Year 2 of The New Grad FAANG Engineer's Path to FIRE

Part 3 of following a new grads career on the path towards early retirement

Welcome to Part 3 of our fictional FAANG engineer’s path to FIRE. Be sure to read through part 1 which includes a lot of the set up and assumptions made as well as Part 2 which goes deep into Jane’s first year.

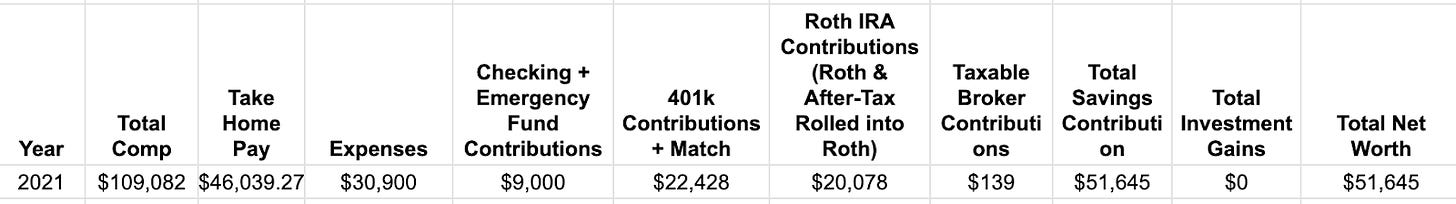

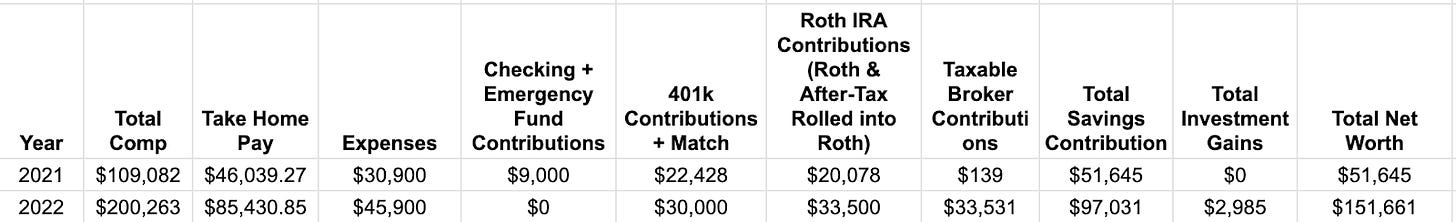

Here is where Year 1 left Jane:

$51,645 Total Net Worth

Maxed out 401k ($19,500 + $2,928 match)

Maxed out Roth IRA ($6,000)

$14,078 into After-Tax 401k contribution which was rolled into the Roth (this is out of a max $27,500 potential contribution the FB plan allows)

$139 in a taxable broker

$9,000 Checking & Emergency Fund

Year 2:

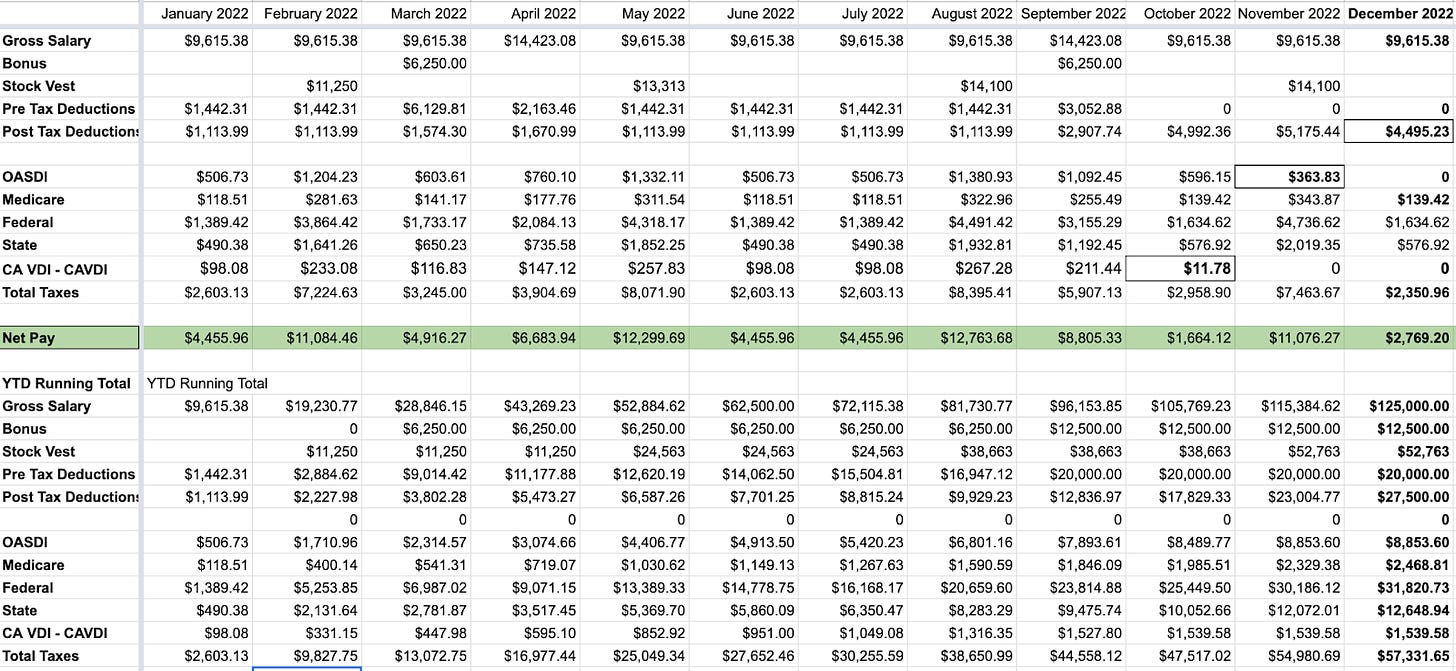

Calendar Year 2 (2022) will be Jane’s first full year of employment! With that comes a full year of salary, stock vesting, and bonus.

401k Contributions

In year 1 the 401k contributions were a little complicated due to wanting to both max our potential contributions but also make sure we had enough cash flow to cover our expenses while building up an emergency fund. This year will still see some adjustment, but it should be one of the last ones needed.

Another key thing Jane is doing is contributing very large percentages directly from their Bonus. This is a great way to quickly inject contributions that mentally aren't part of your normal monthly budgeting.

Jane’s 2022 401k Contribution Settings:

Pre-Tax: 15%

Pre-Tax Bonus: 75%

Roth: 0%

Roth Bonus: 0%

After-Tax: 20%

After-Tax Bonus: 50%

This will result in maxing out the full $20,0001 Pre-Tax 401k in September. Since Jane has a bit more cash flow they will adjust their contribution settings one more time in October to ensure they max out the $27,500 for After-Tax 401k.

October 2022 401k Contribution Settings (changes in bold):

Pre-Tax: 15%

Pre-Tax Bonus: 75%

Roth: 0%

Roth Bonus: 0%

After-Tax: 75%

After-Tax Bonus: 50%

Bonus

Jane still earns $125,0002 per year in base salary. They receive the following performance ratings that will impact their bonus payouts in 2022:

March 2022: $6,250 for Meeting All Expectations in the previous half year (H2 2021)

September 2022: $6,250 for Meeting All Expectations in H1 2022

Stock Vesting & Refreshers

In addition to Jane’s original $180,000 equity grant which is still vesting quarterly, Facebook give annual equity refreshers in Q1 of each year. These are based on level and performance. For Jane having only worked a partial year and received Meets All Expectations a rough estimation for their first refresher would be $33,000 worth of additional Facebook shares which also vest quarterly.

Quick Math:

I am appreciating the Facebook stock value by 7% a year (1 year from first vest for simplicity). So instead of $11,250 per quarter from Jane’s new hire stock grant they will receive $12,038 beginning in August.

May is the first quarter where Jane will receive both the $11,250 as well as $2,063 from their first refresher.

August and November Jane will receive $12,038 + $2,063 (original grant’s vest appreciated by 7% + refresher1)

Monthly Paychecks

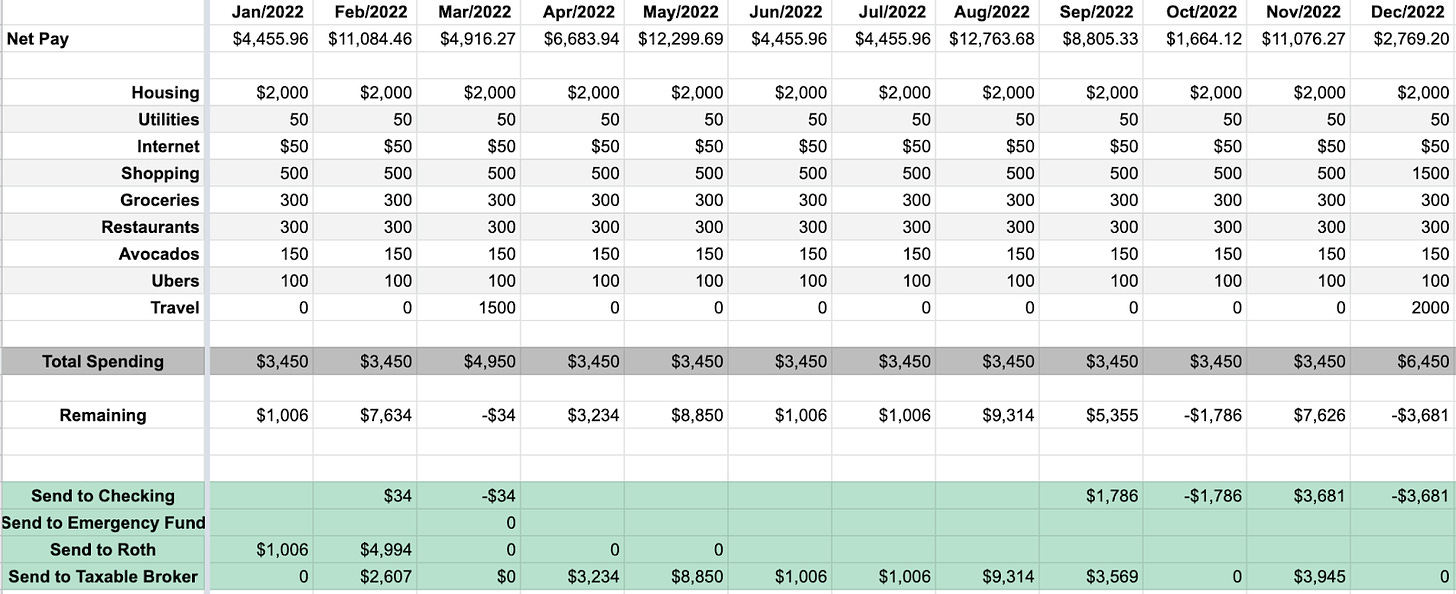

Budget

The overall budget increases from $30,900 to $45,900 which accounting for spend per month is actually slightly less per month $3,862 -> $3,825. Main reason was the rent deposit and extra shopping budget in the first month of 2021. The primary change was that Jane increased their travel budget from $1,500 -> $3,500. There was also an overall $150 increase per month allocated to Restaurants and Avocados. This will result in Jane being able to save an additional $33,000 on top of all their retirement contributions. So if you disagree with the overall budget simply adjust the extra you wish to spend from that $33k.

The excess will flow in this order:

If there are larger planned expenses in the next month Jane keeps the excess in their checking account

$6,000 into a backdoor roth (It sounds complicated but is pretty simple. Jane needs to do this due to not being able to contribute to a Roth directly due to a higher income.)

Everything else goes into Jane’s taxable brokerage account. This will allow Jane to save an additional $33k in their taxable brokerage account.

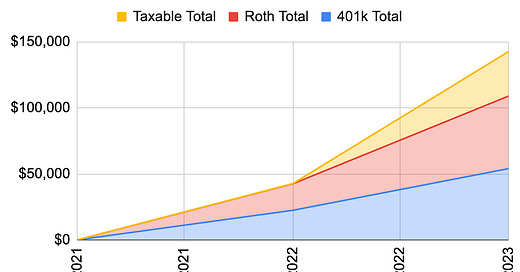

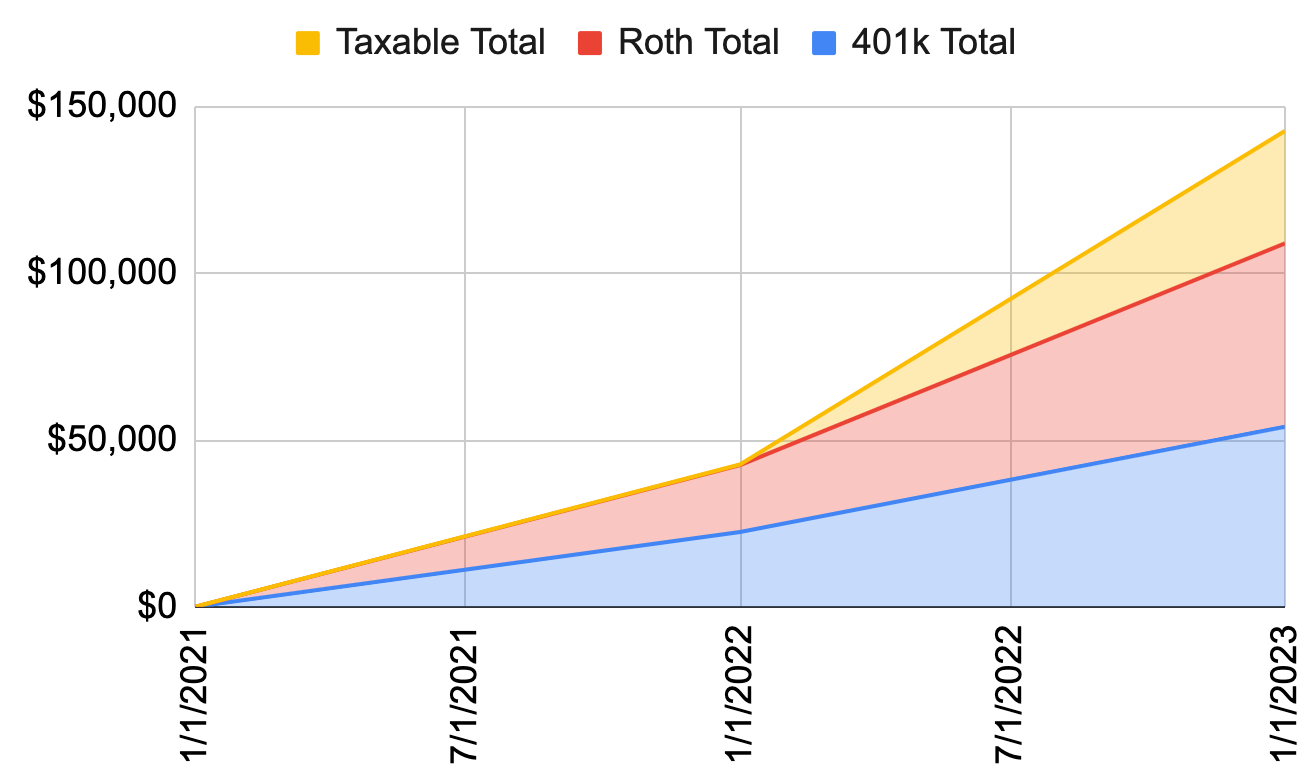

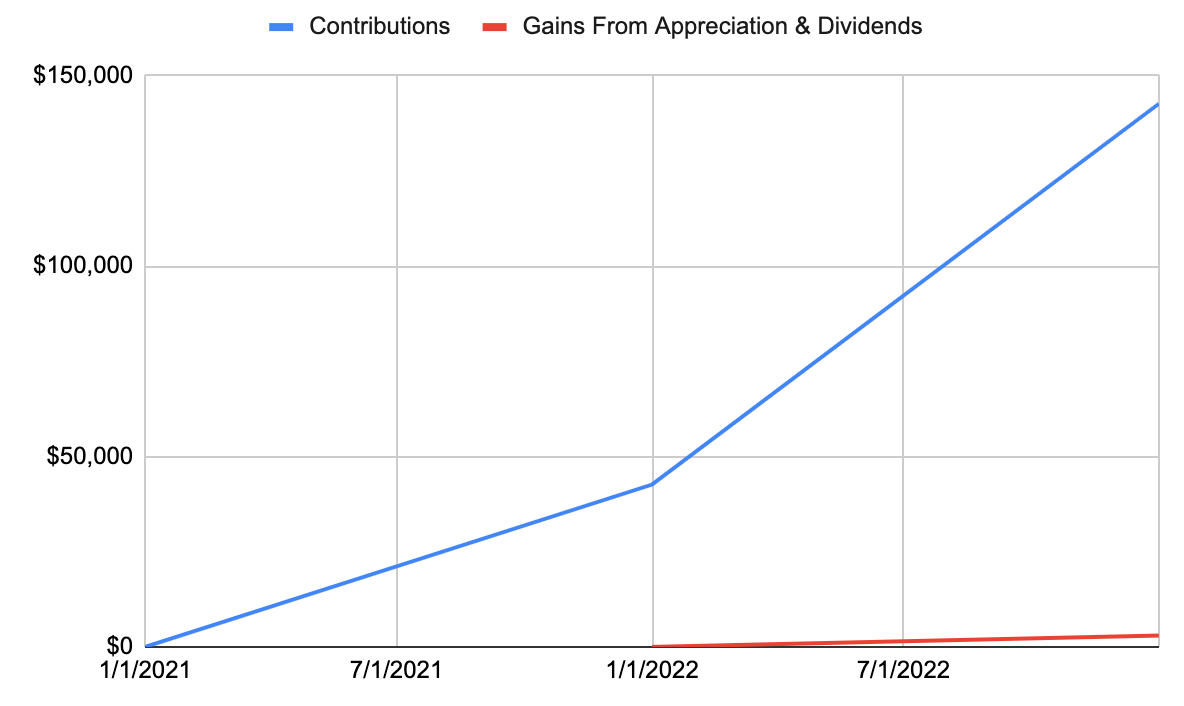

Jane was able to contribute an additional $97,031 in 2022! Factoring in the $51,645 saved in 2021 plus the investment gains from their 2021 investments of $2,985 brings Jane’s 2022 Net Worth to $151,661.

One key thing I want to point out is that for the first decade of savings contributions will likely comprise >80% of all your investment value. Compound interest is a hell of a thing over time… key thing there is “over time”. Right now the most important thing will simply be how much can be saved each year.

Now that I have spent time covering the nuances of Jane’s income sources and investments the next few years will be more straightforward. The only changes will be higher salary due to two promotions and the increases in equity and bonus that come along with that.

Continue with Jane on their journey going into year 3 and beyond:

I am making an educated guess that 401k limits are about to be increased to ~$20k per year.

Technically each year Facebook grants everyone a raise in Q1 of each year based on performance. This happens even without a promotion and is based on the salary bands at your level as well as past ratings. This also captures some market adjustments due to inflation and competition (since I am not factoring in inflation in other places keeping it removed from here makes overall comparisons less skewed).

Wait! What's that "Avocados" budget for? :)