This year my family switched from our EPO health insurance plan to a High Deductible Health Plan with a Health Savings Account (HSA). I had been on the EPO for most of the last decade, choosing simplicity and less overall hassle that comes with the EPO over any financial savings the HDHP w/HSA might have.

For both Meta & Uber in California there has always been some variation of these options:

HMO via Kaiser

Requires you to use Kaiser for everything.

PPO via Meritain at Meta and Blue Shield of California at Uber

Most expensive but allows the most flexibility with in-network and out of network co-pays.

EPO again via Meritain at Meta and Blue Shield of California at Uber

The love child of an HMO and PPO. You are not tied to a specific hospital, but generally need to stay in-network for most reimbursements.

HDHP w/ HSA Meritain & Blue Shield with HSAs held at Optum and HealthEquity

Lowest cost option in most cases and makes you eligible to have an HSA account. You will pay out of pocket for everything other than preventive care until you hit a deductible.

Using the EPO in the San Francisco area had always been dead easy for my family. No deductibles to think about, very low co-pays, and all major hospitals were in-network. But this year, I decided it was time for a change.

So why did I decide to go with the HDHP over the EPO option this year?

I wanted to test out whether the benefits of a HSA can overcome the potential hassle of having a High Deductible Health Plan.

What Makes Health Savings Accounts Awesome?

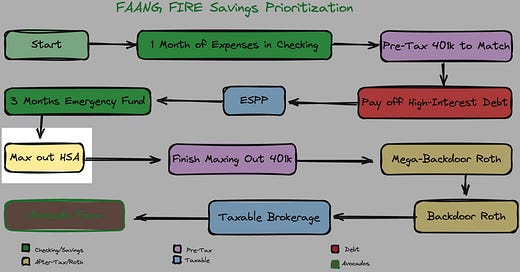

To help provide some context into how awesome an HSA account is, I thought it would be helpful to see where it falls in my Savings Prioritization Waterfall:

I view maximizing your HSA contributions as better than maxing out your 401k beyond the employer match and before contributing to your Mega-Backdoor Roth. To be clear, I think you should do all of these if you have the means— but if you HAD to choose I would select maxing out an HSA over contributing to your 401k beyond the employer match.

Wait— we were talking about health insurance. Why are we talking about saving money and investments? (What I imagine you wondering.)

If you treat the Health Savings Account (HSA from here on out) as an investment account, it is by far one of the best accounts you could have. But you can only fund an HSA if you have a qualifying High Deductible Health Plan (HDHP). To realize the benefits involves needing to pay for all your medical expenses out of pocket and investing the money within the HSA account to like any other retirement account.

The HSA Advantages

It gets funded pre-tax.

It grows tax-free.

You can withdraw tax-free for qualified medical expenses.

Penalty-free withdrawals for non-medical expenses after age 65

Funds are not subject to RMDs.

1. Pre-Tax Funding

HSA contributions are funded with pre-tax dollars. This means it will reduce your taxable income by the amount you contribute.

Note for California and New Jersey residents: For whatever reason, these two states do not treat the income as pre-tax at the state level. So you will still pay state level taxes on your contributions if you are in these two states. You are still saving at the federal level.

2. Tax Free Growth

The amount you contribute into your HSA can be invested! The funds within the account will grow tax free just like a Roth IRA.

Note for California and New Jersey residents: The growth is taxed as normal income in these states. So if you sell within your HSA, you may still be subject to state taxes. For those outside these two states, the growth is tax free at the state level. You are still saving at the federal level.

3. Tax Free Withdraw (for qualified medical expenses)

Even though the HSA was funded with pre-tax dollars, when you withdraw for qualified medical expenses, you do not need to pay any federal income taxes (or state taxes unless you are in California and New Jersey).

4. Penalty Free Withdrawals for Any Reason after Age 65

Normally, if you withdraw funds from an HSA without a qualified medical expense, you would owe taxes on the withdraw plus a 20% penalty. After the age of 65, you are no longer subject to the 20% penalty. The withdrawal would still be subject to ordinary income taxes.

5. Not Subject to RMDs

We haven’t discussed Required Minimum Distributions on FAANG FIRE yet. With Pre-Tax accounts (Traditional IRA, Pre-Tax 401k) the IRS eventually will want to have those funds taxed. So, starting at age 73, you are required to begin withdrawing funds from those pre-tax accounts. Even though your HSA is pre-tax, it isn’t subject to these Required Minimum Distributions.

6. Bonus Benefit: Adult Children Double Dipping Contributions

Another fairly unknown benefit for parents of adult children who are on their HSA-qualified plans is that both you and your child can separately contribute to the family max of $8,300! See William Stuart’s LinkedIn Article for full details.

Contribution Limits

For 2024, a single taxpayer can contribute $4,150 if you are single and $8,300 for families, with those over 55 able to contribute an additional $1,000.

Within the FAANG FIRE audience this isn’t a very large annual amount, particularly when most are already contributing $69,000 into their 401ks in addition to $7k into backdoor Roths. It can definitely add up over time though, and I have seen some view this as dedicated funds to be used to self-funded their long-term care needs.

How to Take Full Advantage of Your HSA

Most people use their HSAs wrong. Here’s how to get the most out of yours:

Treat your HSA just like a ROTH IRA.

Think of your HSA as an investment account, not just a place to stash cash for medical expenses. Fully invest the funds within your HSA just like you would with any other Roth funds. This way, your contributions can grow tax-free over the years.Pick the Right HSA Provider

If your HSA provider charges fees to invest or doesn't let you invest the full amount, it's time to shop around. You're not stuck with the HSA provider your company uses—you can transfer your funds to any provider you like. I personally use Fidelity’s Free HSA accounts (not sponsored). Throughout the year, I transfer funds from my employer's HSA provider over to Fidelity. Zero fees and I can invest the entire amount however I want.Pay Medical Expenses Out of Pocket and Save Receipts

Whenever possible, pay your medical expenses out of pocket. Save all those receipts but don't request reimbursement. You can collect receipts throughout your life and choose to reimburse yourself later. There's no time limit on when you can reimburse yourself, as long as the expenses were incurred after you opened your HSA. Just keep the receipts handy in case the IRS ever comes knocking. I have a dedicated Google Drive folder and Gmail filter for this purpose. Alternatively, since medical expenses in old age are inevitable, some folks save these funds to use as a self-funded long-term care fund.

Please go log into your HSA account right now. This applies to your old HSAs too. Make sure the funds are fully invested. Don’t leave money on the table.

Did I just save you tens of thousands of dollars over your lifetime?

A household in the 32% tax bracket that contributes the family maximum of $8,300 would reduce their federal taxes by $2,656 per year.

If you only use health care for preventive care, you will often save over $1,000 per year in insurance premiums.

Plus a lifetime of additional tax free growth and tax free withdrawals when used for medical expenses.

I just spent >1,000 words telling you why HSAs are great. The ROI of the HSA is easy to calculate. The Return on Hassle, on the other hand, is more subjective.

“Return on hassle is the idea that you need to consider the time and work associated with an investment in addition to its expected return.” -Nick Maggiulli

So even though HSAs are amazing, I think 2024 has taught me that it isn’t the right fit for my family. I’ll walk you through how I think about the “Healthcare Math”, and why the return on hassle (the time, energy, and stress that goes into it) is too high for my family right now.

Deciding Between HDHP, PPO, or EPO

There are few moments when everyone is collectively forced to make decisions that will impact their entire year. Open enrollment is one of those moments, presenting a myriad of options: HDHP, PPO, EPO, HMO, VSP, questionable dental insurance, and a random assortment of other insurance options.

Since I am Semi-FIRE now, I no longer have my own employer subsidized health insurance. Instead, for 2024 the full family jumped over to my partner’s health plan at Uber. I took the opportunity to really run the numbers comparing our past health related spending habits and projecting out the impact of choosing the HDHP w/HSA over the PPO or EPO options. I am always looking for a new excuse to create a spreadsheet.

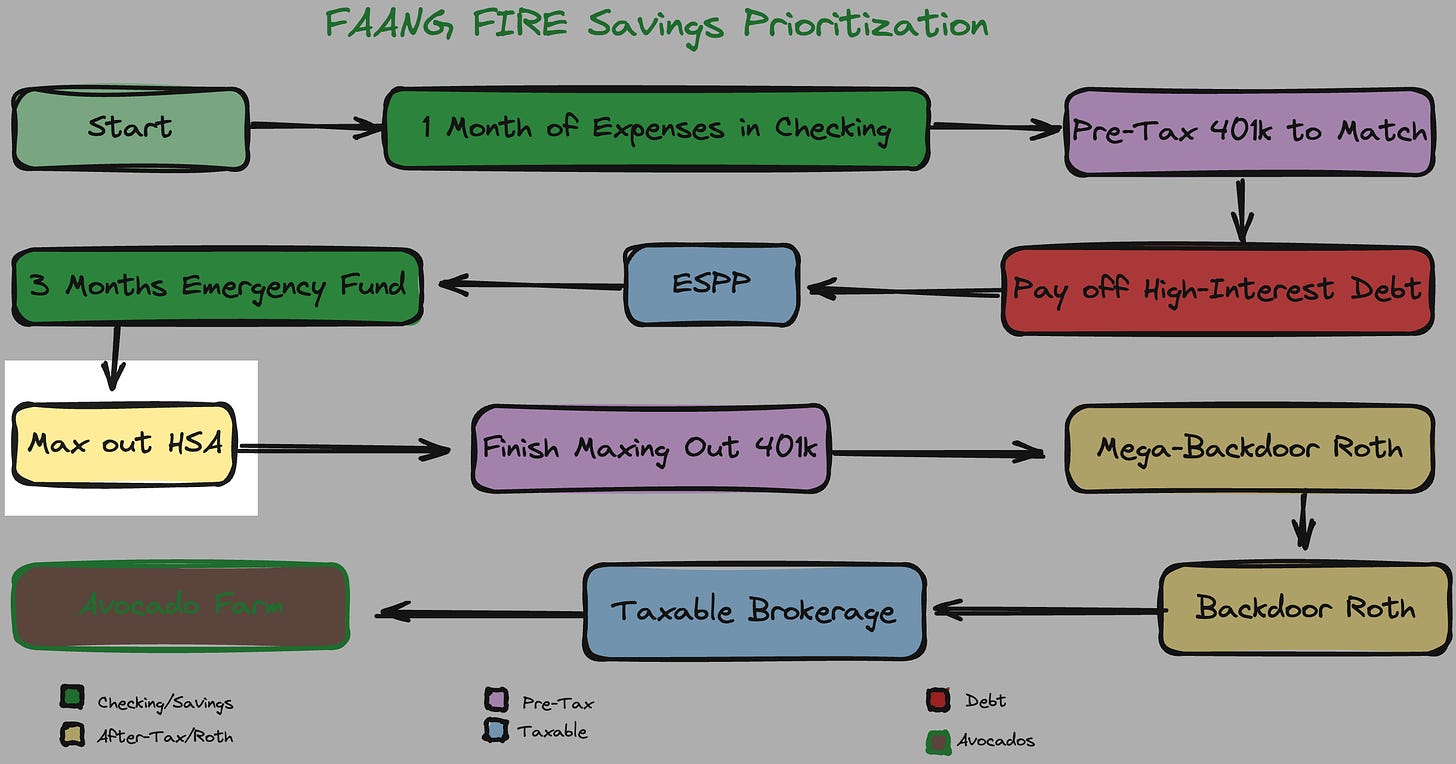

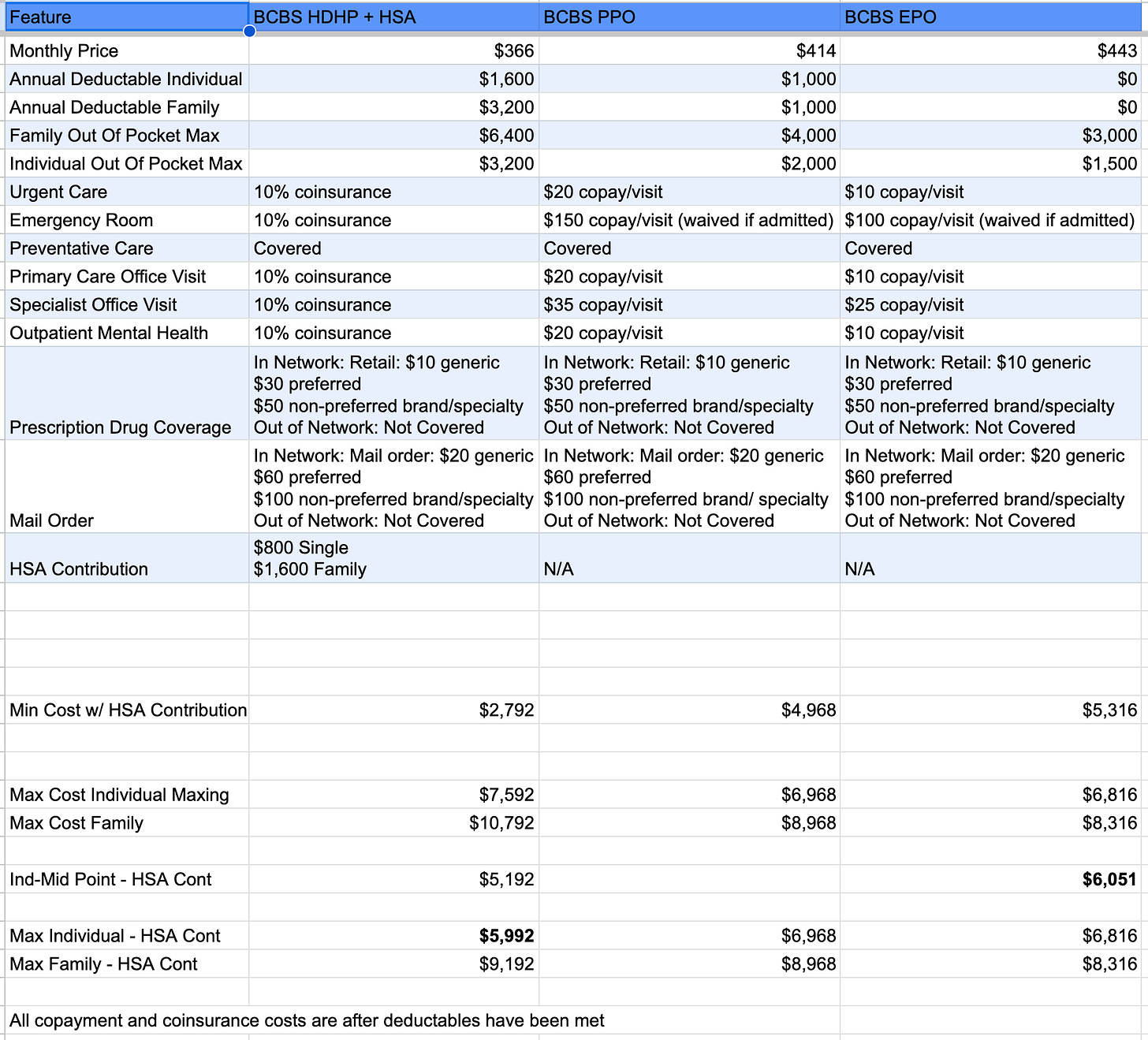

Here is my high level non-personalized estimate of Uber’s 2024 healthcare options. I wanted to estimate the minimum annual cost as well as the maximum potential cost.

Lowest Cost Possible: The annual minimum cost of the HDHP w/HSA (including Uber’s contribution) would be $2,792.

Highest Possible Cost: If we were extremely high consumers of health care in 2024, the maximum out of pocket also was the HDHP w/ HSA coming in at $9,192.

To try and estimate where our household might fall between the minimum cost and maximum cost I exported all our health claims over the past 2 years, classified visits, looked at all prescriptions, and made a few educated guesses into our future healthcare needs.

It sounded like a simple projection.

Spoiler: It was not a simple projection.

There are few things more frustrating than trying to calculate potential coinsurance amounts or figure out which tier each medication you have falls under. I focused my analysis just on the EPO and HDHP since we have never had an issue personally staying in network within the San Francisco Bay Area (except that one time I went to a Dr who is normal in network, but not when they are at the hospital I visited them in, isn’t insurance fun?)

The High Deductible Health Plan is the easy choice if you are young and healthy. It features the lowest monthly premiums and Uber will also contribute to your HSA for you to sweeten the deal even further, $800 if you are getting coverage just for yourself and $1,600 if covering your family (even if it is just you and a dependent with your partner on their own plan through their employer).

This brings the minimum cost per year for a family to $2,792 (factoring in the HSA contribution from Uber) vs $5,316 with the EPO.

If you have an accident or are a big user of healthcare services, it becomes a little more complicated. My family probably leans towards the mid-point or high end depending on the year. So for my calculations I focused on the maximum out of pocket for a family. Which was $10,792 for the HSA, or $9,192 after factoring in the Uber HSA contribution (intentionally simplified calculation) versus $8,316 for the EPO.

Even though the HDHP w/ HSA had a maximum out of pocket that was ~$876 more than the EPO, I decided the extra benefits of being able to contribute to an HSA in addition to testing the waters to see how we liked being on an HDHP for the first time with a child would be a good experiment. On top of estimating a high likelihood of the actual amount being much closer to break even.

The Hassle of the HDHP

Is the return on having an HSA worth the hassle?

We are now nine months into the HDHP w/HSA experiment, I think I have the answer. For us personally, I don’t think the hassle is worth it.

One of the reasons the High Deductible Health Plans are more affordable is that the upfront costs are intended to incentivize consumers to be financially motivated to make more affordable decisions. With the EPO every urgent care visit is $10. With the HDHP you are paying the full amount out of pocket, this could be hundreds of dollars. That means the consumer with the HDHP is going to shop around more or forgo that urgent care visit.

So far, 2024 has really tested things for us. We have already blown past the $3,200 family deductible and are chipping away at the full out of pocket maximum. I want to say we had an emergency room visit (our 6 year old required a single stitch in her lip from a fall), at least 6 urgent care visits (flu, strep, ear infections, twisted ankles, hand foot and mouth, stitch removal), a number of out of network specialists, and expensive prescriptions.

When I had the EPO, I wouldn’t think twice about going to urgent care. With the HDHP, I mentally hesitated each and every time. As someone who is naturally frugal, I can’t help thinking about the cost. This resulted in me potentially delaying or avoiding healthcare that would have made my quality of life better in the short term.

I hate that I would hesitate in getting care. Isn’t the point of FIRE that I don’t need to factor in the financial implications of my decisions? Price be damned… Right?

Considering my family seems to be on the medium/high medical expense buckets in addition to the behavior hassle we experience with the HDHP I think for this upcoming open enrollment we will once again run the numbers but heavily lean towards the EPO options again. Sometimes, even though the ROI is there, the return on hassle isn’t.

Thinking About Healthcare & FIRE

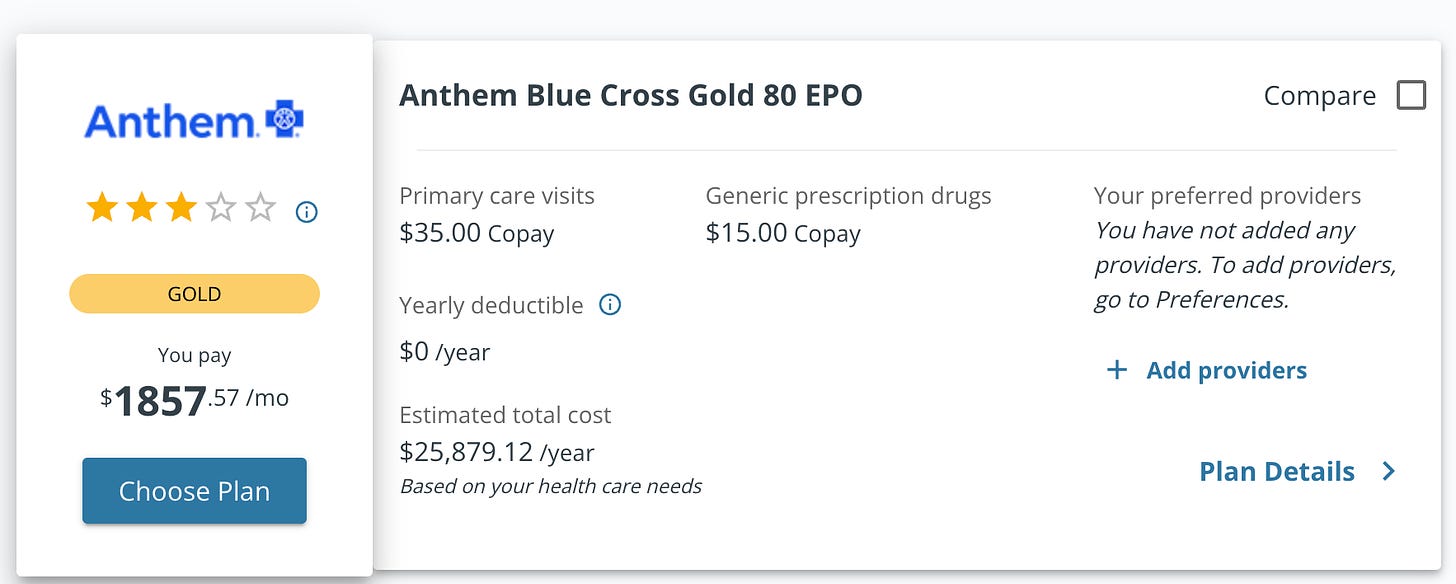

Knowing how we felt as a family about the HDHP w/ HSA helps us better understand and price our long term health care cost needs when we are fully FIRE and reliant on the health care marketplace for coverage.

I can make sure I am properly estimating future healthcare costs as I think about “How Much is Enough to FIRE in San Francisco”. Instead of pricing the lower cost HDHP’s, I will be ensuring that I am factoring in the costs of the EPO options.

Health insurance while retired early is a fascinating subject. It is one variable that is really challenging to confidently project out long term. The current system under the Affordable Care Act is actually an early retiree’s dream. You can have millions in the bank but if your AGI is low enough you could qualify for significant subsidies. Predicting what that same system will look like 5, 10, or 20+ years down the line, seems like a fool's errand. That is a topic for another day!

Now that you understand how powerful HSAs can be in your FIRE journey, especially if you're young and healthy, it's time to take action. Ensure you're maximizing their benefits and carefully consider your options during the upcoming Open Enrollment. Your healthcare choice is one decision that impacts your next entire year—make it count. Think ROI AND Return on Hassle.

-Andre

Great thought experiment (or actual experiment, in your case!). I am definitely not frugal by nature, and I'm always thinking about the value of my time when making decisions that will cost me either time or money. Personally, I would be very inclined to just pay for the EPO plan and do away with the decision making and price shopping that comes with every healthcare need, especially with young children. The additional stress is not worth the benefits the HSA offers. Plus, you're not getting the deduction or tax-deferred growth in SF!

Loved your concept of Return on Hassle. There's just too much uncertainty with the HDHP/HSA plan. That one time I enrolled in one few years ago based on my own past health care expenses and projections was the same year I needed to undergo an ER visit followed by a procedure. That coupled with a few other urgent care, paediatrician visits, and prescriptions. I made my decision then that I'll always just stay with my Kaiser HMO plan that's predictable and less stressful.