FAANG RSU Increases Driving Total Comp Recovery

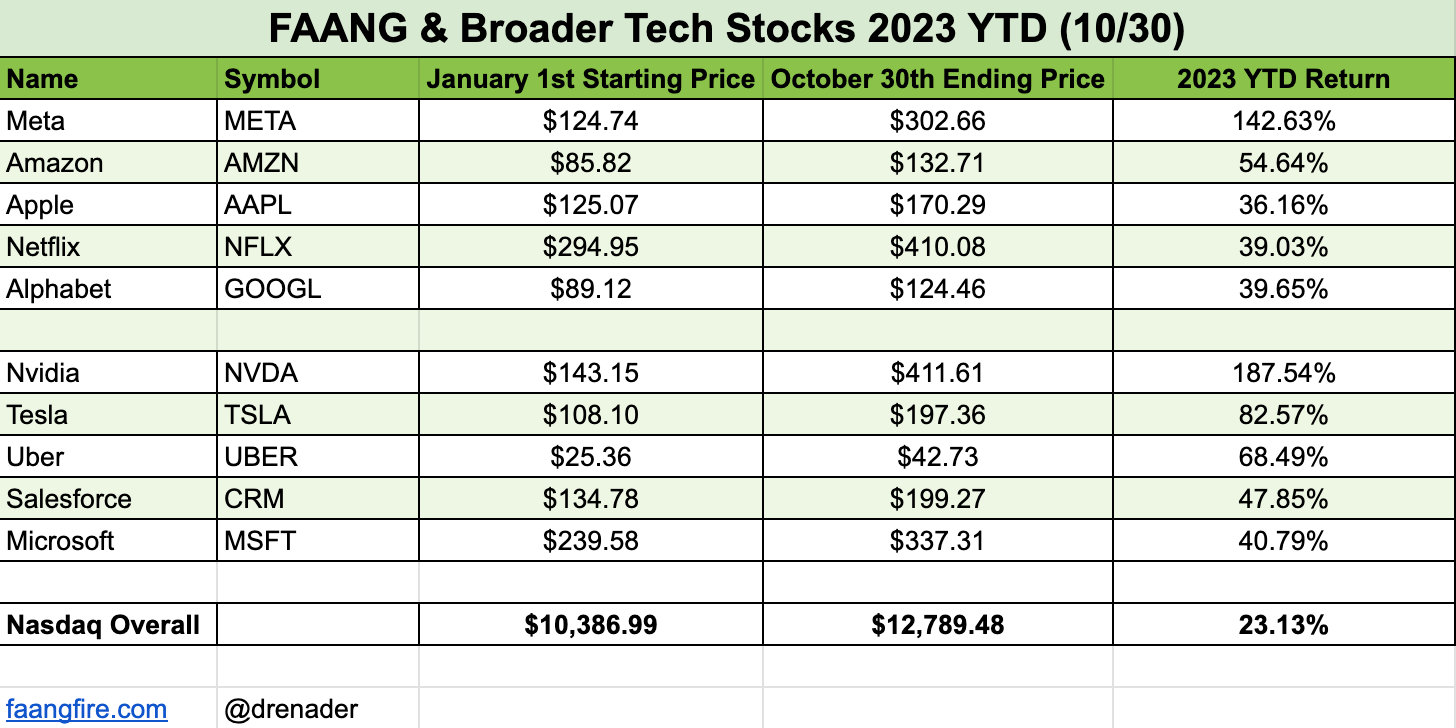

We have just closed out Q3 quarterly reports. While most of FAANG beat earnings expectations, investors found one reason or another to sell pushing many stocks off their recent highs… however FAANG stocks across the board have seen phenomenal performance year to date.

That means FAANG compensation is back!

One very important note… it isn’t all sunshine and roses across the broader tech market. More than 50% of the 1,000 largest companies in Nasdaq are negative year to date. So, if you are stressed out seeing FAANG stocks soaring while your company is down YTD, you are not alone. Not to mention those, like me, who were previously employed by FAANG companies but since being laid off no longer get to enjoy any future vests.

2023 RSU Refresher Performance

At each of the FAANGs, RSUs can make up an increasingly significant amount of an employees Total Compensation. Most of FAANG workers receive stock in the form of RSUs. They tend to get a “New Hire” stock grant as part of their job offer, in addition to receiving annual stock refreshers. Drastic swings in stock price over short periods of time can cause major swings up and down to Total Compensation. So how have employees at each of the FAANGs done so far in 2023?

Meta RSU Refreshers

Meta (Facebook) gives annual refreshers in an extremely formulaic process. The dollar value is determined based on an employees country, job role, level, and past performance. The number of shares is calculated based on taking that dollar value and dividing by the average Meta stock price for the first 7 trading days of February.

Meta employees received their annual stock refreshers this year at a price of $184.07. The current value of their most recent vests alone are up 64%. Stock refreshers vest quarterly, over 4 years, without any cliffs. The refresher grants are given in March with the first vest of those refreshers in May.

A $200,000 refresher is now worth $328,000, or $20,500 in Meta shares vesting each quarter from this refresher alone. 2022 refreshers were priced at $228.51 and 2021 at $264.81.

If someone has 3 years worth of RSU refresher, $200k per grant, they would now be vesting >$50k per quarter worth of RSUs in addition to any other prior stock grants.

Simplified Math Check : (200000/184.07/16*302.66)+(200000/228.51/16*302.66)+(200000/264.81/16*302.66)

Meta 2021 New Grad Update

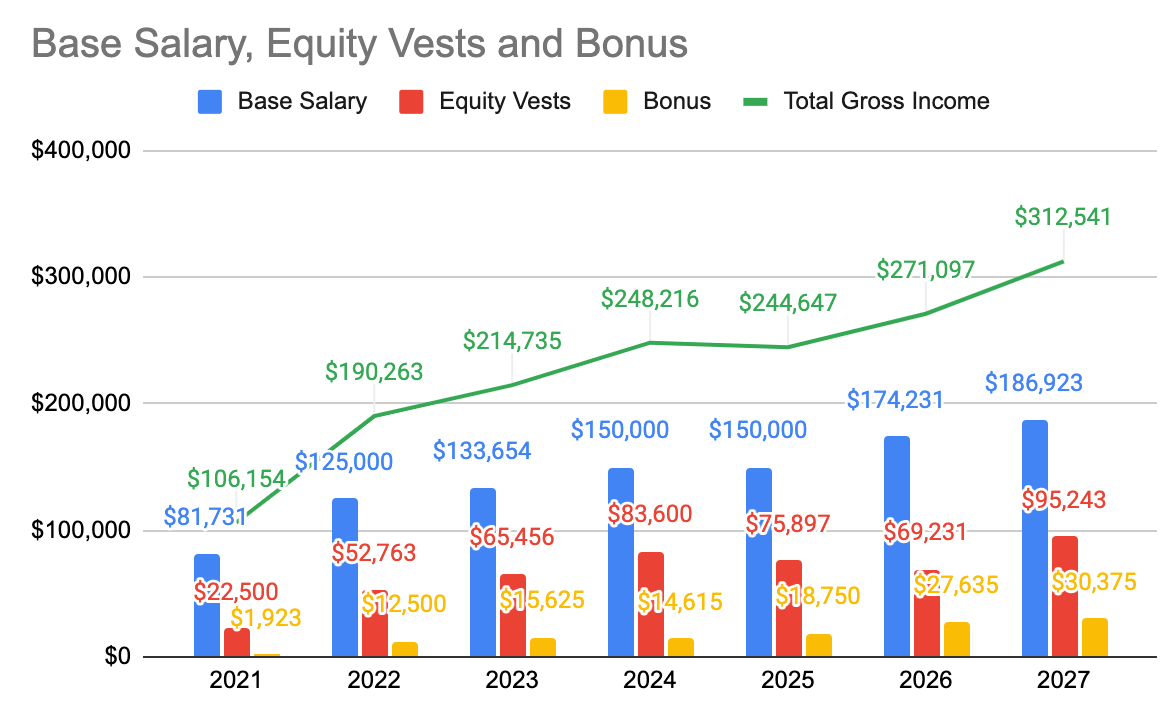

In 2021 I modeled out a new grad software engineer at Meta’s path to FIRE. It has been awhile since we checked in with Jane.

My original annual projections had Jane earning $214,735 this year.

In 2022 they saw the equity portion of their Total Compensation crash by 50%, leading to a >15% drop in Total Compensation.

For 2023 Jane’s Total Compensation is projected to be $219,004. Back above our original projections. You can also see 2024 is looking great. Even excluding 2024 refreshers Jane is looking at a 30% increase in RSU based compensation. This will get pushed even higher when Jane get’s a promotion in February which will see their base also increase to $150k (from 133k).

Alphabet

Google’s equity refresher is similar to Meta in that it is very formulaic. With the exception of an additional “Manager Discretion” which allows ones manager to have a greater say in your annual refresher amounts to a more direct degree.

Refresher grants are given in March and vest Monthly (for most higher earning employees) over 4 years. There is a little one-time nuance here since Google shifted from January to March grant dates and increased everyone’s equity award by 1/6th to make up for the shift.

Alphabet (Google) employees received their annual refreshers this year at a price of $78.56. The current value of their most recent vests alone are up nearly 58%.

2022 refresher grants were valued at $148.0365 (Down 16% in value from original grant).

Amazon

While Meta and Google give 4 year refreshers, Amazon seems to have varied their approach over the years. They currently give refreshers in 2 year chunks. Amazon also has a target overall compensation level for each employee and uses annual refreshers as a lever to control for that. Which means that if Amazon stock does really well, upcoming refreshers would be lower to keep employees within their target compensation bands.

Target compensation is based on Job, Level, Location, and Performance. There is also a built in assumption that Amazon stock will increase by 15% each year in order to hit target compensation. Amazon also doesn’t have the RSU’s vesting equally over the 2 years. They seem to vary the number of shares vesting in the short term to keep employees within target compensation. For example a 2 year refresher could start vesting in 1 year with 33% vest, another vest in 6-months at 33%, with the remaining vests % amount.

Again, each input from shares, vest schedule, amounts is used as a lever to help Amazon better control Target Comp. This is very different from Meta, where the refresher formulation is more blind to an employees current target compensation.

Apple

I don’t have a data points. If you have this info, reach out and I can update. To my understanding they issue annual refreshers which vest every 6 months over a 4 year period.

Netflix

Employees can elect the % of their compensation as salary vs stock options. Based on the most recent Netflix securities filings, 27% of all outstanding employee options are currently priced higher than the current stock price (ie not worth anything at the current price).

Closing RSU Thoughts

There is a fascinating phenomenon that happens where rational people make irrational decisions. More people hold onto their vesting RSUs when there are large increases and sell more frequently when RSU values are lower. Please remember, when your company RSUs vest, it is the exact same from a tax perspective as if they gave you cash. So if you wouldn’t use a cash bonus to buy your company shares, the rational decision would be to not continue to hold your company shares.

Compensation is compensation is compensation. It doesn’t matter if it is base salary, bonus, or RSU’s. I truly do not believe nearly 50% of Meta employees (from blind) would use a cash bonus to purchase more Meta shares. Not financial advice… it just hurts my mind.

Free FAANG FIRE RSU Video Calls

One very acceptable reason is fear or lack of confidence. This is particularly true for people when it is their very first time selling. Thinking about taxes, selecting the wrong inputs, or even just not understanding the selling flow, can all get in your way.

So for the next two Wednesday’s I will be hosting an RSU office hour. Anyone can drop in with their questions and I will share how I would approach it and give you the education to help you have the confidence in your own decisions.

Quick Hits

Mint.com will be closing down and merging into CreditKarma. One easy, and free, recommendation I always make for overall Net Worth tracking is Empower. It is by far my favorite overall Net Worth tracker. I really like the investment breakdowns and various projection tools they give… all for free. If you sign up through my referral link I may earn a commission. Even if I wasn’t an affiliate partner I would be recommending them.

My Current Spending/Personal Finance Tech Stack:

Mint: OG. Historical data. Intuit forgot about it.

YNAB: I like using this for very intentional spend tracking. I also use this often when doing financial coaching to help people better understand their spend.

Empower (Personal Cap): Free, Great for Net Worth Tracking, Good Investment Tools, Good Projection Tools

Monarch: Good overall spend/goal tracking. Decent for overall net worth. Better category selection and rule based automation for categories. Underwhelming Investment tracking. Really visually nice and good shared account controls (ie couples, and can even give guest access to say a coach temporarily).

Quicken Classic: Like... downloaded software. Great for more detailed tracking and custom reporting. Can track individual investment lots (a little manual). Can output different tax forms. Complicated.

New Retirement: The best tool for more detailed retirement projections, helping estimate lifetime tax obligations, RMDs, and Roth Conversions.

ProjectionLab: Great overall networth projection tool. Can built out complicated future scenarios.

CoPilot: On my list to test out. Most compelling feature they have is an Amazon connection that will categorize at the order lvl.

TillerMoney: On my list to test out. Super powers your GoogleSheets/Excel docs with all the automation goodness the other apps provide.

I’ll make a post outlining the many other different tools I use. Each has different strengths and weaknesses. For example I wouldn’t use Empower for monthly spend tracking… it can do it, but it just doesn’t do a great job.

Start Thinking about Tax Loss Harvesting to offset your income by $3,000. I wouldn’t go crazy, tax loss harvesting can be a waste of time beyond that.

RSU values have gone crazy. It isn’t a bad idea to estimate your tax bill early this year. You may be able to adjust your RSU tax withholdings for your final vest to help soften the blow.

That is it for now. Have a great final two months of the year. Join me on Wednesday for RSU Office Hours and consider becoming a Founding Member of FAANG FIRE to help support my writing and get personal 1:1 time to chat through your own FIRE journey.

-André