Your RSU Questions Answered

Over the past year I have hosted multiple free live Q&As to help answer your pressing RSU questions.

I thought it would be helpful to pull all the RSU specific questions from those sessions into a single post. There were 27 different questions!

If there are still questions or demand for future live Q&As let me know in the comments.

Disclaimer: I am not a tax or investment professional. Everyone has unique circumstances. Please do additional research and seek out the guidance of a professional. Please don’t sue me.

RSU Tax Planning Implications:

This section covers questions related to tax planning and implications around RSUs. It includes queries about tax rates, withholding, avoiding short-term gains, tax optimization strategies like harvesting, and when/how RSUs are taxed.

Question #1: What are the tax implications for RSUs?

Question #2: Are we taxed twice for RSUs? When we receive them, are taxes already removed? And if we sell them, are we taxed again?

Question #3: When do you have to pay taxes on vested RSUs?

Question #4: How many times are RSUs taxed (at vesting as salary, on that salary amount, when selling)? How to avoid paying so many times?

I’ll try to answer all of these questions at once!

RSUs are taxed as income when they vest. It is the exact same from a tax perspective as if your company gave you the value of your vesting shares as a cash bonus.

It doesn’t matter what the value of your RSUs were when they were originally given to you, all that matters is the price when they finally vest.

When you sell your RSUs, you may pay additional taxes on the gains.

Gain: If you sell your RSUs for a higher price than their value at vest, you pay taxes on the amount of the gain.

Often, if you sell right away, the gain will be very small, resulting in the taxes on the gains being minimal.

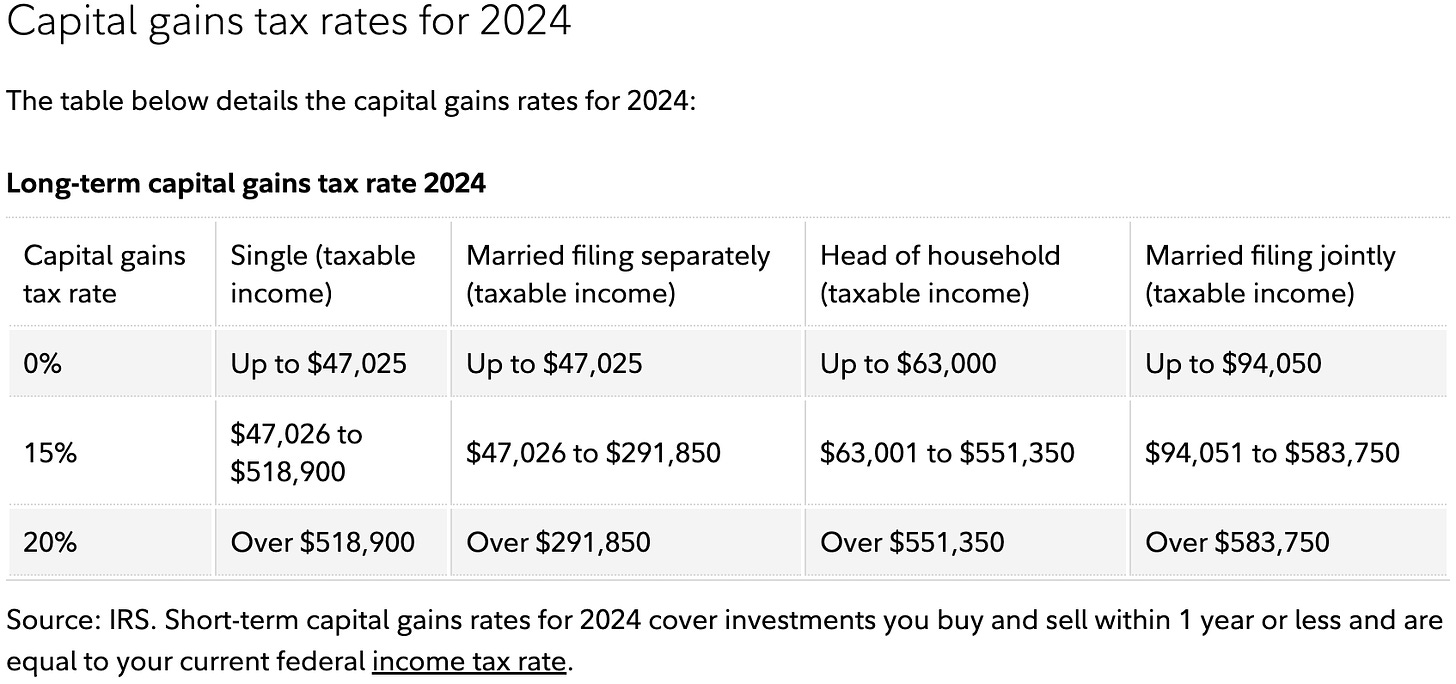

The amount of tax you pay on the gains depends on how long you have held the vested shares.

If you held your shares less than 1 year, they will be taxed just as if the amount of the gain was normal income. These are referred to as short term capital gains.

If you held the shares more than 1 year, they will be taxed at the long term capital gains tax rate. See the chart below for the different rates.

Note: The income thresholds above include all your taxable income. I have seen some people mistakenly calculate these independently (i.e. incorrectly thinking their $50k capital gains was in the $0 tax bracket while they also had over $500k in taxable income pushing them into the 15 and 20% brackets.

It is also possible for there to be a loss.

Loss: If you sell your RSUs for a lower price than their value at vest, you don’t pay any additional taxes on the loss. In fact, a loss can be used to offset other gains you have. If you have more losses than gains, you can even reduce your taxable income by up to $3,000 per year. If you have even more losses than that, they will carry forward into future years to offset future gains and income.

A succinct answer to the second question:

RSUs are taxed as income when they vest. When you sell, if there is a gain, you will pay capital gains tax only on the amount of the gain. If there are no gains, or a loss, you will not owe any taxes.

Question #5: How do I know which stocks/how many to sell in order to avoid short-term capital gains tax?

Question #6: How do you strategize taxes when selling RSUs with gains? How does tax harvesting work?

Question #7: Could you explain the "wash sale" rule? I work at Uber, so I'm familiar with our vesting schedule, ESPP, and blackout blocks.

Question #8 How do I decide whether to sell my first RSU vest or last RSU vest?

If you have multiple vests you have not sold, it is important to understand the tax considerations when you go to sell. Don’t let taxes keep you in an unoptimized position, but factor in taxes into the equation.

Helpful links:

Question #9: I'd like to understand default tax withholding on RSU options and how to estimate additional payments required when selling at vest.

Question #10: When I sell vested RSUs on the same day, does the employer automatically withhold taxes?

Question #11: The standard federal withholding is 22% unless changed to up to 37%. How come, if I maintain 22%, do I not see 78% of vested shares hit my account but it ends up being closer to 64% of the total vested amount. Can you ELI5? State withholding?

Question 12: What are strategies for selling/keeping RSUs and tax optimization?

RSUs are referred to by the IRS as “Supplemental Wages”. The default federal withholding on RSUs is 22% unless you earn more than $1,000,000 then it increases to 37%.

A withholding of 22% is simply not enough for anyone earning more than $95,375 while single or $190,750 is married and filing jointly.

The 22% above only refers to the Federal tax withholdings. You still have State Tax (10.23% supplemental rate in CA) in addition to Medicare (and potentially Social Security & CA VDI depending on if you hit the cap yet). This is why those in California often owe federal taxes but receive a refund on state taxes.

One helpful tip to better understand your withholdings is to find the paystub that includes your RSU vest (for Meta employees, this will appear as a $0 paycheck in Workday).

Selling Strategy:

Questions in this category focus on strategies for selling RSU shares - when to sell, how much to sell, whether to dollar cost average sales, analyzing cost basis, and selling specifically for life events like buying a home.

Question #13: If my main goal is to buy a home in the next 1-2 years, does it make sense to sell my RSUs and put the money in a savings account?

Question #14: When saving for a big purchase like a house, when should I sell RSUs?

I treat RSU income just like any other income. It isn’t any different than if you were to receive a cash bonus. If I had short-term spending goals (ie buying a house) I would be sure that the funds I needed for those goals were not invested in a way that would experience large changes in value. This means that if I had short term goals (<3 years) I would probably hold the funds in a high yield savings account, CDs, or treasuries that have little to no risk.

Question #15: What RSU selling strategy should I use for figuring out cost basis when trying to target a 10% portfolio allocation?

If you have any RSU lots with losses I would start with those in addition to targeting your newly vested shares. If you have significant gains, then things get a little trickier.

I would reference these articles:

Question #16: If planning to sell RSUs and the share price plummets, is it better to DCA between vests or sell all at once?

This often becomes emotional. You have FOMO because the stock previously was higher than it currently is or it was given to you at a higher initial grant. I would try to remove the emotion from the decision as much as possible. Identify your goal asset allocation and then find the most tax efficient way of getting there.

Question #17: Is it better to hold RSUs long-term considering a FAANG's future growth?

It really depends on your goals and risk tolerance. Rationally, you shouldn’t treat your RSU vests any different than a cash bonus. If you are not using your cash bonus to purchase more company shares, ask yourself why the RSU vests are different?

If the company does well, you will still be rewarded by your future vests. If the company does well it also likely means the overall US economy is doing well so your other, more diversified investments, will also continue to grow.

Diversification:

These questions explore ways to diversify holdings and reduce concentration in employer stock, including leveraging 105b plans and equity diversification platforms.

Question #18: For someone with a disproportionate percentage of FAANG RSUs, do you have suggestions on how to approach diversification?

Question #19: If diversifying, what percentage to hold vs sell?

If you have more than 5% of your net worth in a single company stock I would view that as a concentrated position. If it is >10%, it is a highly concentrated position. You may have benefited greatly from this concentration. However, having all your eggs in a single company can lead to drastic and sometimes catastrophic outcomes. You are winning the income game! You very likely can hit your goals without taking as much unnecessary risk.

Posts on the topic:

Question #20: How do 105b plans work, and how can I think about equity in terms of portfolio diversification and platforms to manage RSUs?

Rule 10B5-1 trading plans are a way to be able to sell your company stock outside of the trading windows. They were originally designed for executives who hold insider information at all times to be able to come up with pre-set rules ahead of time which would allow them to sell their shares. Now they are becoming more common and available more broadly. Setting them up can vary by employer as well as third parties who offer this as a service (candor.co being one).

Company Specifics:

This bucket covers company-specific queries, such as cashout timing for certain stocks like Meta and dealing with wash sale rules or vesting schedules at particular employers.

Question #21: When should I cash out my Meta (Facebook) stocks? Should I do this for a car purchase?

I personally sold nearly every single vest as soon as I received it. More than 30 Meta vests in total. Each time I asked myself whether I would buy more Meta stock if I received the amount of my vest in cash, and each time I answered “No, I wouldn’t buy more stock”. Fighting my emotions, I tried to be rational each vest. I would then use the funds from the sale to buy low fee index funds that matched my asset allocation.

If I had short term goals, like buying a car, I would hold the necessary funds in a much more liquid way. Likely in a high yield savings account, but never invested.

Question #22: Could you explain the "wash sale" rule? I work at Uber, so I'm familiar with our vesting schedule, ESPP, and blackout blocks.

I previously touched on how wash sales work in “Dealing with Wash Sales”. That said, it is worth going into more detail here for the Uber example.

Recall that a Wash Sale occurs when you sell a stock for a loss and then buy or sell the same stock within 30 days (before or after). One suggestion I had in the linked article was to sell your upcoming vest in addition to the shares that had a loss to undo the wash sale and allow you to claim the loss.

It gets tricky at Uber. This is due to the monthly vesting schedule as well as an ESPP purchase that occurs twice per year. This means that there is rarely a 30 day period when you can sell for a loss and not trigger a wash sale from the new vest. You can sell the new vests, but the next vest or ESPP sale can trigger another wash sale! It is a fun daisy chain of wash sales that can be hard to get out of. I have not come up with a great solution that consistently works. Even with auto-sell on vest, it can still be an issue. Let me know if you found a good way here. With Uber’s stock increasing recently (although off its highs) it hadn’t been as much of an issue.

Process and Logistics:

Process and logistics questions range from using finance tracking tools, transferring shares between brokerages, understanding the share acceptance process, to state tax implications when moving.

Question #23: How can we leverage RSUs to get into real estate?

RSU vests are considered income. You can use the proceeds from selling the vested shares however you would like. Since your question mentions the word ‘leverage’, I am guessing you are wondering how to use the funds without selling the underlying RSUs. In many cases you would be able to take a loan out against your shares (a pledged asset loan) that would allow you to buy a home without selling the underlying shares.

It is important to note that many companies prevent you from doing this with the company stock while you are employed there. You will also want to pay careful attention to the terms for when the company will auto-sell your shares to cover the loan if the stock drops suddenly.

Question #24: Do we need to "accept" stocks or options every time they are issued to get credited, or is it an auto-credit process?

I believe you do. I am not really sure why you need to physically accept each new grant, but it is a good idea to regularly log in to make sure you do! I never wanted to risk seeing what would happen if I didn’t.

Question #25 How does California tax RSUs when you leave the state?

The California Franchise Tax Board (think of this as the IRS for California) will want every single dime that can be tied back to when you lived and worked in the sunshine state.

You will no longer pay any additional state income tax on your base pay and bonus going forward; however, California will still want a piece your future equity vests.

For more details check out this post on the topic:

Question #26 How do I sell my shares and then transfer them with no fee to Fidelity?

If you sell your shares, you will end up with cash in your brokerage account. You should be able to simply transfer the funds to your Fidelity account without any fees if using a normal bank to bank transfer.

If you are running into a fee, you may be wiring the funds or transferring the shares themselves prior to selling (ACAT).

Pre-IPO:

A niche section addressing the distinct scenario of RSUs at pre-IPO companies and how the tax treatment may differ.

Question #27 What if your RSUs are in a pre-IPO company? 2) When/how are you taxed (at vest or sale)? How does income tax bracket factor in?

Almost everything I write is in reference to RSU vests at public companies. Private company and pre-IPO company vests can vary differently. I would find someone familiar with your specific company’s vesting terms.

I do have experience with my partner’s pre-IPO Uber RSUs. They were referred to as double trigger RSUs. As the name implies, it required two different triggers for the shares to be taxed. The first trigger is the traditional vesting schedule, the second trigger is a liquidity event or the IPO in Uber’s case.

Looking for more RSU content? Be sure to check out the FAANG RSU Vesting Resources page.

I appreciate everyone asking questions in the live RSU-specific Q&As I held in Q1. If there are still questions or demand for future live Q&As, let me know in the comments!