I start every year by revisiting my financial mission statement, adjusting my personal long-term FIRE goals, and setting new annual financial goals (see 2023). I find physically writing down my goals and revisiting them on a regular schedule, annually in my case, to be an incredibly valuable exercise.

These are long-term FIRE focused goals and I try to be intentional about each piece. Revisiting and modifying long-term goals annually is also an acceptance that life can drastically change one year to the next and thus long-term goals may (not always) change as well.

This is intended to reflect back on the highlights of the past while also being forward looking to call out things you are working towards. Kinda like writing your family’s personal performance self-review rather than making a one time new year’s resolution.

One important reminder is that personal finances are deeply personal. Your own values, family makeup, and generational upbringing, can all influence your mission statement and goals.

FAANG FIRE Action Item: Write down your financial mission statement and long-term goals.

Revisiting Last Year’s Mission Statement and Goals

My 2023 mission statement:

“I want to be able to Avocado FIRE in the next 5 years after hitting my ‘Enough’ number of $3.3M in index funds, $600k housing fund, and $90k college fund. I want to achieve my goals while also ensuring that I also set up my daughter to have a future where she is able to contemplate ridiculous things like early retirement (if she chooses). I also really want to be living somewhere that I can see myself staying for the next 3 years.”

My 2023 Investment Goals:

Note: I focus my goals on contributions. This is something I can directly control, vs account value goals which are at the mercy of the broader economy.

$66,000 towards maxing out my Meta 401k + After Tax.

$66,000 towards maxing out my partners Uber 401k + After Tax.

$20,000 into iBonds

$13,000 into Backdoor Roth IRA

Any additional excess will then go towards my taxable brokerage, 529 college savings, and moving fund

I successfully hit all of these goals despite getting laid off in May 2023. The only individual element that I didn’t do was contributing $20,000 into iBond due to my preference towards the easy availability of high interest rate saving vehicles (as a part of my three tier emergency fund).

Changing my Mission Statement for 2024

I think my 2023 mission statement is pretty awesome. It is clear, articulate, and there are specific numbers that make everything appear perfectly calculated. Seriously, look at the confidence:

“I want to be able to Avocado FIRE in the next 5 years after hitting my ‘Enough’ number of $3.3M in index funds, $600k housing fund, and $90k college fund…. I also really want to be living somewhere that I can see myself staying for the next 3 years.”

Remember when I said that revisiting your long-term goals annually is “an acceptance that life can drastically change one year to the next”—well that seems exceptionally true at this moment.

🟠 I am now a single income household.

🟠 My $600k housing estimates might be too low for most places I would want to live.

🟢 I can see myself staying in San Francisco for the next 5 years (through elementary school)

🟠 I can’t see myself in my current rental over the next 3.

🟠 My enough number definitely isn’t enough for San Francisco.

🟢 Overall net worth is at an all time high.

I begin 2024 as single income household, with my partner being the sole breadwinner. We are in the very fortunate financial position where my household spending has never exceeded the lower of our two incomes. I find myself in a semi-FIRE’d state, where I don’t need to go back to work. Technically I can call it, and comfortably reach our FIRE goals on just my partner’s single income. Yet, this doesn’t feel like FIRE.

This isn’t how I pictured things. My original vision was to FIRE at the same time as my partner. To leave San Francisco for more affordable pastures. To have clarity into how I will be spending my time. To use the <5 year to FIRE time frame to fill in all the gaps in my plan. To practice what I preach around: “FIRE to something, not away from something”.

Life happens. I got laid off in May 2023, while the overall stock market races up. My daughter graduated from a rather $expensive$ Montessori pre-school, and then started at a San Francisco public elementary school we are very happy with (nailed the timing on this transition btw).

Since my partner is still working, I find myself less “FIRE’d”, and in a new role more akin to “Stay-at-home dad”. Only, I am a stay-at-home dad to a child who is at school from 8am-6pm. That leaves me with both an extreme amount of time but also a new set of obligations.

What are those new obligations?

That is a post for another day, but it involves a lots of laundry, school drop offs, pick ups, after school activities, sports, camps, grocery shopping, cooking, and learning what the word “Shefault” means.

Andre Action Items: Create a new mission statement. Do more laundry.

2024 Investment Goals

While my Mission Statement is in flux I still feel good about my 2024 Investment Goals.

Not having my Meta income will absolutely impact my overall financial goals. But I should still be able to max out all of my partner’s tax advantaged accounts and would even shift money from my taxable accounts if necessary to do so.

$69,000 towards maxing out my partners Uber Traditional 401k + After Tax.

$23,000 to Traditional 401k

$8,000 Match— Uber finally added a 401k match to the tune of “50% on both pre-tax and Roth contributions you make to your 401(k) plan, up to 6% of your Eligible Compensation, with the maximum yearly company match capped at $8,000.”

$38,000 After-Tax 401k which gets converted to a Roth 401k (mega back-door Roth)

$8,300 towards maxing out my partners Uber HSA (I view this as a Roth retirement account, post coming soon)

$14,000 into Backdoor Roth

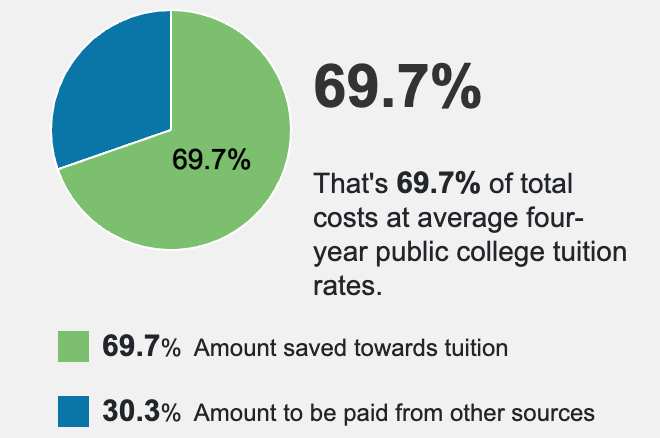

$30,000 into a 529 education fund to reach my current goal of covering 70% of a 4 year college degree for my daughter via a 529 (~$60k by the end of the year w/ 12 years to grow), the remaining will be covered through our taxable accounts as needed.

Any additional excess will then go towards my taxable brokerage, 529 college savings, and moving fund

FAANG FIRE Stretch Goals

$69,000 towards maxing out my Solo 401k (partner link)

$23,000 to Traditional 401k

$46,000 to After-Tax 401k which gets auto-converted to a Roth 401k

Earning revenue from FAANG FIRE hasn’t been something I prioritized. I do this because I get energized when I talk with people who have learned how to set themselves up for FIRE from the words I write.

The simple truth is that if I were purely financially motivated, I would be better off jumping back into big tech. Sure — there are newsletter writers in the space that are bringing in FAANG level compensation. But I guarantee you they are working their asses off for it.

Despite this — I am still a financially motivated person. I have been hard wired to think about monetization for my entire life. I can’t turn that part of my brain off. So I am going to channel that motivation into setting up a Solo 401k with Carrymoney.com and creating a stretch goal of being able to max out both my traditional 401k contributions as well as the mega back door after-tax portion.

Last year’s FAANG FIRE related earnings

1:1 Coaching (60% of earnings): I get the most energized from 1:1 coaching— which is also the least scalable way to monetize

Affiliate Links (25% of earnings): I am fairly passive with my approach to affiliate links and only include products I physically use (and in most cases used for years prior to being aware of an affiliate program — as is the case with Empower, my favorite free net worth tracker 😊 or Carry Money, where I set up my Solo 401k).

Paid Substack Subscribers (15% of earnings): My most scalable channel. However I don’t want to pay-gate any content. This takes away the #1 way most Substack newsletter monetize.

I will need to 10x my overall earnings to be able to reach the goal of maxing out a Solo 401k (back of the napkin accounting to account for taxes). How will I accomplish this? I have some ideas, but if you have more for me, I am all ears (send me an email, leave a comment, or message me on LinkedIn)!

FAANG FIRE Action Item: Write out your investment contribution goals on a per-account basis for the year.

Future FAANG FIRE Content

I am planning on producing more educational content focused on helping high paid tech workers reach financial independence as well as refreshing past content. I also wanted to see if there were specific topics you would like to see me cover or get my opinion on.

Current posts I am working on:

HSA: Health Savings Accounts for FIRE

Traditional 401k vs Roth 401k

Simplifying and Consolidating Your Financial Life

Getting Unstuck from the Boring Middle on the Journey to FIRE

If I had an Extra $200k Right Now I Would…

Personal Inflation Rate: Tracking Avocado Prices

FAANG Fertility Benefits

The Impact of Kids on FIRE

Refresh of Where to Live for FIRE or Remote Work

Refresh of The New Grad FAANG Guide to FIRE

My Simple Retirement Projection Dashboard

FAANG FIRE Monthly Financial Checklist

Life and Umbrella Insurance for FAANG

Deeper Product Reviews of Financial Tools (New Retirement, Monarch, Projection Lab, YNAB, Empower…)

What You Should Know About Sequence of Return Risk

Your Idea’s Here

Drop your content ideas in the comments!

-André

I love how clearly you've laid out your reflections on past and future goals here. I want to nail down a FIRE mission statement at last for myself as well.

My votes on which upcoming posts I personally most want to see:

1. The Impact of Kids on FIRE

2. Personal Inflation Rate: Tracking Avocado Prices

3. Getting Unstuck from the Boring Middle on the Journey to FIRE

4. Life and Umbrella Insurance for FAANG

5. What You Should Know About Sequence of Return Risk

I listen to the audio, it gives a lot more personality. Hearing the action item "do more laundry" I imagined this was actually an audiobook.