Year 1 of The New Grad FAANG Engineer's Path to FIRE

The nitty gritty details on Jane's journey to FIRE

Welcome to part 2. If this is the first post you are reading, go ahead and start at Part 1 here.

*disclaimer: this is not investment advice. This is just for entertainment purposes. I am not an investment professional and you should do your own research or consult a fiduciary.

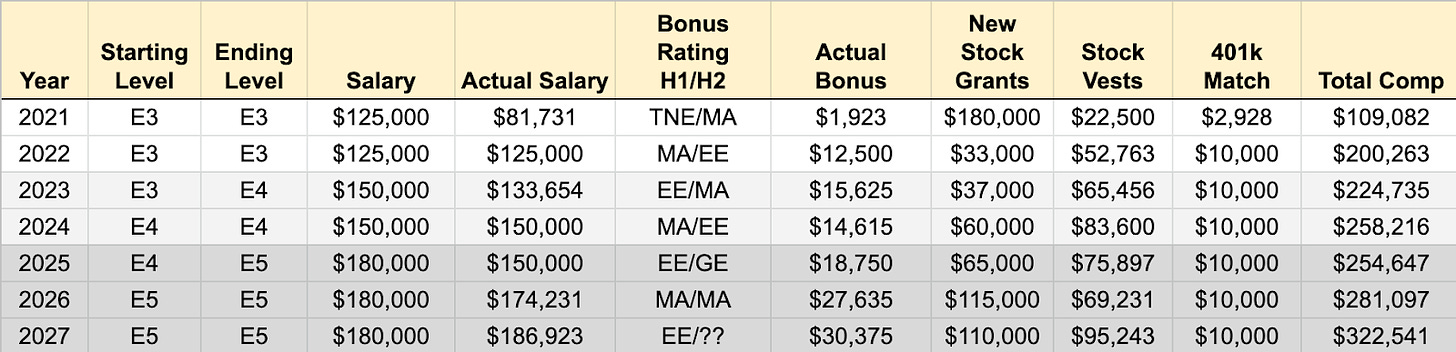

To quickly recap. I am showing how a new grad software engineer could set themselves up to FIRE. I projected 6+ years of Jane’s, our fictional FAANG engineer, career. Here is Jane’s total compensation projection. I am using May 1st 2021 - December 31st 2027, so 6 years 7 months and 30 days.

Total Compensation Projection

Quick explanation of some of these columns. For new and non Facebookers.

Levels

E3: Starting level for a new grad

E4: Mid-Career. Facebook requires that E3’s reach E4 within 24 months

E5: Senior Engineer. Facebook requires that E4’s reach E5 within 33 months. This is also the first level one can convert to the management track or remain an individual contributor. No requirement for additional raises beyond this point.

Bonus Level

Each engineering level above has a corresponding base bonus payout as a percentage of earned base salary.

E3: 10%

E4: 10%

E5: 15%

Bonus Multiplier

There are two multipliers on a typical Facebook bonus. An individual multiplier and a company multiplier. I am assuming the company multiplier is simply 1X (ie no change). The individual multiplier is based on the rating you receive for the half. Facebook pays out bonuses twice per year in February for the second half of the prior year and August for the first half of the current year (this may change in 2022 as they move to a single performance cycle).

Too New to Evaluate (TNE): For new hires that were at the company a short period of time they get a default “TNE” rating which equates to 100% of their level’s target.

Meets All Expectations (MA): 100% of your levels bonus

Exceeds Expectations (EE): 125% of your levels bonus

Greatly Exceeds Expectations (GE): 200% of your levels bonus

There are others for underperforming as well as redefining. The ratings projected should be roughly in-line with someone able to progress to an E5.

New Stock Grants

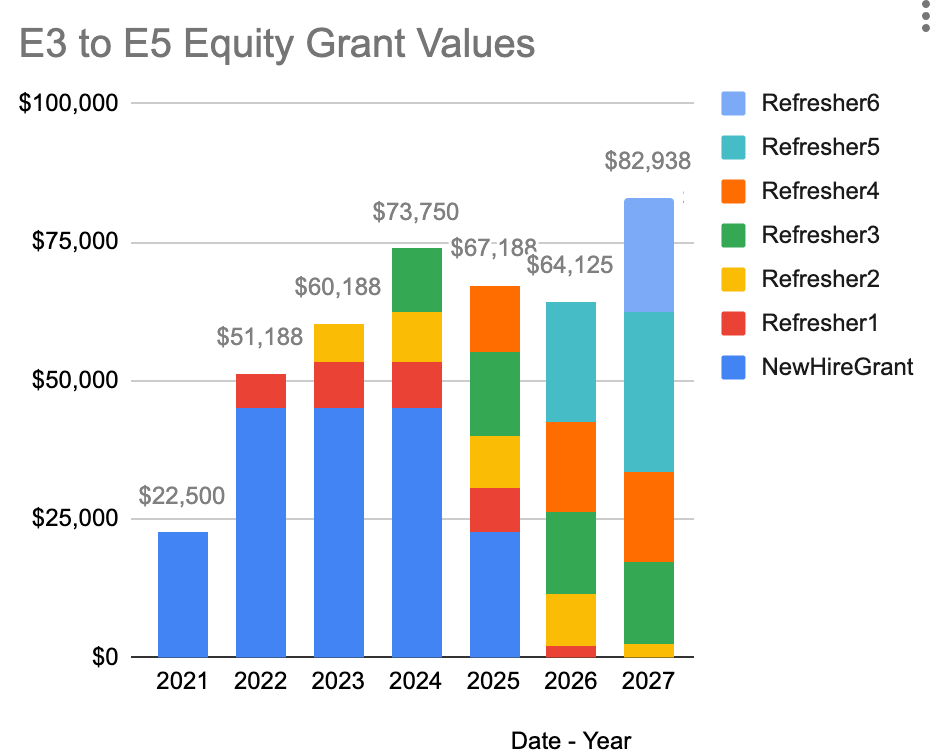

This is the stock based compensation given as part of your compensation package. Facebook gives FB stock which immediately starts vesting quarterly over 4 years. Jane, our new hire, was given $180,000 worth of FB stock as part of their new hire offer. So after 1 quarter $11,250 worth of FB will “vest”. The value is based on the price when the stock grant was given. Each year if Facebook stock increases in value the actual amount vested would increase. Additional grants are given each year and vary based on level and performance.

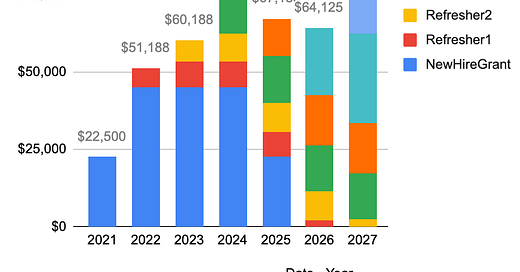

The initial new hire grant is typically much larger than each annual refresher. You can see this result in a drop off in total annual equity starting in 2025 in the graph below. This can become even more drastic when the underlying stock goes up in value during this time, resulting in large drops in total comp after an employee’s 4 years (very common time to job hop). In the case here it does rebound as they continue to get promoted and receive larger grants.

Visual of Equity Grants Over Time (Without Stock Appreciation)

Year 1

What should Jane do to set themselves up to FIRE? They have a big advantage beyond their total comp, they are fresh out of school and used to living off a student budget. By minimizing the number of large recurring expenses Jane will be able to invest significant amounts of their take home pay.

The initial savings priorities:

You need enough to cover immediate expenses

Build up 3 months of emergency fund between checking and savings account

Max Out 401k

Max out Roth IRA

Max After-Tax 401k Contributions with in-plan conversion to roth

Build up Taxable investments

Year 1 is a little more complicated than all future years. It involves some upfront expenses that are higher which require more cash flow, has a minimal bonus payment, and the need to build up an emergency fund from scratch.

401k Contributions:

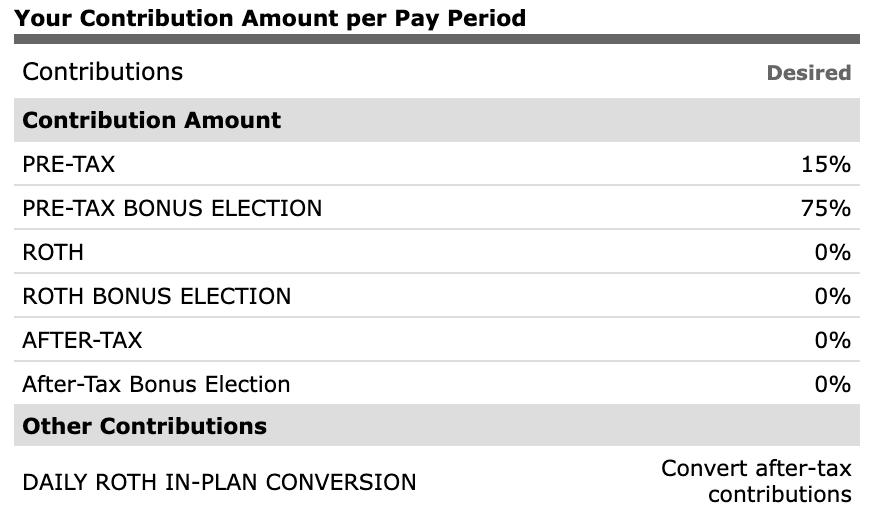

These contributions come directly from your paycheck. This is why we need to begin here since all changes to 401k contributions will impact our take home pay. Facebook allows you to contribute to a traditional 401k, a roth 401k, and an after-tax with automatic rollover (also nicknamed mega back-door roth). You can choose what % of your salary as well as what % of your bonus you want allocated to each of these.

Jane has her initial contributions set to:

Pre-Tax: 15%

Pre-Tax Bonus: 75%

Roth: 0%

Roth Bonus: 0%

After-Tax: 0%

After-Tax Bonus: 0%

Which looks like this:

These amounts will allow Jane to max out the $19,500 she can contribute. It also will leave them with enough money in their monthly budget to build up an emergency fund of $7,500.

Jane will return to this in August prior to their bonus payout in September to update things to:

Pre-Tax: 30%

Pre-Tax Bonus: 75%

Roth: 0%

Roth Bonus: 0%

After-Tax: 40%

After-Tax Bonus: 100%

Just before December paychecks Jane will update things one more time to get a bit more into their After-Tax.

Pre-Tax: 30%

Pre-Tax Bonus: 75%

Roth: 0%

Roth Bonus: 0%

After-Tax: 75%

After-Tax Bonus: 0%

401k Investments

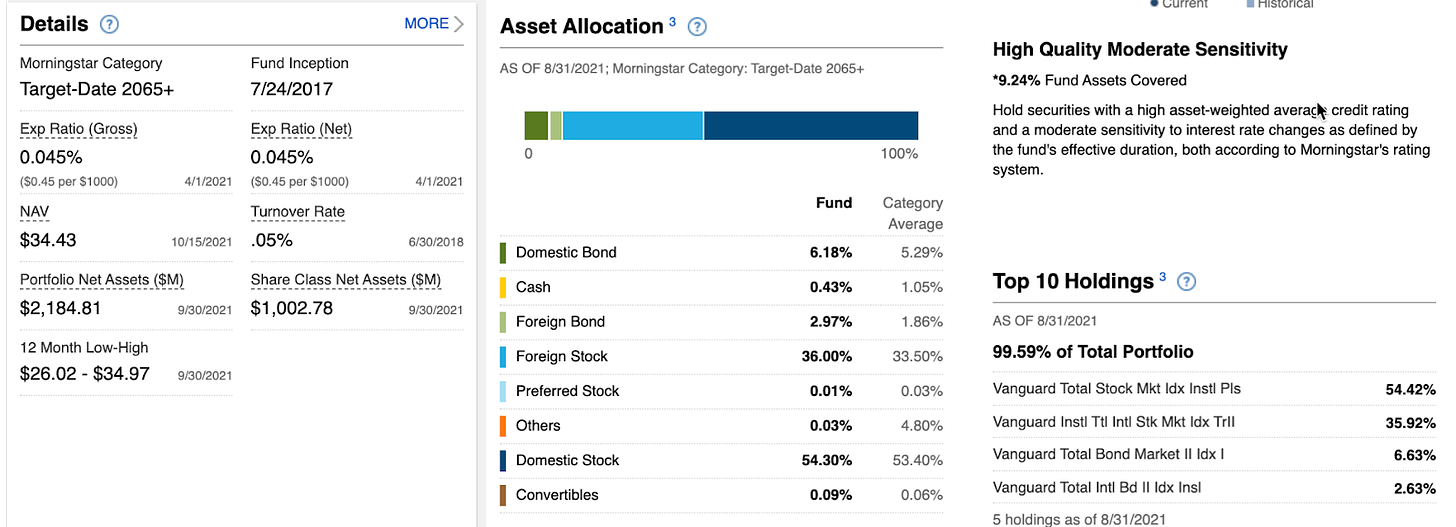

By default Facebook will set your investments for all your contributions to a good low-fee Vanguard target date retirement fund. You would be more than fine leaving this as is to start. Looking at the Vanguard 2065+ fund you can see the following:

Essentially this fund is holding 55% US stocks, 36% International stocks, 9% bonds. Over time it would slowly shift more away from US & International stocks into bonds. If you looked at the Vanguard 2040 target retirement fund you would see it holding 19% bonds. If you looked at the Vanguard 2025…. It would hold 42% bonds. These are great low fee options. Facebook also has some great low cost options from State Street so you could customize your own mix. Jane is a BogleHead at heart and keeps things simple and will revisit the options later on.

Note Facebook also offers something called Brokerage Link which allows you to access the rest of the market beyond the set list the plan offers. So if you wanted to YOLO it all in GameStop you theoretically could, please don’t, but you could.

Monthly Paychecks

Now that we have our 401k contributions set we can model out what our paychecks will look like. We needed to first look at 401k contributions because these come out directly from your paycheck before hitting your bank account. You don’t need to read this full spreadsheet. The Bolded/Highlighted “Net Pay” row signifies the amount which will land in Jane’s checking account. This is what we need to start budgeting.

There is some simplification here. While Stock Vest would be taxed as income (withheld at 22%), technically it wouldn’t be deposited into your bank account. It would land in your brokerage as Facebook Shares (less 22% which is automatically sold for taxes). I accounted for the taxes here and am making the assumption that all Facebook stock is sold right away at no additional gain/loss and deposited into your checking account along with the paychecks you receive in those months.

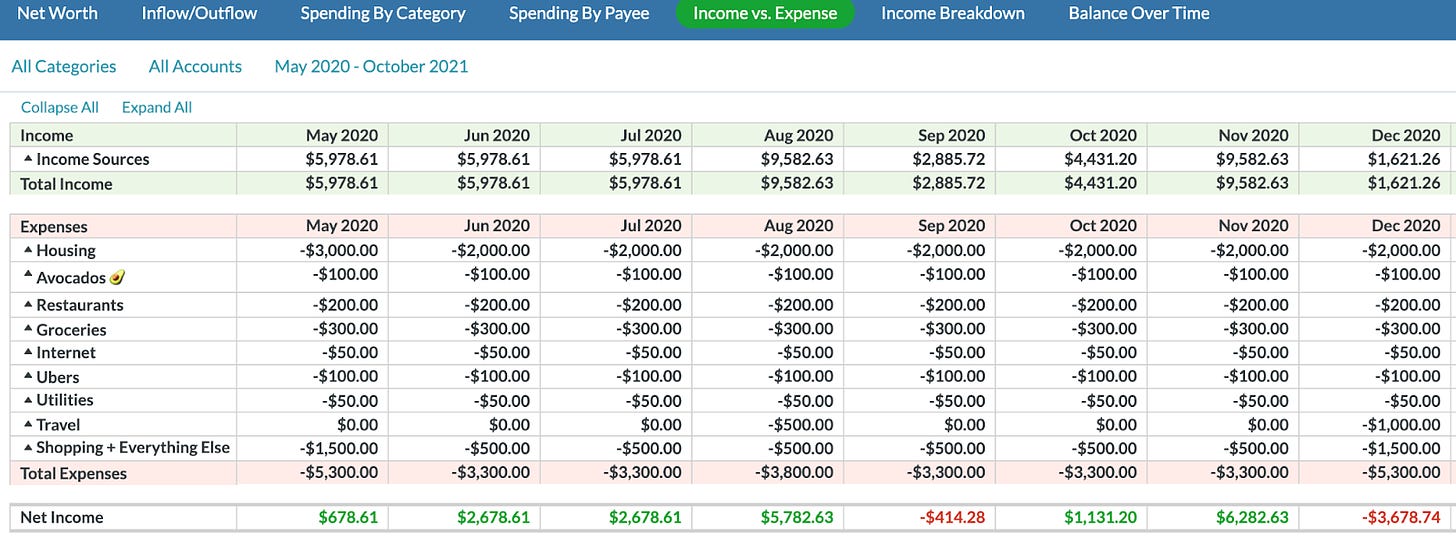

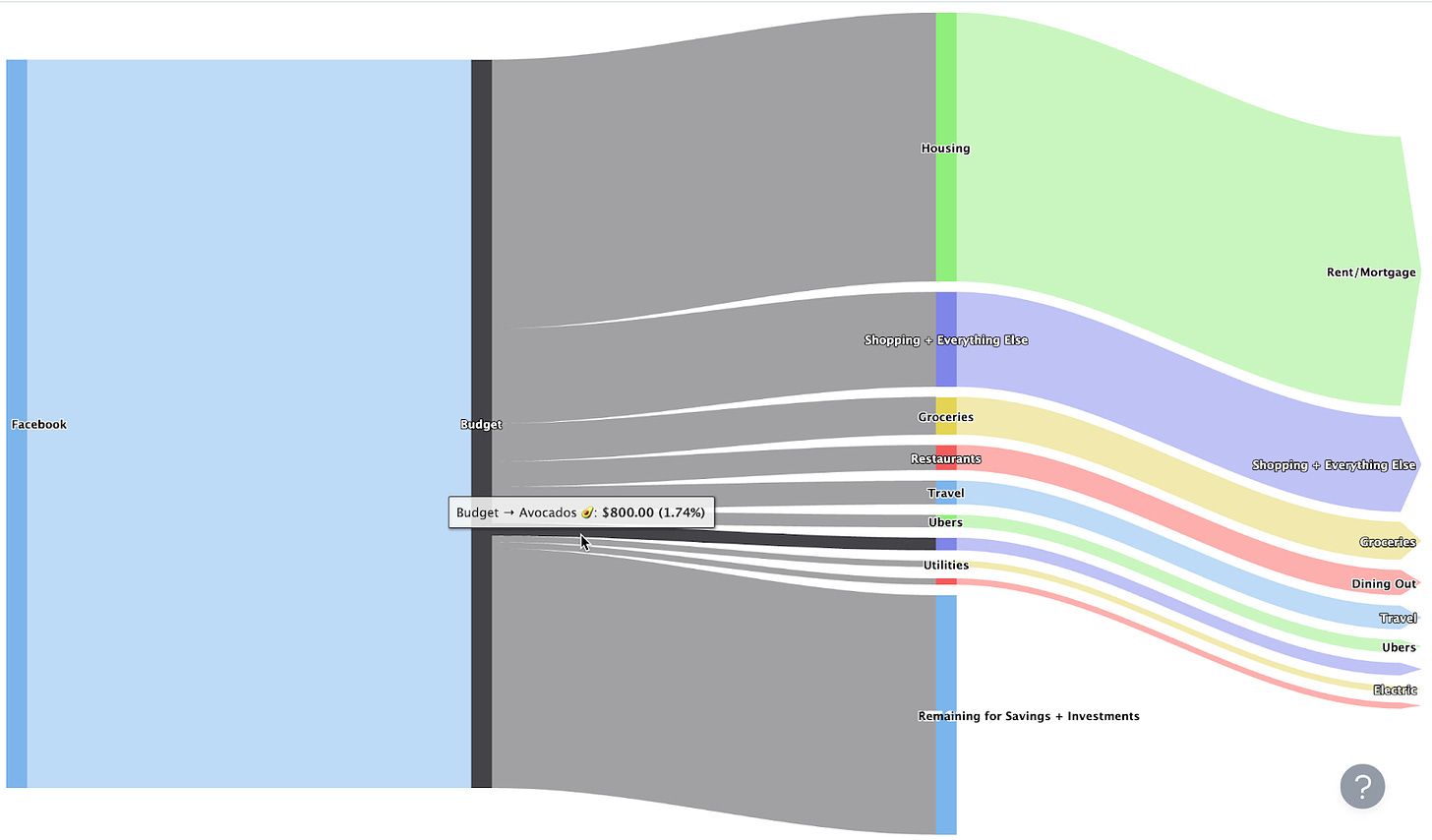

Budget

What I anticipate being the most contentious part of this. Jane is renting a room with a fellow co-worker (or 2) near the Facebook campus (or on the free shuttle route/caltrain/bus). Their rent is $2,000 per month and they split the costs of all utilities. They need to pay an additional $1,000 in May as a security deposit in addition to having larger “Shopping + Everything Else” costs to help furnish the place. Jane doesn’t own a car nor does she really need one since Facebook has free shuttles across the entire bay area. They are also able to save on food expenses if they really want to be frugal by eating breakfast/lunch/dinner at the multiple free cafes on the Facebook campus.

These screenshots are from Jane’s YouNeedABudget account. You can learn more on my approach to logging data in “A Product Growth Guide to Financial Independence”.

Total 2021 Expenses:

$30,900 with $17,000 (55%) being from rent costs alone, welcome to the Bay Area!

You might notice the “Net Income” row at the bottom. We are ending nearly every month with a bit of a surplus. Here is where that will be going:

The excess will flow in this order:

$1,500 minimum checking account balance (if there are larger planned expenses in future months Jane holds onto that in the Checking account)

$7,500 emergency fund (between this and the checking we have 3 months buffer savings for high priority expenses)

$6,000 roth ira. This will be the only year we can contribute directly to a Roth IRA since our income will be too high in future years.

Everything else will go to a taxable brokerage account (just a normal account at Fidelity/Schwab/Vanguard)

This brings us to the full annual summary!

Jane finishes off her first working year with a net worth of $51,645!