Since the first robo-advisors came on the market, I have been “robo-curious”.

The future promise of an automated world. Where your asset allocation is constantly on target. Where every dollar perfectly is allocated. Where every tax opportunity is captured.

But those damn fees.

I could never justify the fees they charged over my usual selection of index funds like VTI or VXUS. Even at the lower end, the fees still seemed to muddle the benefits for me.

The most compelling element for me wasn’t even the automated rebalancing. I never had an issue updating my asset allocation manually.

The one-two punch of direct indexing with automatic tax loss harvesting was really what enticed me. Direct Indexing with tax loss harvesting was the one of the “magic” things the roboadvisors could do that I couldn’t do myself.

But still, the fees were too high in my opinion.

That is where today’s sponsor comes in:

This Post is Sponsored by Frec

Just as easy as investing in an ETF, Frec Direct Indexing can help you earn more by unlocking tax savings, no matter the market. Direct index for as little as 0.10%. Check them out at https://frec.com/

FAANG FIRE readers are eligible for a $250 Sign Up Bonus when you join Frec and invest at least $20,000 into one of their Direct Indexing portfolios.

Frec CEO, Mo Al Adham, and I will be co-hosting a FIREside chat on August 14th. We will discuss how direct indexing can be used to help diversify heavily concentrated positions in a tax-efficient manner and address any questions you have on the topic.

A Low Fee Direct Indexing Option

Frec was really fascinating to me with their fee of 0.10%. I had never seen a fee this low.

The incremental fee is actually even lower than 0.10%. Frec’s direct indexing doesn’t use ETFs, which means you aren’t paying for an ETF expense ratio. This lowers the incremental fee down from 0.10% to 0.07% when compared to the very low fees VOO has (0.03%). In comparison, many robo-advisors use ETFs and therefore you’re charged an expense ratio on top of their management fees (often ~0.25%).

So while I could never make a .25% fee pencil out, Frec’s significantly lower effective .07% fee, meant I needed to take a closer look.

Frec didn’t originally reach out to me, I reached out directly to them. I wanted to learn more about how Frec was approaching direct indexing, and more importantly hear from them directly on my biggest fears, concerns with Direct Indexing in the first place, and the sustainability of their fee structure.

My Experiences with Frec & Direct Indexing So Far

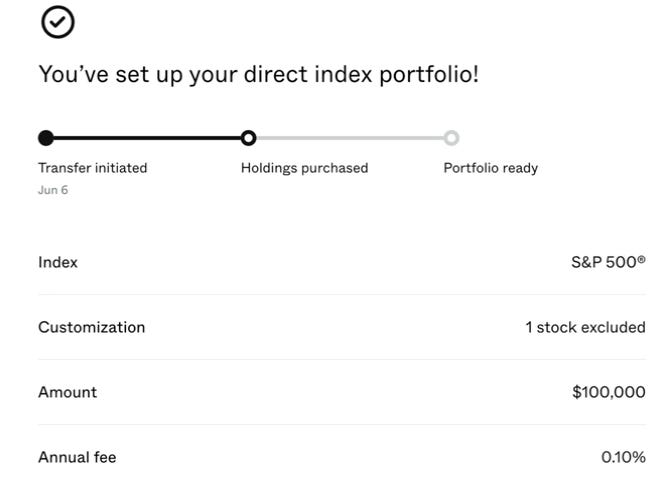

I invested $100,000 of my own money with Frec.

I am not willing to take sponsorship money from a product unless I would use it myself. So before agreeing to anything w/ the Frec team I decided to put my own money in so I could share my real experiences with direct indexing and see if it would be something I would be comfortable recommending to the broader FAANG FIRE audience.

The $100,000 is being invested into Frec’s S&P 500 direct indexing product. I was easily able to exclude Uber from the S&P500 direct index since my wife works there, it can only be traded within open trading windows, and we are already overly concentrated in our Uber position.

Key things I am tracking:

Frec’s Fee: 0.10% or 0.07% more than VOO factoring in the VOO expense ratio

Tax Loss Harvesting

Tracking Error against VOO

Broader Tax Implications (Dividends, Distributions, ect).

Early Impressions

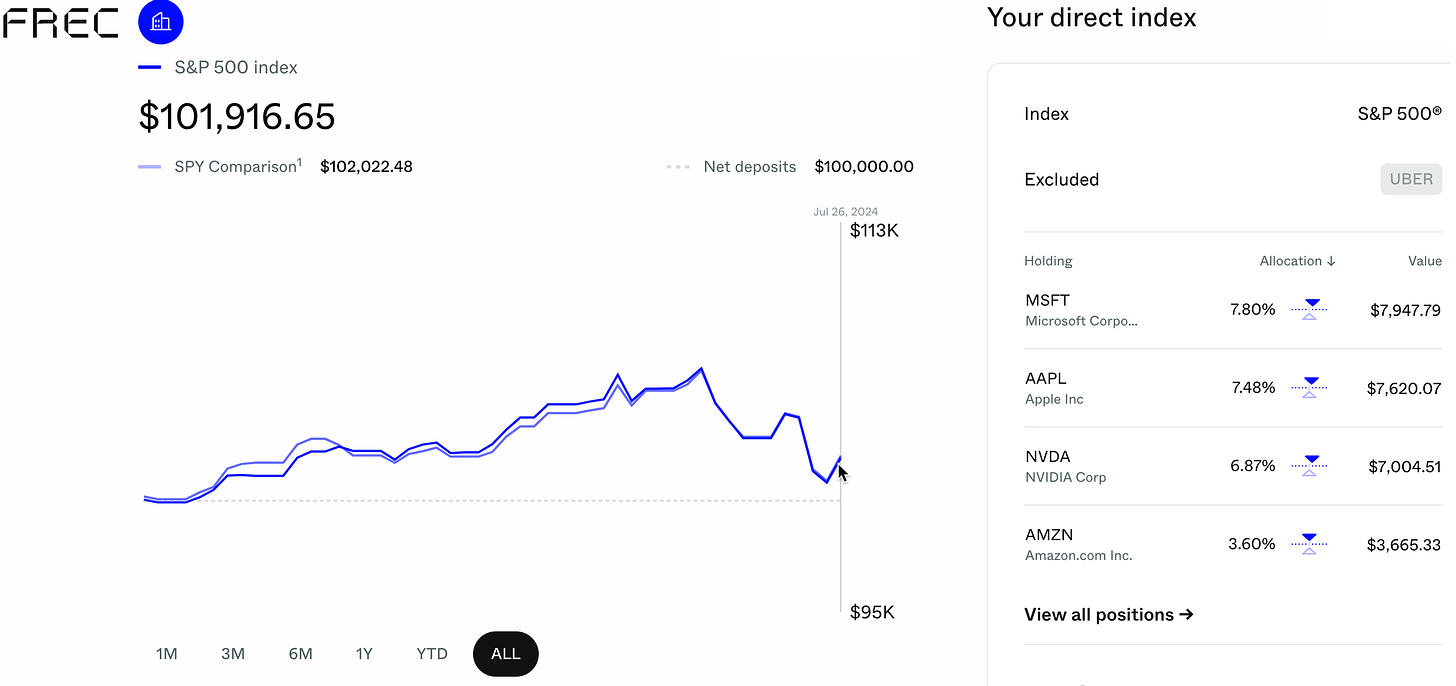

My Frec Direct S&P 500 index is up to $101,916 since I first deposited my funds on June 6th. This is in-line with the core index it tracks. This is the goal. If things were to deviate from the index, this would be referred to as tracking error. Frec has estimated that you would see a tracking error of less than 1% per year over 10 years.

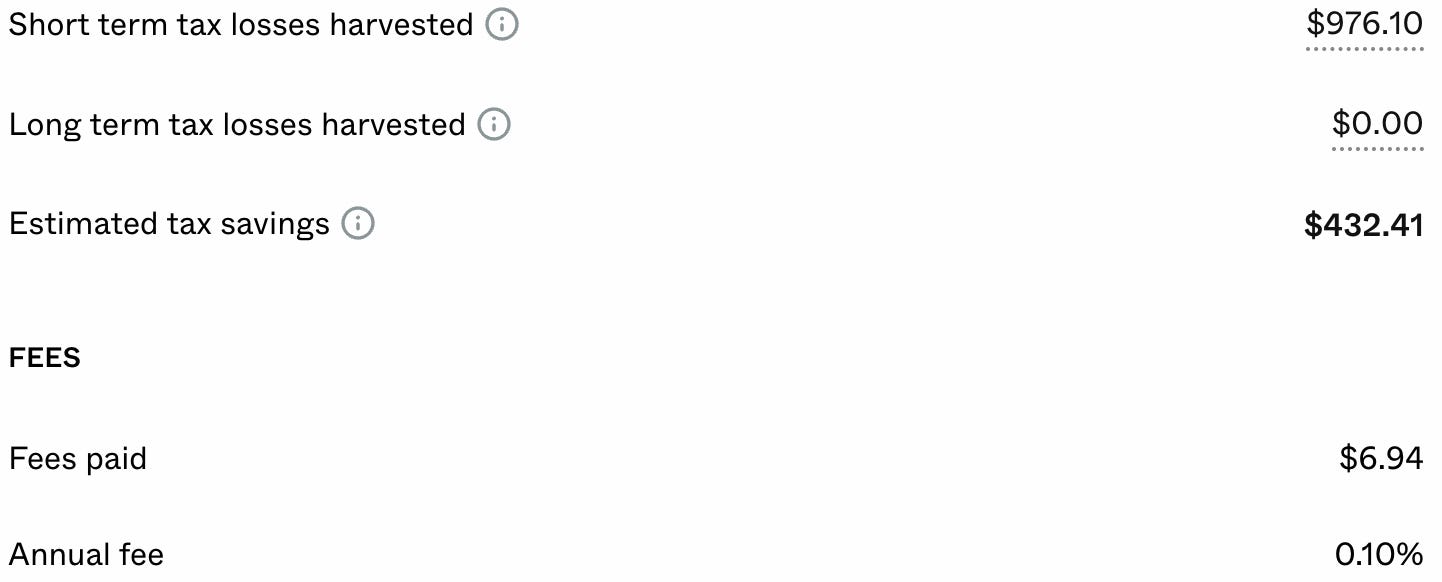

Frec was able to harvest $976 in losses over the past 2 months. Frec’s research says that on average you can expect around 14.7% of your initial contribution in losses within the first 12 months. That translates to 1.225% per month, or $1,225 per month.

If the losses were perfectly linear, that would expect ~$2,000 in losses at this point. So we are under performing the estimates, but again, the market was straight up for most of the past two months. The fact it has been able to still harvest $976 makes me feel good about their ability to “catch-up”! I’ll keep y’all updated here.

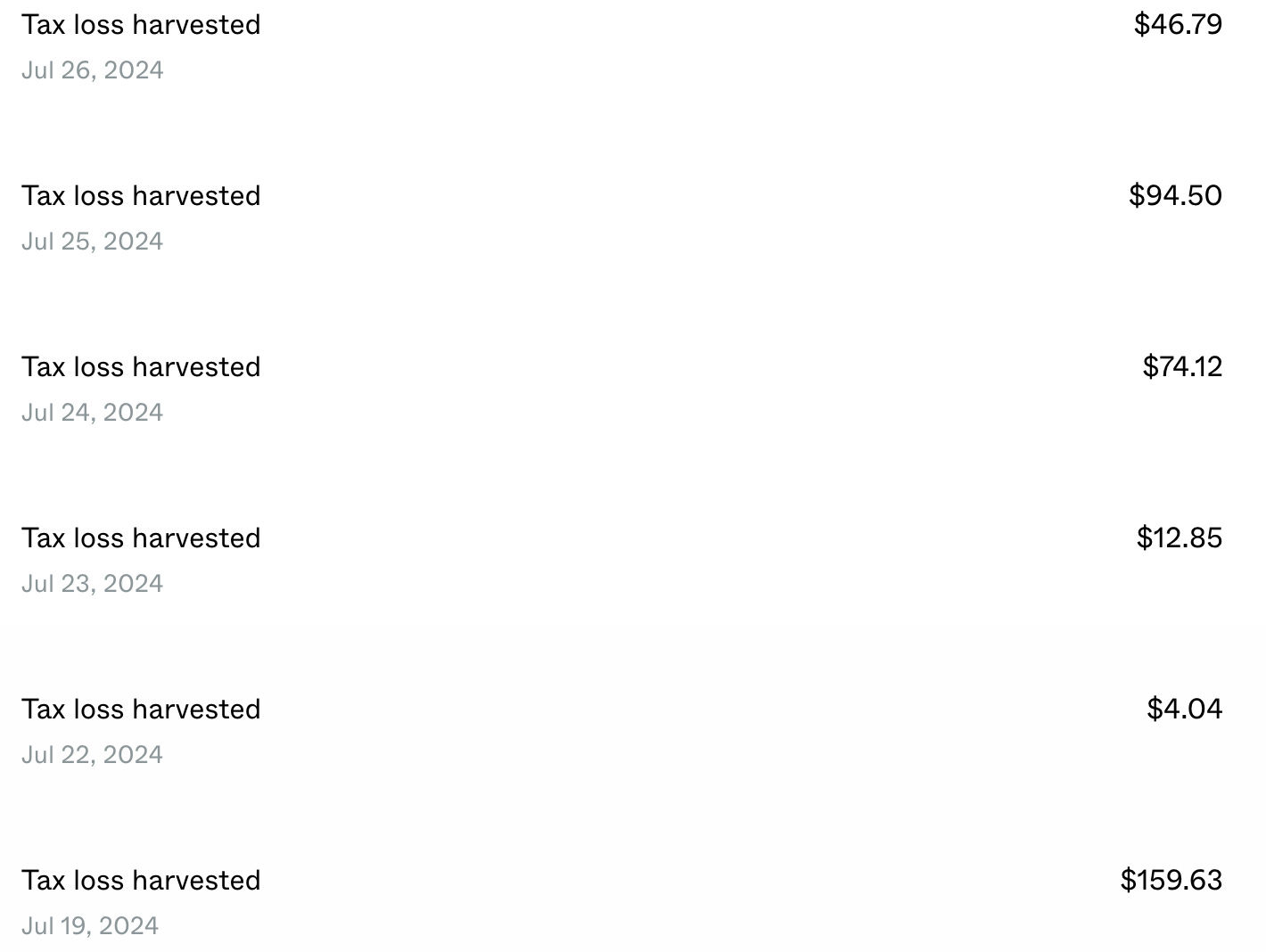

It has been fascinating to see the daily trading activity of losses harvested and dividend payments from the nearly 500 companies I now hold shares in.

So What Exactly is Direct Indexing?

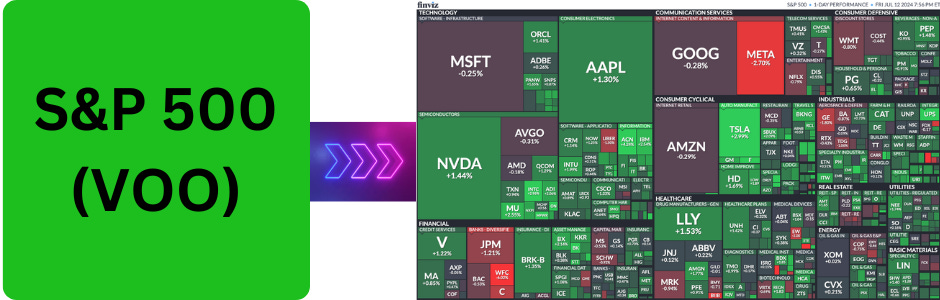

With direct indexing, instead of holding an ETF of the S&P500 like VOO, you own the underlying stocks that make up the index. You would have ~500 individual positions, matching the weighting to put you roughly equivalent to the overall index you are mirroring.

The real magic happens though when automation is layered on and each small movement across the 500 individual companies you hold has the capability to generate countless tax loss harvesting opportunities.

What is Tax Loss Harvesting?

Tax loss harvesting is when you sell a stock at a loss in a taxable account for the purposes of reducing your taxes.

Tax loss harvesting can reduce your taxes by using your stock losses to first offset your stock gains as well as reduce your overall taxable income. Losses can offset an unlimited amount of capital gains. For example, you could offset $1,000,000 in gains with $1,000,000 in losses. If you have more losses than gains, you can offset $3,000 in ordinary income with those losses. And if you have even more leftover losses, you can carry those forward into future years.

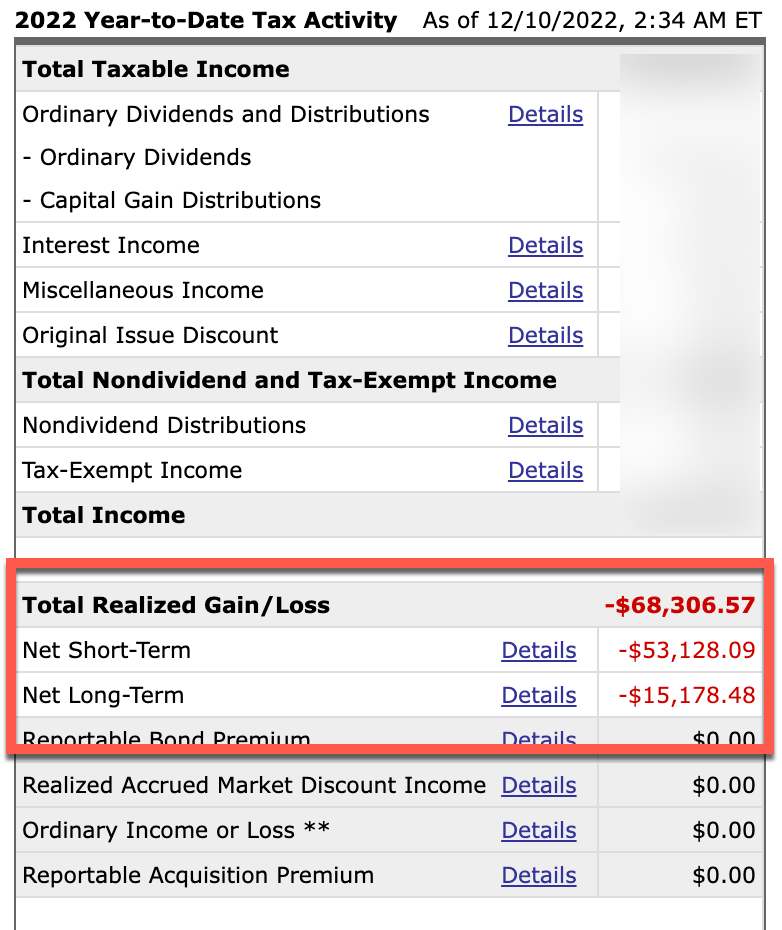

In 2022, I was able to capture $68k in losses through tax loss harvesting! This was relatively easy to do manually since in 2022 nearly all my index funds were down. I used a strategy of index fun pairing to sell losses of one index and buy a similar, but not substantially identical, fund. Full Details Here.

In 2022 I didn’t have any gains to offset, so I was able to use those losses to reduce my taxable income by $3,000, and carry forward the remaining $65k in losses into 2023.

Then in 2023, while the markets were ripping in the positive direction, I was able to use the remaining $65k in losses to sell some of my partner’s highly appreciated Uber stock (from past RSU and ESPP purchases). This allowed me to reduce my household concentration in a single stock closer to my goal levels.

But now that we are halfway through 2024, the overall markets have continued on their overall upward trajectory. That also means nearly every one of my taxable holdings of low fee index funds are positive. Good problems to have, but that means I don’t have the ability to harvest any losses.

Improving Tax Loss Harvesting Using Direct Indexing

With my usual simple portfolio of primarily VTI/VXUS (and different variations of similar ETFs and Mutual Funds) it has been easy to harvest losses when the overall market is down. Particularly during my peak earning years where I am making consistent monthly contributions generating a large number of lots of purchases at different prices.

In years like 2023 and 2024, losses are very hard to come by.

This is where the real magic of direct indexing combined with tax loss harvesting comes into play.

Instead of needing the overall index I am invested in to be down to capture a loss, I just need a small number of the 500 companies in the S&P 500 to be down.

This creates the opportunity to harvest losses almost every single day. This would be impossible to do manually, but the power of modern computing makes this trivial.

For example, looking at just a single week in the S&P 500, even though the overall index was up 1%, there are countless companies that were down (red in the image below).

And this is just over a week. Direct Indexing w/ Tax Loss Harvesting can capture losses every single day to be used to offset capital gains.

The Key Benefits of Direct Indexing w/ Tax Loss Harvesting

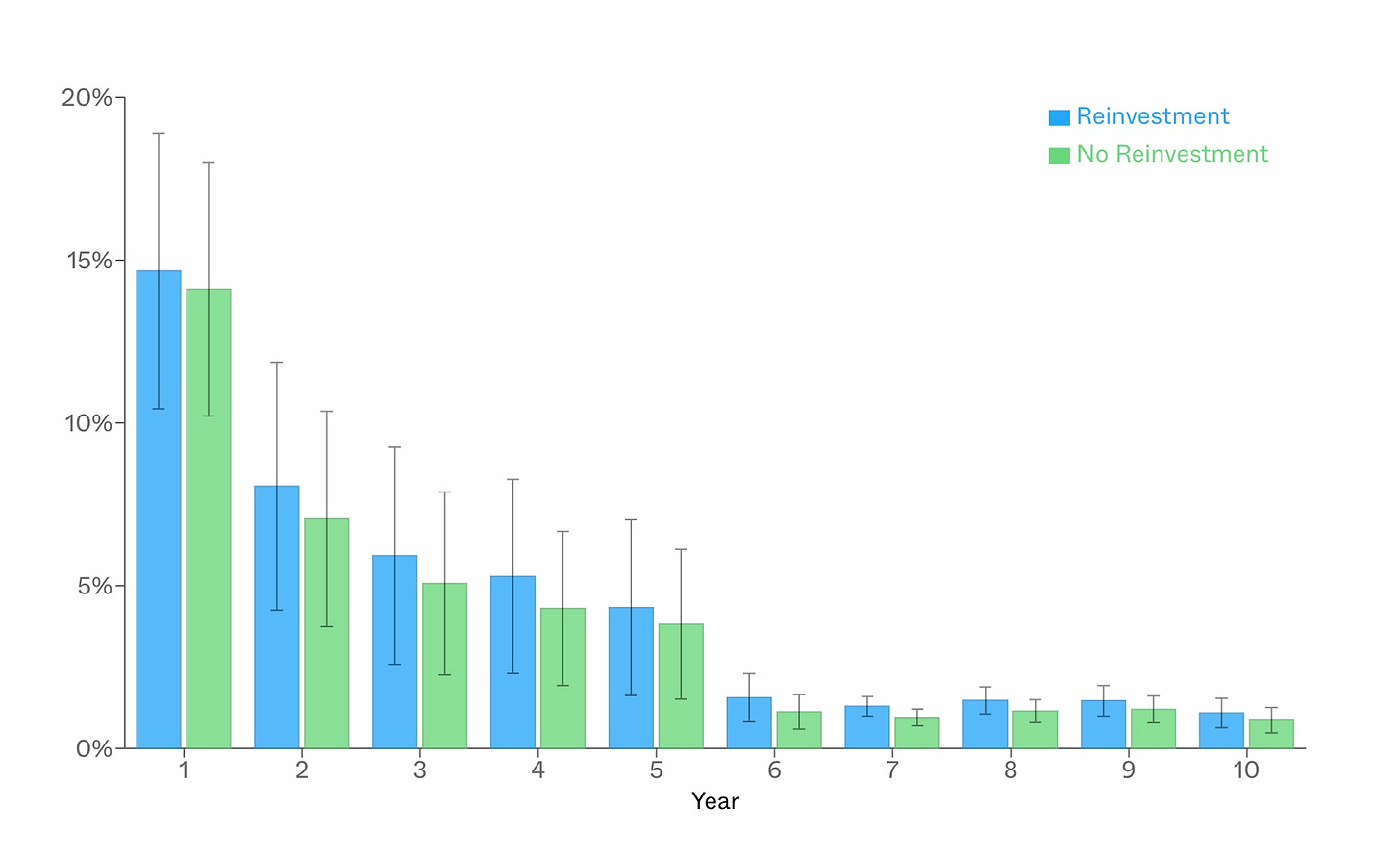

Frec’s research found that “after 10 years the direct indexing algorithm harvested losses summing to 45% of the initial deposit ($22,567) when reinvesting and 40% ($19,820) without reinvesting losses…. we anticipate you to harvest losses equal to 14.7% of your portfolio in your first year”.-Frec’s Whitepaper

That means on average you will tax loss harvest 40% of your original investment value over 10 years. The majority of losses likely captured in the first 5 years. Frec has a nice visual in the chart below showing the average annual percentage of your original investment that would have historically been harvested by year following your initial investment.

Vanguard’s Tax Alpha calculator also allows you to see the cumulative losses that a $1,000,000 portfolio would have experienced when direct indexing over every 10 year period starting with 1983-1992 and ending with 2013-2022. The lowest amount of harvested losses over 10 years was 25% and the highest 85%.

What’s The Catch?

This isn’t a free lunch. I previously wrote in my post “Is Tax Loss Harvesting a Waste of Time” that the stated benefits of tax loss harvesting were often inflated by robo advisors to cover their fee.

I think tax loss harvesting is relatively easy and you should do it. But I also want to highlight why many people overestimate the real benefit and you should be leery of financial firms using this as justification for their higher fees.

It is important to view Tax Loss Harvesting overall as a tax deferral strategy. This is particularly true in the FIRE scenario where there is an expectation to eventually spend down your portfolio.

The losses that are captured will decrease the cost basis of your investments. When you sell your investments in the future, you will then pay additional capital gains from reduced basis, reducing some of the tax savings.

This fact also makes Direct Indexing w/ Tax Loss Harvesting even more compelling to those who plan on passing down their portfolio to their heirs or donating them in the future. They would effectively be able to defer the losses entirely.

Is it a one way door?

I am always hesitant to go through one way doors. Those are doors that once you enter, you can’t leave. If you start Direct Indexing do you now need to stick with it forever? Am I locked in with Frec forever?

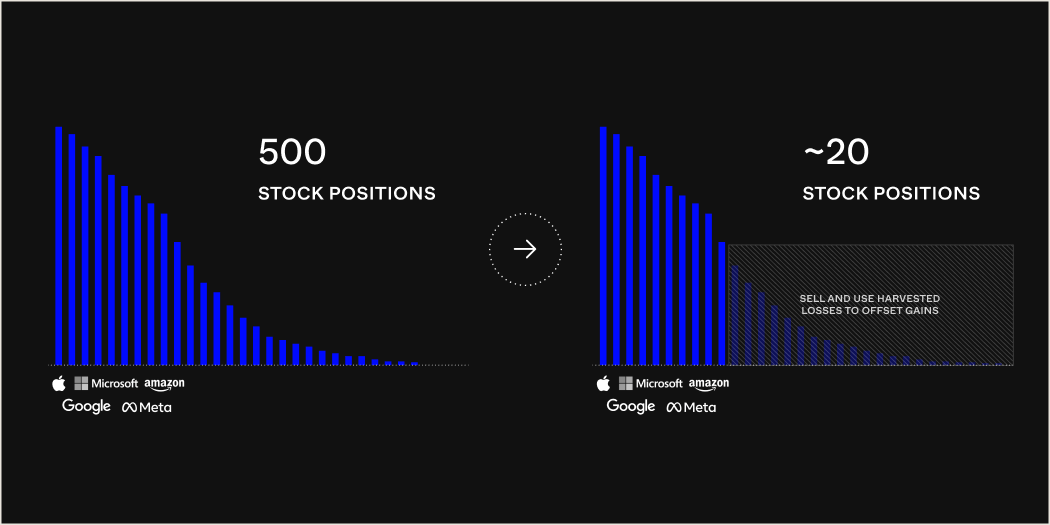

The answer: No, all your funds are held with Apex Clearing. You can ACAT your shares out of Frec at any time (to another Direct Indexing company or into your typical brokerage account. Frec also estimates that most of your holdings would be relatively small, so instead of needing to hold 500+ company shares, you could reduce down to the 20 largest with minimal tax implications.

Who is A Good Candidate For Direct Indexing with Tax Loss Harvesting

You will realize a large amount of capital gains

You are in peak accumulation years and able to contribute regularly over time

You want to reduce the short term tax impact of diversifying out of a large concentrated position.

You anticipate being in a lower tax bracket if/when you sell

You never plan on selling and utilizing stepped up tax basis or donating shares

Who Isn’t A Great Match For Direct Indexing?

It is also important to know who might not be a good fit for Direct Indexing.

If you don’t expect any significant capital gains in the future

If you already have a lot of capital losses

You don’t regularly contribute new funds

You don’t plan on utilizing stepped up basis

You will be in the same or higher tax bracket when you liquidate

Some other scenarios that can impact the benefit:

In FIRE you could end up with lower income and a 0% LTCG tax rate

LTCG rates could go up or down

If you pass the assets on to your kids under current laws the cost basis gets reset at death (referred to as step-up cost basis)

You re-invest your tax savings. I have seen investment companies use this in their calculations. I just don’t fully believe that this would actually happen. Particularly since most high earners will end up with tax bills so a slightly lower tax bill doesn't instantly lead to increasing investments by that amount.

August 14th FIREside Chat w/ Frec CEO

Join me and Frec’s CEO Mo Adham for a live FIREside chat and Q&A on August 14th. Mo will share the latest data the Frec team has put together on using direct indexing to diversify from concentrated positions in a tax efficient way.

Mo has some really interesting case studies that mirror real world scenarios FAANG workers go through.

I look forward to seeing you there, and thank you again Frec for sponsoring FAANG FIRE.

Now the real question: how likely is the benefit dwarfed by the risk that the Evolves/Synapses these companies use will one day lock my funds up indefinitely, like Yotta did?

I'm confused about how they are able to TLH every day, despite the 30-day wash sale rule.