FAANG Total Compensation can be "lumpy" and dynamic due to RSU vests and bonus payouts. I am working on updates to the RSU Dashboard to automatically track your total compensation.

Here is a mock up showing total comp “Jane” the E3 engineer who is convinced they are getting promoted to E4 mid-cycle ($125k base to $150k).

This is modeled after an internal tool that Google employees have that I was always jealous of. Be sure you are subscribed to be among the first to gain access, as always completely free.

While you are waiting for that to finish I thought I would rapid fire a few timely topics that I have been getting questions about.

Start Your Taxes

Every FAANG worker should start their taxes now. You are probably missing a few brokerage statements, but all your core W2 info should be ready to go. Get started ASAP, you don’t want to end up shocked by a high tax bill. Owing money isn’t a big deal, but being surprised and needing to come up with $50,000 last minute is never fun. Give yourself a two month warning to prepare.

Top FAANG Tax Gotchas

A few other things for the FAANG FIRE crowd to look out for when doing their taxes:

Make sure the cost basis of your RSU sales isn’t incorrectly getting loaded as $0

Backdoor Roth IRA’s shouldn’t increase your taxes, but entering things correctly can be tricky. If you notice your total tax due increasing after entering your Roth conversion information, follow this guide. I made the mistake twice and it requires re-filing and physically mailing in my return.

Megabackdoor Roth IRA’s shouldn’t increase your taxes either. Turbotax guide by FinanceBuff on ensuring it is entered correctly. Sometimes the data gets imported incorrectly

Watch out for bad W2 imports. I have seen multiple instance where State taxes or other fields are getting dropped during the automatic imports.

If you have a large tax bill. It is probably due to RSU’s getting taxed at 22% federally. Keep reading to fix this!

Updating RSU Supplemental Tax Withholdings

Starting in 2022, Meta allows you to set the supplemental withholdings on your RSUs to anything from 22-37%. This increases the amount of your RSU’s that are automatically sold at vest to cover your taxes. By default the federal withholdings are only 22%, which for many FAANG workers is just far too low leading to large tax bills.

If your goal is to not owe the IRS any money at the end of the year, you can increase your supplemental rate up from 22% to a value closer the marginal tax rate your RSU income is likely to fall into. A quick way to estimate what to set your supplemental withholdings on RSU to, is to add your base income and annual bonus, then subtract your traditional 401k contributions, and then see which Tax Bracket you fall into. Set your supplemental withholding rate at or above that amount, this is setting the withholdings at your marginal tax rate.

For example, if you were married and the sum of your base salary and bonus (for both you and our partner) was $350k setting your supplemental withholding rate to ~32% would be a good starting point.

In 6 months I recommend reviewing your total withholdings for the year to date and compare it against the official IRS withholding estimator to see if you need to make any further adjustments.

Alternative strategy: Try to owe the IRS as much as possible while satisfying Safe Harbor rules by paying 90-110% of last years tax liability to prevent owing fees while saving the money in high yielding savings accounts.

Meta employees can update this rate at any time but you need to update it prior to February 8th to have it set for the first vest of 2023. Uber just added this feature in December, however there is a restriction of only being able to change it in the last 2 weeks before the next blackout period starts.

This functionality seems to be becoming more and more common. If you don’t currently have this functionality as part of your equity plan, I would advocate to your companies equity team to consider adding it.

Now if only I could get Meta to implement auto-sell!

Personal Note

The US economy added more than 500,000 jobs in January. Lowest unemployment rate in 54 years! My personal net worth is approaching the record highs last seen on 1/3/2022. Meta shares doubled in the last 3 months.

I am not celebrating through. This isn’t the time to get comfortable. Every time I go on LinkedIn I see more layoffs in tech. Last thing I want to have to do is go back to my income projections and start zeroing out cells.

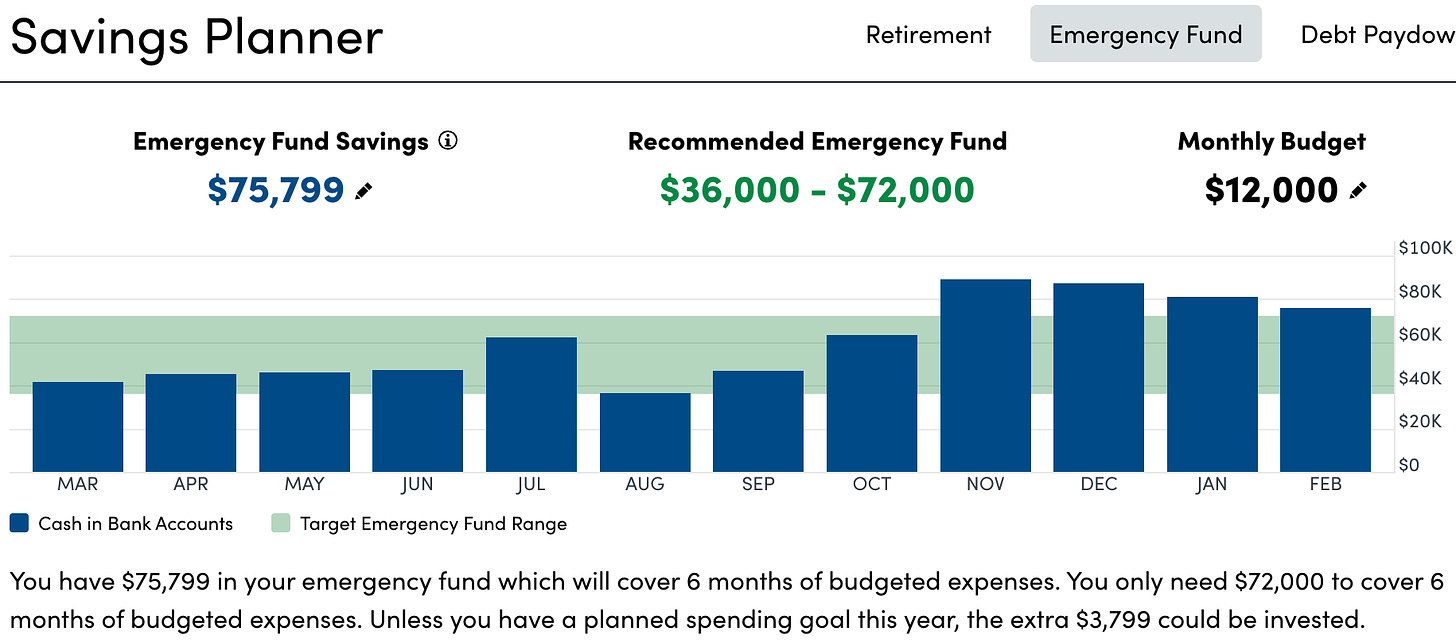

I am focusing on what I can control. Monitoring and securing a strong emergency fund and taking advantage of increased interest rates (earning >4.05% w/ Wealthfront1 currently).

I am being extra conservative here. Realistically we are a dual income household. Losing both our jobs at the same time seems unlikely. On top of that the recent trend has been towards generous severances. I don’t want to rely on that though, FIRE for me is having control over my situation. I am using this emergency fund buffer to give me the confidence to stick to my FIRE plans.

-Andre

Did you know I added a section with my favorite dashboards and third party tools?

Disclaimer: I have all of my emergency fund with WealthFront. If you sign up for an account through this link we both get an extra 0.5% interest for 3 months.

Hi Andre, great article. Curious on your take between Wealthfront's cash account (currently yields 4.05%) vs. a Vanguard MM fund such as VUSXX (currently yields 4.4% PLUS state tax exemption). Thanks for sharing!