Hey FAANG FIRE,

Today I wanted to expose a hidden risk that many FAANG workers are facing — unknown concentration risk.

Before diving into the unknown, let’s recap what known concentration risk looks like.

Concentration Risk

When I covered the different strategies you could take when selling your RSU’s I touched on The 5% Rule.

The 5% Rule States: You never want an individual stock to make up more than 5% of your overall portfolio.

It can be very easy for your RSUs to accumulate and make up a very significant percent of your portfolio balance. The 5% rule is all about helping you avoid large concentrated positions. The old idiom “Don’t keep all your eggs in one basket” applies here.

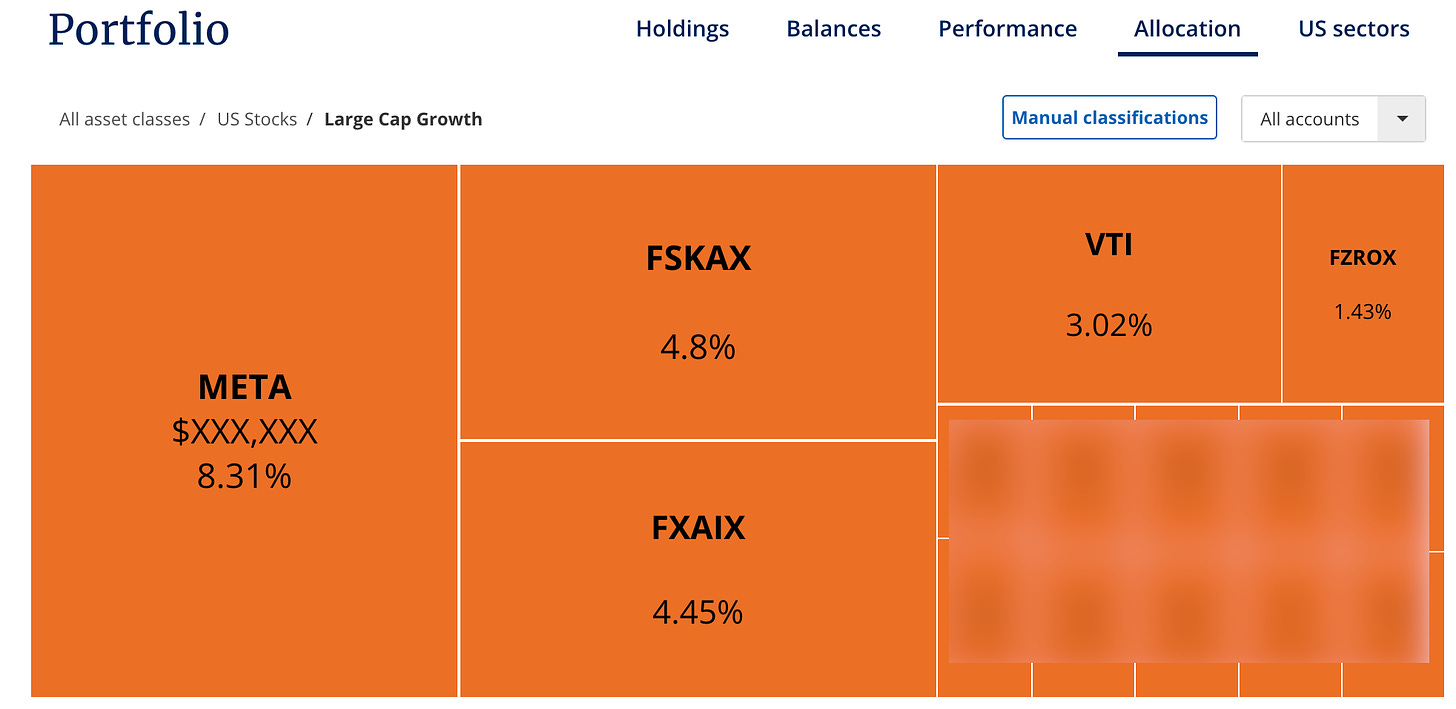

I covered how you can easily track whether you go over 5% using a free tool like Empower1 (formerly called Personal Capital). Where, within their investment dashboard, you can drill down into your overall investment allocation to see exactly how much of your portfolio any given stock has.

In the above example the person has 8.31% of their portfolio in Meta. If they wanted to stick to the 5% rule they would need to sell enough Meta to stay under 5%.

This is the known concentration risk. It is very easy to understand and calculate what percent an individual share makes up in your portfolio… or is it really?

Unknown Concentration Risk?

You have unknown concentration when your actual exposure to a single company stock is larger than you realized, primarily due to also having additional exposure through Index Funds.

The key to unraveling your unknown concentration is all about understanding what your portfolio actually holds. If you are like me, your portfolio is nearly all low fee index funds that replicate the total market at your desired asset allocation — or you simply this further with a target date mutual fund.

To simplify things I am going to dive into hypothetical portfolios holding VTSAX and VFIFX. The Vanguard Total US Market Fund and the Vanguard 2050 Target Date Fund.

VTSAX: One of the OG low cost index funds from Vanguard. “Created in 1992, Vanguard Total Stock Market Index Fund is designed to provide investors with exposure to the entire U.S. equity market, including small-, mid-, and large-cap growth and value stocks.” You may come across the phrase “VTSAX and Chill” referring to the strategy some people employ of only holding VTSAX.

VFIFX: Vanguard’s Target Date Retirement Fund for those targeting a 2050 retirement. This type of fund is often the default investment option in many 401k plans. They automatically adjust the asset allocation to be more conservative as you get closer to, and pass, the year 2050.

VTSAX Composition

The goal of VTSAX is to mirror the entire US market. That means that this fund will try to replicate owning every single publicly traded US company. From the VTSAX prospectus:

The Fund employs an indexing investment approach designed to track the performance of the CRSP US Total Market Index, which represents approximately 100% of the investable U.S. stock market and includes large-, mid-, small-, and micro-cap stocks regularly traded on the New York Stock Exchange and Nasdaq. The Fund invests by sampling the Index, meaning that it holds a broadly diversified collection of securities that, in the aggregate, approximates the full Index in terms of key characteristics. These key characteristics include industry weightings and market capitalization, as well as certain financial measures, such as price/earnings ratio and dividend yield.

And sure enough, if you visited the VTSAX Composition Page you would see 3,895 individual stock listings! As mentioned in the prospectus, the holdings factor in the weighting, and market cap of each company. So the index will naturally hold more of the largest companies, since they make up a larger share of the overall US market’s value. The top 10 largest holdings make up more than 23% of the total value of VTSAX.

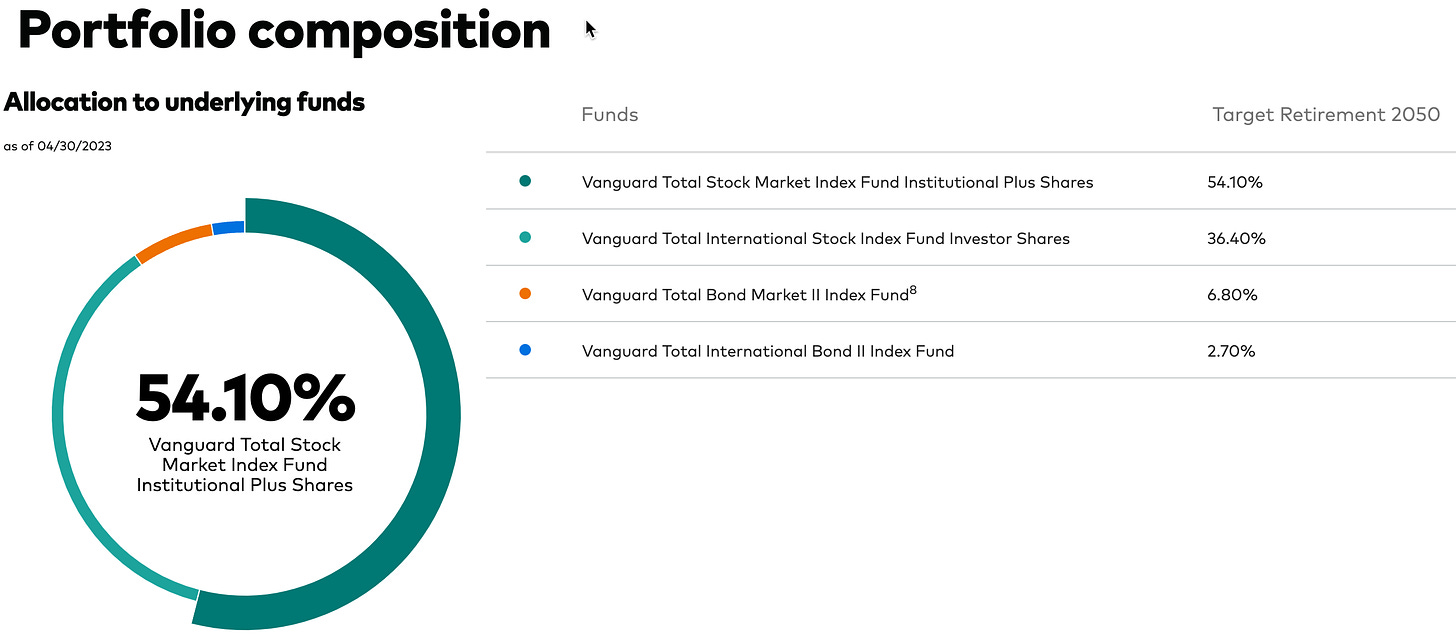

VFIFX Composition (Target Date 2050)

Vanguard Target Retirement Funds offer a diversified portfolio within a single fund that adjusts its underlying asset mix over time. The funds provide broad diversification while incrementally decreasing exposure to stocks and increasing exposure to bonds as each fund’s target retirement date approaches. The funds continue to adjust for approximately seven years after that date until their allocations match that of the Target Retirement Income Fund. Investors in the funds should be able to tolerate the risks that come from the volatility of the stock and bond markets. You may wish to consider this fund if you’re planning to retire between 2048 and 2052.

Digging into what VFIFX actually holds shows us that Vanguard is using an Asset Allocation of ~ 55% US Equities, 36% International Equities, 6.5% US Bonds, 3.5% International Bonds. They are doing this by holding— even more index funds.

They are using the fund VSMPX to replicate the US Market. This is essentially the institutional version of VTSAX. With slightly lower fees of 0.02% vs 0.04% and requiring a cool $100M minimum investment. The underlying holdings are essentially identical.

Breaking Down True Concentration Risk

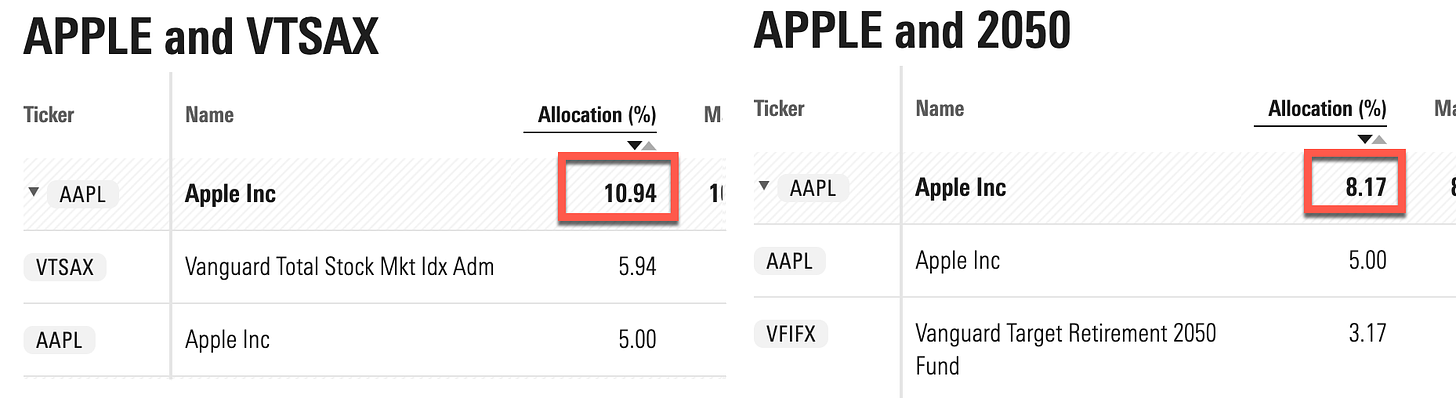

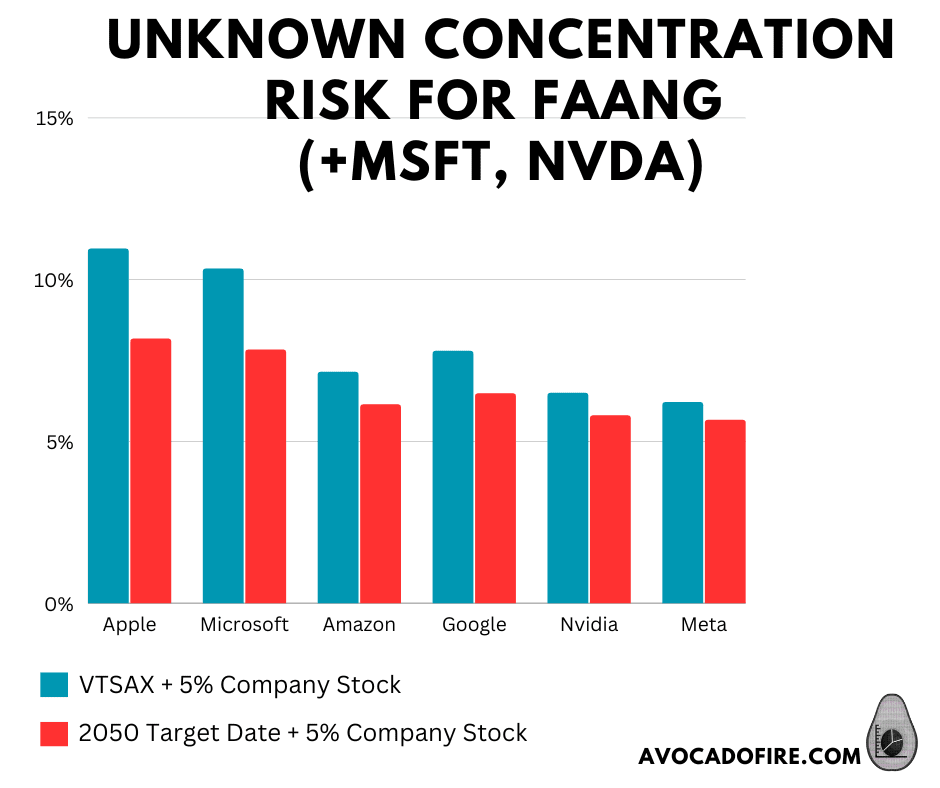

For this next section we are going to pretend we are employees at Apple, Microsoft, Amazon, Nvidia, Alphabet, or Meta who follow the 5% rule and hold either VTSAX or VFIFX with the remaining 95% of their portfolio. Let’s turn the Unknown Concentration Risk into the Known.

Caveat: These estimates are based off 4/30. Since then Nvidia is up 35%, Amazon 15%, Alphabet 13%, Meta 13%, Apple and Microsoft up ~5% each. The overall allocation for each would be even higher than shown.

Apple

5% Apple + 95% VTSAX = 10.95% Apple

5% Apple + 95% Target Date 2050 = 8.17% Apple

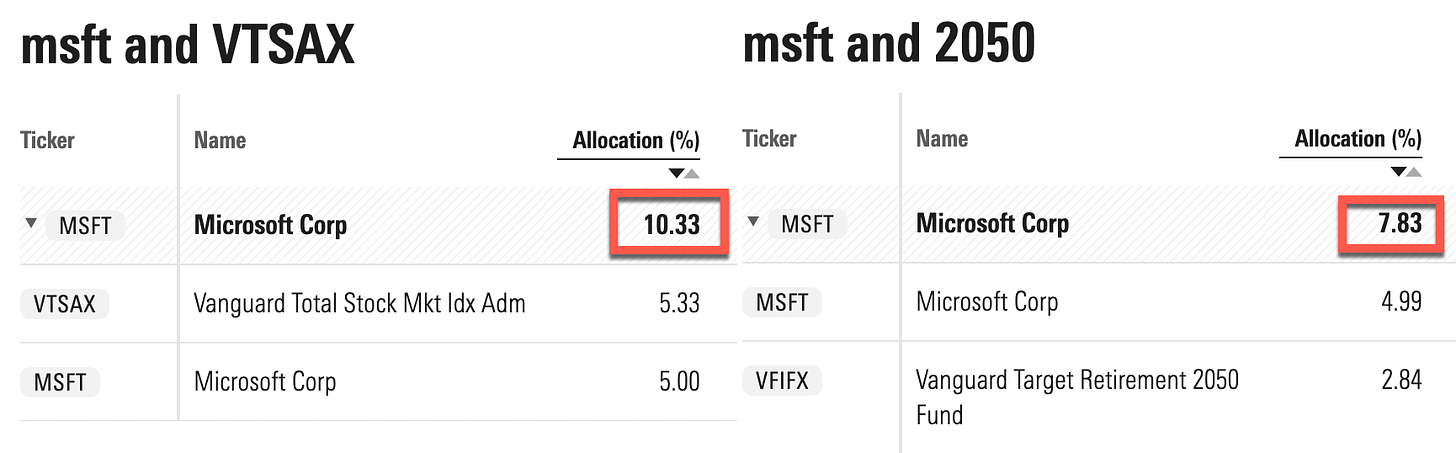

Microsoft

5% Microsoft + 95% VTSAX = 10.33% Microsoft

5% Microsoft + 95% Target Date 2050 = 7.83% Microsoft

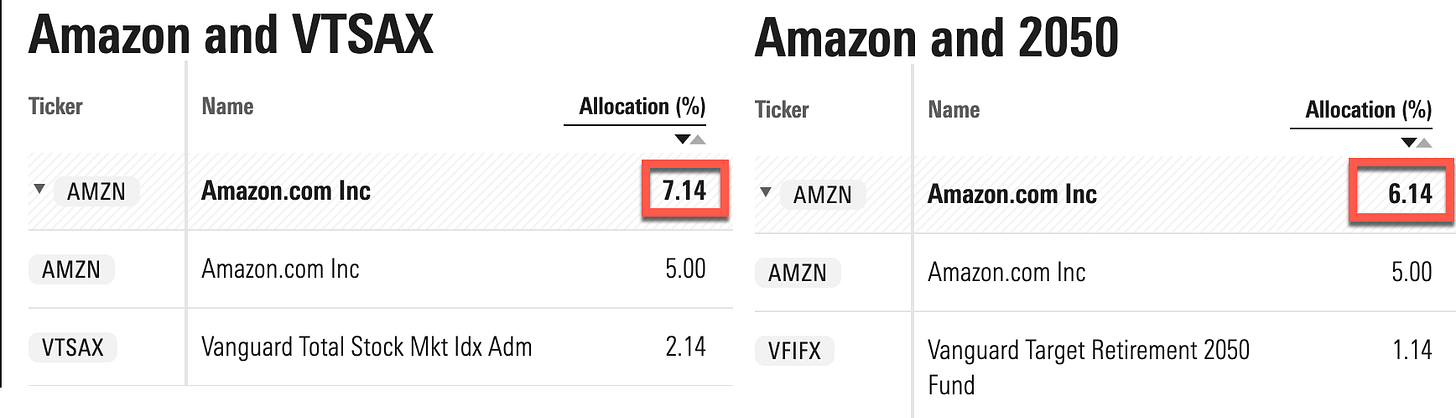

Amazon

5% Amazon + 95% VTSAX = 7.14% Amazon

5% Amazon + 95% Target Date 2050 = 6.14% Amazon

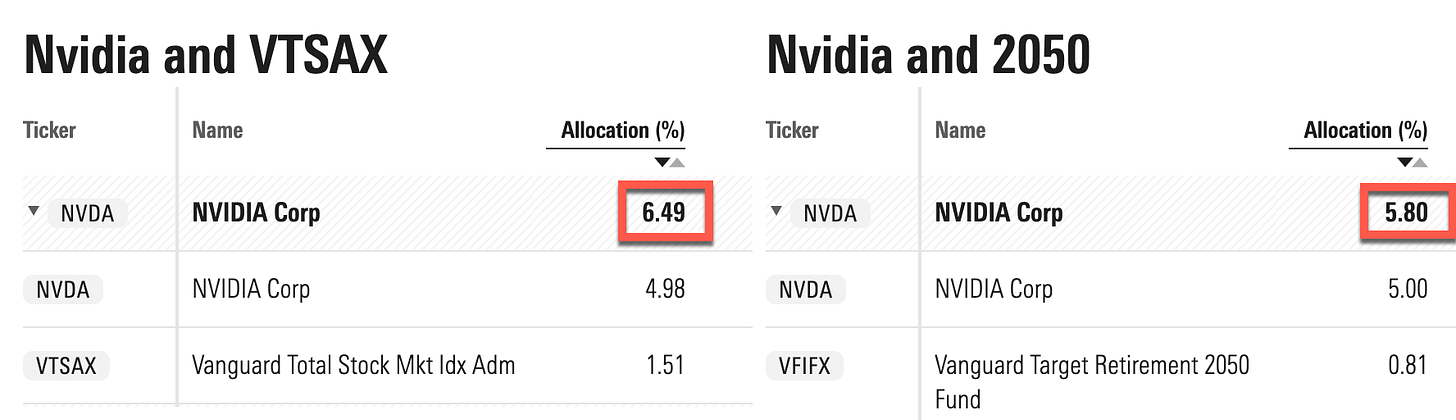

Nvidia

These totals were calculated prior to Nvidia increasing 35%!

5% Nvidia + 95% VTSAX = 6.49% Nvidia

5% Nvidia + 95% Target Date 2050 = 5.8% Nvidia

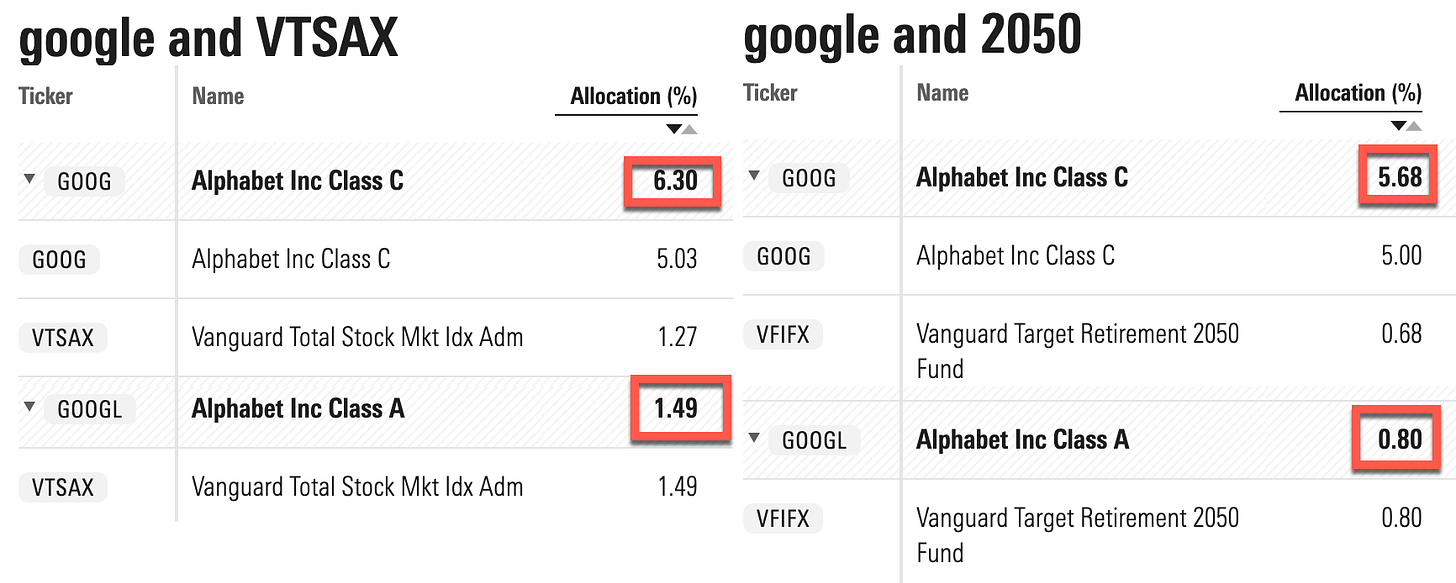

Alphabet/Google

5% Google + 95% VTSAX = 7.79% Google

5% Google + 95% Target Date 2050 = 6.48% Google

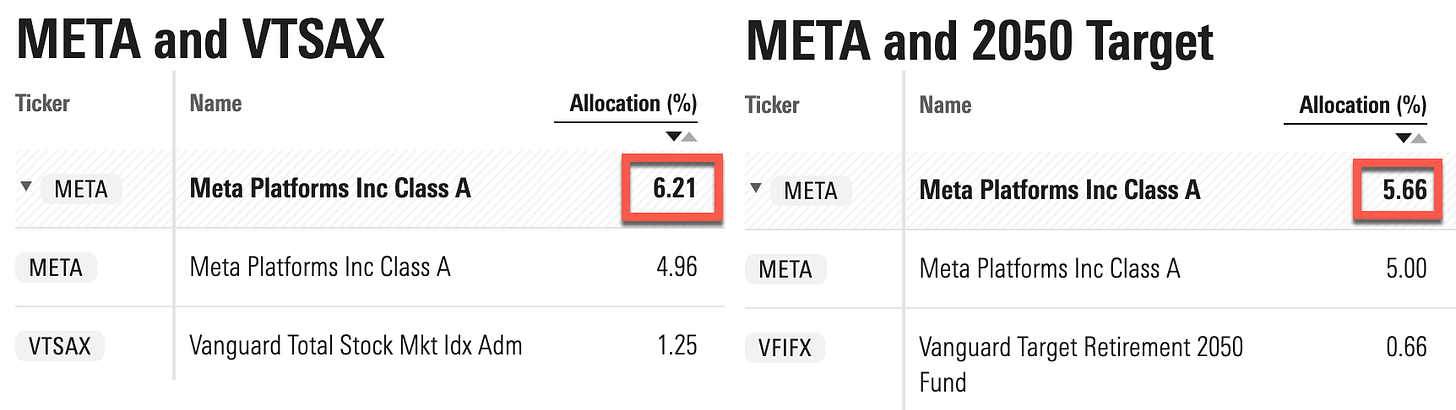

Meta/Facebook

5% Meta + 95% VTSAX = 6.21% Meta

5% Meta + 95% Target Date 2050 = 5.66 Meta

Recap

Apple, Nvidia, Microsoft, Amazon, Google, Meta — these 6 companies make up nearly 20% of the total value of the US market. If you also work for these 6 companies, and are compensated with company stock, it will be very very easy for a large percent of your total net worth to be tied to your employer. I want you to understand how large that percent and your concentrated risk and to not fall victim to the unknown. All analysis was done through Morningstar and their Stock Intersection tool. They offer a free trial if you want to use an automated way of checking across your full portfolio.

Did you realize how large a role these 6 companies played in nearly everyone’s portfolio? If you were trying to keep your company asset allocation under 5% do you factor in the amount held in index funds?

I have personally used Personal Capital since 2013! It is completely free to sign up and use. If you do sign up through my newsletter I may receive a commission.