Looking for a single post with everything you need to know about FAANG RSU Vesting? Well here it is.

My approach when it comes to managing vesting RSUs:

“Come up with a plan before your RSUs vest. Write down your plan. Stick to the plan.”

A good plan has a set strategy that tells you when to sell, which shares to sell, and just as important, what you are going to do with the money after you sell.

What does my RSU plan look like?

During my 9.5 years at Meta, and after more than 30 different RSU vesting periods, I nearly always sold my shares within a few weeks of vesting.

I transferred the money from the sale to my taxable brokerage at Fidelity where I bought simple low cost mutual funds that matched my asset allocation —primarily VTI and VXUS (as well as some similar fidelity funds).

I did this because I already had an emergency fund. I didn’t have any debt. I was already maxing out all my tax advantaged accounts (401k, mega-backdoor, backdoor, FSA, DFSA…..). I wasn’t saving money for any major short term purchases (like a house). Because I was already doing all of that, I was able to simply transfer the cash from selling my RSUs into my Fidelity account, and then invest in my taxable brokerage account.

The key thing to remember is that RSU income, is income. If you sell on vest, treat it like you would any other income.

New Paid Subscriber Perk

FAANG FIRE paid members have a new perk. Those subscribed to the Monthly ($5) or Annual ($50) subscription plans can now schedule a 15-minute 1:1 Zoom call with me every 6 months. Founding Members ($100) are eligible for a 30-minute 1:1 Zoom Call every 6 months.

This is a great way to support FAANG FIRE and allow me to keep producing high quality FAANG-focused FIRE content without paywalls.

New paid members will receive a link in their welcome email. Already a paid member? Shoot me an email, by replying to this or any other email and I will send you the scheduler.

You can also support FAANG FIRE by sharing this post with your colleagues anytime they have RSU related questions.

FAANG FIRE RSU Resources

Now that we touched upon my approach, let’s go over all my past writing on RSUs to help you come up with your own plan. This will serve as a single resource into all things FAANG FIRE and RSUs, whether you are new to RSUs or simply looking to refine your strategy.

How Vesting Day Works

Ahh vesting day. A magical day. But also one full of confusion. Let’s break it down.

Vesting Day (V-day): The day your shares vest.

V+1: The day after your vesting day. This is when the shares will be deposited in your account (minus the shares auto-sold for taxes and other withholdings). This is the first day you can physically sell.

V+2: Two days after your vest is when, at least for my broker, the cost basis of the new vest gets populated correctly. If you hold shares from multiple vests it is often important to wait until V+2 for the cost-basis to load in so you can choose the correct lots of shares to sell or to ensure you select LIFO (last in first out) as the selling method.

2024 FAANG Vesting Days (V-day)

Facebook/Meta Vesting Schedule (Quarterly)

February 15th 2024

May 15th 2024

August 15th 2024

November 15th 2024

Amazon (Quarterly, Previously Twice per Year, Initial Grant Varies)

May 15th 2024

November 15th 2024

Apple (Twice per Year, Initial Grant Varies)

~October 15th 2024

~April 15th 2024

Netflix (?)

Google (Monthly, Initial Grant Varies)

January 25th 2024

February 25th 2024

March 25th 2024

April 25th 2024

May 25th 2024

June 25th 2024

July 25th 2024

August 25th 2024

September 25 2024

October 25 2024

November 25th 2024

December 25th 2024

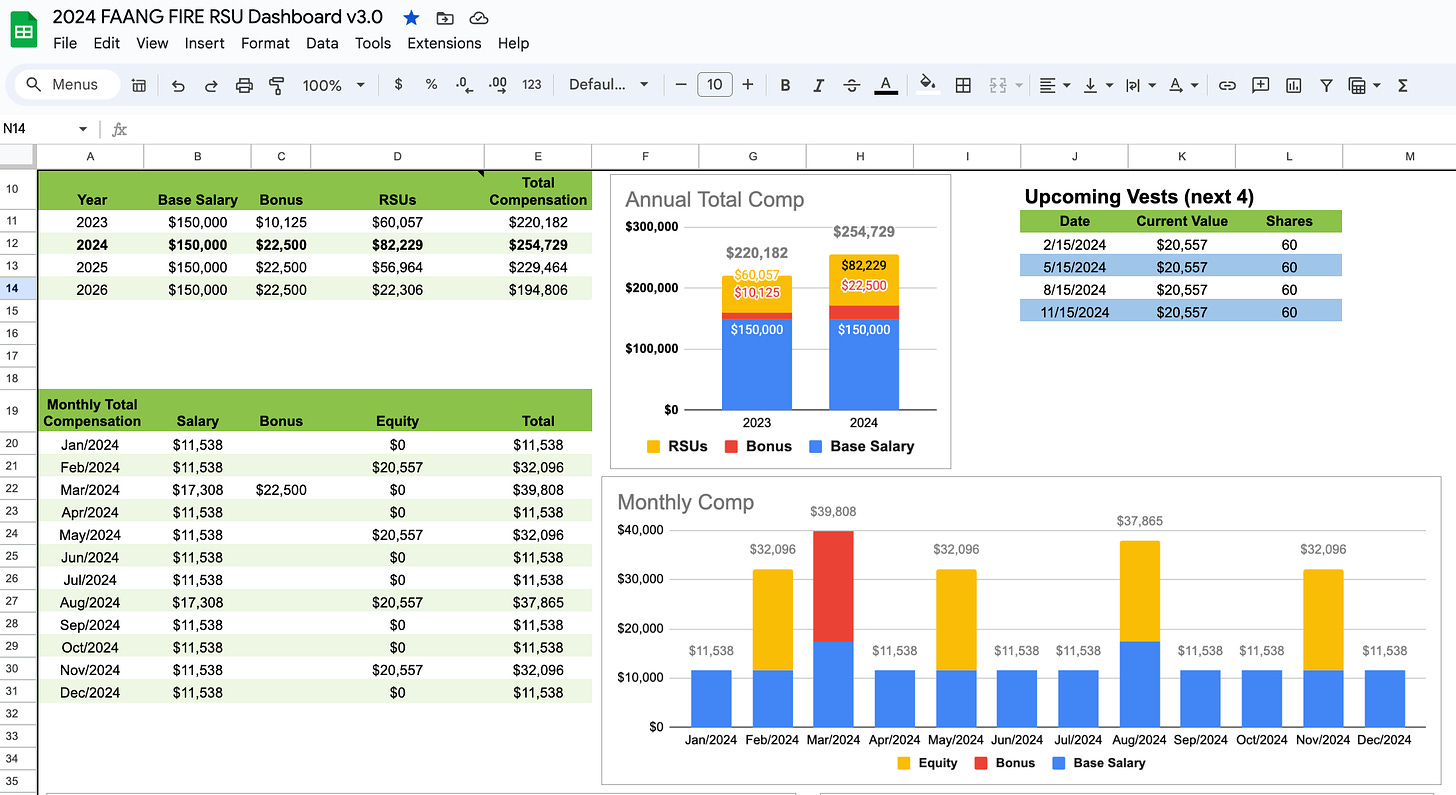

How I Track My RSU’s Using The FAANG FIRE Dashboard (link)

What this article covers:

Creating Your Own RSU Dashboard

Helping Your Understand how your RSUs impact your Total Compensation

Helping you proactively understand how much future income from RSUs you might have

5 Different Approaches to Selling your RSUs (link)

What this article covers:

Sell Everything on Vest (my approach)

The 5% Rule: Picking and writing down the max percent of your net worth you ever want your company stock to be.

Fixed x% Approach: Always keeping a set % of each vest for the long run

Sell Nothing: The Inertia Approach.

The Panic Approach: Abandon the “Sell Nothing” approach and panic sell after every crash

How I Sell All my RSUs Each Vest (link)

What this article covers:

RSU Tax Myth Busting

How I determine which shares to sell

My Personal Plan and how I deal with my partner’s Uber RSUs

Primer on Wash Sales & RSUs (link)

What this article covers:

How to decide which RSU lots to sell.

What happens when sell your RSUs for less than their value when they vested it is important to understand how wash sales can impact you.

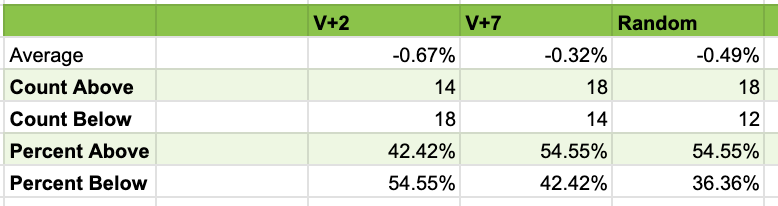

Does the Day you Sell Your RSU Vests Matter? (link)

What this article covers:

An analysis into selling immediately on vest vs selling randomly during the vesting window.

Looking at 9 years of real vesting data I concluded that it doesn’t matter when you sell during the trading window.

Here is the summary when comparing relative to V+1.

Don’t stress about V+1, V+2, or being late. If you sell at any time during the trading window your outcome overtime will be nearly the same historically.

Updating your Supplemental Tax Withholdings on RSU Vests (link)

What this article covers:

Under withholding taxes from RSUs is a major driver behind your large tax bill

How to Update Your Supplemental Tax Withholdings to prevent this

RSU Refresher Comparison Across FAANG (link)

What this article covers:

2023 Refresher Performance across FAANG

RSU Philosophies for Meta, Google, and Amazon

Your RSU Questions Answered (link)

27 Reader Questions on RSUs answered

What Do I Do After I Sell My RSUs?

So you came up with a plan for how to sell your RSUs. You painstakingly decided which specific RSUs to sell. But now you are sitting with cash in your broker and you don’t know what to do!

The lack of having a plan for the proceeds of your RSU sale is a major blocker for so many people. You are not alone if you feel this way! It feels easier to just do nothing. If I don’t sell my RSUs, I don’t need to figure out what to do with the cash — this is what you tell yourself every three months. You promise yourself that you will figure this stuff out next quarter. Then next quarter happens and you repeat the same lie to yourself.

Stop it! Take the time once and for all to come up with a plan.

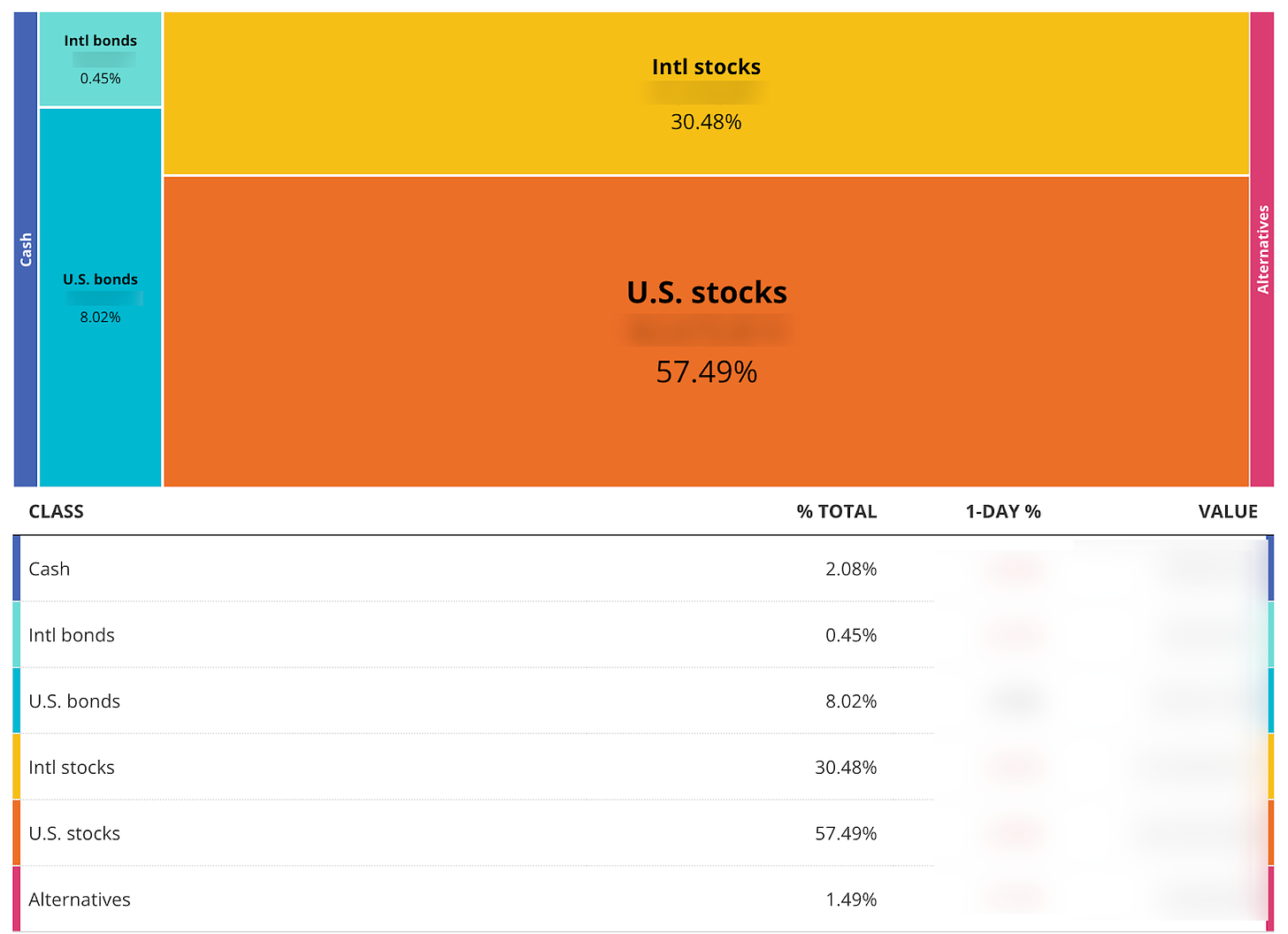

Again, my own plan is simple. I would sell every RSU each vest, transfer it to my Fidelity broker, then buy either VTI or VXUS depending on my current asset allocation.

I track my asset allocation using Empower’s Free Dashboard*. Empower far my favorite free tool for tracking my overall net worth and investments. I regularly use it for monitoring my top level net worth, tracking asset allocations across all my investments, their savings planner, and they have one of the best sets of retirement projection tools available.

*I have personally used Empower (Previously Personal Capital) for more than 10 years before ever writing this newsletter! I now sometimes receive commission when you sign up through my link. FTC Disclosure: Empower Personal Wealth, LLC (“EPW”) compensates FAANG FIRE for new leads. FAANG FIRE is not an investment client of Empower Advisory Group, LLC.

Closing Thoughts

I am hoping this post will act as a FAANG RSU reference guide. If there are specific aspects of RSUs you want to see covered, please let me know in the comments or as a reply to this email.

If you are trying to come up with your own plan, the first thing I would do is take a step back. Stop bucketing different types of income and treating them differently. RSU income is income. Paycheck income is income. Bonus income is income. Commission income is income.

Econ time: Money is fungible. That means that money from one source is the exact same as money from another source (simplified to think about it in after-tax terms).

This means that you really shouldn’t be coming up with a plan just for your RSUs but an overall plan for all your money. How money flows through your accounts should also be a reflection of your plan.

Start with the basics. Emergency Fund, Debt, Short Term Savings, Company 401k Matches, Other Tax Advantaged Accounts, and then building up your taxable broker.

Happy Vesting,

-Andre

For many years I didn’t sell FB stocks after vest. I felt bad selling them as they used be on the upward trend. I knew about the risks. Though after 2020 dip I learned my lesson and stared offloading on vest and gradually sold a lot of them over the years to buy VTI / some VGT.

I like the part about writing down your plan so that you don’t deviate from it. Thanks for sharing.

Thank you for this! I’m working at Meta in a non-tech role and fortunate to get RSUs for the first time in my career, and this is helpful. It’s not much compared to SWE roles but I’m so grateful for the extra income