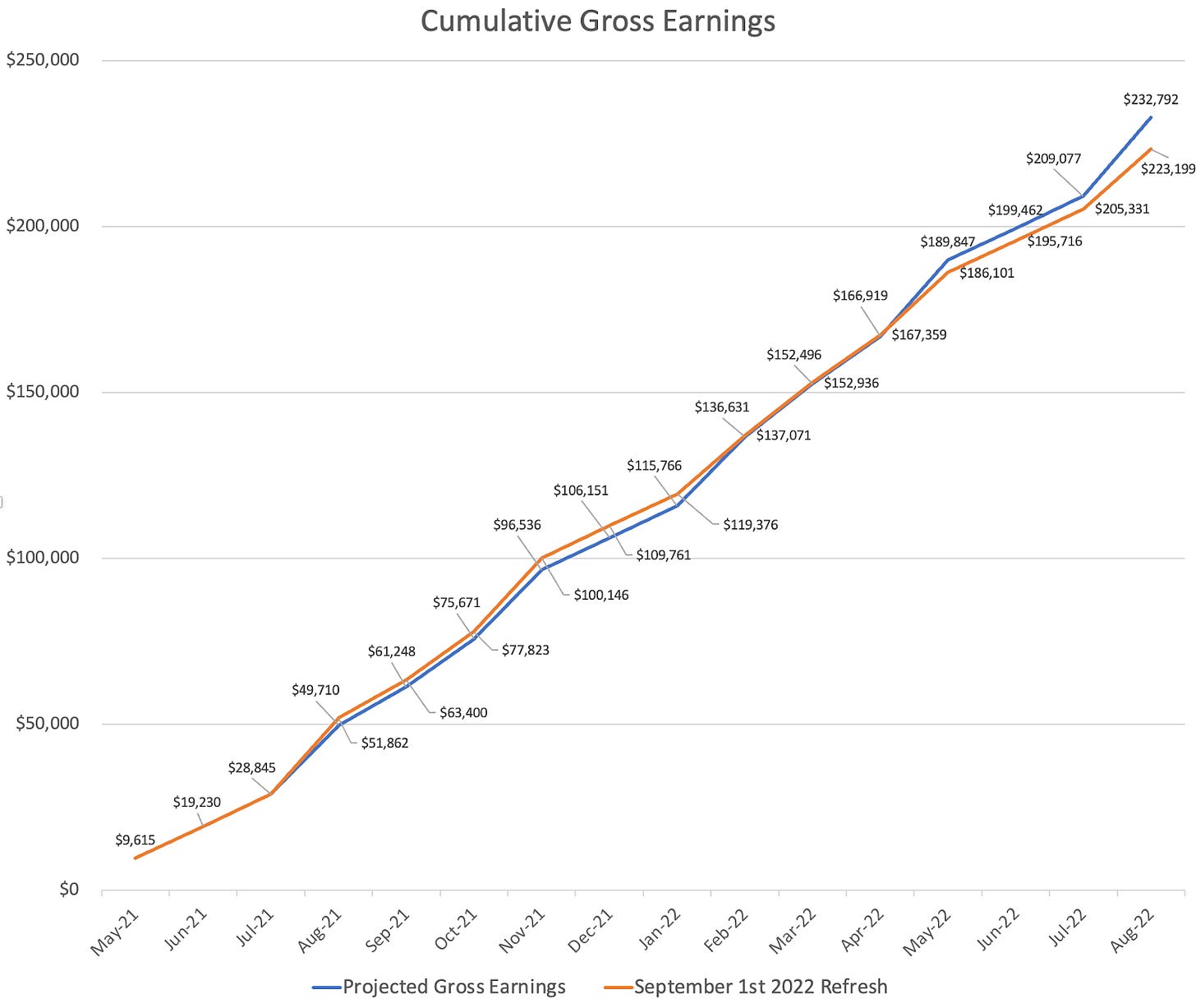

Cumulative Lifetime Earnings

In order to save money you have to first earn money. The first source of Jane’s gap in Net Worth and Earnings come from clear deviations in projected earnings beginning May 2022. As you can see from the monthly earnings overtime Jane was actually ahead of projections all the way until February 2022 where the gap becomes -$3,745. The gap widens again in August 2022 to the current -$9,593. As you can tell the changes in the gap seem to come in 3 month increments. What happens every 3 months? Jane’s Meta stock vests occur quarterly. From an earnings perspective the drop in value of Jane’s Equity fully explains the gap in Cumulative Gross earnings.

To dig further we first need to better understand how Jane’s Meta compensation works.

On Jane’s first day their 12 month total compensation was $182.5k ($125k base, $45k RSU, $12,500 Bonus).

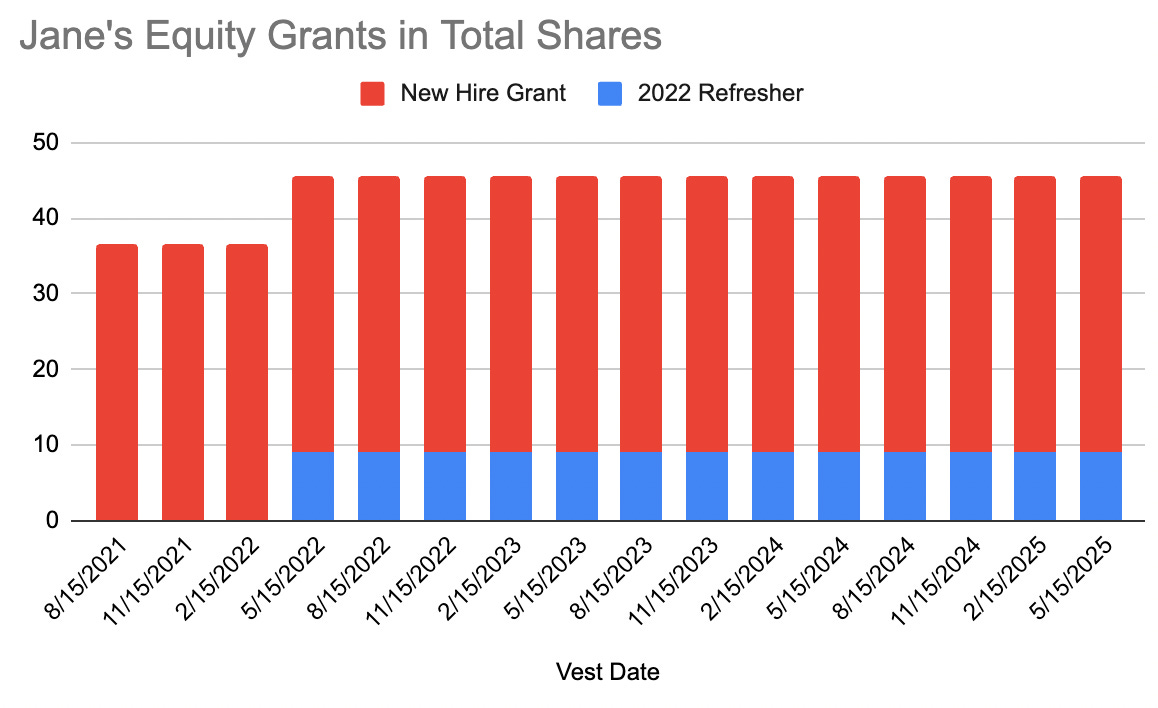

New Hire RSU Grant

Jane’s new hire equity grant was $180,000 which vests quarterly over 4 years. The equity grant is expressed in pure dollar values in Jane’s offer, and the number of shares that dollar value translates to is determined by the average price of FB (now META) shares the month before they joined; which in April 2021 was $307.75. Taking $180,000 divided by the average price in April $307.75 gives Jane 584.89 shares which gets rounded up to an even 585 shares.

New Hire Stock Grant Summary:

$180,000 Vesting over 4 Years (first vest is 8/15/21)

Becomes 858 shares based on the average stock price in April of 307.75

36.5625 shares will be deposited in Jane’s Schwab account quarterly (less taxes)

Annual Refresher

Once per year Meta employees receive stock refreshers. Jane received a $33,000 annual refresher grant in March 2022 based on their IC3 level and past performance ratings. The February 2022 average stock price of FB shares was $228.51. So Jane’s 2022 annual refresher will give them 144.41 additional shares vesting quarterly over 4 years, which rounds up to 145 shares.

2022 Stock Refresher Summary

$33,000 Vesting over 4 years (first vest 5/15/22)

Becomes 145 shares based on the average stock price in February of $228.51

9.0625 shares will be deposited in Jane’s Schwab account quarterly (less taxes)

Above gives us a visual representation of the number of shares of Meta Jane is vesting based on the two stock grants they have received thus far.

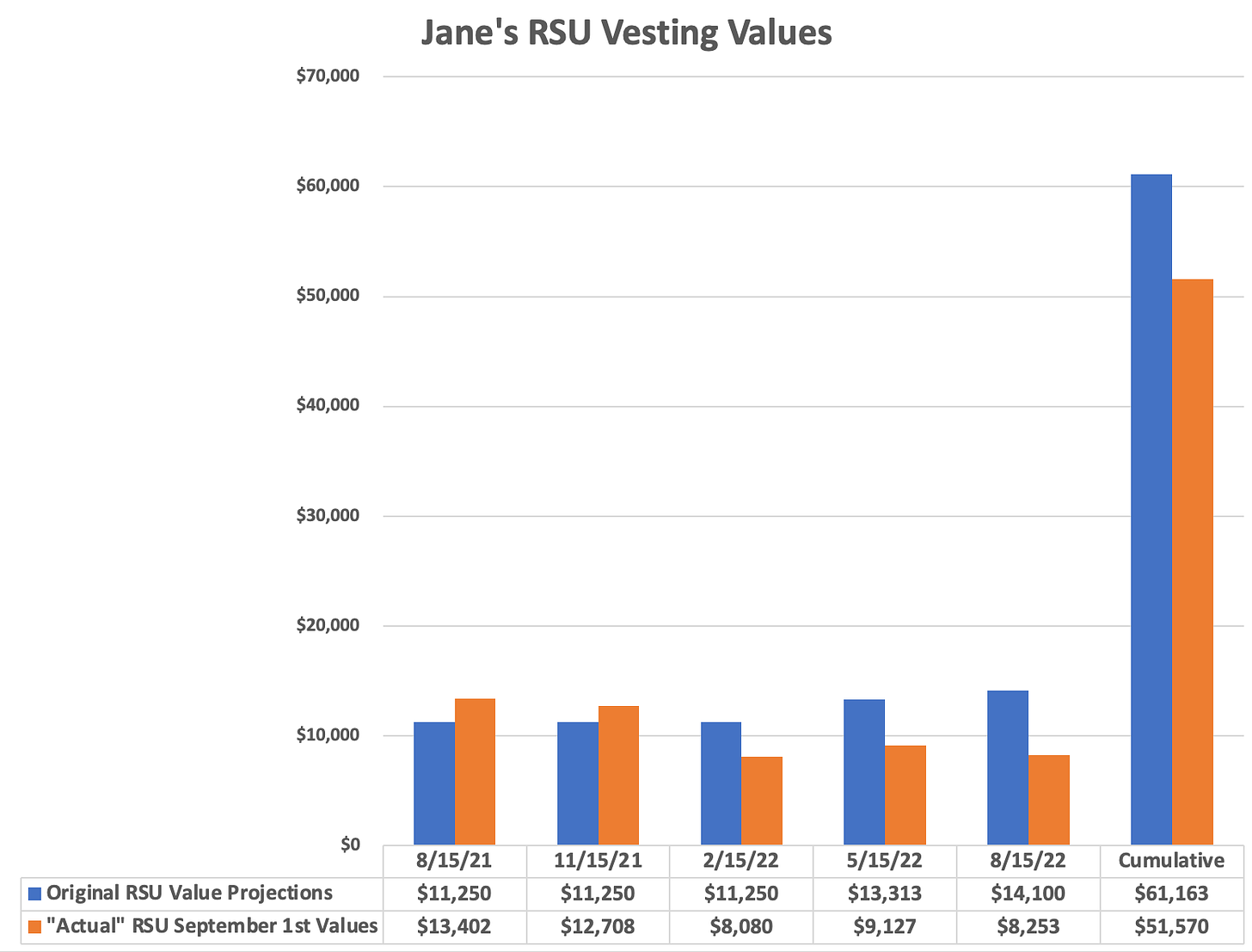

Projections vs Reality

In the original projections for Jane’s RSU value a very simple assumption was made. The value of each individual vest would grow 7% annually from the date it was originally granted. For simplicity this was only done annually (ie a February 2022 grant would be valued the same until February 2023 where all values from that grant will be appreciated by 7%).

Here is how those assumptions varied from reality:

This gives us the total delta in cumulative RSU value on vest (what would be used to calculate Jane’s Gross Income) to date of -$9,593.

Net Worth Delta

Now that we have explained the gap in cumulative earnings we can turn our attention to the gap in Jane’s net worth.

Jane doesn’t own any property so calculating their net worth = Checking + Emergency Fund + Investments

The two things that will impact the calculator are Contributions (the amount Jane is able to save/invest) and Market Returns (how the underlying value of the investments change).

Investment Contributions

Jane was originally projected to have contributed $111,537 to Investments (includes 401k match) through August 2022. $105,885 was what they ended up being able to Invest. This $5,652 decrease in contributions is entirely due to the RSU value drop explained in the previous section (with the delta from the original -$9,593 being due to taxes).

Market Returns

In the original projections we assumed a flat 7% annual return2. For the updated projections below I re-calculated it monthly (still 7% annual).

The “2022 September Refresh” by contrast takes the total invested amount each month and calculates exactly how many shares of VTSAX3 Jane could buy on the 1st of the following month. This is also reduced by the drop in how much Jane can contribute due to their RSU compensation drops.

(Ignoring dividends for simplicity. It should not make a difference over this short of a period, but if projecting over longer time frames I should go back and account for them).

As of September 1st Jane’s investment account sits $20k lighter than originally projected.

Net Worth Overtime

Decomposing Jane’s Gap in Net worth

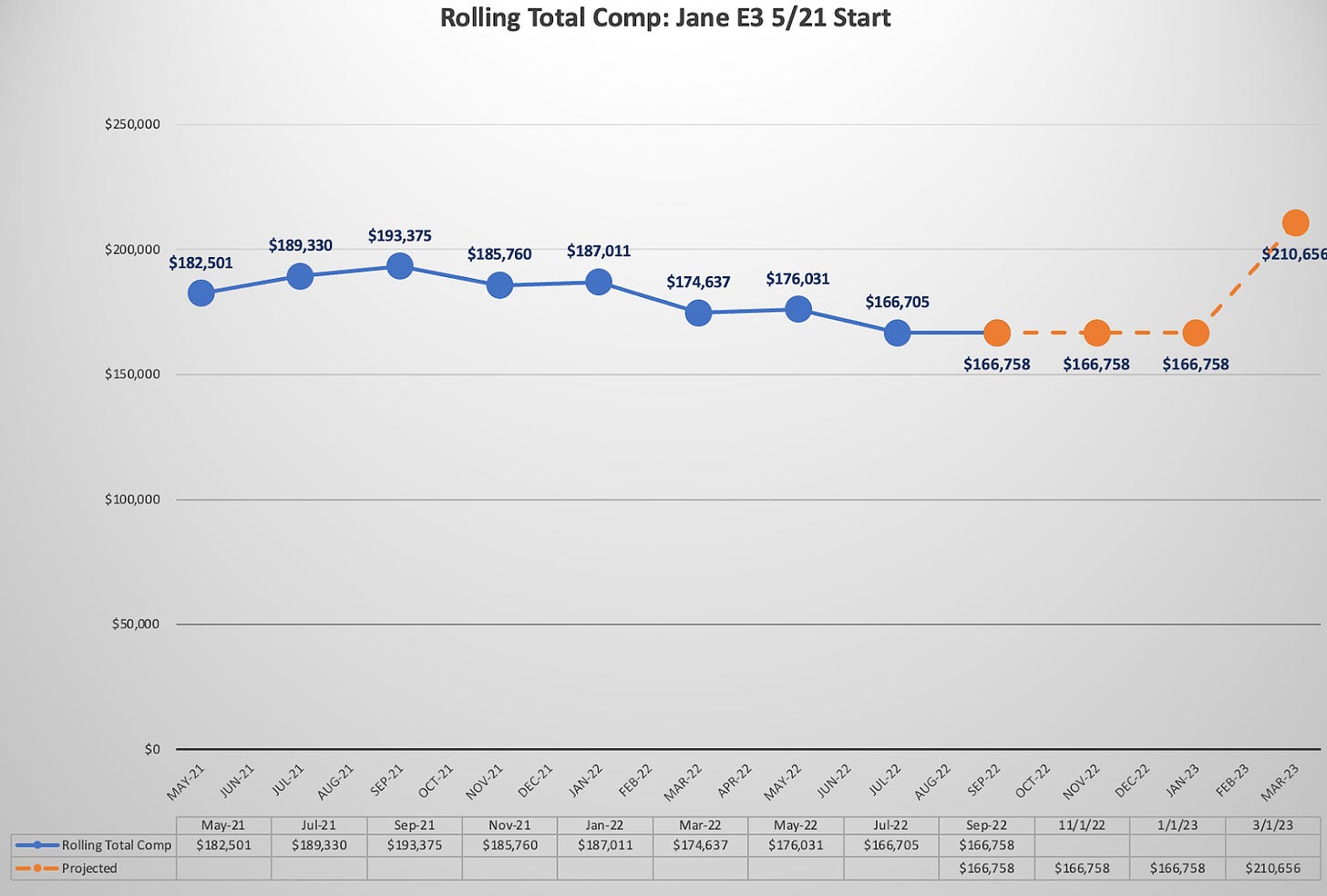

Total Compensation

Below I took a stab at charting out how Jane’s “true” Total Compensation changed overtime. This is looking at 12 month rolling total compensation, and doesn’t factor in future equity until it is given. I then projected it out into the future. In March Jane expects to be promoted from E3 to E4. At E4 Jane’s base jumps up from $125k -> $150k, bonus multiplier increases from 10% -> 20%, and an additional $37k 2023 annual stock grant (these increase to >$60k in 2024 and > $110k after a promo to E5).

How should Jane think about their Total compensation? How do you think about Total Comp? Do you adjust it on a rolling 12 month basis? Do you include projected new raises and grants?

In other news

Still feeling new to FIRE? Don’t know where to start? Check out “A Product Growth Approach to FIRE” and a look at how I calculate my “Enough” number.

I have also opened up a small number of 30 minute calendar spots you can book if you are looking for a more personalized 1:1 conversation. For my Meta coworkers, feel free to throw 30 minutes on my work calendar anytime.

September is one of the BEST months for Meta employees who want to amplify their savings and investments!

Here are the two things that make September special:

TRIPLE PAYCHECK MONTH!

We get paid bi-weekly which results in 26 pay periods in a typical year. This results in 2 months of 3 paychecks vs the typical 2. This is completely arbitrary, but mentally people are used to operating off 2 pay periods per month so the third often feels like extra. Take advantage of these mental modes to "trick" yourself into saving more.

BONUS ADVANCE

This September is also when we will receive an advance on annual bonuses.

Putting this all together means your September income will be >100% more than a typical month (varies by level, 102% for IC3, 128% IC5, 310% VP ).

If you can keep your spending at the levels of your typical month you can really amplify your savings. Great opportunity to increase your 401k % contributions (you can set bonus and paycheck %'s separately in the future), increase emergency funds, or increase your after tax investments.

Total Compensation calculation: Base + 1 Year RSU Vests + Bonus = 125000+(180000/4)+(125000*.1)

Quick note that the original projections only had annual returns calculated once per year.

VTSAX is Vanguards Total Stock Market Index, an excellent low fee mutual fund that is often recommended for those pursuing FIRE.