Strategies for Diversifying Away from FAANG+ Company Stock

Methods to Reduce Single Stock Concentration

Hey FAANG FIRE!

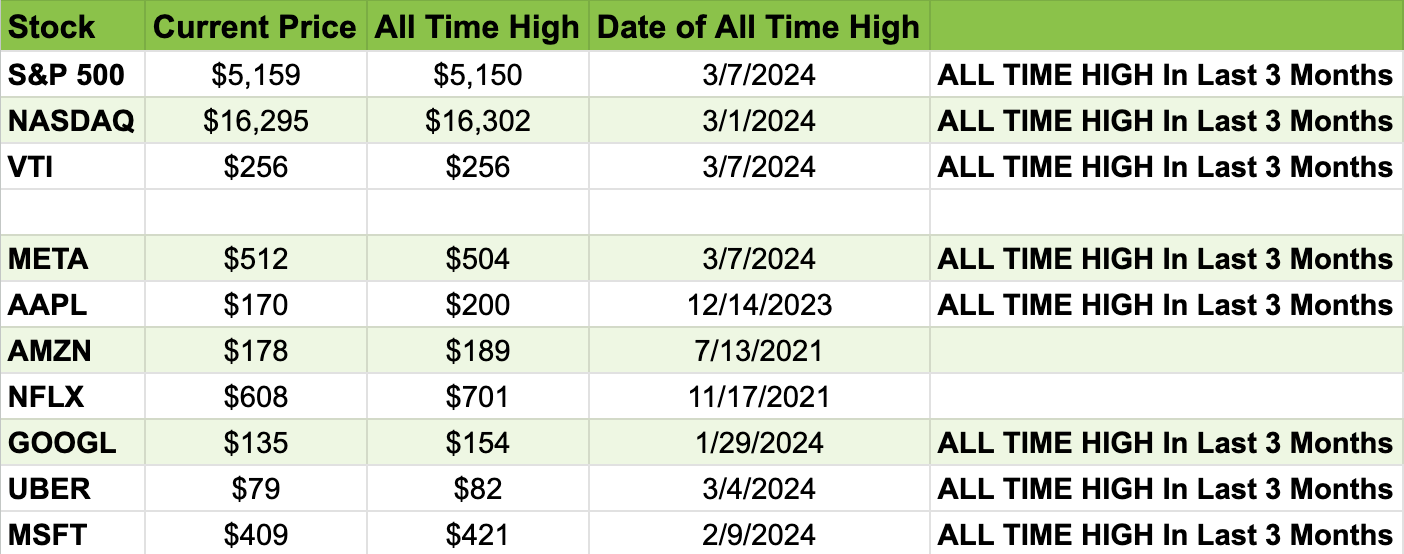

Over the last three months, Apple, Google, Nvidia, Meta, Uber, Microsoft, and countless other tech stocks have hit their all-time highs.

While I personally have always sold my RSUs each time they vest, I know not everyone has.

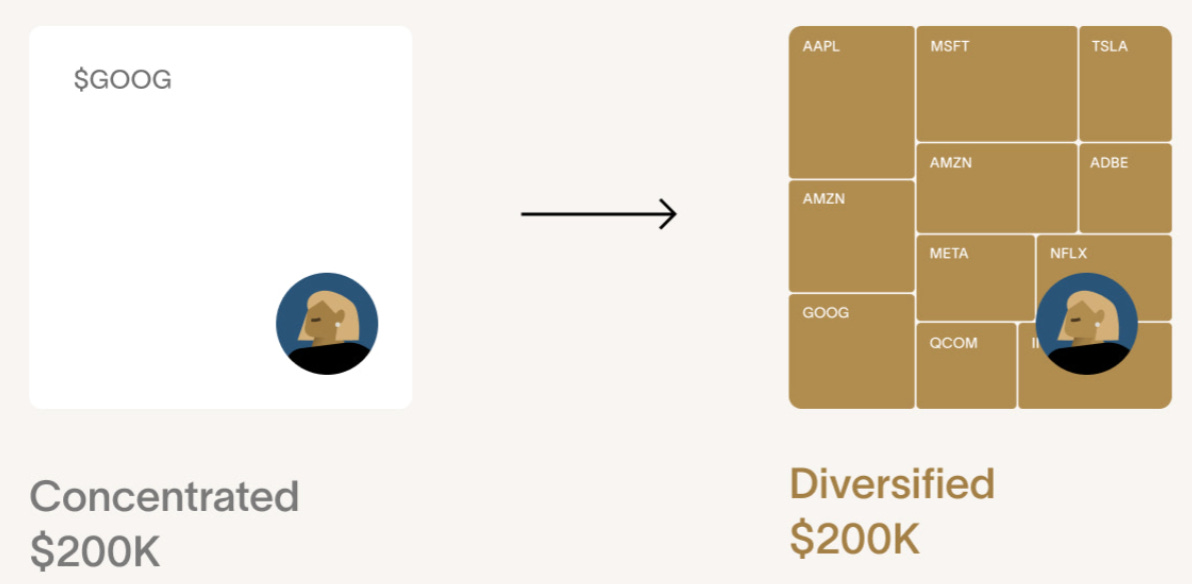

I know that many of you want to diversify out of your heavily concentrated positions but feel paralyzed by how to do it. Many of you are sitting on hundreds of thousands in capital gains.

To make matters worse, companies offering solutions are well aware, bombarding you with messages on LinkedIn and elsewhere about magical tax-saving products.

There are many different options for diversifying away from highly concentrated positions. I wanted to bring in a subject matter expert on the topic to give us a rundown of some of the common options as well as the more exotic ones out there.

Brent Sullivan (LinkedIn) is a former software engineer, investing pro, and founder of Tax Alpha, LLC, a tax strategy consultancy. CFPs, CFAs, and researchers follow Brent for the latest in taxable portfolio management, usually explained with infographics. So I thought he would be the perfect person to give us an unbiased rundown of the different options.

Single-Stock Concentration

Wow! My vested RSUs are worth a lot!

You work at FAANG+ and are nervous about the mountain of vested RSUs you’ve accumulated.

Most people hold onto vested RSUs because they don’t have a plan to get rid of them or think their company is special. “To the moon,” they say. While your company might have the highest performance this year, the reality is that the best-performing stocks change from year to year.

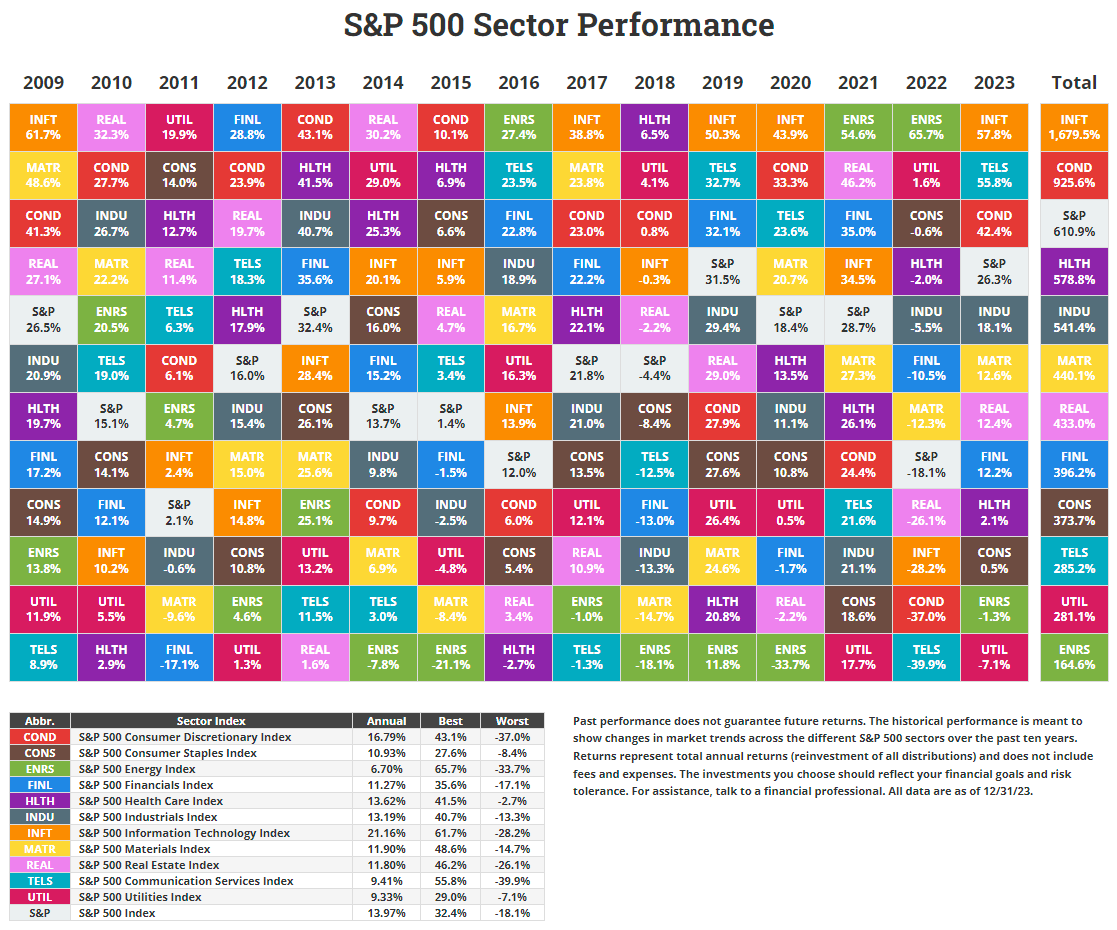

Extreme recency bias has us all thinking that tech is consistently the #1 performing sector. But if we zoom out, the winning sector is all over the map.

There’s also some academic evidence holding one stock does poorer than the broad market. Your vested RSUs could also go nowhere, die slowly, or crater suddenly. Here is an example of each.

Go nowhere — Microsoft was essentially flat from late 1999 until 2016

Die slowly — General Electric peaked in 2000

Crater suddenly — First Republic Bank collapsed in 2023 after peaking in 2021

Andre explained that adding index funds to your portfolio does not solve the problem. Those funds might hold the same shares you do.

Moreover, if your salary and vested RSUs come from the same company, the stock drops and you get fired, you lose income and share value — a double-whammy.

Should I sell now?

If you sell your vested RSUs immediately, you’ll pay tax on the difference between the current and vesting prices in the form of capital gains.

The chunk of cash you give the government is no longer compounding for you. Professional money managers call this “tax drag.”

If you held the shares you are selling less than 1-year you will owe short-term capital gains taxes, which are taxed at the same rate as ordinary income.

If you held for more than 1-year you will owe long-term capital gains taxes. There are also additional state taxes, investment taxes… it can add up.

This article aims to give you a sampler platter of strategies to reduce your pile of vested RSUs while limiting tax drag.

Let’s Dive Into the Different Strategies To Diversify

Sell Everything ASAP

The first strategy is also the simplest. A true embrace of “don’t let the tax tail wag the dog.”

Your goal is to diversify your vested RSUs and you simply accept tax as the cost to get there.

When executing this approach, just be sure you save some of the proceeds to pay the bill this tax year.

Sell slowly

Instead of selling immediately, you sell your vested RSUs over a few years.

You carefully sell only the shares you’ve held for over a year. These shares are taxed at the lower long-term capital gains rate. In some cases, half the short-term capital gains rate.

Many professional money managers help clients sell their vested RSUs over time, but they often add a tax hack called “tax-loss harvesting.”

Tax-loss harvesting

FAANG+ stocks are volatile. Sometimes you have very old vested RSUs that are well above the vesting price and some newer vested RSUs that are below the vesting price.

In this case, you can sell some losing and winning tax lots and net the tax you pay. The result is zero tax due, and you’ve reduced risk.

There are a handful of “gotchas” when harvesting losses. Andre wrote about a big one, the wash sale rule, here. It’s worth checking your vesting schedule and blackout windows to ensure you can fully net capital gains and losses.

But what if you don’t have any capital losses to offset capital gains? This is the case for those working at tech companies whose stocks are at all-time highs (META, UBER, NVDA, MSFT, etc.).

Donate appreciated stock

If you are philanthropically inclined and you itemize your tax return, which is usually the case for high-earners with a mortgage, donating highly appreciated vested RSUs is a tax hack worth knowing about.

The strategy is to find a charity, contact them about making a stock gift, select the most appreciated RSUs you hold, and transfer them to the charity.

When you donate appreciated shares directly, you pay no tax and claim the entire donation as an itemized deduction, which offsets ordinary income.

One gotcha when donating shares is that you must have held them for at least a year, or you limit the deduction you claim.

If you’re unsure of a particular charity, consider using a donor-advised fund (DAF). When you contribute appreciated stock to the fund, you claim the deduction mentioned above, and the fund manager sells the stock and invests. You later instruct the DAF to send a donation to a charity of your choice. They charge fees, but if you’re paralyzed by choosing an individual charity, a DAF helps you reduce risk while you make up your mind.

Your company usually views share donations as equivalent to selling shares, so check your corporate trading policy and blackout windows before executing.

Share donations sometimes take weeks. Initiate a share transfer at the beginning of a blackout window and with plenty of time before the end of the year.

This Kitces Blog post provides tons of detail on donating appreciated shares.

What if donating is not your thing?

No Free Lunch

Things get more complicated from here.

Each strategy below transforms your risk and tax into something else but never entirely eliminates either.

Keep that in mind as we explore ways to diversify your vested RSUs.

Hedge with put options

If your company allows it (check your corporate trading policy), you can buy “portfolio insurance” in the form of put options.

Suppose you hold vested Amazon (AMZN) RSUs. You open a brokerage account, apply for options trading, and buy a put option on AMZN, which makes money if AMZN dips below a specific price. You still hold your Amazon RSUs, but you’ve limited your downside risk without tax drag.

Sadly, you’ve replaced tax drag with “insurance drag” because put options are not cheap. They’re also complex and really worth understanding before trading.

This NerdWallet article gives examples of how put options work.

Remember that put options themselves are taxable depending on how you use them. This explainer from Fidelity and The Options Institute at CBOE® explains the tax consequences of using put options for hedging.

There’s a way to buy put options for “free” using another strategy called a collar.

Hedge with an option collar

Put options are portfolio insurance and they’re expensive. To cover the cost of buying a put option, you can sell a call option on AMZN. Check your corporate trading policy to ensure you can sell calls on company stock.

When you sell (or “write”) a call option on AMZN, you give someone else the right to buy AMZN from you at a specific price. You use the money from the sale to buy an AMZN put option.

The net effect is that you’ve given up upside potential for downside protection. You’ve put a collar on the price of your vested Amazon RSUs.

While you’ve limited the price risk of holding a giant chunk of Amazon shares, you’ve traded it for options risk (which includes margin risk and more), current income (which is taxable), and user-error risk since you have to manage the options continuously.

This Fidelity article describes option collars in simple terms.

Options trades like collars are typically taxed according to the complex straddle rules. This Charles Schwab article briefly outlines the treatment.

Does this sound complex? It is. And I’ve only scratched the surface.

Here’s another strategy to limit tax drag without options.

Hedge by shorting similar stuff

Put options are a form of portfolio insurance because they limit downside risk. Another type of insurance is shorting a stock.

Suppose you hold vested Meta Platforms (META) RSUs. If you short a tech index fund, you make money when tech stocks, including META, go down, a type of downside protection. But your short tech index fund loses money when tech stocks go up.

Shorting involves opening a brokerage account, applying for short trading, paying the borrowing rate, and holding margin.

You may be subject to corporate restrictions on shorting, so check your employer’s policy.

The unfortunate case is when tech stocks go up, and META underperforms. Your short tech index fund loses money, and your META shares are not giving you a good return for the risk you’re holding.

But you haven’t paid tax!

Instead, you’ve shifted tax drag to another type of drag (the cost of borrowing and holding margin), plus some META-specific risk left over.

Here’s Charles Schwab on the mechanics and risks of shorting stocks.

Moreover, capital gains from the short itself are taxed as short-term. Fairmark is an authority on taxation and explains in this article.

If shorting as a tax-efficient hedging strategy sounds odd to you, Dammon and Spatt mention it in footnote 31 of “Taxes and Investment Choice.”

Shorting is a strategy that transforms risk and tax, but neither disappear.

The following strategies almost always require hiring a professional, and they’re worth knowing about, even if the idea of working with a financial planner, wealth manager, or estate attorney turns your stomach.

Combine shorting with tax-loss harvesting

A few money managers offer “long/short” strategies that wrap a giant vested RSU position and wind it down over time using tax-loss harvesting.

The portfolio manager adds leverage to your portfolio to create more opportunities to harvest losses. They add offsetting long and short positions in other stocks to harvest losses regardless of whether the market is up or down.

As they harvest losses, they sell bits of your vested RSUs and aim to pay zero tax each year.

This niche strategy often costs 0.5% to 1.00% per year in portfolio management fees and usually requires a $1,000,000 minimum investment. It is complex and requires keeping an eye on constructive sales.

Long/short tax-efficient strategies are finally making their way into professionally managed accounts. But academics have been writing about the strategy since the 1980s. Here’s a famous article by Berkin (2010) about “extending the long-only mandate” with tax in mind.

And here’s Larry Swedroe writing for Morningstar about this strategy.

Exchange funds

An exchange fund is not an exchange-traded fund.

The idea is to contribute your vested RSUs to a pool of shares with many others who hold different vested RSUs. Each person has a proportional ownership stake in the fund. By contributing to the fund, you diversify risk without paying tax.

The catch is that you must hold the ownership stake for 7 years to get the full diversification benefits. After 7 years, you’ll still owe tax, but you’ll have a diversified portfolio, including a healthy chunk of safe real estate assets, rather than a single vested RSU position.

Here is Cache talking about the basics of exchange fund investing.

If you’re comfortable with a long lock-up period and real estate, then it’s also worth knowing about opportunity zone funds.

Opportunity zone funds

Unlike exchange funds, which diversify risk and defer tax, opportunity zone funds are a rare instance of permanent tax “mitigation.” But they carry extra risk.

To take advantage of the tax benefits of investing in an opportunity zone fund, you sell your vested RSUs and invest in an opportunity zone fund shortly thereafter. It’s worth choosing the fund before selling your vested RSUs.

The opportunity zone fund manager invests in early-stage real estate development projects in census tracts designated “opportunity zones.” IRS provides a lot of information about the rules governing opportunity zones.

If you hold your investment for ten years, you get the full tax benefit of investing, including less tax on your original sale of vested RSUs, plus some tax advantages on returns from the real estate development projects.

The catch is that early-stage real estate development projects are typically risky.

Here’s Baker Tilly on the tradeoffs of investing in opportunity zone funds.

Charitable remainder trusts

Many use estate vehicles like charitable remainder trusts (CRT) to diversify risk while minimizing tax. As the name suggests, CRTs are a donation strategy.

You transfer your vested RSUs into the CRT and get a tax deduction on the present value of the amount you expect to go to a charity of your choice eventually. The CRT then sells the shares without paying tax and buys other stuff to diversify risk. You receive annual income from the CRT, which is taxable depending on the flavor (interest, dividends, capital gains, etc.). Whatever is left at the end of the CRT term is donated to a charity of your choice.

I like Valur’s calculator and explainers for understanding how CRTs and their many variations work.

Setting up trusts is lawyer work. It’s worth talking with an expert to see if this is the right solution for you.

Is that all?

No!

This article is a quick summary of reducing concentrated vested RSU risk while considering tax. Each approach has pros and cons. This list is far from exhaustive.

You can execute some of the strategies above on your own. But remember there’s significant “user error” risk whenever tax is involved, and working with a financial planner, wealth manager, or estate attorney could be the best option.

We covered the following strategies in this article:

Selling now

Selling slowly

Tax-loss harvesting

Donating appreciated stock

Hedging with put options

Hedging with an option collar

Hedging by shorting

Long/short tax-loss harvesting

Exchange funds

Opportunity zone funds

Charitable remainder trusts

Walk through this list with a planner and see how they react. Have they considered the options above, or are they just selling you the thing they know best?

Ask them to elaborate until you understand how the risk and tax of a concentrated vested RSU position transforms into other types of risk and tax. In particular, ask about fees and lockup periods.

If you’re thinking, “bleh, I don’t want an adviser,” that’s cool, but remember that a good one will help you understand the tradeoffs of each option and avoid stockpiling vested RSUs in the future. Many are willing to hustle to win your business.

I know I’m taking too much risk when I constantly check the markets. This is anxiety. It’s my body telling me “I am uncomfortable.” The list above gives you tax-aware options to consider to make this feeling go away.

Reducing risk with tax in mind is a good idea, and might also help you sleep better.

This material is educational and illustrative, not investment or tax advice. The links above are not endorsements of the underlying products or services. As of publication, Brent Sullivan, and his consultancy, Tax Alpha, LLC, are not, and have no immediate plans to be, compensated by any of the vendors linked above, nor are they invested in the companies themselves or their products and services.

That was awesome. I pride myself in writing about what I know and have lived through. This post is an example where I simply didn’t know the answers and was able to reach out to an expert in my network to help us all build a base of understanding.

I want to thank Brent for lending his expertise on the topic. Go follow Brent on LinkedIn for the latest in tax aware portfolio management.

New Avocado Rating System, Give it a Test Run:

Most of the hedging strategies and exchange funds may not be permitted by your employer's policies around RSUs,.so make sure to check before you use these.