Welcome to the second part of the series where I am trying to identify how much is “enough” to retire early in San Francisco. Two years ago I had determined that my “Enough Number” was $4,000,000. This number always assumed I would leave San Francisco. While revisiting my goals in the beginning of this year, I realized I might actually want to stay in San Francisco.

This means I need to figure out what “Enough in San Francisco” looks like.

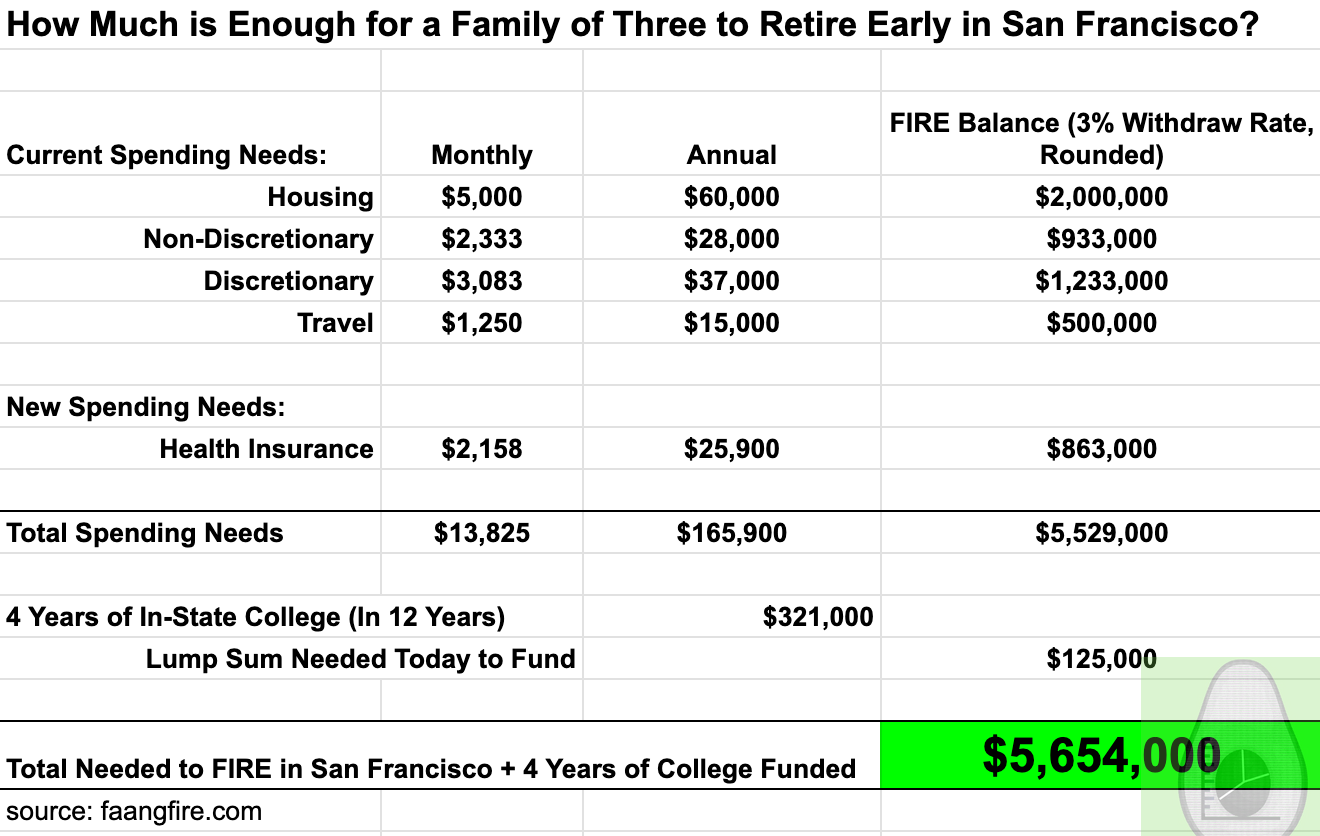

In the first part of the series I dove into my family of three’s current spending to form the basis from which we build out our “Enough” number. In that post I determined that our current after-tax spend was $140,000.

From Current Spend → Enough

Now that we have a basis of current spend, we can start answering our original question.

How much is enough to retire early in San Francisco and sustain $140,000 per year in spend?

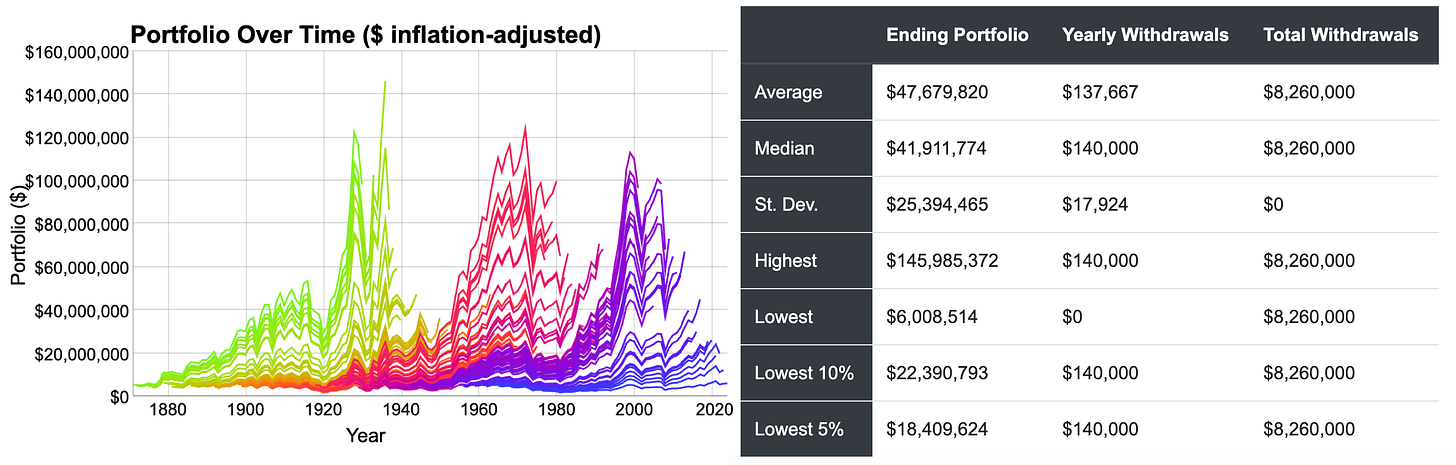

Many FIRE users would use “25 multiplied by their current spend”, which is the classic 4% withdrawal rule. I prefer using an extremely conservative 3% safe withdrawal rate, which has never failed historically over every 60 year period. You can calculate the 3% withdrawal rate by multiplying your annual spend by 33.33.

$140,000 x 33.33 = $4,666,000

$4,666,000 should sustain our current annual spend of $140,000. Historically with withdrawal rate has never had a portfolio run out of money over all 60 year historical periods. The median ending portfolio balance from the tool cfiresim is an obscene $42 Million, showing how conservative a projection this represents.

Is $4,666,000 “Enough” for our family to FIRE in San Francisco?

I am confident that it is “Enough” to sustain my current spend level of $140,000.

But $4,666,000 isn’t actually “Enough” for my goals. It is still missing some critical areas of spend that are not captured when I only look at my current spending.

This is where it is important to go back to my “why”. Here is a slightly modified version with all dollar values removed:

"I want to be able to eat avocado toast every day while being 30 minutes from the beach without needing to work. I want to fully pay for 4 years of public university for my daughter. I want to be living somewhere that I can stay for 10+ years, buy a house, and be part of a community."

If I start going into housing as part of this post, it will completely derail things.

Perhaps this is a reflection of the reality that San Francisco is the land of compromises. If I want to FIRE in San Francisco, the compromise for now is that I need to modify my “why”, and reflect more deeply on whether the home ownership aspect of my “why” is important.

If I am still wanting to live in San Francisco, and willing to keep renting, perhaps home ownership isn’t as important to me as I originally thought. Or more likely, this is how I am internally justifying my own decisions.

Sam, an OG of the FIRE movement who writes on Financial Samurai, put it well in an email thread with me:

“For real estate, we always justify our decisions - rent or own. It's the way it will always be!”

So with the accepted compromise of continuing to rent if we remain in San Francisco, we can treat rent like any other expense. This introduces a pretty big assumption that rent will increase at the same rate of inflation. This assumption will very much depend on your area. If you have rent control it will be extremely easy to make this assumption, if you are in an area with rapid growth, and lack of renter protections, it could be very different.

For me, at my current $5,000 per month price point, I feel fairly good about this assumption. This is based on the past 10 years living in San Francisco and the available substitutions at a similar price point.

Ok. That brings us back to the calculation that started this:

$140,000 x 33.33 = $4,666,000. What is still missing?

Factoring in Health Insurance

Another key piece missing in a FIRE plan is health insurance. Right now our health insurance is heavily subsidized by my wife’s employer. Once we are fully FIRE, we would be on our own to cover the full cost of our health insurance.

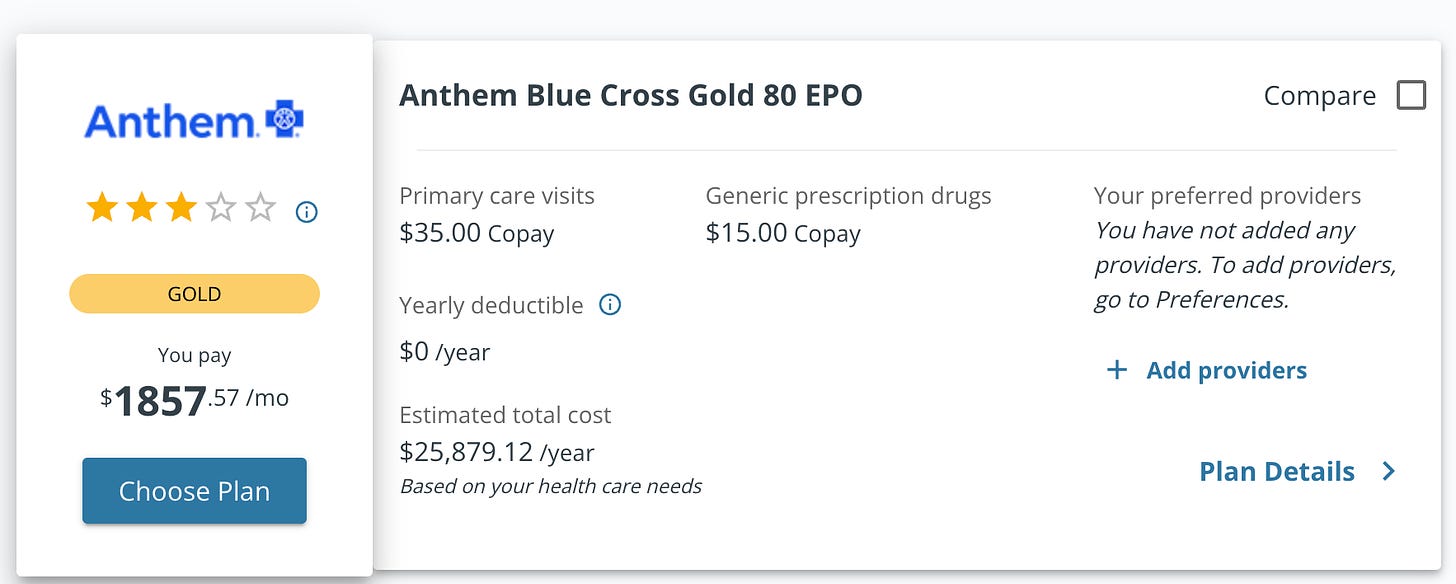

This is one of the biggest unknowns of many FIRE plans. It is so challenging in the USA to even think about what healthcare will look like long term. Right now though, the best we can do is look at the healthcare exchanges. For California that is Covered California.

To simplify a bit, I’ll start by assuming minimal subsidies by entering a projected income of $200k (note, this still ends up with a $140 a month subsidy). After entering in our projected health needs (I would say we are medium/high users of medical services) this Anthem EPO Gold plan for 3 people seems like a realistic plan that we would choose. Note: I am currently on a high deductible health plan with an HSA, but previously had an EPO plan which is what we would likely choose again in the future.

With healthcare premiums, copays, medicine, and out of pocket estimates this ends up being $25,900 per year (note: the original $140k in annual spend estimate does include current out of pocket medical expenses so there is some double counting here, but I am fine over estimating for now).

If we assume healthcare will increase at the same rate of inflation (again, another assumption) we can once again treat it like any other expense and use the same 3% safe withdrawal calculations.

$25,900 x 33.33 = $863,000. Ouch.

Updated Numbers:

Original calculation based on current spending: $4,666,000

Additional required for healthcare: $863,000

Total required: $5,529,000

$4,666,000 + $863,000 = $5,529,000

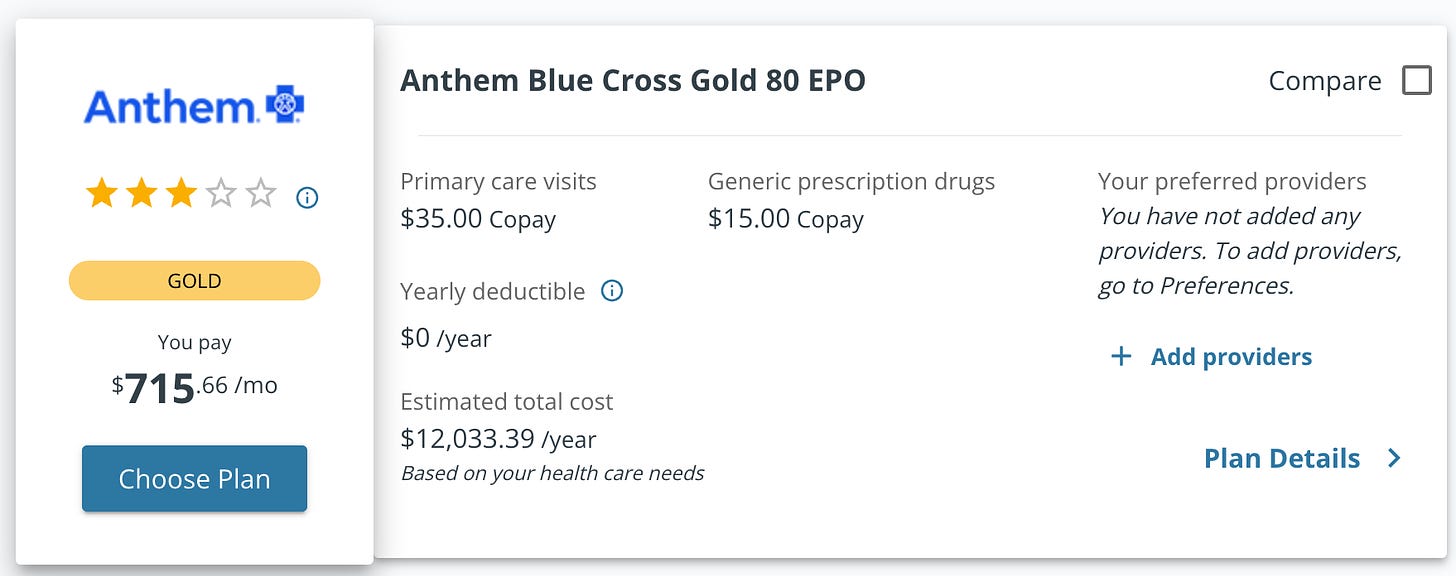

Quick Aside: One interesting thing about how subsidies currently work for health insurance, they are completely based on income. You could have $5,000,000 in the bank, but with controlled reported income through careful withdrawal strategies, you might qualify for significant subsidies. For example, it would be easy for someone with significant assets to only have an income of only $75,000. This would make them eligible for significant subsidies, cutting their annual costs by more than half.

Who knows what things will look like 1 year from now, let alone 10+ years from now. Perhaps they add means testing. Perhaps they have single payer. It is impossible to predict this. For now, given all the uncertainty, I’ll continue to estimate my healthcare needs without factoring in subsidies.

We still aren’t done!

Factoring in Future College Expenses

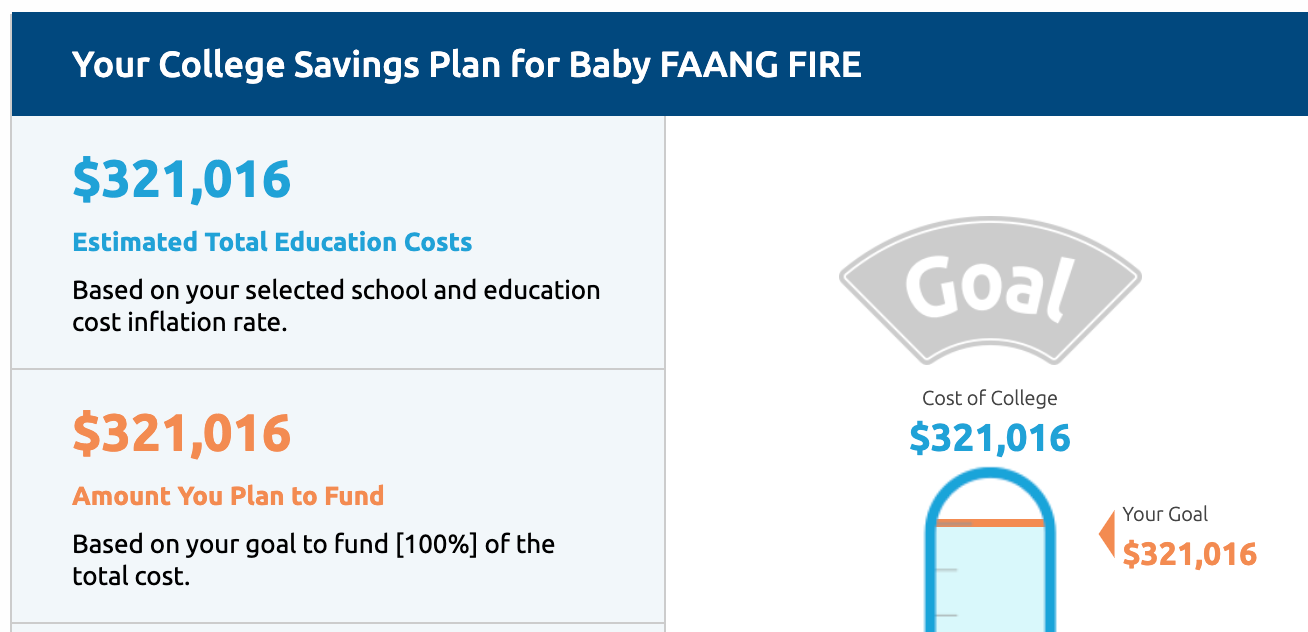

My goal is to be able to fund 4 years of in-state tuition for my daughter. She is currently 6 and would be starting college in ~12 years and 4 months.

According to the college savings calculator on ScholarShare, UC Berkeley currently costs $41,473 per year including room and board. Ouch. If we increase that amount by inflation (my daughter is currently 6) by the time she is 18, 4 years at UC Berkeley could cost $321,000! Note: These are in future dollars.

Using Empower’s College Savings Calculator and playing with the inputs a bit. I find that if I had $125k lump sum right now that should be enough to cover the full $321,000 in 12 years (this is roughly an 8% annual return rate).

My San Francisco Enough Number

So my enough number in San Francisco, at my current spend, is $5,654,000.

Current Spending Needs: $4,666,000

+

Heath Care Saving Needs: $863,000

+

College Savings Needs: $125,000

=

$5,654,000.

The table below breaks it out into more detail.

Lots of assumptions but I still feel good at saying $5,654,000 would be enough for my family to fully Avocado FIRE in San Francisco without needing to earn a single additional dollar of income.

Some quick notes for those that want to get more granular:

This estimate does not isolate or fully account for taxes. Income would be from long term capital gains, qualified dividends, and the cost basis of the original investments. <$5k per year which can get absorbed into our other expenses.

This doesn’t factor in any Social Security. I am fairly confident that Social Security will still be around in some form when I reach full retirement age.

Doesn’t factor in Medicare which should lower health care expenses once we reach 65.

Doesn’t factor in any changes in expenses after my daughter graduates college.

What If I Still Work?

This post answered the question of how much we need to fully FIRE in San Francisco without ever needing to work again.

But what if we decide we want to still work in some capacity?

Even right now, while I am semi-FIRE I am spending my time on things that still earn some level of income; paid subscribers here on substack, 1:1 FIRE coaching, affiliate commissions, and light consulting. This is currently what FIRE looks like for me, spending about 15-20 hours on these projects that energize me, while not focusing directly on the income.

I’ve also heard a similar sentiment from many of my readers. You don’t want to fully retire and do nothing. You want to take a less demanding job, have your spouse quit their job, join corporate boards, focus on your money making hobbies, finally start that business, or join that startup.

All of these could involve not fully retiring, but wanting to significantly cut back on your current income.

This is where two other flavors of FIRE can come in: Barista FIRE and Coast FIRE.

Coast FIRE: You are not withdrawing from your portfolio. You stop contributing to your portfolio. You work a lower paid job that is just enough to cover your expenses (or spend all your earnings) while letting your existing portfolio grow to hit your FIRE number purely through growth.

Barista FIRE: You withdraw from your portfolio at a potentially lower withdrawal rate while working a lower paid job (hence the name Barista, but it could equally apply to entrepreneurship, or joining a start up, or even having 1 person in a household work) to cover a gap in expenses and often healthcare.

What would Barista FIRE or Coast FIRE look like for me in San Francisco?

Stay tuned for Part 3 where we dive into the details and calculations behind Barista FIRE and Coast FIRE in San Francisco!

Love this article, thank you for sharing. I'm looking forward to your part 3 where you are going to talk about coast/ barista FIRE :)

Cost of attendance for UC schools is wild. I’d be pushing for Cal Poly I think