As the end of the year approaches, it seems like everyone is looking for ways to feel better about the losses sitting in their investment accounts. One strategy that has gained some mainstream popularity is tax loss harvesting. In today’s newsletter I'll explain what tax loss harvesting is, how I personally approach it, and why I believe the benefits are often exaggerated.

This post is getting into the weeds of what can be a complex topic. I am sharing my personal approach that works for my own situation. Consult a tax professional or financial planner who can give you personalized advice taking into account the specifics of your unique financial situation.

What is tax loss harvesting?

Very simply, tax loss harvesting is when you sell a stock at a loss in a taxable account for the purposes of reducing your taxes.

How Does tax loss harvesting reduce your taxes?

Tax loss harvesting can reduce your taxes by using your stock losses to first offset your stock gains as well as reduce your overall taxable income. If you are like me, you will have considerable amounts of loss potential this year. If your realized losses are more than your gains the losses begin to reduce your income, but there is a limit. Tax loss harvesting can only reduce your income by $3,000. Any losses beyond that are carried over into the next year.

Reduction in Ordinary Income

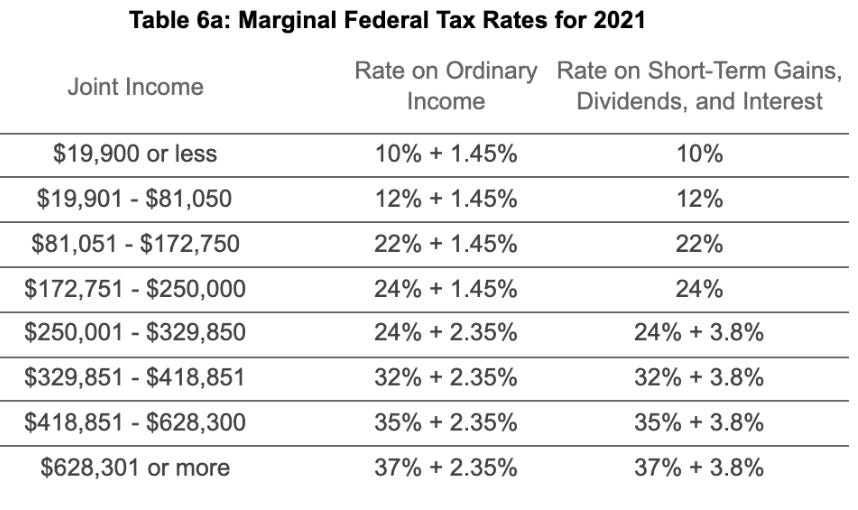

That $3,000 reduction in income is what gets most people excited when they first learn about tax loss harvesting. Again, you are not saving $3,000. But you are lowering the amount of income you need to pay taxes on by $3,000. How much actual savings that is depends on your personal marginal tax rate (ie the top rate your income is subjected to).

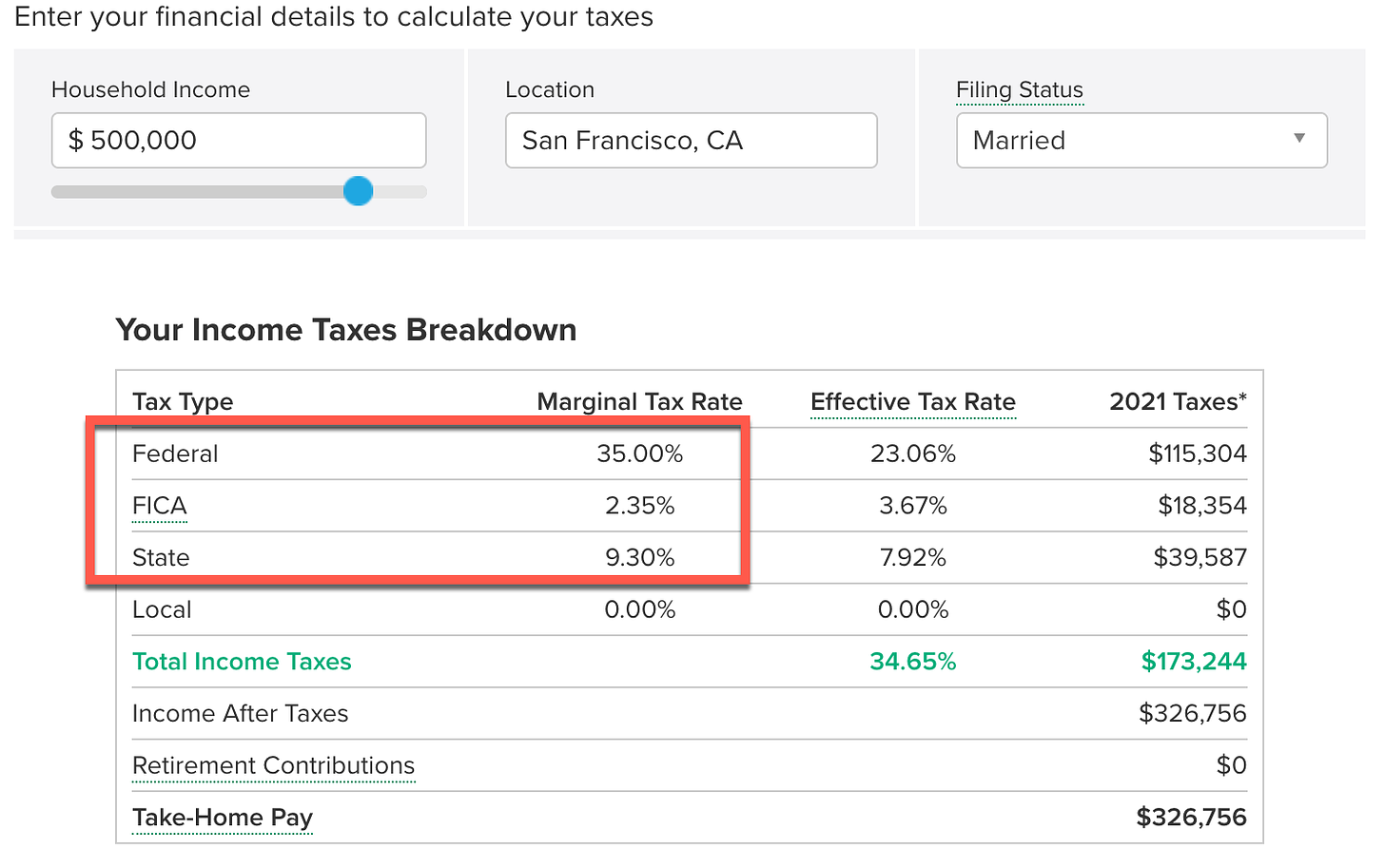

I like to use Smart Asset for a quick estimate of your marginal tax rates. Below is an example of a California family earning $500,000. Their marginal tax rate would be 46.65% leading to the benefit of tax loss harvesting reducing $3,000 of income of $1,400.

Quick Primer on Wash Sales

Before I jump into my strategy for tax loss harvesting we need to quickly explain wash sales. The IRS doesn’t want you to sell a stock for a loss and then immediately buy it again. So they developed the wash sale to prevent this. Let’s go straight to the IRS (PDF) with the explanation:

“A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale you:

Buy substantially identical stock or securities,

Acquire substantially identical stock or securities in a fully taxable trade,

Acquire a contract or option to buy substantially identical stock or securities, or

Acquire substantially identical stock for your individual retirement arrangement (IRA) or Roth IRA.

If you sell stock and your spouse or a corporation you control buys substantially identical stock, you also have a wash sale.”

A few quick notes:

The loss isn’t gone forever, it just gets added back to the cost basis.

RSU and ESPP vests can trigger wash sales

The IRS has never given extreme clarity around what “substantially identical” means. Investment advisors regularly debate the topic but to date the IRS has not clarified.

How I use index fund pairing to perform tax loss harvesting

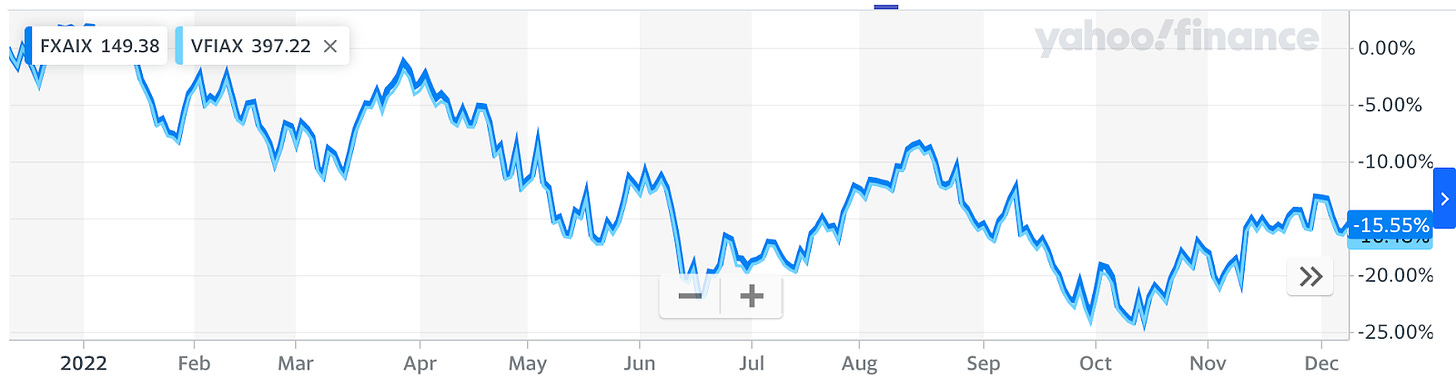

As mentioned above, one issue you run into with tax loss harvesting is wash sales. You can’t sell VTSAX for a loss and then just buy it right back. You could wait 30 days before buying again, but that is 30 days you are not invested with the risk of forgetting for much longer. This is where index fund pairing can come in. The concept is to have 2 similar but not “substantially identical” funds for each of the asset classes you want to invest in. This way after harvesting the losses from one, you can instantly buy the other without any time out of the market or deviations in your overall asset allocation.

Index Fund Pairs I Use

My overall goal asset allocation is ~ 56/34/10 or 56% domestic, 34% international, 10% bonds. Tax loss harvesting only applies to my taxable account (not my 401k, roth…) and I don’t hold any bonds in my taxable broker (this topic is “asset location” if you want to dig in).

Total US Market:

VTSAX/VTI: Vanguard Total Stock Market Index

S&P500:

VFIAX/VOO: Vanguard 500 Index Fund

FXAIX: Fidelity 500 Index Fund

International:

VTIAX/VXUS: Vanguard Total International Stock Index Fund

As you can see I am a big fan of both Vanguard and Fidelities extremely low fee index funds. The Vanguard funds are available as both mutual funds and ETFs.

Example Using Index Pairing for Tax Loss Harvesting

Step 1: Go to your broker and identify if you have any lots with losses. Look at the individual lots and not the overall gain/loss, if you buy regularly over a long period of time you may have an overall gain while still having some lots with losses you can harvest.

What are “individual lots”? A stock lot refers to a group of shares that are bought or sold together at a specific price. So if you buy shares regularly each month, every purchase is a different lot. When you sell your stock, you can elect to choose which lot you sell.

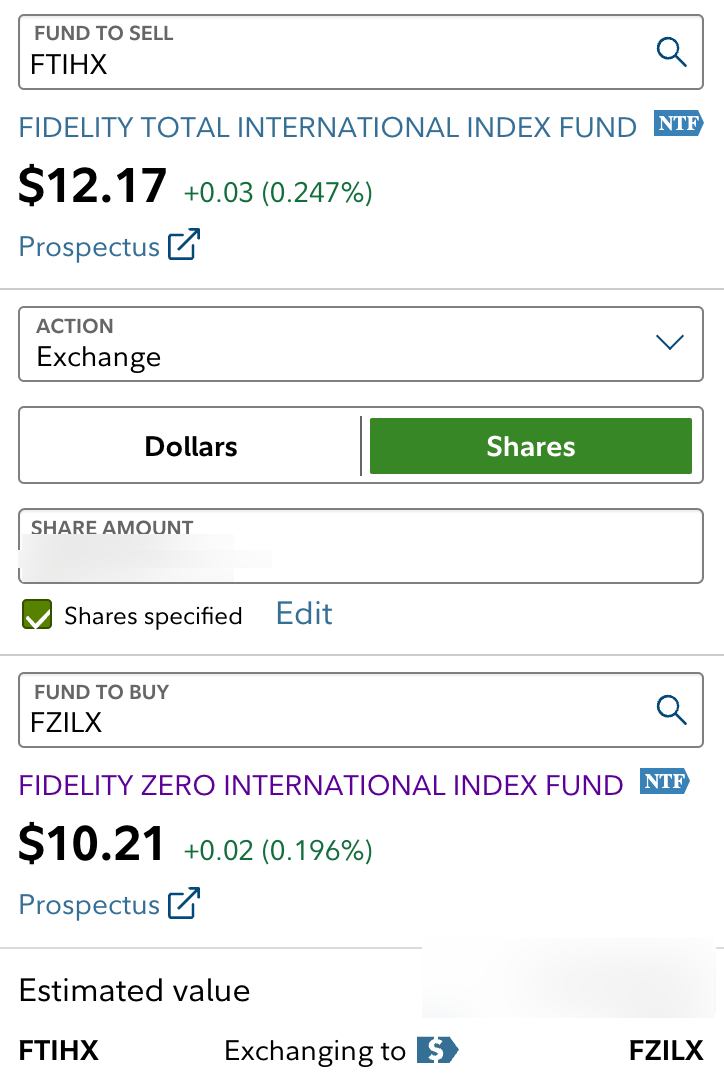

In the image below you can see I have identified a mutual fund with an overall gain of $22,000 but some of the individual lots that have losses which can be harvested. The fund is FTIHX which is an international fund I was previously using prior to Fidelity introducing their “ZERO” funds which I have been slowly switching to.

Step 2: Verify that I have not bought FTIHX in the past 30 days across all my accounts and my partners accounts. This means looking across 401k, ROTH, HSA… and ensuring there were no purchases or automatically reinvested dividends.

Step 3: Identify which fund to exchange FTIHX with. Since FTIHX is an international fund I can swap it to either VTIAX or FZILX. Just like in step 2 I want to look back 30 days to see if I sold either of these two mutual funds for a loss. If I did that would generate a wash sale. In this case I have not sold either one.

Step 4: Sell or Exchange the lots with losses. This is important. You need to specify the lots you want to sell and don’t let it default you to LIFO or FIFO (in this specific case LIFO would yield the same result but that isn’t always the case).

Step 5: Make sure not to rebuy FTIHX in the next 30 days and be sure to turn off automatic dividend reinvesting in any account that holds FTIHX since there is a dividend payout coming at the end of the year.

Since these are mutual funds the transaction will complete at the end of the first trading day and generate ~$3,800 in capital losses. This will push my year to date realized losses to >$70,000.

How TLH Sequences Losses

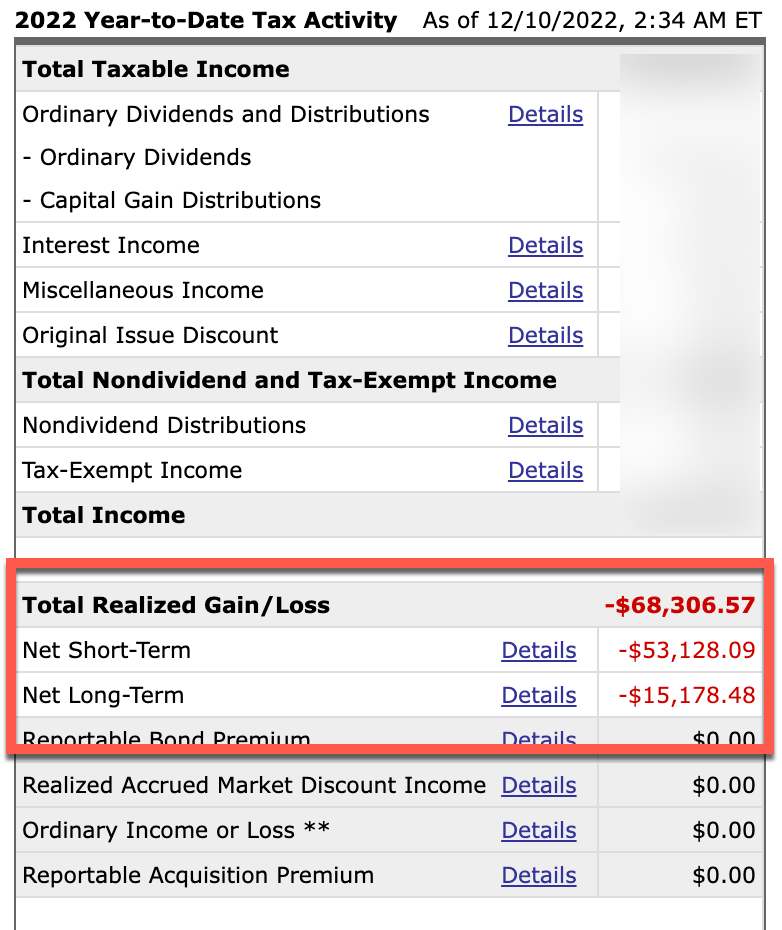

As you can see above I have $68k overall realized losses so far in 2022. These are split out into “Net Short-Term” which are losses from funds I have held less than 1 year and “Net Long-Term” which are from funds held > 1 year. They are taxed at substantially different rates at the federal level.

Short-term and long-term losses first offset by gains of the same type. Using my situation as an example, I have $68k in overall losses, split between $53k short-term and $15k long-term, and let’s pretend I also have $20,000 in long-term gains from another account, the gain would first be offset by the long-term losses. This leaves me with $0 in long-term losses remaining and $48,000 in short-term losses. Any remaining losses can then offset up to $3,000 of my ordinary income, reducing my taxable income by $3,000. This leaves me with $45,000 in short-term tax loss carryover after I do my 2022 taxes. The remaining losses will be carried over to future tax years until they are used up. Since I use the same tax software each year it is tracked automatically but you can also track these losses on Schedule D of Form 1040, lines 13 and 14.

Tax Loss Harvesting Benefits Are Inflated

I think tax loss harvesting is relatively easy and you should do it. But I also want to highlight why many people overestimate the real benefit and you should be leery of financial firms using this as justification for their higher fees. I want to zoom in on the long term impact of that $3,000 reduction in income.

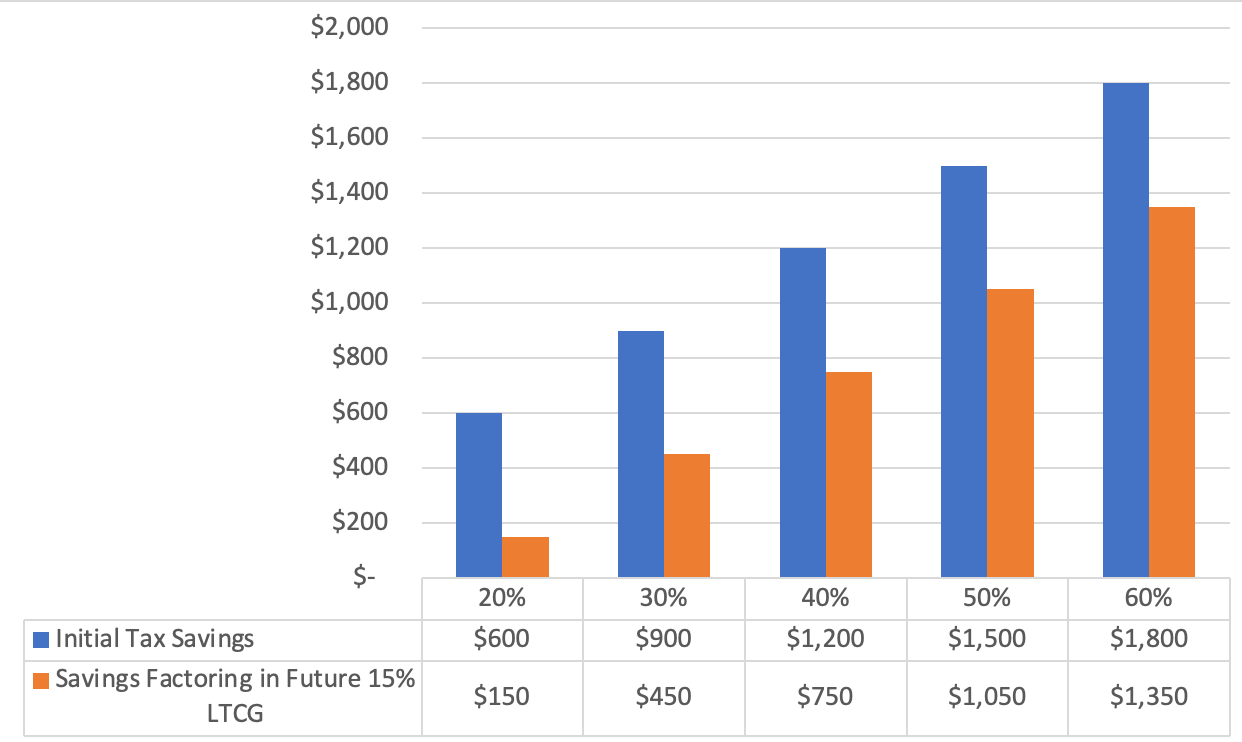

Think about the mechanics of tax loss harvesting. You buy $100,000 worth of stock. It loses $3,000 in value. If you tax loss harvest by selling that stock and buying a similar (but not equal) stock with the proceeds your new cost basis is $97,000. Let’s pretend that in 10 years the stock is now valued at $300,000. You will have $300,000 whether you tax loss harvested or not (assuming the assets performed identically). This means that when you eventually sell these shares you will be paying capital gains taxes on the additional $3,000 you previously harvested. $200,000 in long term capital gains vs $203,000 if you tax loss harvested (remember the cost basis is $97k vs $100k if you didn’t tax loss harvest). Let’s stack things in your favor and assume that long term capital gains (LTCG) tax rates stay at 15% and you move to a state with no additional taxes on capital gains. That $3,000 additional cost basis will lead you to paying an additional $450 in taxes.

Using the previous example of someone in California at the 46.65% marginal tax rate. You save $1,400 in taxes TODAY. When you sell you will pay $450 more. Leading you to a total gain of $950 (and a free loan of $450).

Below is a quick visual looking at the initial tax savings and the eventual “true” tax savings after factoring in LTCG at different initial marginal tax rates. The key thing that really matters is the difference between the marginal tax rate today and the eventual long term capital gains tax rate.

Michael Kitces also covers this with more clarity in his section “Tax Deferral or Tax Arbitrage? With even more detail in ”Evaluating The Tax Deferral And Tax Bracket Arbitrage Benefits Of Tax Loss Harvesting”.

Some other scenarios that can impact the real benefit:

In FIRE you could end up with lower income and a 0% LTCG tax rate

LTCG rates could go up or down

If you pass the assets on to your kids under current laws the cost basis gets reset at death (referred to as step-up cost basis)

You re-invest your tax savings. I have seen investment companies use this in their calculations. I just don’t fully believe that this would actually happen. Particularly since most high earners will end up with tax bills so a slightly lower tax bill doesn't instantly lead to increasing investments by that amount.

More Tax Loss Harvesting Examples

Example 1: You have gains and losses

If you buy VOO for $30,000 and then sell it for $34,000 you have a capital gain of $4,000.

You will owe taxes on the $4,000. If you held VOO for more than 1 year you will own long term capital gains taxes. If you held VOO for less than 1 short term capital gains which is taxed at the same rate your income is taxed (ordinary tax rate).

Now let’s pretend you also bought VTI for $24,000 and then sell it for $20,000 you now have a loss of $4,000.

The way tax loss harvesting works is that the $4,000 loss from your VTI sale will offset your $4,000 gain from your VOO sale and you will no longer owe taxes on that $4,000.

Example 2: You Sold LTCG to Buy a House!

My friend, let’s call him Paul, sold $500,000 worth of META in January for a downpayment on a house in San Francisco which generated $150,000 in long term capital gains. Paul will owe ~$36,000 in taxes (15% federal LTCG and 9.3% state taxes since California treats capital gains as any other income).

Now in December Paul, like most of us, is sitting on unrealized losses. Paul has identified $50,000 in losses across his taxable accounts in a number of different securities but primarily META and ARKK. Paul has been wanting to diversify anyway so he sells his remaining $300,000 in META and ARKK for a $50,000 loss and buys VTSAX (good job Paul).

This reduces Paul’s 2022 tax bill by $12,150.

Example 3: Large Losses + FIRE in 5 Years!

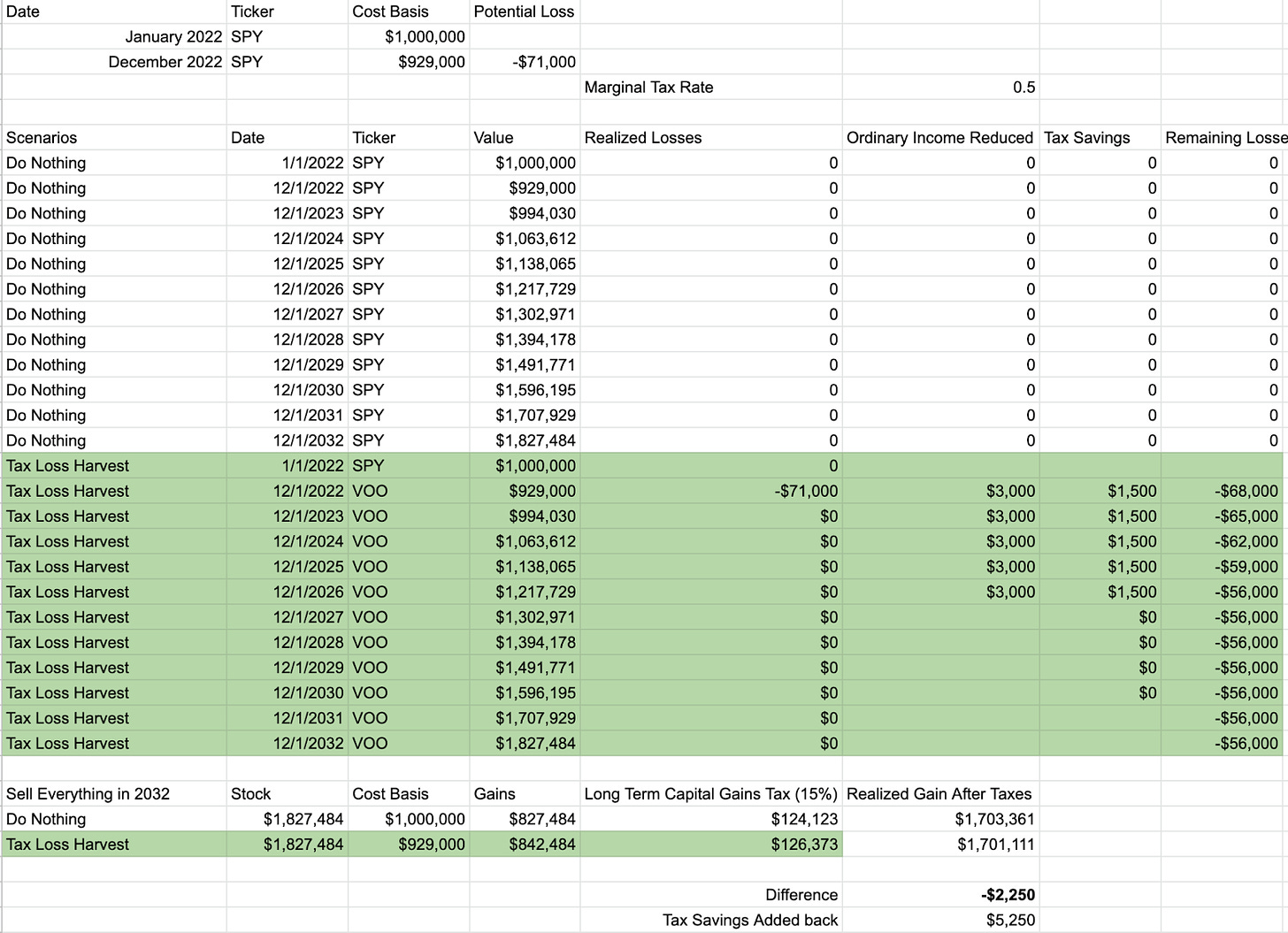

For this example let’s “pretend” someone had a large amount of losses in 2022 and then retired 5 years later. After 5 years in retirement they further sold all their stock.

They start with $71,000 in total losses. $56,000 in short-term losses (after the new translation I made clears) in addition to $15,000 in long-term losses.

There are not any realized gains so offset the losses will reduce the ordinary income by $3,000. Their marginal tax rate between all federal, state, and medicare surcharges is ~50%. Which means they are saving $1,500 today!

But remember, that $71k in losses reduced their cost basis by $71k which they will owe long term capital gains on when they sell in 10 years.

Would They have been better off not selling?

I created a very rough outline of the scenario comparing doing nothing and tax loss harvesting.

In the “Do Nothing” scenario SPY drops by $71,000 in year one and then grows 7% each year. In the “Tax Loss Harvest” scenario SPY drops by $71,000 in year one and then is swapped for VOO with $71,000 is tax loss harvested. In both scenarios they work 5 years and then retire, after 5 years of retirement they sell the entire amount.

Over the 5 working years they reduced their tax bill by $7,500 through offsetting their income. They also still have $56,000 in carry forward losses.

When they sell in 2032 they will actually have to pay $2,250 more in LTCG taxes that year. After accounting for the $7,500 saved in prior years you would net $5,250 in favor of tax loss harvesting.

Closing Thoughts

I still plan on tax loss harvesting each year. It is relatively easy to do manually every few months and deferring taxes while I am in top tax brackets and plan to FIRE still works out. The main benefit is in offsetting your ordinary income and deferring additional taxes for when you eventually sell your investments (in retirement or to fund a large purchase). I also wouldn’t stress too much beyond that. Especially if your goal is to spend down your investment portfolio in retirement, the overall benefits are just so marginal in the grand scheme of things unless you plan to donate your appreciated stock or pass it down to your heirs.

Please consult an accountant or financial planner who can take into account all your unique and nuanced circumstances.

I am lighter on bonds than I should be but have a larger cash emergency fund/house fund currently which I mentally (but not in the above %) use to justify the lower bond allocation.

I’ll increase the bond allocation further as I approach FIRE and will be heavily influenced by this series: https://earlyretirementnow.com/safe-withdrawal-rate-series/?amp

Hey Andre, in step 5, shouldn't the warning be about FTIHX, not FZILX? My understanding of wash sales is that you want to avoid rebuying the fund you _sold_.

Thanks for the guide, this is the clearest guide to tax loss harvesting I've found. I also appreciate the links to kitces.com for more detail.