The Great Tech Salary Crash

2022 is bringing us one of the largest declines in tech compensation in decades

2022 is the year where Tech Compensation drops for the first time in decades. You hear non-stop about the rising costs associated with inflation, rents increasing ,and higher mortgage interest rates. But one thing I have seen missing from the dialog, particularly within tech, is the significant salary compression that is happening due to drops in equity valuations.

YTD Returns Across FAANG

Facebook: -50%

Apple: -17%

Amazon: -30%

Netflix: -68%

Google: -17%

A significant amount of total comp within the FAANGs is based on annual equity grants in addition to a new hire grant you are given when you first join. While it varies by company, typically overtime equity compensation will comprise a greater and greater percent of your total compensation.

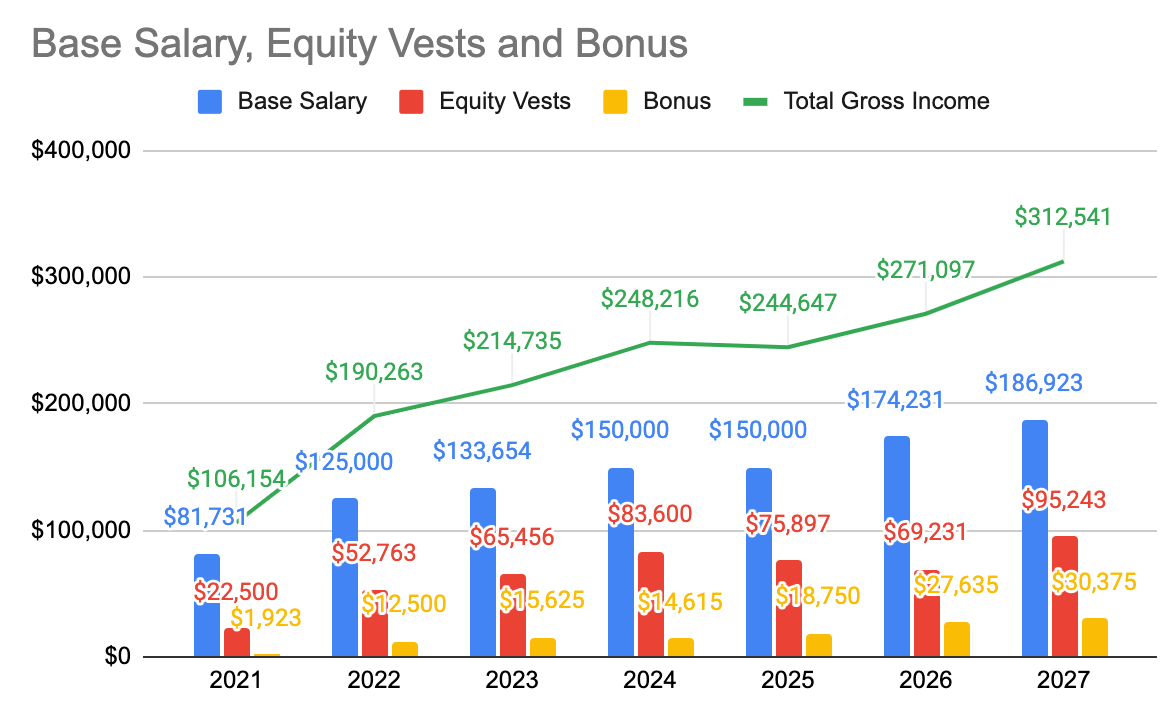

You can look back at the expected salary overtime from the hypothetical new grad engineer on their path to fire series. There you can see that for a new grad software engineer 23% of their TC in their first year might be from equity while in the 7th year that is up to 42%.

These numbers were calculated projecting a fixed 7% annual increase in META stock values. If I were to update the above numbers with current equity valuation, the 2022 equity vest portion would be down to $26,000. That is 50% lower!

So we have seen so far in 2022 that stocks don’t only go up. Not only do they not only go up but they can very quickly drop.

Impact to Total Comp

This varies across FAANGs, as well as by role (ENG >DS), and level (more senior = higher % of comp from equity).

This is how the Great 2022 Tech Salary Compression is shaking out so far. This quadrant chart has Year to Date stock performance on the x-axis and change in salary on the Y axis (2021 vs estimated 2022 full year). Each logo represents a specific person at that company who shared their data point with me.

As you can see, every company is on the left side of the graph (ie all negative Year to Date stock performance) but each individual data point is at varying points along the Total Comp dimensions.

Quick High Level Details

Shopify: Tough Spot w/ Big YTD drops in stock performance without any company driven adjustments

Netflix: Paying Straight Cash limits volatility year to year

Poshmark: Company gave second retention focused refresher in addition to shifting new refreshers to vest over 2 years vs 4 years

Uber: Refreshers designed to keep people at specific target comp. Secondary refresher which vests over 2 years vs usual 4.

Microsoft: Fiscal year ends in August, which means refreshers will be based on current stock price. Refreshers designed to keep people at specific target comp with the CEO committing to raising the bands 25%.

Meta: Multiple data points. Most ~ -15% - -20% with an outlier in very positive territory. The positive TC highlights a major trend we saw mid-pandemic when only the FAANGs were still hiring. Leading to an influx of new hires who saw large increases in TC (although still compressed based on where equity was at offer)

Amazon: Major outlier with a top performer being rewarded. Amazon is known for being more frugal with their equity but they also know how to retain high performers.

The Meta Double Squeeze

I wanted to go into a little more detail on Meta since I can personally expand on my own experience.

Causes of Squeeze: RSU Values, Bonus Payout Policy Changes

Meta faces a double squeeze in 2022. This year's annual refreshers were granted at a price of $228.51. The annual refresher is based on a formula that varies based on role, level, and country. The refreshers are expressed as a fixed dollar amount at grant and the number of shares will be based on that dollar amount. Ie for 2022 if you received a $100,000 refresher your actual grant would be ~437 META shares vesting in tranches of ~27 shares each quarter over the next 4 years beginning in May . With META currently trading at $167.85 that $100,000 pool of shares is now worth $73,450. A rather swift 26.5% drop in this year's grant alone, 2021 refreshers were based on a $264.81 stock price.

The second squeeze is based on changes to bonus payouts. This is more of a temporary squeeze but something that will be felt in 2022 nonetheless. The change has to do with META switching from 6 month performance cycles to annual performance cycles. So instead of bonuses being paid out 2x per year, beginning in 2023 they will only be paid out once per year. 2022 is a transition year where we do not have performance reviews but the company is still paying out an estimated portion of your bonus to ease everyone into the change going forward. So for the upcoming bonus in August, each META employee will only receive 80% of their bonus. The remaining being paid out during the new official annual performance cycle in March 2023.

Closing Thoughts

All in I am estimating that my YoY annual compensation for 2022 to be 17% lower than in 2021 while my partner is seeing a slight increase. So go ahead and pull out the world's tiniest violin for me.

This year provides an excellent gut check for anyone who joined the job market anytime after 2010. Things don’t always go up and to the right. Massive drops don’t always rebound within a month (like they did in 2020). It can still get worse, I encourage you to be prepared. Make sure you know what to do in a tech bear market.

I also encourage everyone to calculate these numbers for themselves. Understanding your compensation is really valuable. I pulled my own numbers based on my last paycheck of 2021 as well as my last paycheck in June and projecting my salary, calculating my bonus, estimating my remaining stock vests. If you need help doing this, reply to my newsletter and I will personally walk you through the calculations.

Looking for 1:1 FIRE coaching?

Partner with me to identify your FIRE goals and create an action plan on how to achieve it. Over the course of 4 sessions we will outline your personal goals, how to make a plan to reach those goals, create a 2 year projection of your income and savings personalized for you.

Hi Andre, I need help calculating and projecting my salary.

insightful, thanks