Hey FAANG FIRE,

Today, I want to walk you through how I rebalance my investment portfolio.

The goal of rebalancing is to keep your overall portfolio aligned with your target asset allocation.

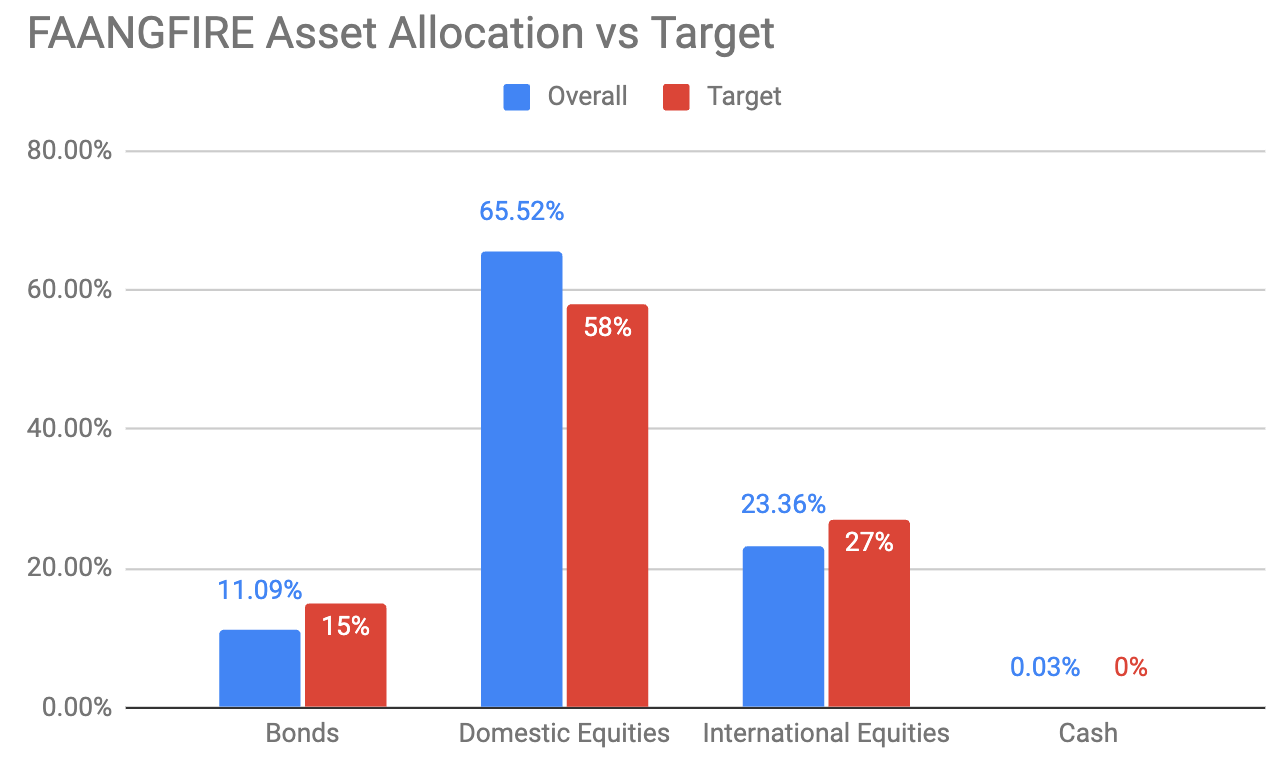

My Current Allocation:

65.5% US Equities

23.5% International Equities

11% Bonds

My Goal Asset Allocation:

56% US Equities

27% International Equities

15% Bonds

These asset allocations represent my entire household’s portfolio, which I view as one large, unified portfolio. It includes only my FIRE-allocated investments. It excludes my emergency fund, bank account balances, my daughter’s 529 account, and any individual stocks I hold. The exclusion of individual company shares is very unconventional. I primarily use it as an extra forcing function to consistently sell RSUs that vest (META and UBER previously, now only UBER via my partner). The one recent exception to my individual company exclusion is the $100,000 I have invested with FREC’s Direct Indexing Product (which is lumped into my US Equities allocation).

Speaking of Frec…

This Post is Sponsored by Frec

Just as easy as investing in an ETF, Frec Direct Indexing can help you earn more by unlocking tax savings, no matter the market. Invest in popular indices like the S&P 500 and Frec will automatically tax-loss harvest the underlying stocks, resulting in significant tax losses that can be used to offset capital gains.

Check them out at https://frec.com/

FAANG FIRE readers are eligible for a $250 Sign Up Bonus when you join Frec and invest at least $20,000 into one of their Direct Indexing portfolios.

Frec CEO, Mo Al Adham, and I will be co-hosting a FIREside chat on August 14th. We will discuss how direct indexing can be used to help diversify heavily concentrated positions in a tax-efficient manner and address any questions you have on the topic.

Recap on Asset Allocation

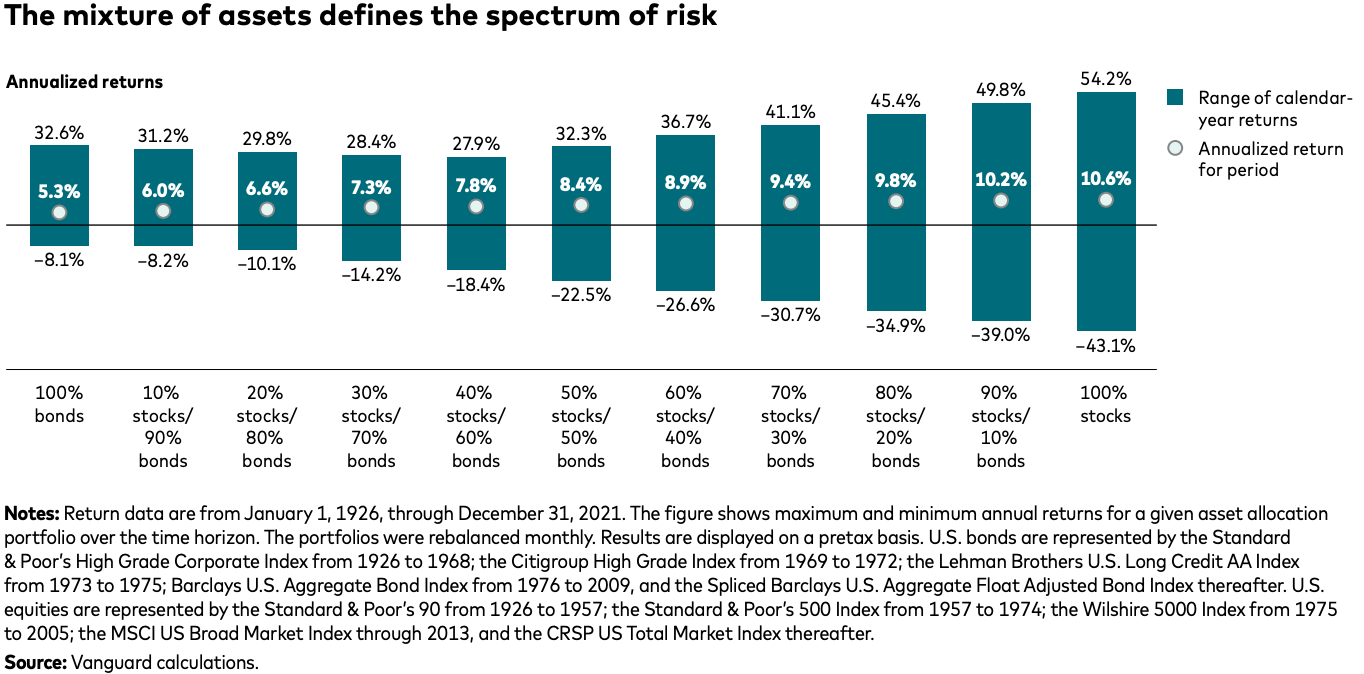

My portfolio consists of three primary asset classes: US Stocks, International Stocks, and Bonds. At the simplest level, you could view it as consisting of two primary asset classes: stocks and bonds. Generally, the more bonds you hold the more “conservative” or “lower risk” your portfolio would be. A 20-year-old new investor might be comfortable with 100% VTI, while that might be extremely risky for an 80-year-old who is relying on their portfolio to fund their final decades of life.

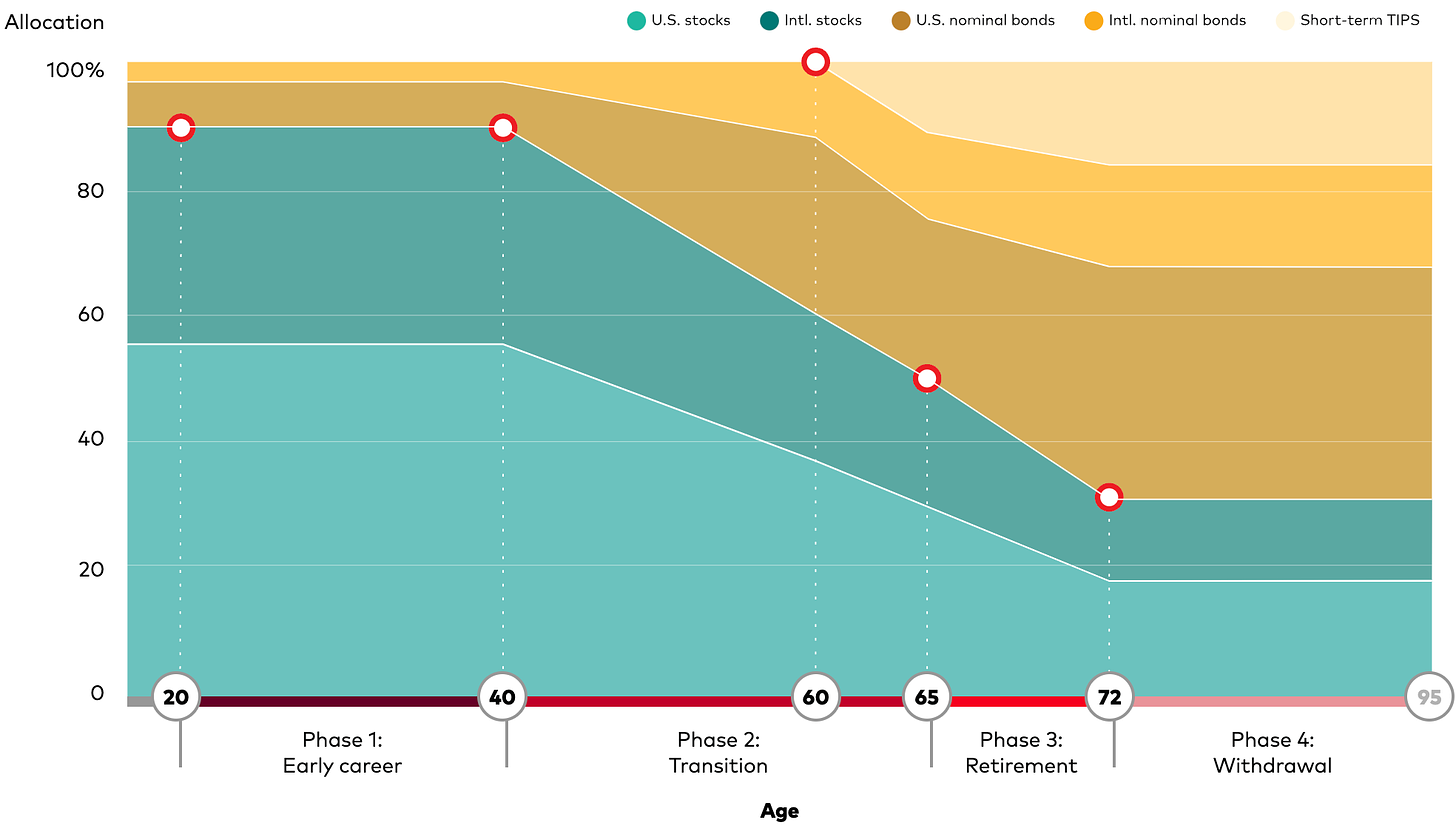

One helpful way to understand how asset allocations might change over time is to look at how different companies who offer target date retirement funds manage things.

You can see here that Vanguard generally has an asset allocation for their target date funds of 54% US Equities, 36% International Equities, and 10% Bonds until you reach age 40. Then it begins slowly increasing the percentage of the portfolio that comprises bonds. With a final asset allocation of 30% Stocks and 70% bonds from age 72 and beyond. This shift in asset allocation overtime is referred to as an equity glide path.

My personal asset allocation might generally be different than the default for a few reasons. For one, I am semi-retired already. This might push me to be slightly more conservative for my age. At the same time though, I need my portfolio to survive a 65+ year early retirement vs the more traditional 30 years. This might push me to maintain a more aggressive portfolio longer. If you are near FIRE I would recommend a casual read through ERN’s Safe Withdraw Rate Series, which may influence your asset allocation as you move into the phase of relying on your portfolio for your living expenses.

For some more details behind my asset allocation and asset location strategy be sure to read this prior post. The main change I have made since that time is increasing my Bond allocation from 10% to 15% as I officially became Semi-FIRE:

Why Rebalance?

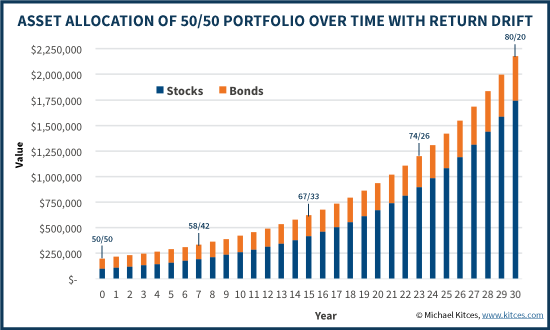

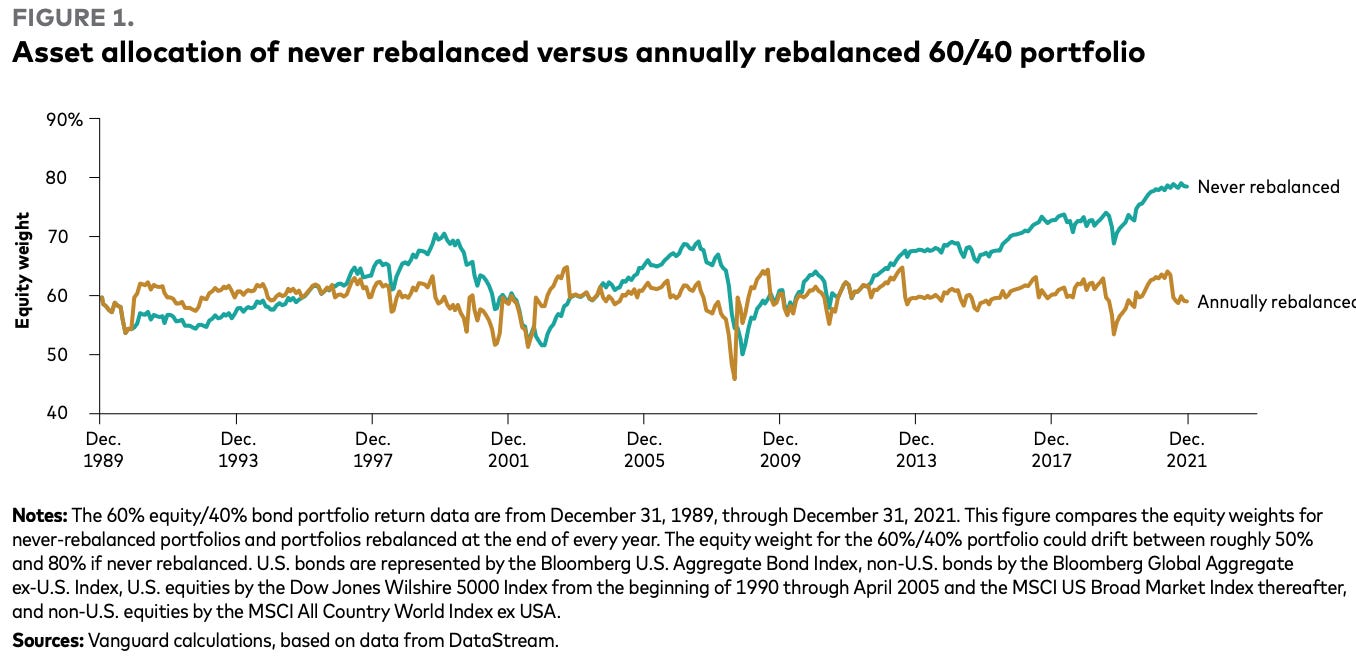

One reason to hold different asset classes is that they are not perfectly correlated. Over time, if you don’t rebalance your portfolio, your asset allocation will naturally drift away from your target allocation. This drift could leave you with a much riskier portfolio than you originally intended.

“What starts out as a 50/50 portfolio drifts to 67/33 by 15 years, and nearly 80/20 after 30 years! Thus, just buying and holding a stock/bond portfolio will eventually lead equity exposure to become far greater than what was originally intended, and perhaps greater than what the client can tolerate.” - Kitces

This isn’t about maximizing returns; it’s about maintaining my desired level of risk and diversification over time. Vanguard’s research

Rebalancing to Reach my Goal Asset Allocation

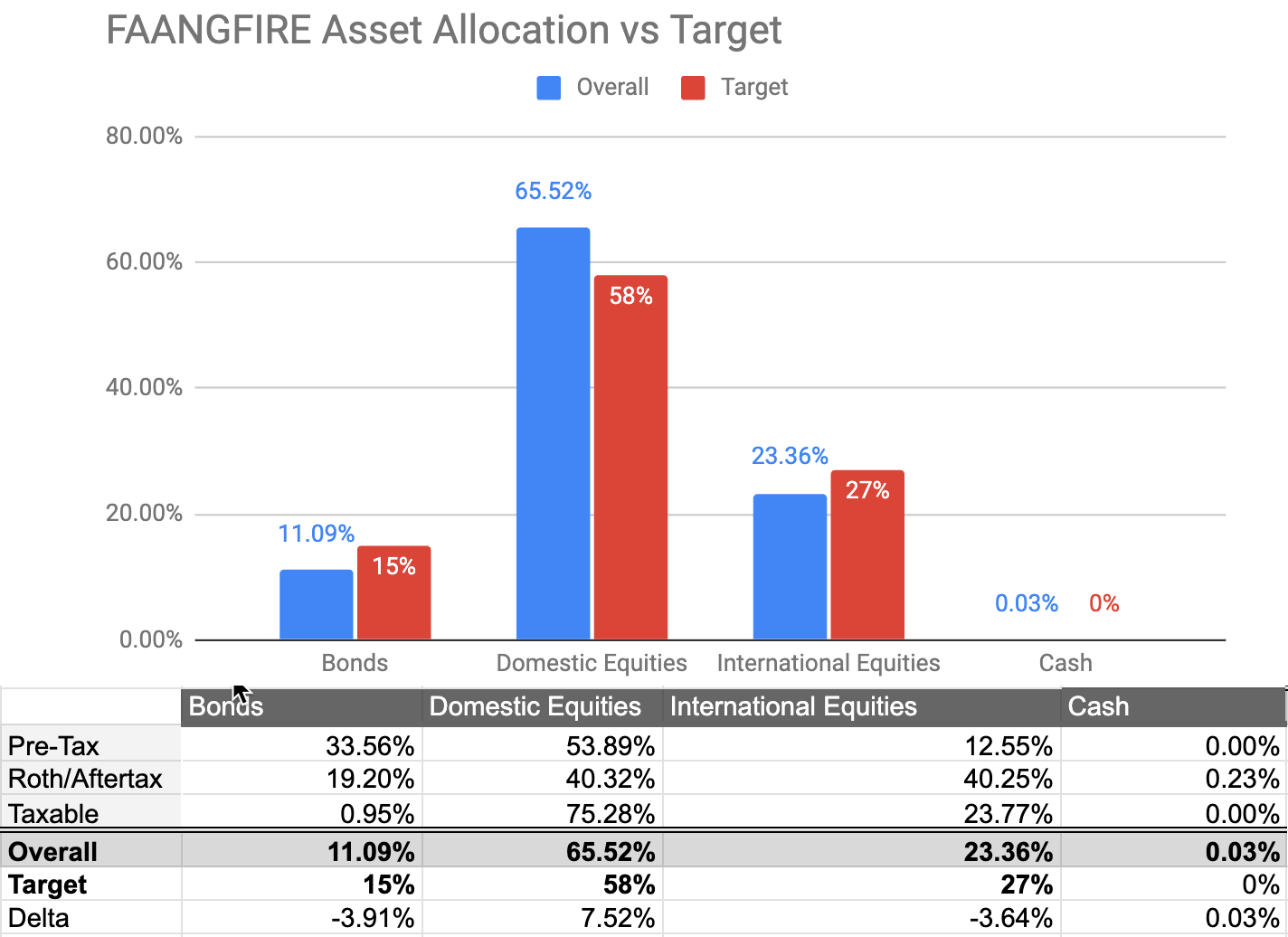

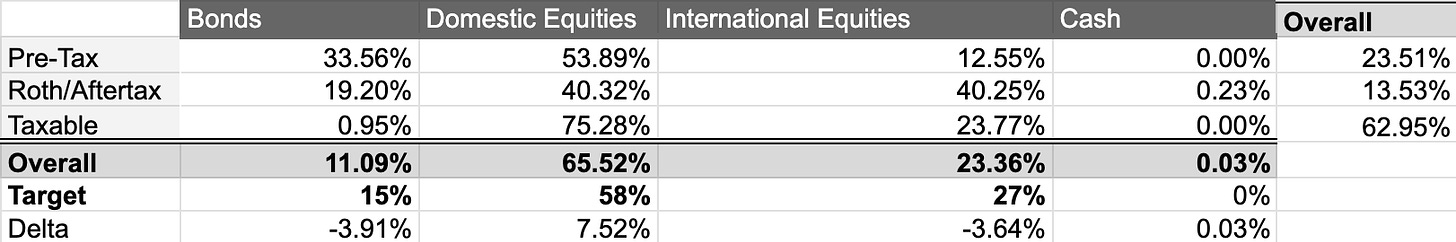

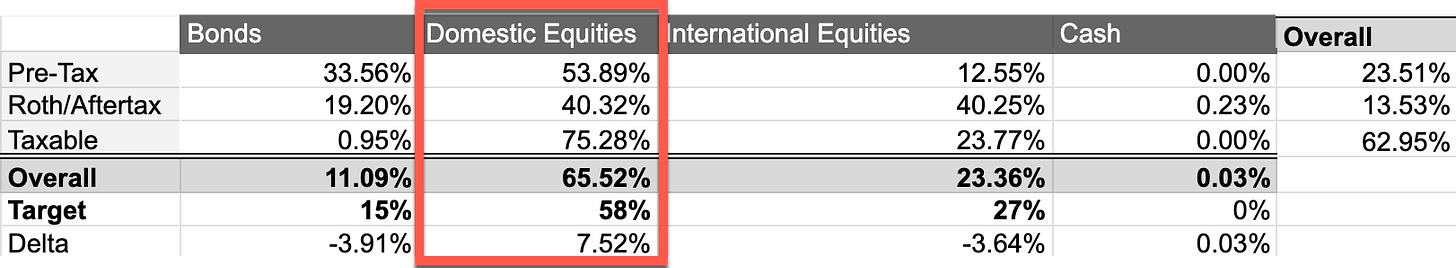

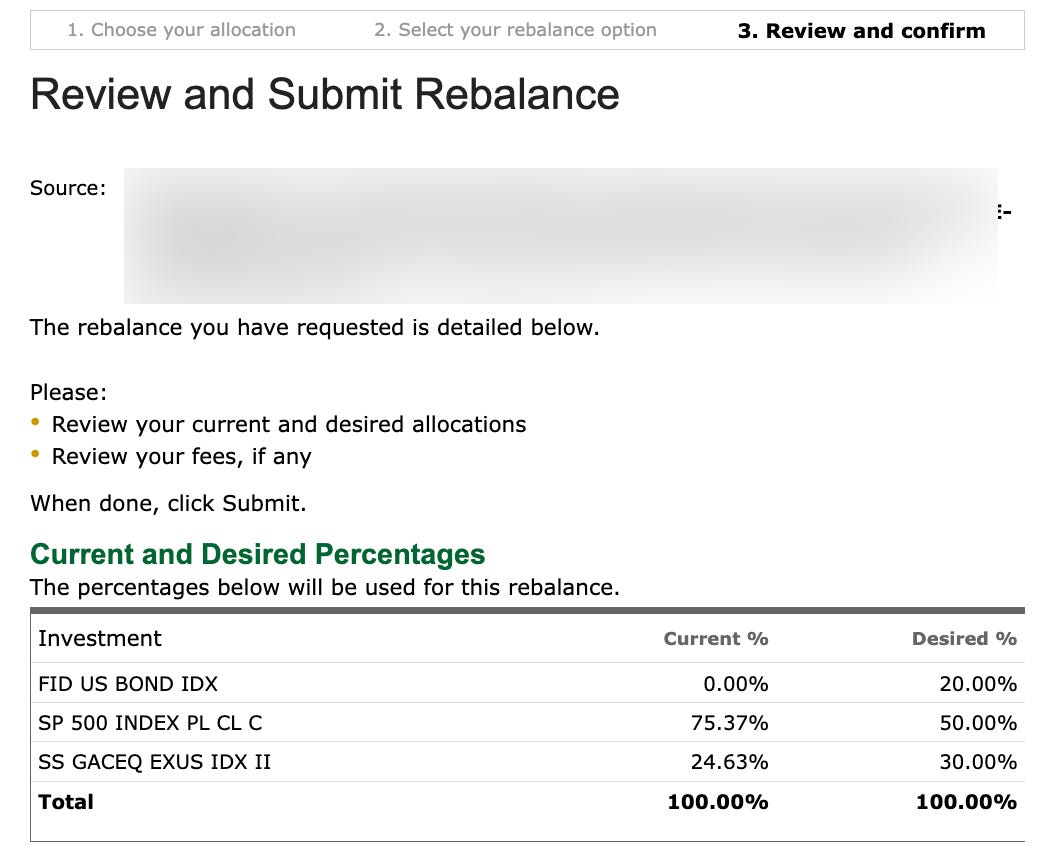

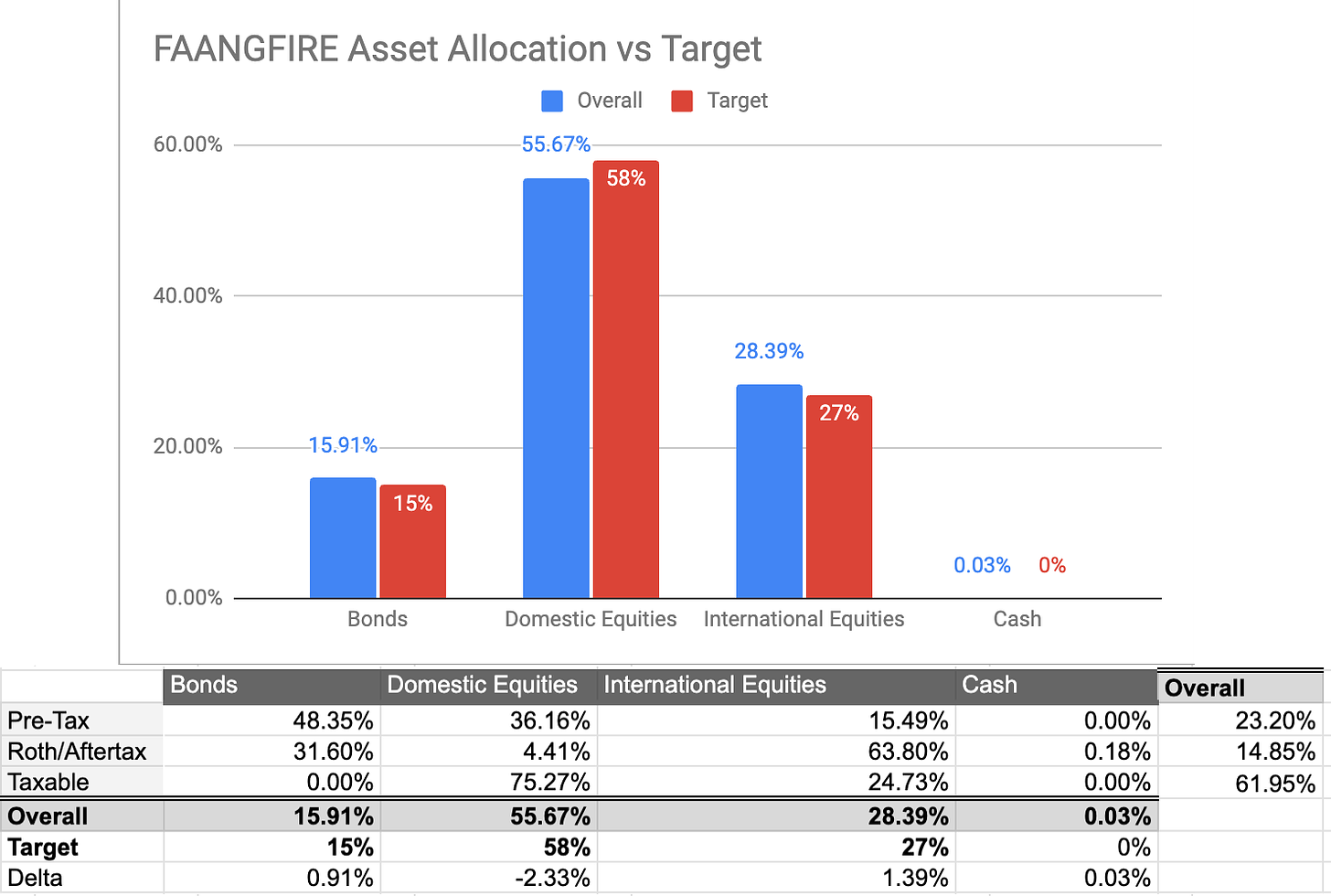

The chart above displays both my current overall asset allocation and my target allocation. It also details the underlying asset allocation within each of the three account types I hold:

Pre-Tax: Pre-Tax 401ks, Traditional IRAs, Rollover IRAs

Roth/After-Tax: Roth IRAs, Roth 401ks, HSAs

Taxable: Normal Taxable Brokerage Accounts

My current asset allocation is overweight in US equities and underweight in both international equities and bonds. I need to reduce my US Equity Holdings by 7.5% overall and roughly split that across both International Equities and Bonds.

If we pretend my overall portfolio balance is $1,000,000, I would need to reduce my U.S. equity holdings by $75,000, increase my international holdings by $39,000, and increase my bond holdings by $36,000."

If I were still working full-time at a FAANG company, I would typically adjust my asset allocation by changing how I allocate future investments. So all my new money going into my 401k and taxable accounts would shift to stop buying more US Equities and instead buying Bonds and International Equities. I would be doing this while factoring in my Asset Location goals (primarily of avoiding Bonds in my taxable accounts).

However, I am not currently working at a FAANG company. That means I am not making enough new contributions to my retirement accounts to rely only on new money to help me reach my asset allocation goals.

The obvious solution here is for me to sell $75,000 of US Equities and buy the requisite amount of International Equities and Bonds.

To determine what to sell, I start by looking closer at where I currently hold US Equities (referred to as Domestic Equities in the charts).

I am holding US Equities across all my account types (Pre-Tax, Roth, Taxable).

This is important to consider. I can buy and sell within my tax-advantaged accounts (Pre-Tax and Roth) without considering taxes. However, if I sell within my taxable account, I need to factor in the potential tax implications.

My mental thought process:

I start by looking at my taxable account.

Do I have any cash in the account from dividends? I have a very small amount.

Do I have any tax-inefficient holdings that I shouldn’t be keeping in my taxable account? I see that 0.95% of my taxable portfolio is in Bonds. Normally, from a tax location perspective Bonds should be held within a tax advantaged account. However, my current bonds in my taxable account are actually in a Treasury-Only Money Market Fund (FDLXX), which is yielding just under 5% and is not subject to California taxes. Because they are money market funds, they generally maintain a net asset value (NAV) of $1, eliminating concerns about capital gains.

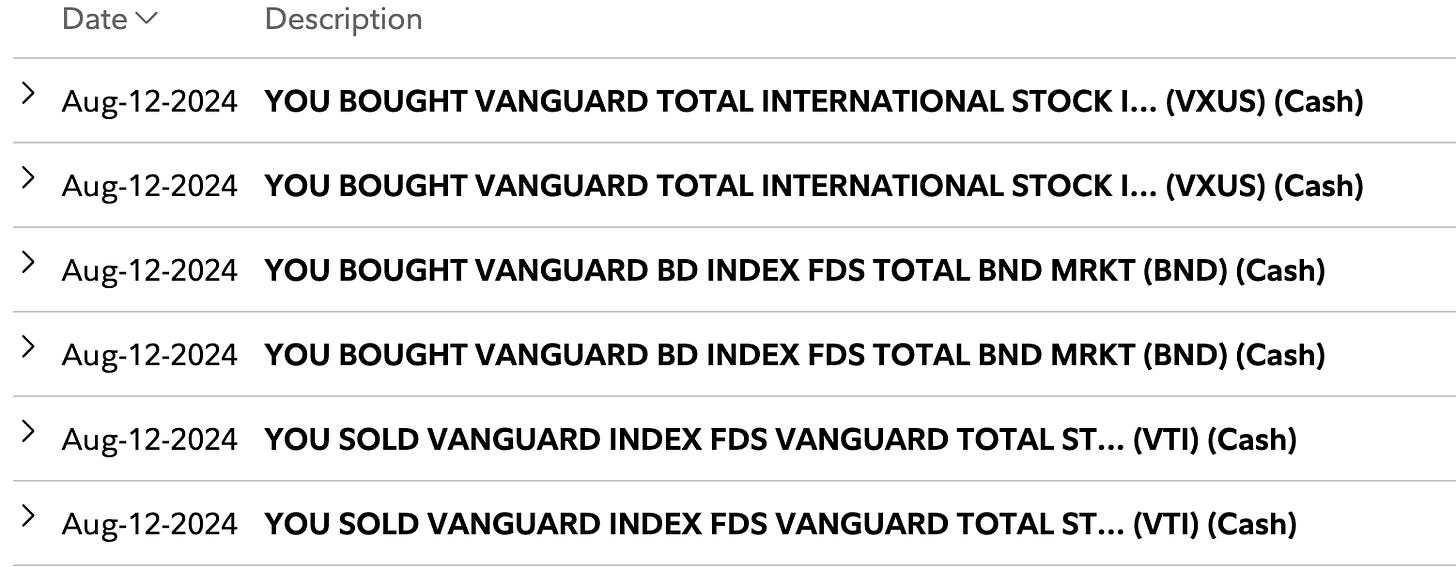

Since this isn’t part of my emergency fund, I decided to sell FDLXX and use the proceeds to purchase Vanguard’s low-fee international index fund, VXUS. The amounts here are very small, effectively amounting to a rounding error within my overall asset allocation.

Next, I review all my U.S. equity holdings to see if any individual tax lots have losses. I would begin by selling those lots with losses to take advantage of tax-loss harvesting, thereby avoiding tax implications when selling to rebalance. However, I currently don’t have any taxable U.S. equity lots with losses.

So, I then turn to my tax-advantaged accounts, where the process is much more straightforward. One of the benefits of having money in my pre-tax 401(k) or Roth IRA is that I can buy and sell funds without worrying about taxes. One thing to watch out for is holding the same funds in both your tax-advantaged and taxable accounts. If you sell VTI for a loss in your taxable account and then purchase VTI immediately in your Roth IRA, it would trigger a wash sale.

A large portion of my US Equity positions are in my Pre-Tax accounts. These would be my Meta 401k and my partner’s Uber 401k.

Within Uber’s 401k at Fidelity I used the functionality where you can set your asset allocation for the account. This was honestly more of a pain than it was worth. If I were to do this again, I would simply exchange one fund for another, which would allow me to easily set the amounts in dollar terms rather than as a percentage of the account.

I then went through my Meta 401k where I sold more of my US Equities positions (VTI) and purchased International Equities (VXUS) and Bonds (BND).

Next, I reviewed my Roth IRA and once again sold more U.S. equities while purchasing international equities. I purchased FTIHX, Fidelity’s version of VTSAX, over my usual VXUS simply because I was already holding a mutual fund which prevented me from simply selling and buying during the trading day. Exchanging one fund for another saved me a step.

After all was said and done, I am pretty much at my target asset allocation.

Future optimizations

I need to do a little more research into my asset location. It feels like it might be a mistake to have 30% of my Roth funds dedicated to Bonds. The struggle is that if the bonds are not held in my Roth they would push my pre-tax funds into being primarily Bonds. I have currently chosen to have a mixed asset allocation within both my Roth and Pre-Tax. This is all a micro-optimization though. As I refine my strategy, I can easily make changes within my tax-advantaged accounts without worrying about any tax implications.

How Often do I Rebalance?

On a quarterly basis, I review my asset allocation and adjust where any automatic investments are directed (currently, this only applies to my partner’s 401k). If, during these quarterly reviews, my asset allocation has drifted more than ~3%, I will follow the steps I shared in this post and make manual adjustments, primarily within my tax-advantaged accounts, to avoid transaction costs. Each time I make a lump-sum investment, I review my asset allocation to determine which asset class to purchase to get closer to my target allocation.

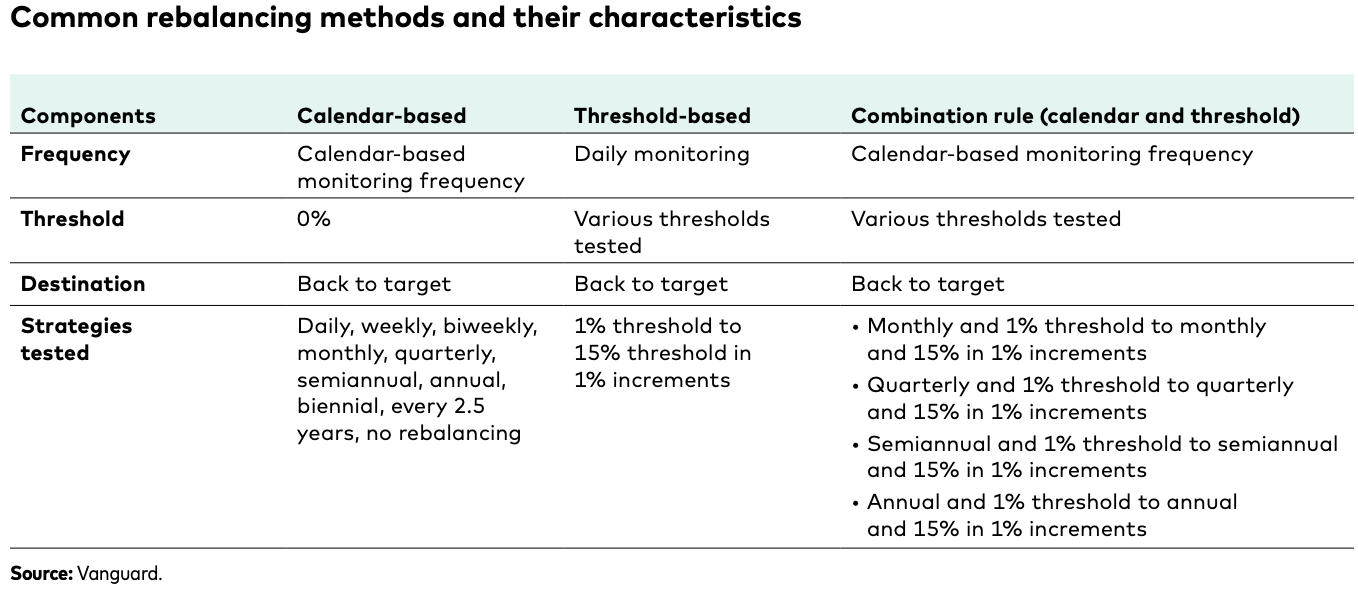

Much has been written about how often you should rebalance and the different strategies for determining when and how to rebalance. Here Vanguard lists the most common methods:

For example, Vanguard’s Target Date Funds handle rebalancing primarily through a threshold-based approach, rebalancing portfolios only when the asset allocation drifts approximately 2% from the target. They prefer this over calendar-based rebalancing because it minimizes transaction costs and better maintains the strategic asset allocation, especially during periods of market volatility.

The more you read, the more conflicting information you encounter. You'll find arguments for everything from avoiding rebalancing altogether, to rebalancing monthly, annually, or based on set thresholds.

How Often Should You Rebalance Your Portfolio? - Early Retirement Now

Rational rebalancing: An analytical approach… (Vanguard, PDF)

How Portfolio Rebalancing Usually Reduces Long-Term Returns (But Is Good Risk Management Anyway) - Kitces

Final Thoughts

Keep it simple.

Identify a reasonable asset allocation for your age and risk tolerance.

While you are working you can easily make changes to your asset allocation by changing where you invest new money.

Come up with a rebalancing timeline that works for you and stick to it. Adjusting your rebalancing timelines based on vibes is market timing under the guise of managing risk.

Look to your tax advantaged accounts when rebalancing where you don’t need to worry about capital gains taxes.

I promise that if you even know your current asset allocation you are ahead of 90% of people.

My one word of caution is to be realistic with yourself.

Are you genuinely rebalancing your portfolio, or are you just finding a justification to time the market?

-Andre

Good write up, Andre. I would be hesitant to hold any bonds in your Roth, with the main goal being maximum growth on those tax-free assets. Given you still want a 15% bond allocation, that leaves pre-tax accounts or taxable accounts. I would argue that the main benefit of making pre-tax contributions for a younger investor with relatively high income from big tech is to get the resulting tax deduction each year, and less so the tax-deferred growth that a 401k or IRA offers. With that in mind, holding bonds in a pre-tax account seems optimal. You also reduce the future account size by holding lower-growth assets, which reduces RMDs and the associated taxes; however, since RMDs are so far in the future (30-40 years for most investors in this cohort) it may not be wise to rely too heavily on current tax law enduring through then. If you really want to maximize tax-deferred accounts and hold bonds only in taxable accounts, the tax drag from a 15% bond allocation likely isn’t huge - it probably becomes more of an issue as the bond goal pushes 30%-40%. Another consideration for the semi retired (or fully retired) investor is that having a bit of money in bonds in a taxable account vs. tax-deferred gives you quick access to liquidity without worrying about taxes or penalties when withdrawing from a tax-deferred account. If you need cash for expenses during a severe market downturn and don’t want to sell stocks at a big loss to cover cash needs, having taxable bond money provides quick access to relatively stable assets, usually with much lower unrealized capital gains.

What do you think of the advice in A Simple Path to Wealth that is, if I can summarize, "VTSAX and chill"? I haven't bought bonds as investments, I either have cash or cash-equivalent for funds that I want not to have risk, and the rest are pretty much all in some kind of total market index.