New Grad FAANG Engineer's Path to FIRE Year 3 and Beyond

Part 4 of following a new grads career on the path towards financial independence

Welcome to Part 4 of our fictional FAANG engineer’s path to FIRE.

This is the 4th and likely final post following “Jane”, our hypothetical first year software engineer working at Facebook, on their journey towards FIRE. If this is the first post you are reading, go ahead and start at Part 1 here. This post will be part summary and part years 3-6.

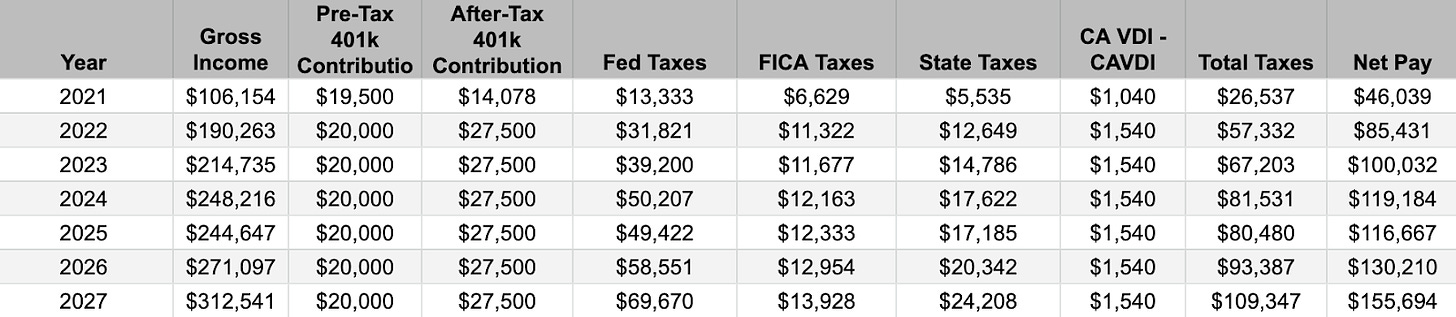

Total Compensation

Or for those coming in from Blind: TC or GTFO. This is the full breakdown of every dollar of base, bonus, and equity vest that FB would give Jane. Two promotions and 6 equity refreshers later Jane’s total Facebook compensation from May 2021-December 2027 is $1,650,579.

Column Definitions:

Starting Level: Jane’s level going into the year.

Ending Level: Jane’s level ending the year. Promotions can happen in March or September corresponding with Facebook’s review cycle1.

Promotions: Highlighted in Green. Jane went from E3->E4 on 9/1/2023 and then from E4->E5 3/1/2025. This lines up with the need for new engineers to progress from E3 -> E4 within 24 months and E4->E5 within 33 months.

Salary: Jane’s ending Salary for the year

Actual Salary: How much actual base salary Jane earned over the year.

Bonus Ratings: Historically Facebook has two rating cycles (being refreshed for 2022 down to 1 but guidelines have not been shared publicly yet). In Year 1 I went into all the details of facebook engineering levels, bonus structure/multiplies, ratings.

Actual Bonus: Jane’s total bonus earned that year.

New Stock Grants: Total new equity grant given to Jane. This happens once per year and is based on level, time in role, past ratings. They vest quarterly over 4 years without any cliffs.

Stock Vests: How much actual equity that Jane vests each calendar year. It includes a 7% annual stock value increase for Facebook on prior grants.

401k Match: For 2021 Facebook matched 50% of the first 3.5% of salary contributed. For 2022 forward Facebook’s 401k match is 100% up to 50% of the IRS individual contribution limit2.

Total Comp: Jane’s total realized compensation for that year. Actual Salary + Actual Bonus + Stock Vests + 401k Match

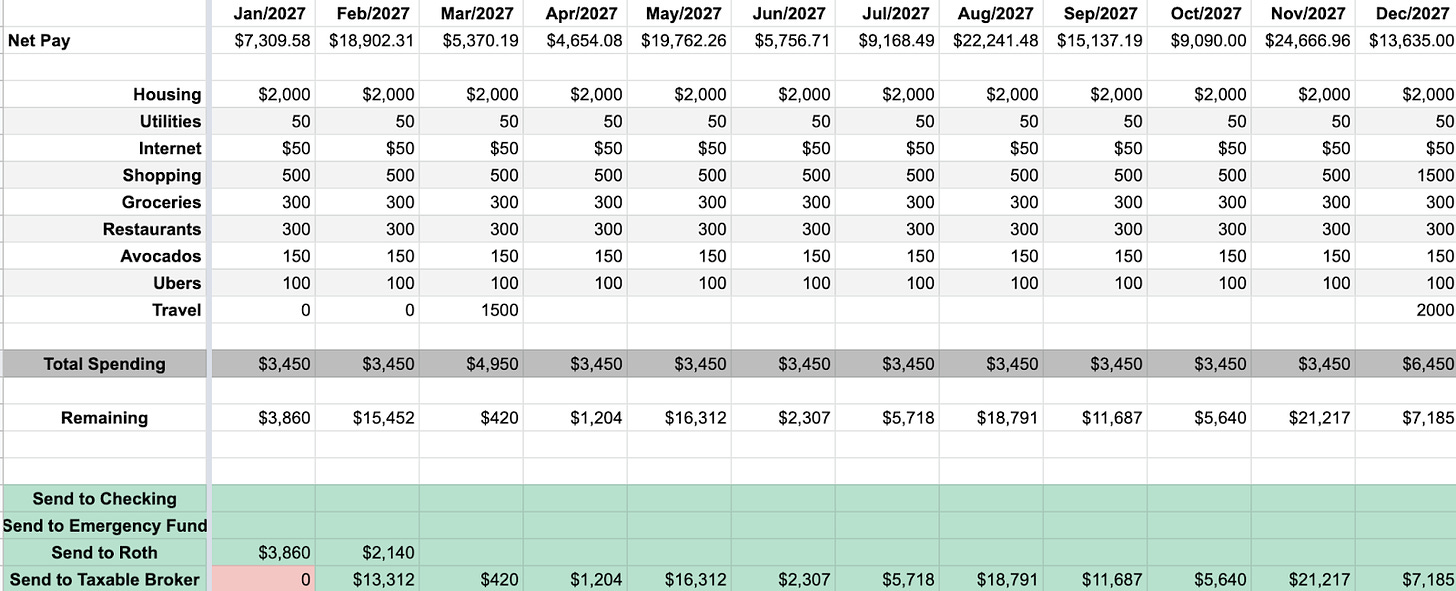

Total Take Home Pay

Next up we need to determine how cash will Jane actually see in her bank account each year. All direct retirement contributions and of course Federal and State Taxes. Jane worked in California which resulted in them paying out over $120,000 in CA specific taxes. If Jane really wants to take things even further they might explore working out of the Seattle office or going fully remote in a different state without income taxes3.

Gross Income: All base income, bonus income, and stock vests count towards Gross income and are subject to both federal and state taxes.

Net Pay: The amount of pay that Jane will actually receive in her paycheck each month. The one slight nuance here is that vesting stock will be taxed as income it will get deposited as actual Facebook shares in a separate brokerage (less 22% sold for federal supplemental tax withholding and 10.23% for state supplemental tax withholding). Jane sells immediately and puts the money and treats the money as part of her monthly pay.

Pre-Tax Contributions: 401k Contributions. I was guessing the limits would be raised to $20k but in reality they just raised them to $20,500!

After-Tax Contributions: This is the after tax contributions to employee retirement account with in plan roll over aka the mega backdoor roth.

Taxes: The rest are the usual federal and state taxes for California employees.

Traditional 401k and After-Tax Settings

In past years we made manual adjustments to Jane’s 401k contribution setting to ensure they had enough cash flow. By now Jane’s income has reached a level where they can set it and forget it.

Jane’s 2023 and beyond 401k Contribution Settings:

Pre-Tax: 15%

Pre-Tax Bonus: 75%

Roth: 0%

Roth Bonus: 0%

After-Tax: 30%

After-Tax Bonus: 75%

This will result in maxing out the full $20,0004 Pre-Tax 401k as well as after tax.

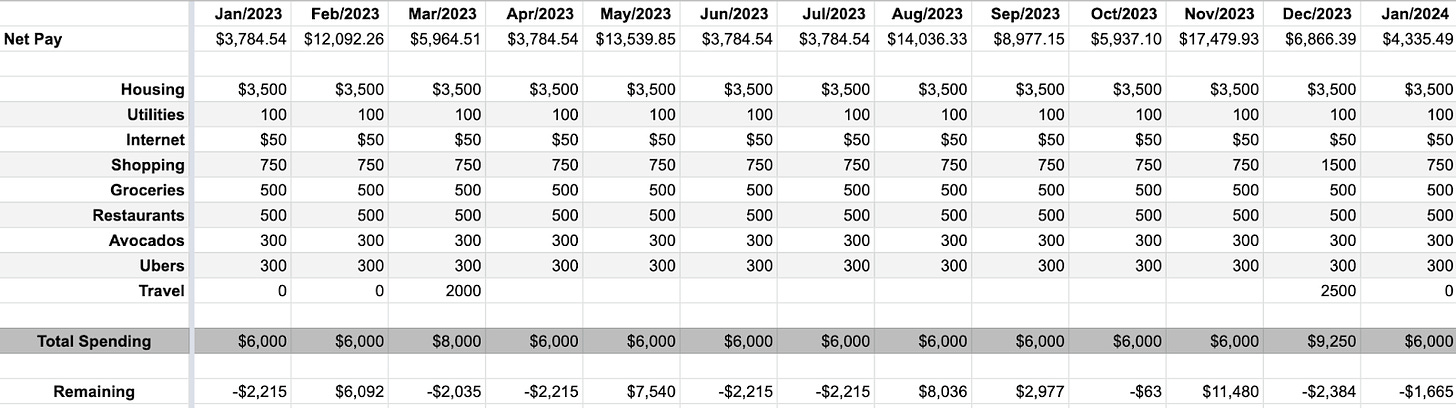

Budget & Expenses

Jane is going to rock the car-less roommate life through 2027. Perhaps they will get a partner during this time and move in together… essentially still a room mate but with better economies of scale (don’t normally share a bed with a roommate). Bonus point if this partner also happens to share Jane’s penchant for FIRE and holds a FAANG job.

Freezing annual expenses at year 2’s levels of $45,900 or $3,825 per month. Here is a sample of what 2027 might look like with that budget.

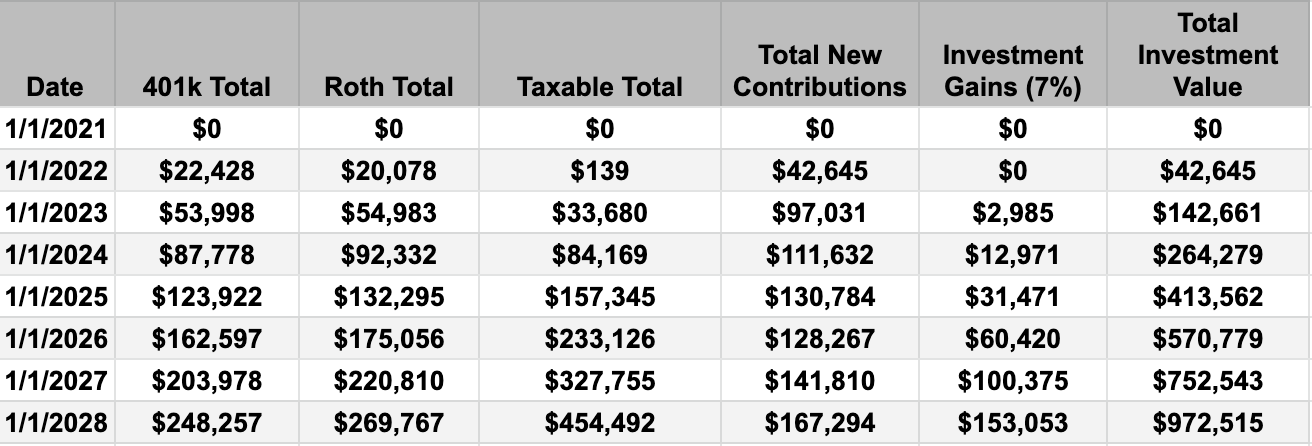

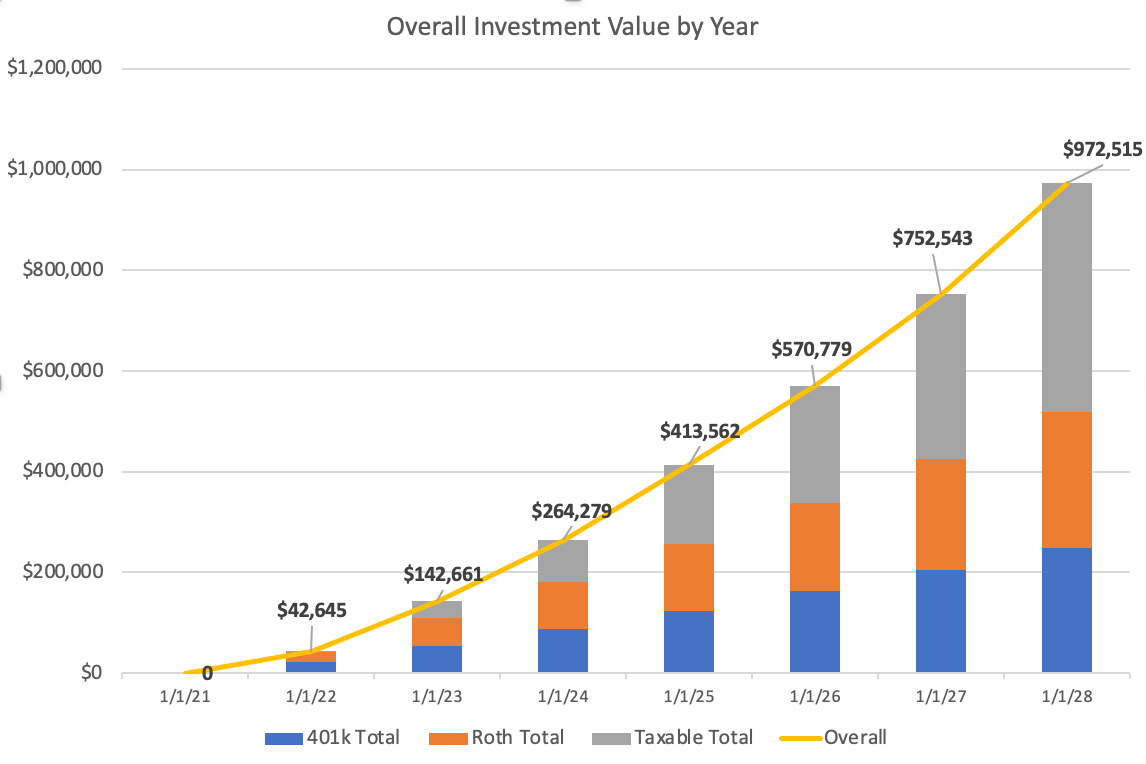

Net Worth Over Time

Jane ends 2027 with a $981,515 net worth. Here is the full accounting:

Breakdown of Investment Accounts

Higher Budget Scenario

So far the main criticism I have received is primarily around Jane’s budget. I’ll admit that it is on the tighter side but still feels completely doable. That said let’s say that Jane decides to increase their monthly budget. How will that impact the numbers?

Instead of Jane spending $45,900 per year, we will model out what $77,250 per year for 2023-2027 would yield. That is a nearly 70% increase in annual budget! They are swimming in avocados.

This will drastically cut down on the Jane’s ability to save in their taxable brokerage early on but they will still be able to do a phenomenal job building up their nest egg. The key thing will be whether they try and avoid seeing spending increase at this level each year.

Summary

Starting your career at a FAANG with a high pay engineering job right off the bat is setting you up to easily be able to save ridiculous amounts of money. You have the ability to be completely Financially Independent! Even if you don’t want to retire early, having nearly $1,000,000 before age 30 could put you completely in control.

Bonus Graphs:

In Jane’s first year 77% of her overall gross came from their base salary. In 2027 that is down to 58% and could be even lower if FB stock performs even better than the modeled 7%. This is why when you talk to current engineers at E5 levels that have been at the company for 5+ years their total compensation could be much higher, FB stock increased 191% over the past 5 years.

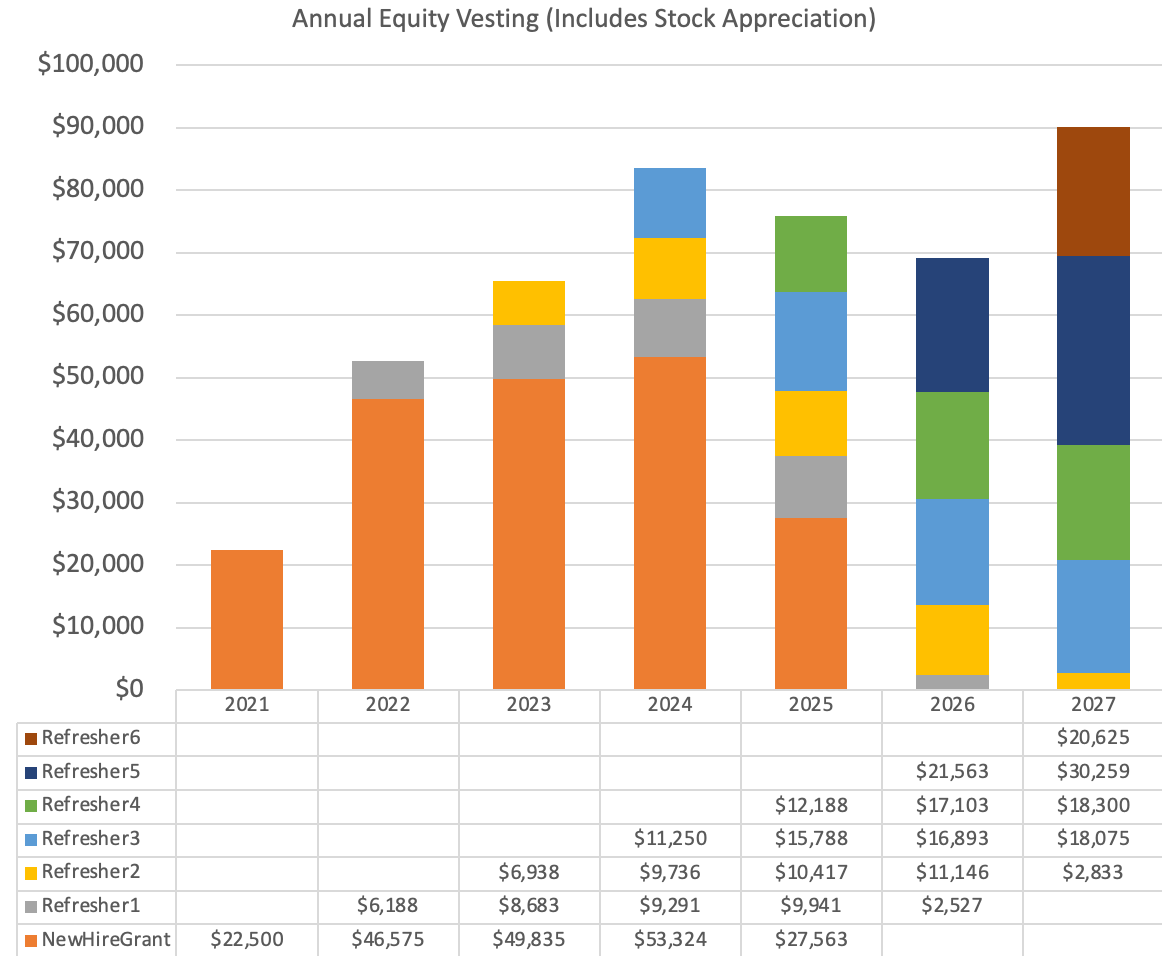

Vesting Equity Per Year

The 4 year cliff is real. Jane was able to over come it through receiving 2 promotions.

2021: $22,500

2022: $52,763

2023: $65,456

2024: $83,600

2025: $75,897

2026: $69,231

2027: $90,093

Starting in 2022 Facebook is moving to a once per year review cycle. It is still not public how this will impact bonus payments but it is public that promotions will still be possible twice per year.

I used $20,000 for the 2022 and beyond 401k limit. As of November 4th the IRS announced that for 2022 401k limits are increased to $20,500 making the FB match $10,250 vs $10,000. Small enough for me not to want to make all the changes!

Relocating does come with an adjustment to salary based on area cost of living as well as level. Looking at Levels.fyi Seattle base is ~5% lower with equity not being impacted.

See #2