How much is “enough” if my family of 3 wants to retire early in San Francisco?

This post will walk you through how I am currently approaching this very question. This isn’t a hypothetical, this is my life. It will give you a peek into how I think about this question and give you ideas on how you might answer “How much is Enough” for yourself.

Enough: When I refer to an “Enough” number, I am talking about the amount of money where you can hang up your keyboard and never need to earn another dollar.

Starting With Current Spend

It is important to start this exercise grounded in the actual numbers. My spending in FIRE (Financial Independence Retire Early) might be very different than my current spending, but my current spend is a critical starting point.

About me: I live in San Francisco with my wife and our 5 year old daughter. We have been in San Francisco for a decade, with both adults working in tech (ex-Meta, Uber). I am currently semi-retired/stay-at-home-dad and my wife is still working as a designer for Uber.

Ages: 37, 40, 6

Status: Married Filing Jointly

Occupations: Semi-Retired (ex-Meta Product Growth Manager), Designer, Student

Housing Situation: Rent

School: Public

Current Expenses (March 2023-February 2024)

I don’t budget, but I believe in tracking/logging expenses, I use a number of different tools for this, you can see my favorites in my budget tool comparison post. For this post I used Monarch which was the easiest to quickly create these charts and a custom GPT that used my Monarch transaction data.

Once again, all good estimates of how much “enough” should begin with a realistic starting point. There is no better starting point than your actual spend.

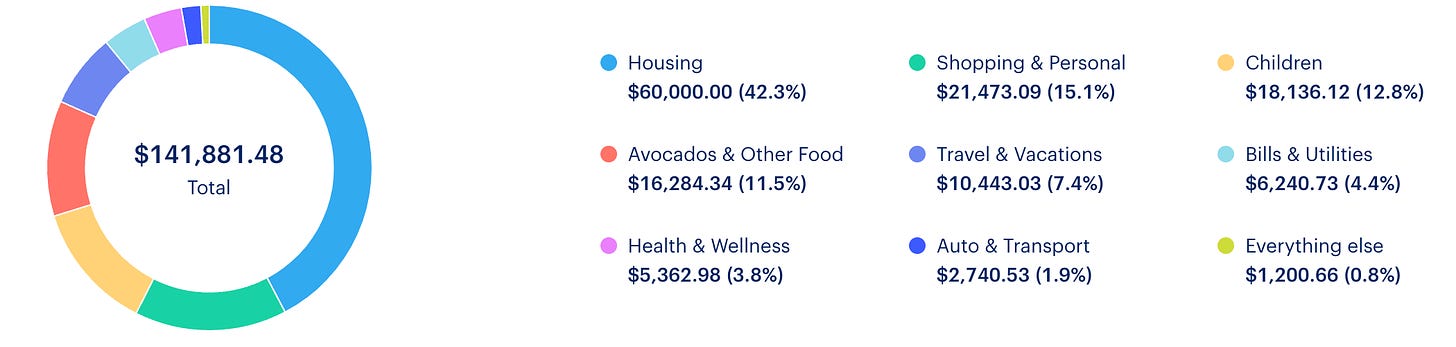

Current Annual Spend: $141,881

Total Annual Spend: $141,881.48

Average Spend per Month: $11,823.46

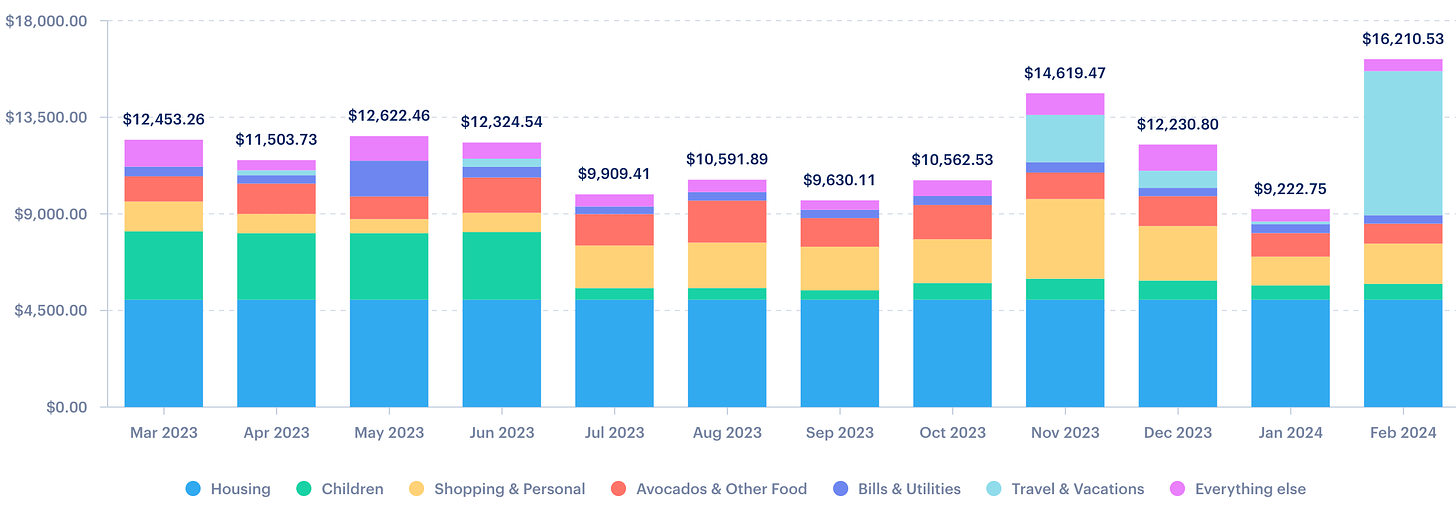

While the overall totals are an excellent starting point. It is important to also break things down into a monthly view to identify any major changes, seasonality, and other recurring fixed expenses.

Overall Spend by Month

Looking at a high level I can see a few trends that we will want to dig into more. The two most notable are the Children category and the other is Travel & Vacations category. We should also look at housing as well since it is the largest category by far.

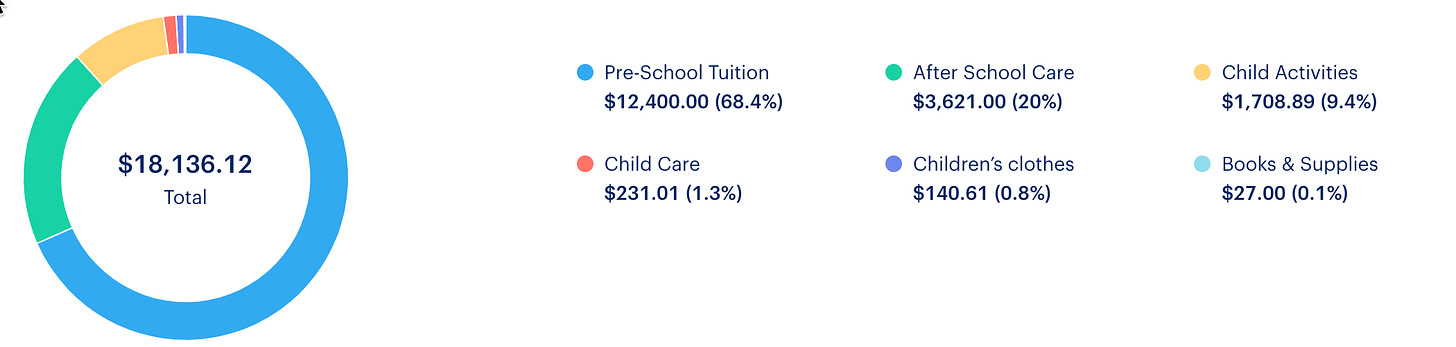

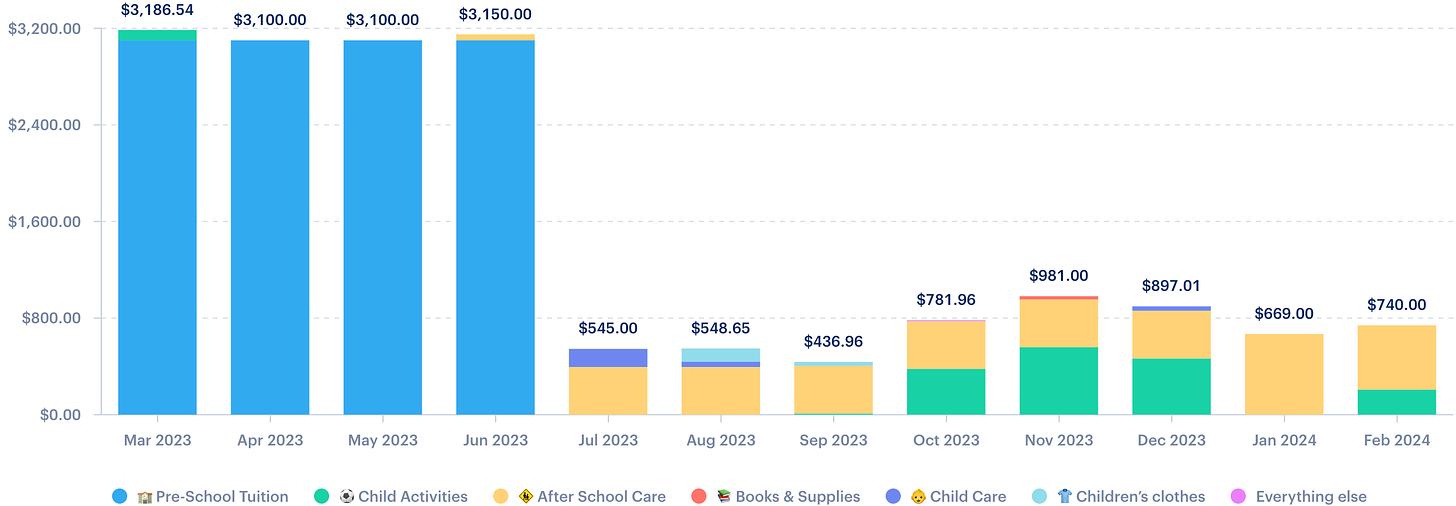

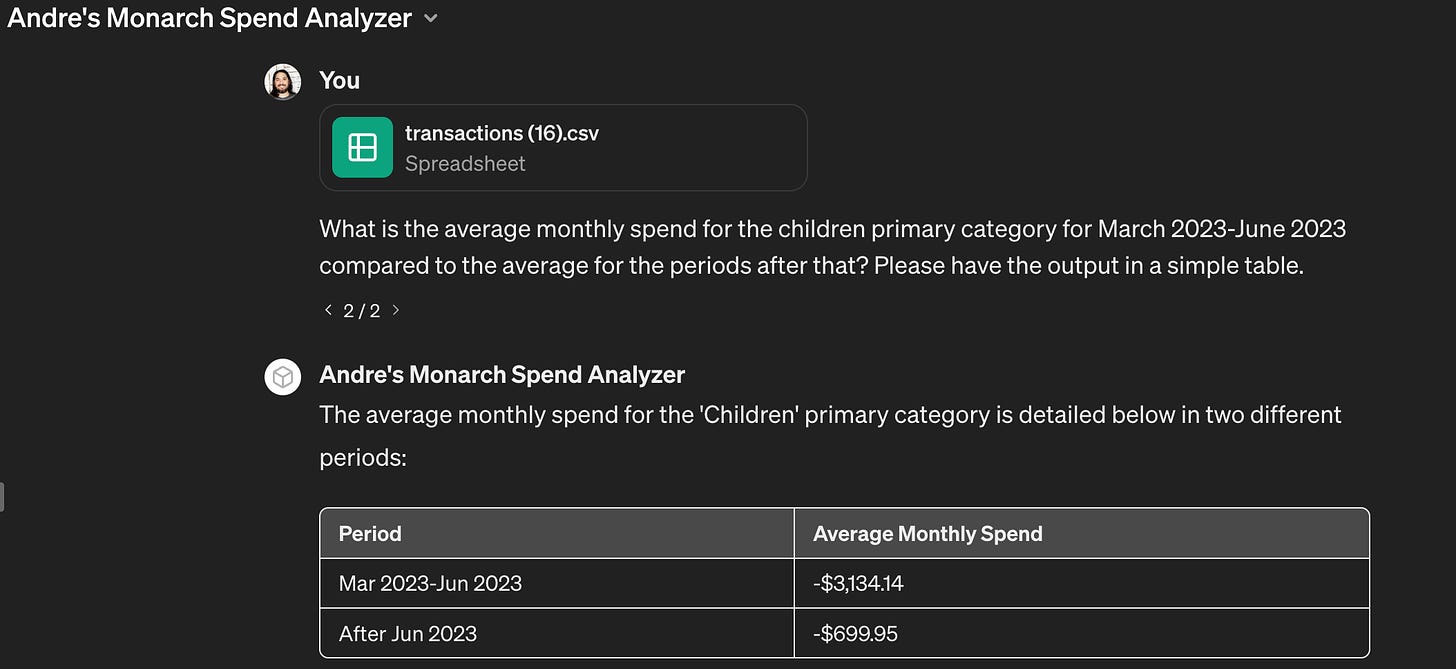

What is going on with the Children Category?

Data Side Note: Apologies for colors not aligning between pie charts and bar charts. The data gods are punishing me for using pie charts.

My daughter graduated from pre-school in the summer and entered a public school for kindergarten. This drastically reduced the monthly expenses down from ~$3,100 to $700 per month. The new child related expenses are primarily after-school care and other organized activities (soccer, swim class, dance, etc). The only thing missing here are any summer camps that might increase expenses, but should be offset by not having after school care during those months.

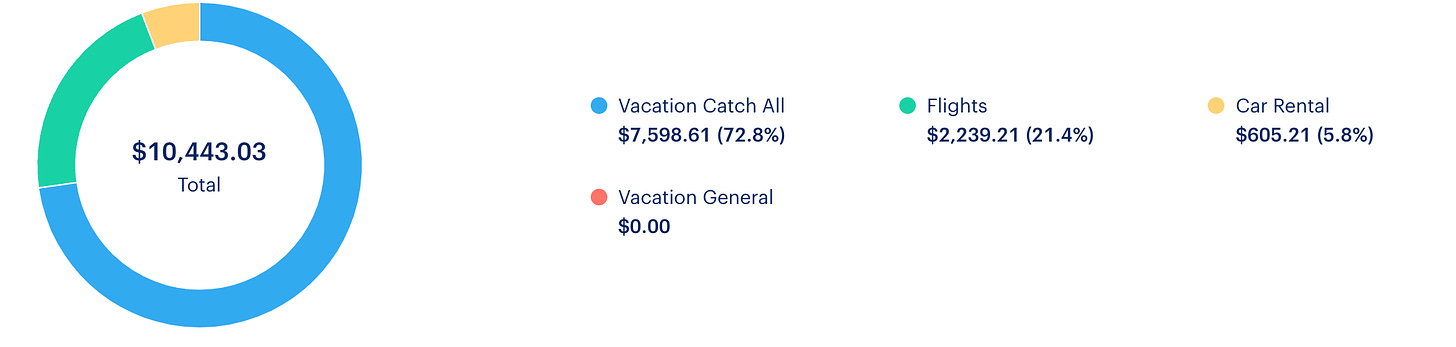

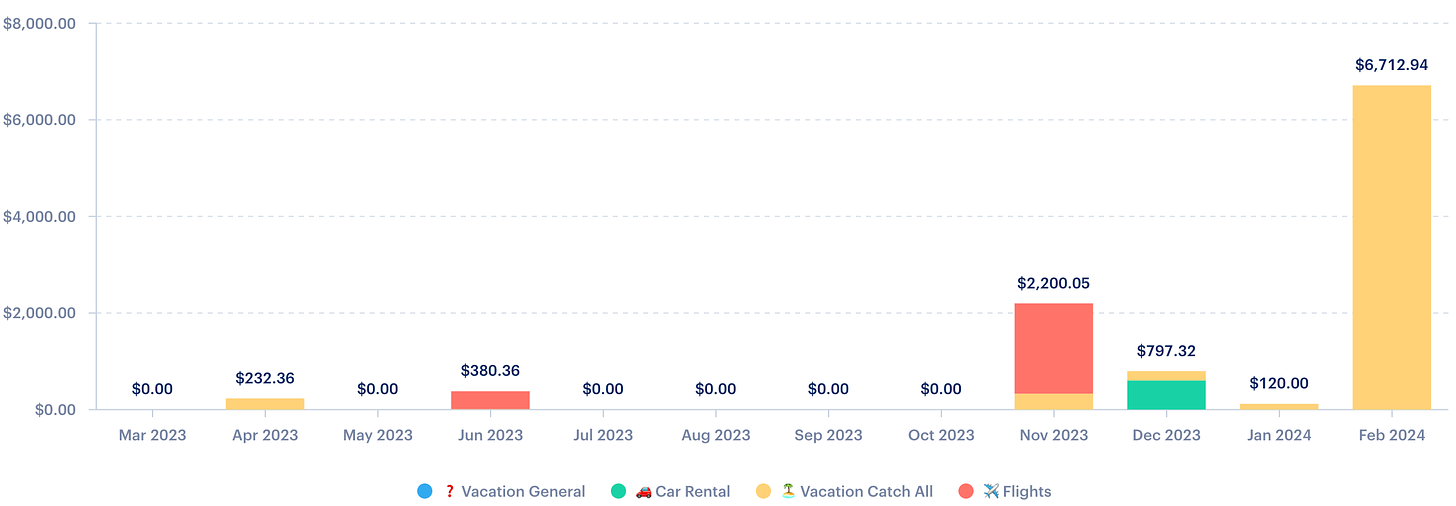

What is going on with Travel?

This is an area of our spend I am trying to intentionally increase. Particularly as my daughter gets older, vacations are slowly getting more enjoyable again. Travel is also completely discretionary, meaning that we have full control over how much we want to spend in this category year to year.

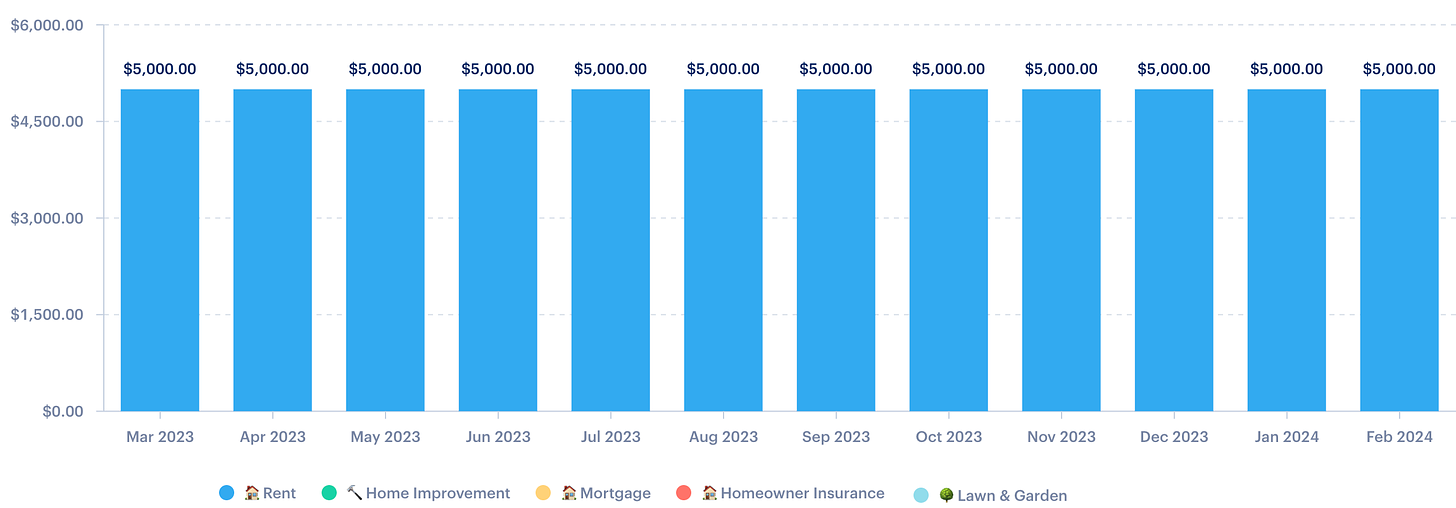

Housing

This is an easy one. My rental expenses have been very stable the past few years. They even decreased by $500 per month during covid, and have since remained stable. In the decade I have spent in San Francisco my rent has only increased when I moved into a new place. This includes both rent controlled units and newer condos not subject to rent control.

Rent vs Buy is a different topic, but running the numbers for my personal situation, I have never been able to make home ownership pencil in within San Francisco. One big factor is that I never picture myself here >7 years.

I’ll channel Ramit Sethi and say “Rent is the maximum you will pay”.

Transportation Spend

One of our favorite things about moving to San Francisco from Texas was being able to sell our 2 cars. I went 7 years without a car, relying on company shuttles to get to work, public transportation, ubers, and the occasional rental to get around the rest of the bay. We finally broke down during the pandemic and bought a car. This has unlocked parks outside a 2 mile radius, last minute local travel, and weekly costco trips.

Our annual transportation expenses are artificially low due to having a paid off 2021 car with a pre-paid maintenance plan for the next 4ish years.

Ok, so where does that leave us?

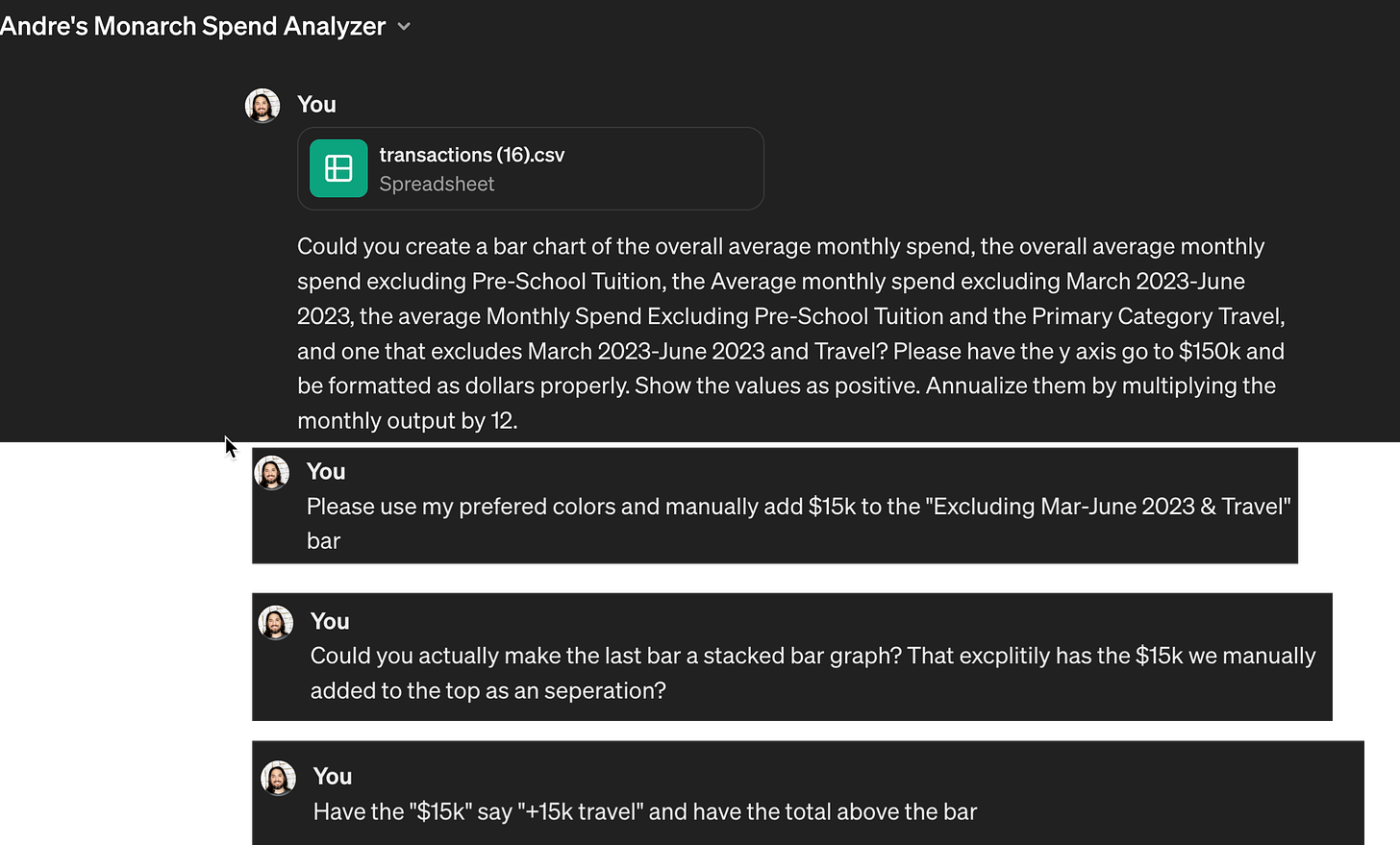

We might want to re-run the total annual spend a few different ways. Perhaps to exclude Pre-School, maybe Travel, or only looking at more recent months?

I created a custom ChatGPT that can take my Monarch transactions and allow me to “quickly” answer some of these questions.

Reasons I am looking at these breakdowns:

Overall Average: This is my true overall spend for the past 12 months. But my spending has changed with my daughter starting school. I am not sure this is fully accurate.

Excluding Pre-School Tuition: My first instinct is to just remove all Pre-School spending. The issue here is that just removing pre-school doesn’t account for after-school care being needed in those months (artificially lowering the average).

Excluding March 2023-June 2023: A more accurate way to exclude the pre-school months overall vs just the pre-school expense. My concern here is that now the peak vacation months are getting over counted in the monthly averages.

Excluding Pre-School & Travel: Probably doesn’t make any sense to look that this knowing what we know from the prior bullets…

Excluding March 2023-June 2023 & Travel but adding $15k: This is my attempt to solve for the issue of travel being over counted to get an accurate annual estimate and then manually adding $15k to reflect my goal to spend more on vacation.

Looking at my spend a few different ways gives me confidence in a realistic forward looking average.

My Family Spends ~$140,000 in San Francisco

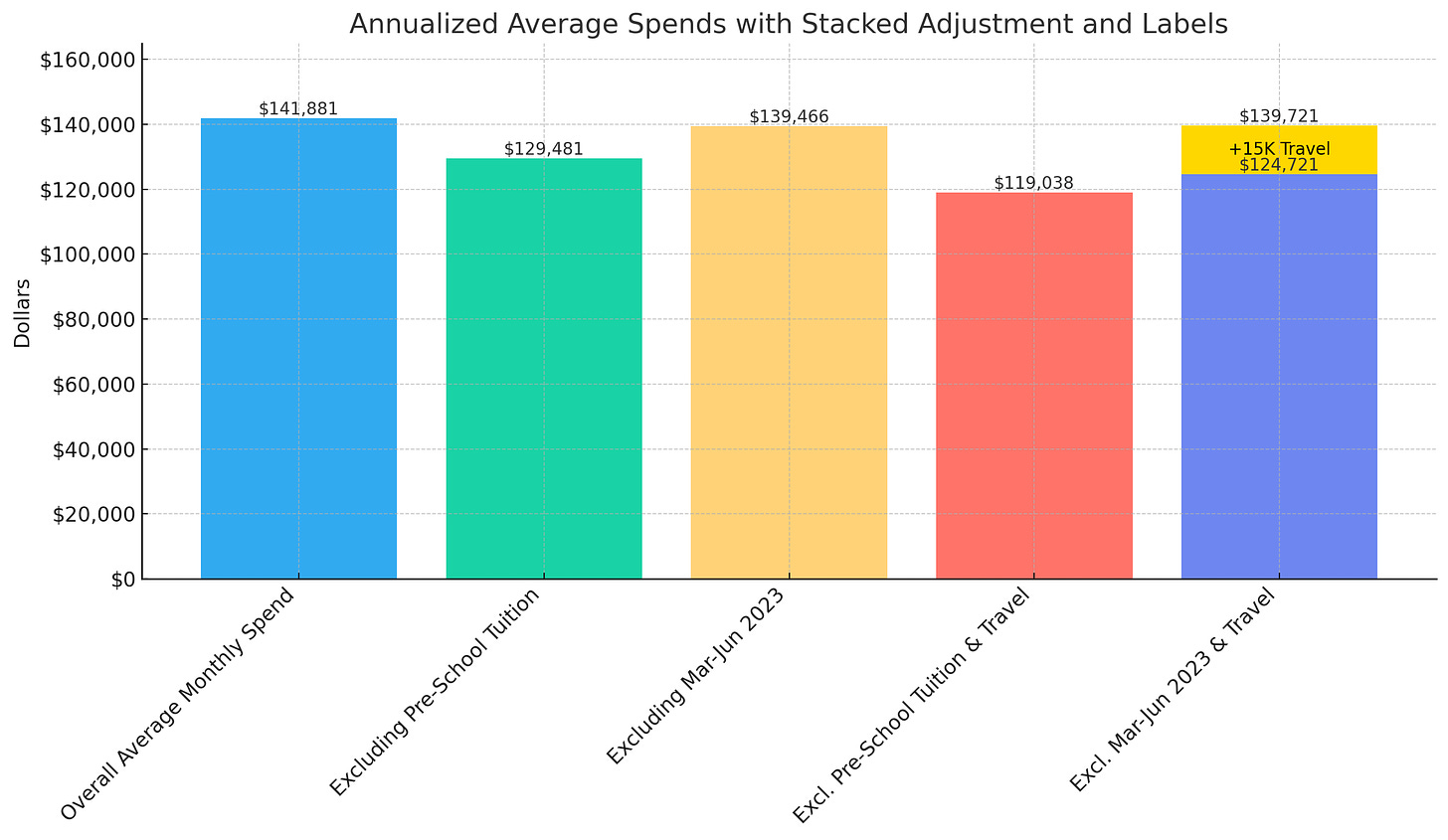

As someone who started their career earning $35k in Texas this seemed like a ridiculous number. This is the reality though. The year is 2024, and I am very much not in Texas. To help baseline things a little bit, I asked my network on LinkedIn which is primarily other Tech Workers in coastal cities:

“Bay Area and New York City parents, How much household spend per year do you think would be enough?”

One More Data Cut

There is one more way I want to break down the $140,000.

There are a few categories of spend that I like to treat differently. Having these categories broken out will let me easily make future adjustments if one part of my spend changes.

Breaking Out Fixed, Discretionary, Housing, & Travel

Fixed/Non-Discretionary: Essential expenses necessary for daily living, including groceries, healthcare, and utilities.

Housing: Only includes rent.

Discretionary: Expenses that are optional or non-essential, such as entertainment, dining out, and luxury purchases.

Travel which is a fully discretionary spending category that can easily be decreased if needed. I am breaking this out from the rest of discretionary because I want to reemphasize my goal to explicitly increase spending in this category. For the calculations below I removed my current Travel spend of $10,400 and manually increased it to my goal spend of $15,000.

When we break down the $140k into these categories we are left with:

Current Spend: $140k per year

Housing: $60k

Travel: $15k

Non-Travel Discretionary: $37k

Fixed/Non-Discretionary: $28k

The next step is going from my Current Spend to calculating Enough.

From Current Spend → “Enough” + FIRE vs Barista FIRE

To be continued in the next post.

Looking for more? Check out a few past posts on this topic:

Lindsey Stanberry’s series devoted to looking at families income & spend “Home Economics No. 2: Living in the San Francisco Bay Area on $13,200 a Month”

Lol "Avocados and other food" category. Cheeky, I like.

As a parent with a daughter in kindergarten, i recommend you doublecheck your expected childcare expenses. I live in the East Bay and was surprised to realize that our outlay at public school would be about $15k/year.

That comes from paying for after care, holiday care (e.g. spring break if you don’t go on a trip), and summer camps (again if you’re not traveling). I know we’ll travel for some of the holiday/summer periods, but either I spend it on childcare or vacation so the money is being spent either way.