Hey FAANG FIRE!

You have heard your colleagues talk about this “Mega Back Door Roth” thing? Or perhaps you read about it here on FAANG FIRE and thought it was some exotic, complicated, advanced strategy.

I’m here today to tell you that it’s one of the easiest things you can do.

I’ll walk you through exactly how to do it, dive deeper into what is happening under the hood, and then share how I almost lost out on over $5,000 in company match by not understanding the Uber 401(k) true-up.

The reason I get excited about the 'Mega Backdoor Roth' is that it’s the only way a high-income earner can put significant amounts of money into a Roth account each year. A normal “back door roth” maxes out at $7k, while a “mega backdoor roth” could allow you to save over $30k per year. This is money that will benefit from a lifetime of tax free growth and tax free withdrawals in retirement.

If you are a high earner who is already maxing out your Traditional 401k and is looking for more tax advantaged accounts, the Mega Backdoor Roth is for you.

All US FAANG workers should have access to this. So let’s jump into how easy it is to start contributing to your MEGA BACKDOOR ROTH!

If you are not currently contributing anything to your Mega Backdoor Roth, I challenge you to start doing so. Even a small percent just so you can get familiar with the mechanics of how exactly it works.

Mega Backdoor Roth: Simplified Set Up

Contributing is very easy, especially for Meta employees. Literally all you need to do is add a number into a box and change a drop down. For many other you may have to add in a phone call, otherwise just as easy!

Step 1: Go to your companies 401k contribution screen (Netbenefits if your company uses fidelity). If you see “After-Tax” as one of the contribution options, congratulations, you have access to the mega backdoor roth!

Step 2: Change that number in the box next to “After-Tax” to the percent of your after tax earnings you want to contribute.

Step 3 (Meta Specific): Change the drop down under “Daily Roth In-Plan Conversion” to “Convert after-tax contributions.

Meta folks are done! You are now contributing to a mega backdoor! Pat yourself on the back.

Step 3 (Non-Meta): Wait until after your first pay period where the After-Tax contribution has deposited. Then call your 401k provider and tell them “I would like to perform an in-plan conversion of my after-tax 401k contributions into a roth 401k.”

After they do this, initial in-plan conversion. Ask them if they can set it up on their end to automatically to the in-plan conversion for all future after-tax contributions. This is possible with Uber’s plan with Fidelity, so I assume others might have this functionality.

If that isn’t possible you will want to call your 401k provider periodically to do the in-plan conversion. It doesn’t need to be every single paycheck, but I would call at least quarterly; otherwise, you risk paying taxes on any dividends the account might generate while in the 'after-tax' state.

BOOM! You’re now contributing to a Mega Back Door. You too can now sound cool and sophisticated at dinner parties.

Do me a favor, if you are contributing to your Mega Back Door for the first time due to this post, reply to this email and let me know. Even if it is just 1%, the most important thing is just getting started and understanding the process.

Solo 401k w/ Mega Back Door

Writing about Mega Back Door Roths at big tech made me envious. Since I no longer have a W2 job, I don’t have access to a normal workplace 401k.

Luckily, there is a solution for my envy! If you have your own side-business you can contribute to a Solo 401k, some of which include access to Mega Back Door Roths.

I personally use Carry Money for my Solo 401k, where I funnel any profits from FAANG FIRE straight into! I would definitely recommend Carry Money for anyone with a side hustle or your own business. There is a $299 annual fee, but they helped me receive a $500 tax credit as part of the Secure 2.0 Act, which I’ll also get the next two years.

This email isn’t sponsored, but I may receive an affiliate commission if you sign up through my link. This helps FAANG FIRE generate a profit so I can contribute back into my Carry Money account while also keeping FAANG FIRE free.

Mega Backdoor Mechanics

After Tax? Mega Backdoor Roth? What is actually goin on?

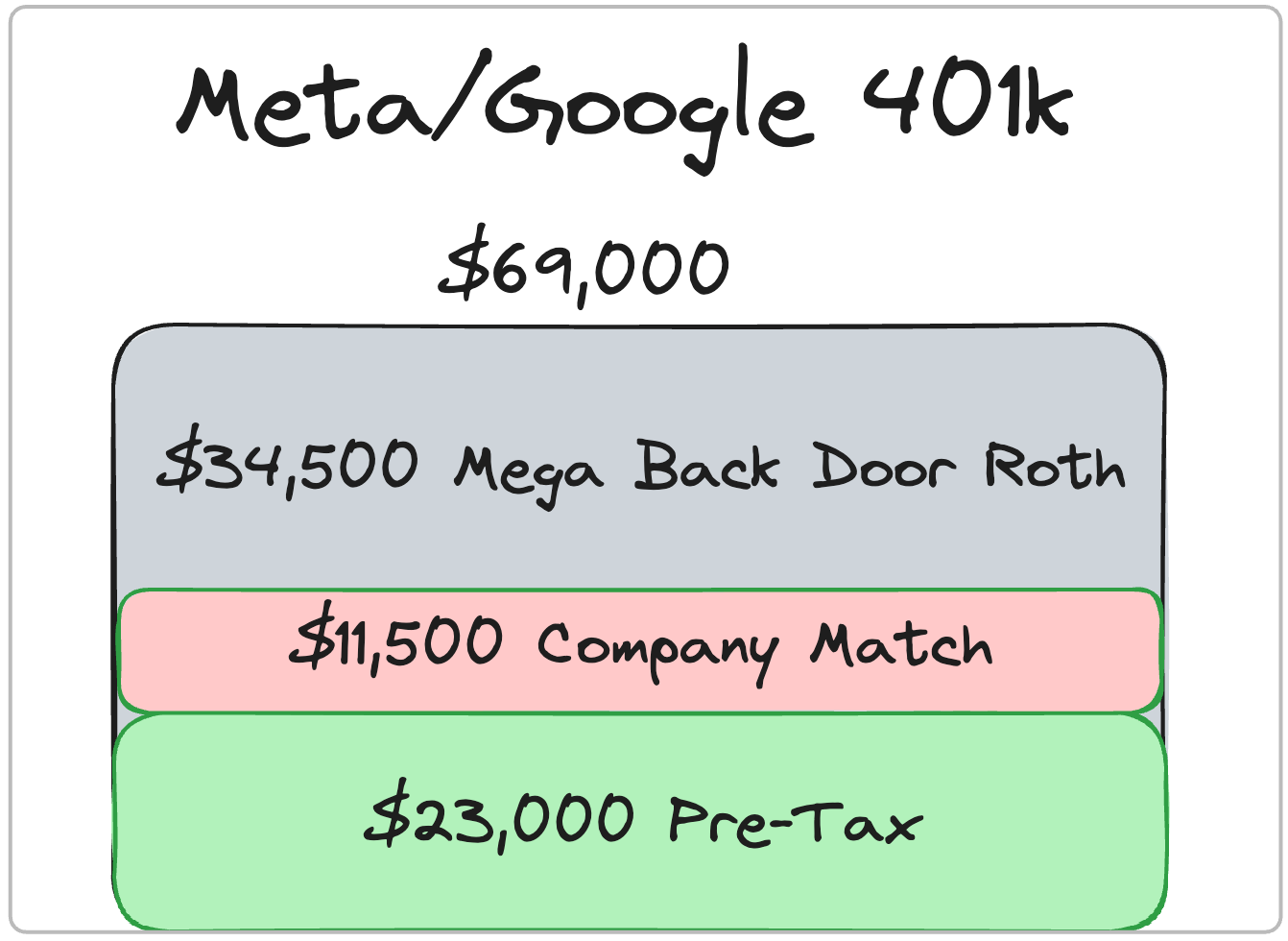

What is essentially happening is that the IRS allows you to contribute up to $69,000 per year into your 401k (2024 limits). They also limit the total amount you can contribute to both a Pre-Tax 401k and Roth 401k to $23,000.

Now the $69,000 maximum contribution includes the company match. So that typically still leaves a gap in the amount you are able to contribute.

So the IRS allows you to make these “After-Tax” contributions up to that $69,000 limit.

$69,000 - $23,000 - [Company Match] = Total Remaining to Contribute to After-Tax

However, having money just sitting in this “After-Tax” state is not the same thing as having money in a “Roth” state.

While sitting in the “After-Tax” state it doesn’t have the benefits that the Roth has, mainly the Tax Free Growth. So to get the real benefit you want to do an “In plan conversion” to either your ROTH 401k or a separate Roth IRA.

You won’t see the words “Mega backdoor roth” anywhere, because those are just made up nick names. The actual terminology is that you are making an “After Tax” 401k contribution and then converting it into a roth via an in-plan conversion.

Confused? Don’t worry, you’re not alone! An important lesson is to sometimes accept that this just doesn’t make intuitive sense. Many tax related things don’t. They are bi-products of imperfect laws.

It is also worth highlighting that this might not be around forever. Every so often a budget proposal will pop up that includes language that does away with both the Mega Backdoor Roth and it’s little brother the Back Door Roth. Apparently it is pretty popular to take away “back doors” that only really benefit high income earners.

Quick Reference of Contribution Limits for 2024:

Overall 401k Limits: $69k!!

(Includes Pre-Tax, Roth, Company Contributions, and After-Tax)

Meta/Google 401k MATH:

$23,000 Pre-Tax

$11,500 Meta Match

$34,500 After-Tax

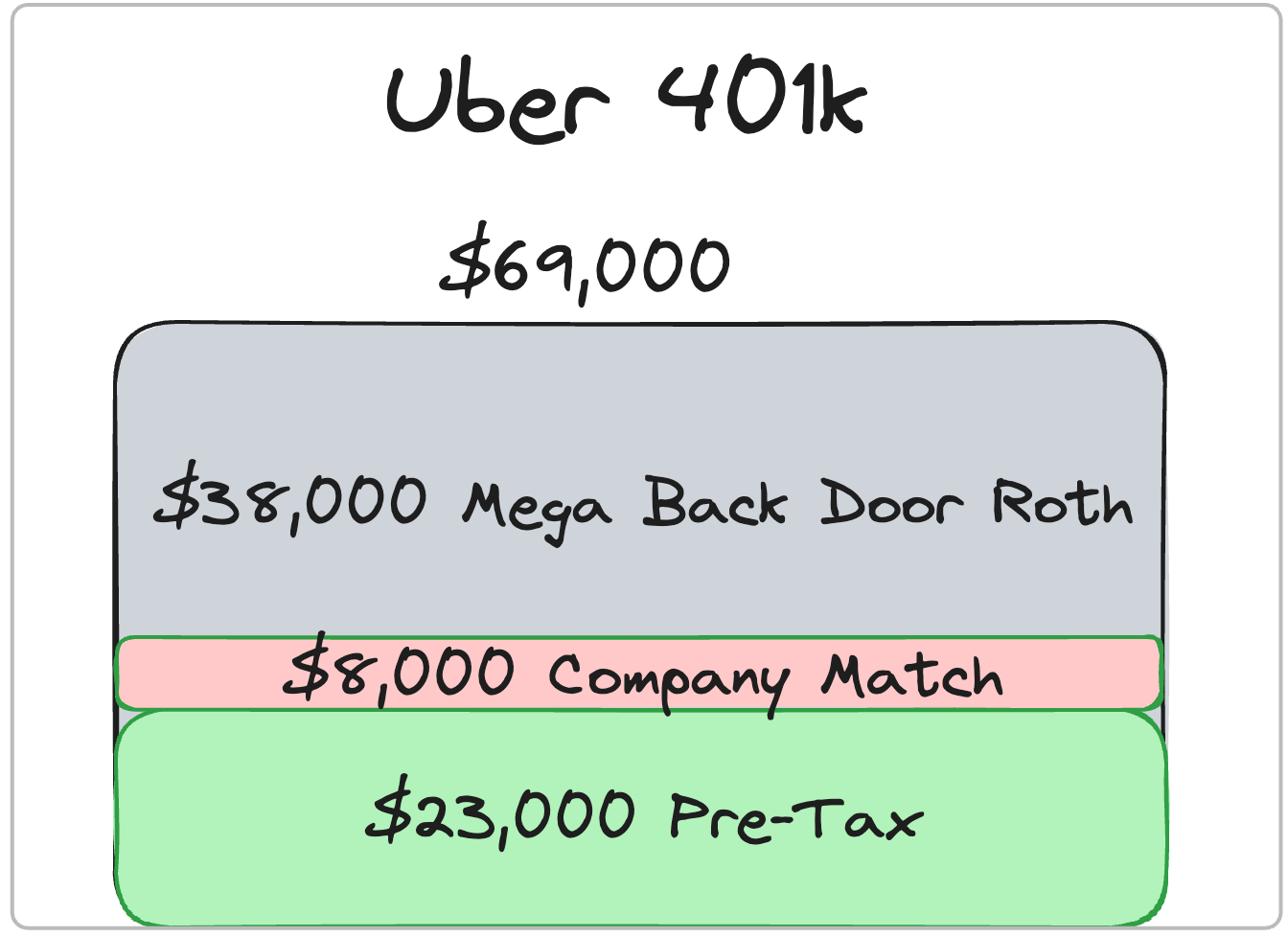

Uber 401k Math:

$23,000 to Pre-Tax 401k

$8,000 Match

$38,000 After-Tax

True Ups and How I Almost Lost $5,000

I almost fucked up. I live and breathe this stuff, so it is a little embarrassing that I made a rookie move and almost cost my household exactly $5,505.

Luckily, thanks to a comment on LinkedIn over the weekend, I was able to get things fixed!

So what happened?

For some reason, every company’s benefits team handles their 401k matches slightly differently.

Let’s focus in on Meta & Uber’s implementation:

Dollar-for-Dollar Match: This is where the employer matches 100% of the employee's contributions up to a certain percentage of their salary.

Meta’s 401k works like this. Meta will match your contributions instantly. Up to their limit of 50% of the IRS limit. So if you contribute $11,500, Meta will match you $11,500 right away.

Percentage of Contribution Match: Employers match a set percentage of each dollar contributed by the employee.

This is how Uber’s 401k match works. They will match “50% on the contributions you make to your 401k, up to 6% of your Eligible Compensation, with the maximum yearly company match capped at $8,000.

In some cases, those whose companies utilize the “Percentage of Contribution Match” also have what is called a “True Up”.

In theory, if you max out your 401k early, the “True Up” will give you the full match at a later date (Q1 for Uber).

My fuck up

This is the first full year that Uber has a 401k match.

My normal 401k strategy is “Hard Mode” which involves maxing out your contributions early in the year.

For some reason I thought the Uber 401k After-Tax contributions would automatically stop at $38,000, allowing space for the full $8,000 match via the “True Up” in Q1.

That is very much NOT how it works.

Uber matches on a per-paycheck basis, only when you have a contribution. I maxed out my partner’s Uber 401k in Q1, and then the match stops too. But I should get the full match in Q1 via the “True Up”

In order for Uber to perform the “True Up” in Q1, it requires that you are not yet at the $69k annual contribution limit.

Normally “Hard Mode” has me maxing out my After-Tax in the first half of the year. Luckily, Uber has a cap of 15% on after-tax contributions.

I was on pace to contribute $43,504.96 vs the $38,000 max that would allow me to get the full match.

My partner would have only received $2,495.04 of match instead of the full $8,000. So thanks to this comment, and digging into the Uber 401k documentation, I was able to get this fixed by cutting my After-Tax contributions in half.

The LinkedIn comment that made my family $5,505. Go give Matt Pruitt a follow on LinkedIn, I owe him a whole lot of Avocado Toast.

So learn from my, almost, mistake. Dig into your benefit teams documentation to understand how they deal with a match if you also plan on maxing out your after-tax. Especially if you work somewhere with a True Up.

Did this post finally push you over the edge to start contributing to your mega backdoor roth? Do you still have questions? Let me know in the comments!

This is such a valuable piece. I had no idea this existed until you started posting about it. My wife works for EA, and it looks like they allow it. So many years of missed massive Roth contributions...sigh. Thank you.

Great stuff, thanks! Just shared inside Meta.