Hey FAANG FIRE!

A large number of y’all are going to get a nasty surprise when you file your 2024 taxes this upcoming April. This is particularly true if you received a significant amount of your total compensation in RSUs.

It’s November, so there isn’t a lot you can do. But, do you know what sucks more than owing $50,000 to the IRS? Owing $50,000 to the IRS without having time to prepare.

But, do you know what sucks more than owing $50,000 to the IRS?

Owing $50,000 to the IRS without having time to prepare.

The FAANG FIRE Bookclub will be meeting this Friday at 12pm PST to discuss our latest book “How to Retire” by Christine Benz. The book club is limited to Paid Subscribers as well as those who attended the first book club meeting.

I’ll also be hosting an RSU 101 Workshop in early December. Paid Subscribers, be on the lookout for the invite shortly.

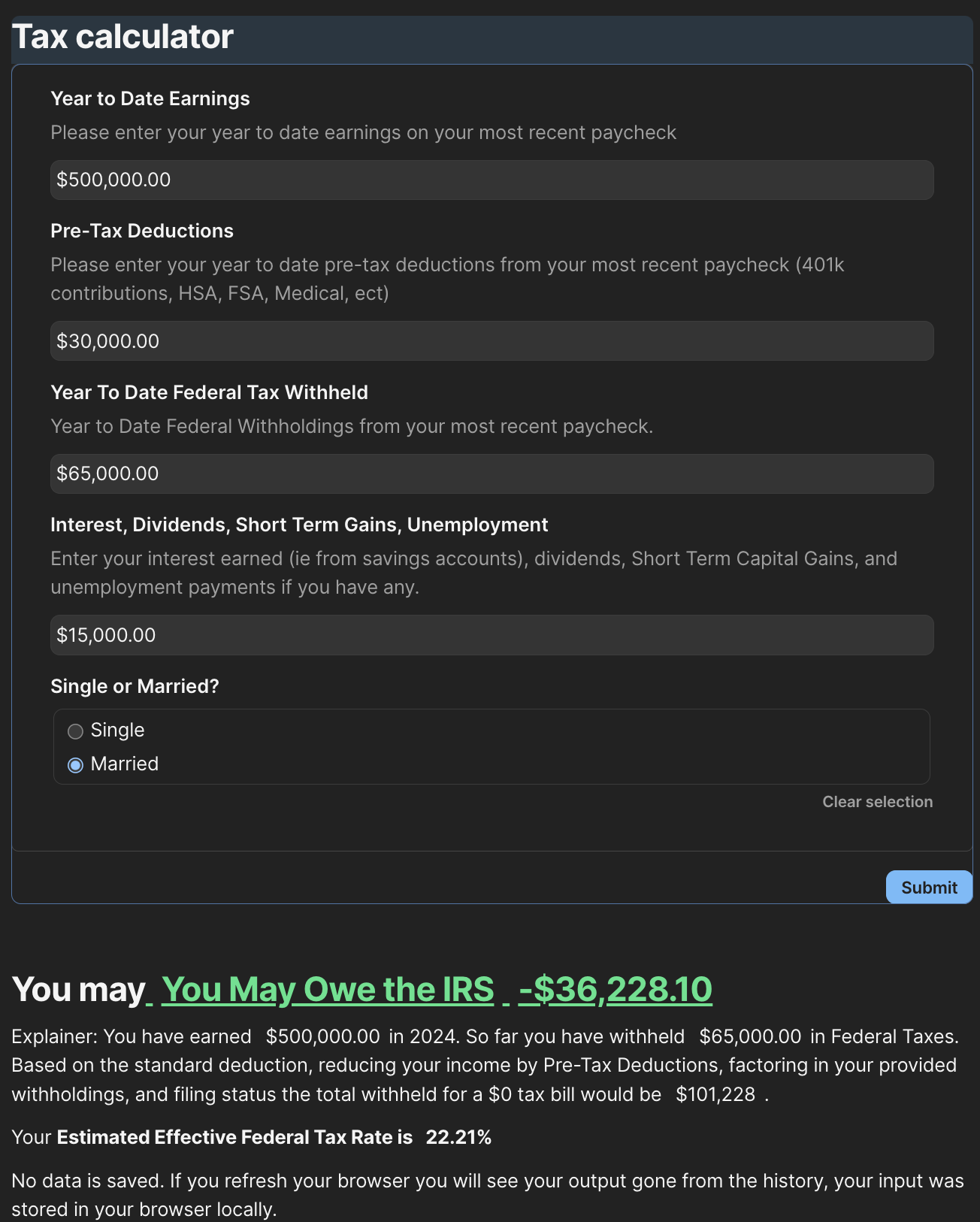

Estimating Your Tax Bill Calculator

Today I am going to share with you how to use a tool I created to estimate whether you might be in for a painful tax bill. Don’t worry though, I’ll also walk through what you can do to prevent this situation next year.

All information is provided for educational purposes only and does not constitute legal or tax advice.

I was annoyed that the online calculator I previously used to estimate my taxes wasn’t updated for 2024 tax data. So I decided to just build one myself. I wanted it to be simple and quickly answer roughly how much I might owe the IRS when I file my taxes.

Here is the free estimator: https://coda.io/@andre-nader/quick-federal-tax-bill-estimate-for-2024-faangfire

Calculator Walk Through

The Data Fields

When you open up the calculator you will be greeted by a simple form. Here are the descriptions of each field.

Year to Date Earnings

Overall earnings which includes Base Salary, Bonus, Imputed Benefits, and in my case Severance

Where to find this data: most recent paycheck

Pre-Tax Deductions

Deductions that reduce the amount of income subject to many taxes. Includes pre-tax 401k contributions, HSA, FSA, and Medical expenses withheld from payroll.

Where to find this data: most recent paycheck

Year to Date Federal Tax Withheld

Total federal taxes you have already given to the IRS. Only Federal, doesn’t include state, social security, or medicare.

Where to find this data: most recent paycheck

Interest, Dividends, Short Term Gains, Unemployment

All interest, dividends, and short term capital gains, and unemployment get taxed the same as income. Many have earned a decent amount this year from banks paying 5% interest, all this will need to be taxed.

Where to find this data: most recent paycheck, broker, bank

Single or Married?

This is your IRS filing status. It is used to determine whether to use Single or Married tax brackets as well as the standard deduction.

Filing Out the Fields

To get an accurate estimate you will want to use data from your most recent paycheck. If you are married, or had multiple jobs this year, add all the data together prior to entering into the form.

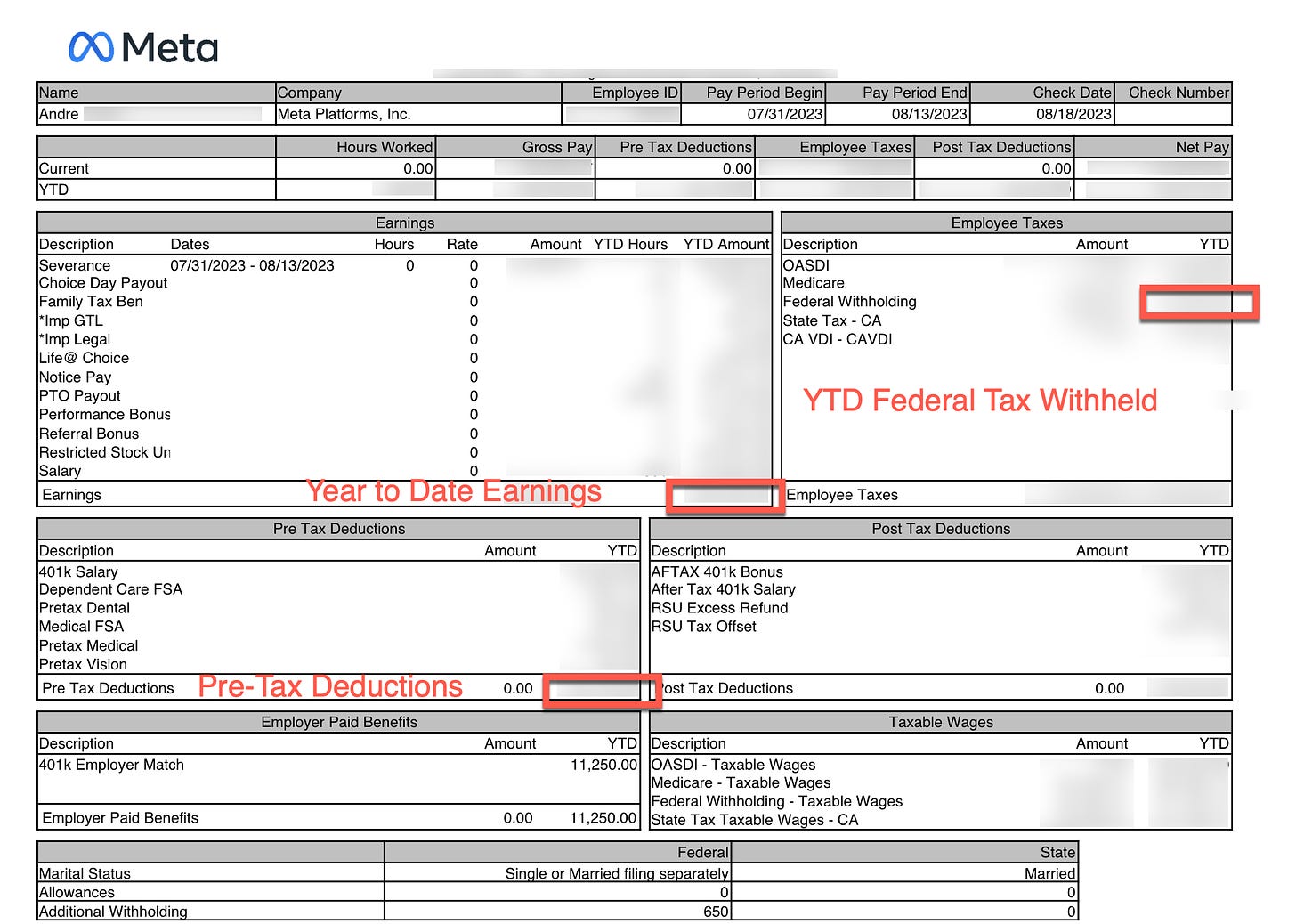

Paycheck

You will be able to get most of the information for the form from your most recent paycheck; Year to Date Earnings, Pre-Tax Deductions, and Year to Date Federal Tax Withheld.

Here is an example of what a Meta paystub looks like, with the data you need highlighted.

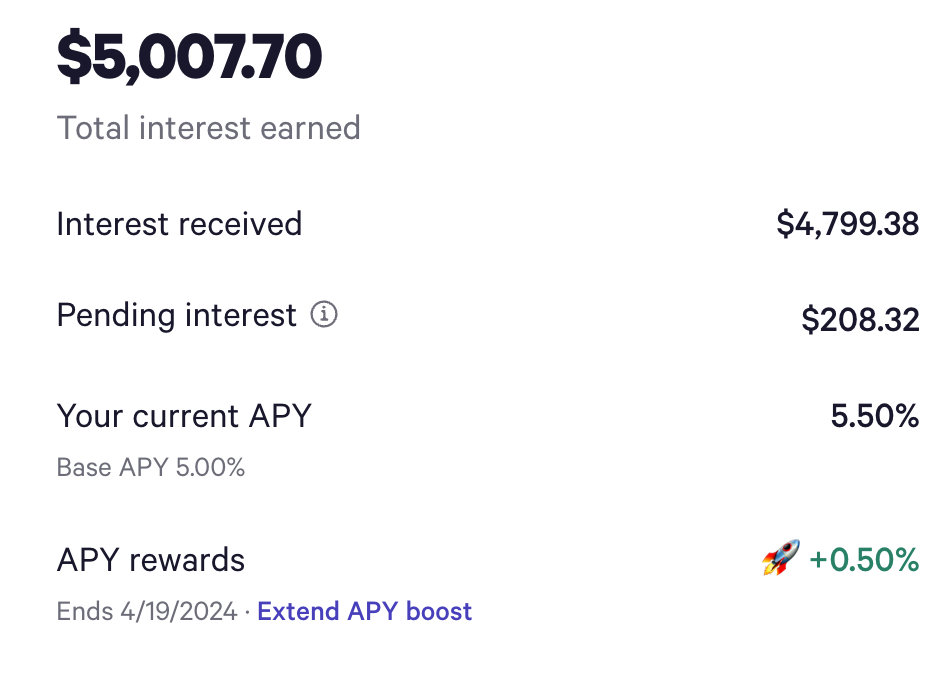

Bank Interest

If you are like me you also may have your emergency fund + additional savings earning >5% interest which will also be taxed as income.

I have the majority of my emergency fund in Wealthfront which currently earns me 5% thanks to their base of 4.5% per year + 0.5% “boost” thanks to those who signed up through my friend referral link (you will receive a .5% boost for 3 months). This should drop down a further 0.5% in the next few weeks since the FED lowered interest rates.

Dividends + Short Term Gains

If you have a taxable broker it is likely you will also have dividends. Many of the mutual funds I hold will pay their final dividends in the final weeks of the year.

If you have sold stock within your taxable broker as well as your RSUs for a gain, include the portion of your short term gains. (The calculator doesn’t currently factor in long term gains. I will add it in a future iteration.) Be sure to subtract out your losses if you sold some shares for losses.

Unemployment

If you were laid off and received unemployment benefits, remember that these payments are taxable. If you chose to have federal taxes withheld by the unemployment office, include this amount in the 'Pre-Tax Deductions' field.

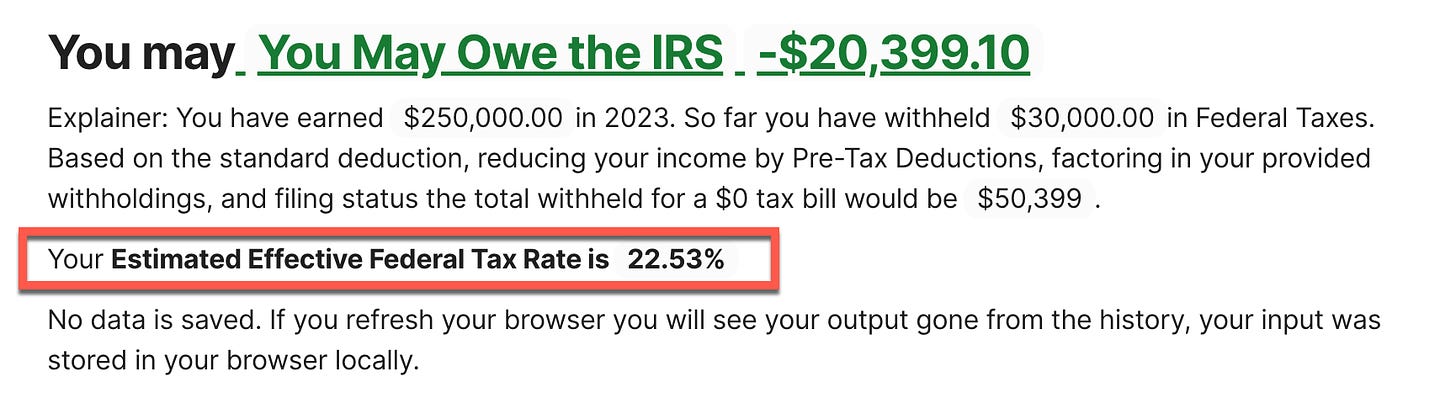

Calculator Output

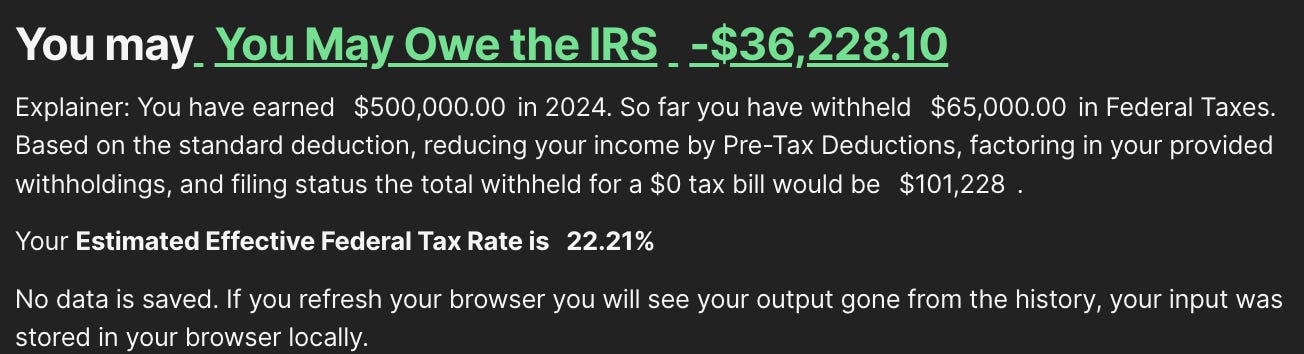

After entering all your information and pressing “Submit” the document will update with a quick summary and whether you might owe at the federal level or potentially be getting a refund.

Why Might You Owe The IRS?

First, take a breath! I know it can seem stressful if you owe a large amount. While it isn’t a fun surprise, know that it happens really often and you will probably not even owe very much in penalties. One of my first posts was on “Shocked by Your Tax Bill” (so hopefully those who have been following me are not shocked!).

Blame Bad Defaults

Taxes on RSUs are the #1 reason FAANG workers owe a large amount when they file. It all comes down to, what we in the product growth world would consider, bad defaults.

From the IRS perspective, Income is Income is Income. When you file your taxes, income from your base salary, bonuses, RSUs (value at vest) gets added up and taxed the exact same. You would think that since “Income is Income is Income” the IRS defaults would be simple… well they are not. Income is Income, but withholdings (the amount removed directly from your pay for taxes) can be different for Wages, Bonuses, and RSUs!

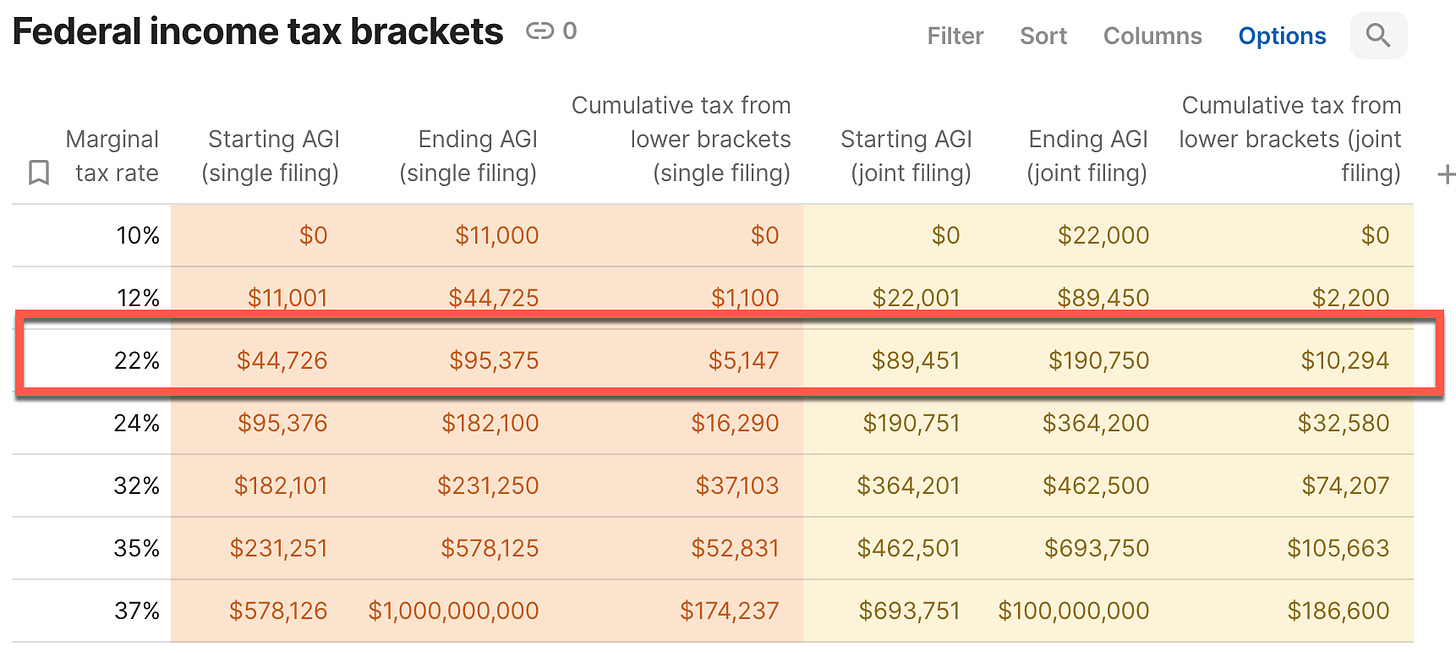

RSUs are referred to by the IRS as “Supplemental Wages”. The default federal withholding on RSUs is 22% unless you earn more than $1,000,000 then it increases to 37%.

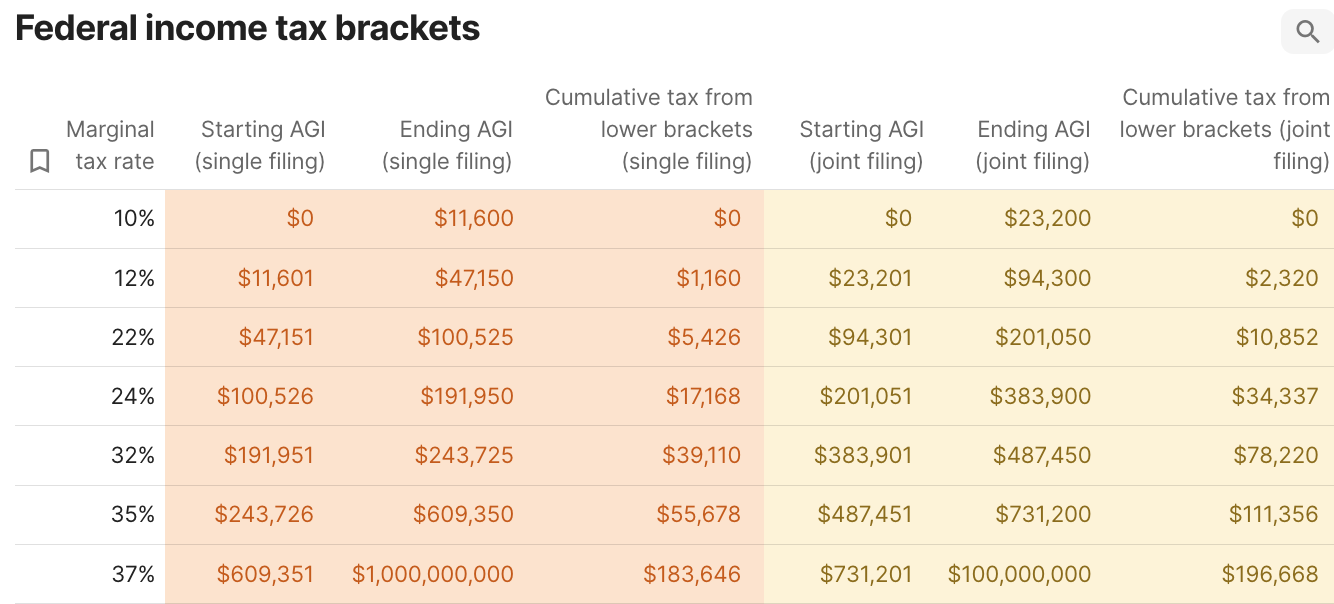

A very casual glance at the Federal Tax brackets should make it clear that 22% is simply not enough for anyone earning more than $100,525 while single or $201,050 married and filing jointly. This means that a new grad earning $100k in their first partial year of employment will have their RSUs withheld at the exact same rate as many directors (if they surpass $1M in compensation only then are the supplemental withholdings by default increased to 37%).

If you want to understand more about how federal tax brackets work, see my Federal Tax Explainer.

A Few Other Reasons

While bad defaults on supplemental earnings are the biggest cause for FAANG workers. It isn’t the only reason. Some other causes:

Incorrect W4 Withholdings: If you configured your W4 withholdings incorrectly, the amount taken out of each paycheck might not be sufficient.

Interest/Dividends: You earned a significant amount of money on your cash sitting in a high interest account and/or your hold stocks/bonds in your taxable broker that pay out significant dividends. (Keep those bonds/high interest funds in your 401k/roth see Tax Location vs Tax Allocation)

Capital Gains: Selling stock for a gain is subject to normal income tax rates if held for <1 year, and long term rates if held longer.

Side Hustles: If you have a side hustle and are not paying quarterly taxes

Is Owing Taxes Bad and are There Penalties?

The IRS has some scary language that says “If you don’t pay enough tax through withholding and estimated tax payments, you may be charged a penalty.” However if you keep reading you should sigh in relief:

“Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller.”

“If your AGI for 2023 was more than $150,000 ($75,000 if your filing status for 2024 is married filing a separate return), substitute 110% for 100% in (2b) under General Rule, earlier.”

That second bullet point above will be most applicable for many reading this. It states that if you made more than $150k last year, as long as your paid 110% of what you owed last year, you will not be subject to federal penalties for under-withholding. These are referred to a “Safe Harbor” rules for underpaying your estimated taxes.

So, even if you owe $50k in federal taxes you might not owe any additional penalties!

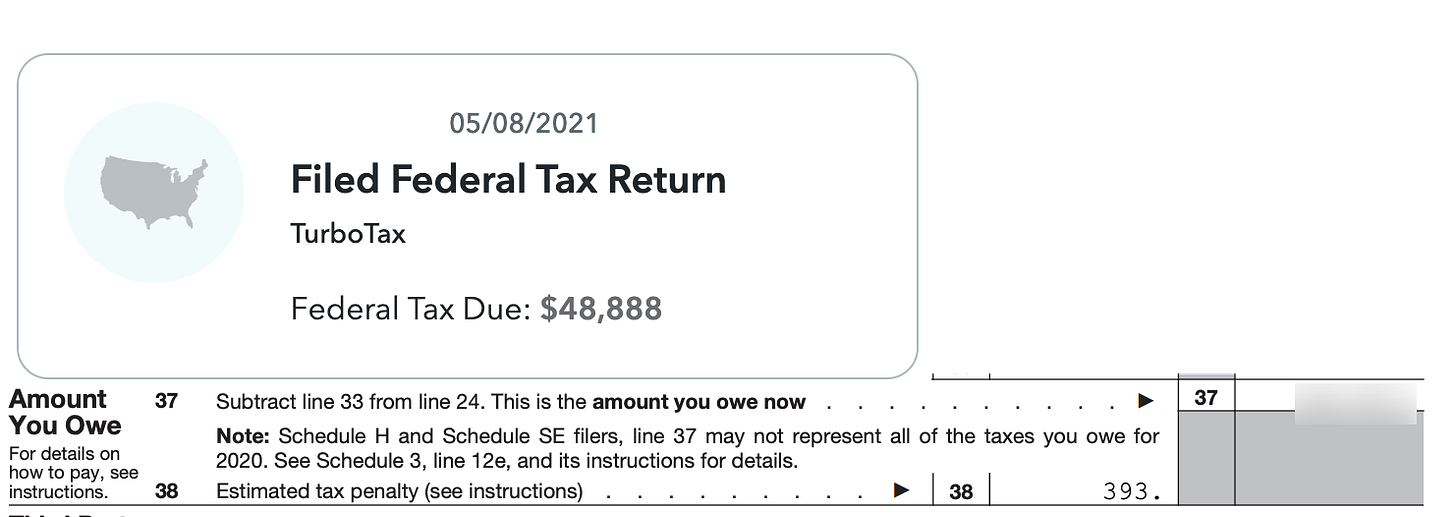

My personal tax bill history:

In 2019 I owed >$30k and paid $0 in penalties

In 2020 I owed $50k and paid $393 in penalties

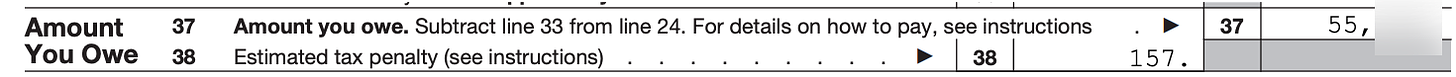

In 2021 I owed >$55k and paid $157 in total penalties

In 2022 I owed >$15k and paid $0 in total penalties

If you don’t fall under the safe harbor provisions, then you will likely be subject to more penalties in addition to interest on under withholdings which is currently 8%!

You are starring down a $50k bill due April 2024. Luckily your read FAANG FIRE and at least had 4 months to prepare for the bill!

How To Avoid Under Withholding in 2025

If you are walking through this section I want you to know that you are awesome. It is November 2024 and you are already thinking about how you can help your future self avoid the stress you might be feeling right now. You have 5 months to plan for your April tax bill and 12 months to avoid it from happening again!

Update Your Supplemental Withholdings

By now you know and understand that bad defaults, in the form of 22% supplemental withholding rates, are the cause of the majority of your tax bill. Luckily, many of you will be able to directly change this default.

Meta, Google, Apple, Uber all let their employees directly update their supplemental withholdings anywhere from 22-37% manually.

Meta Employees can change this in workday, search Life@ for "Federal supplemental tax rate election for RSUs" (Equity → Compensation)

Google Employees can access their settings by going to go/supplementalwithholdingelection

Uber Employees can update through Solium (Only available quarterly I believe)

If your employer doesn’t allow you to make this update; ask them to! Reach out to your benefits/RSU/payroll teams to let them know more and more companies are allowing their employees to update their supplemental withholding rate. They may not even be aware this is an issue and/or there is a way for them to add the functionality.

What to Change Your Supplemental Withholding Rate To?

The short answer: more than 22%. A good minimum starting point would be to use your effective federal tax rate based off your current taxes (or at least prior years taxes).

Effective Federal Tax Rate: Total Annual Federal Taxes Owed / Total Annual Income (less deductions). If you used the Tax Bill Estimator I updated it to include this quick calculation based on your provided data.

Halfway through the year I would again estimate your taxes (ask me to update the doc with 2024 tax rates :) ) and make adjustments going forward to make up for the shortfall. The optimal amount amount is somewhere between your Effective Rate and Marginal Rate (that you can pull from the table below).

Update Your W4

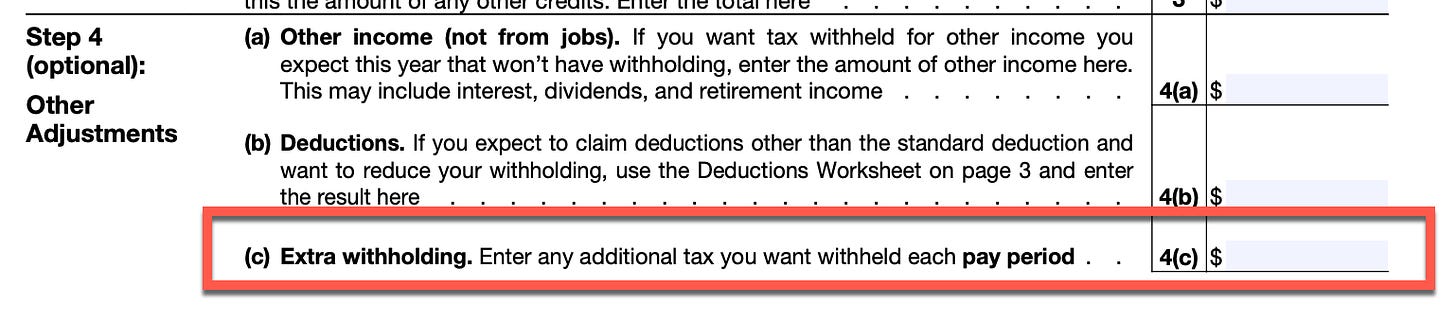

I would recommend always starting with your supplemental withholding rate if possible. If you can’t do that, the next best thing might be to update your W4.

It is important to know that no amount of playing with the number of withholdings will make up for a significant gap caused by supplemental withholding rates on RSU income. You will need to find the section on your W4 (available through your payroll provider) called Extra Withholdings. Whatever number you enter in this box will be taken out of each paycheck.

If you want to have your entire shortfall taken care of by the Extra Withholding on your W4 you can divide your total amount you of shortfall you owe in federal taxes (the shortfall between how much you withheld and how much your actually owe) by the number of pay periods your have.

Example: You estimate that you will owe $25,000 when you file in April 2024 and you get paid bi weekly (26 pay periods). $25,000/26 = $961.53. If you enter $961.53 additional dollars would be taken from each paycheck. Not super fun, make sure your cash flow prior to RSU vests/bonus are in a good place prior to this.

Paying Quarterly

Updating your W4 to have additional taxes taken out of each paycheck to make up for an under withholding on your RSUs can feel shitty and still be imprecise. Luckily there is yet another option, simply paying the IRS quarterly based on your actual estimated taxes owed. The US Department of the Treasury offers a free tax payment system through EFTPS.gov where you can submit payments.

All you need to to is log into EFTPS.gov every 4 months and complete an ACH payment. You can precisely calculate your current shortfall or just estimate the shortfall based on the prior year’s tax bill.

Closing Thoughts

With only a month remaining in 2024 there isn’t a tremendous amount you can do to lower your tax bill. In addition to estimating your tax bill, I would ensure you are fully taking advantage of all your tax advantaged accounts: Pre-Tax 401k, After-Tax 401k, HSA. While you are there, make sure your beneficiaries are up to date!

Here are my 2023 End of Year Tasks that will largely be the same this year:

If you're looking to jumpstart your financial journey into 2025 you may be interested in my 1:1 coaching https://app.practice.do/me/andre-nader.

My most popular packages is the "Path to Fire" package, which includes four meetings designed to set you on your path to financial independence. If you're interested in a 1:1 deep dive before the year ends, make sure to book this week. Our initial session, lasting one hour, goes through a comprehensive understand of your current landscape. This is an opportunity to lay a solid foundation for your FIRE journey.

Let me know what you think about the free Tax Estimator Tool in the comments or by replying to this email.

Bravo and kudos to you for building this tool. Getting precise tax estimates can be really difficult without specialized software or outside help, especially if you're implementing strategies that can significantly affect your taxes, like charitable giving, Roth conversions, exercising ISO/NSO, etc. One thing I'd mention is that nailing down your expected tax bill does more than just help you avoid penalties, it factors into your cash, investment, and financial planning strategies as well. For instance, if you don't know your tax bill precisely -- even if you are making quarterly payments large enough to meet the safe harbor -- you still may feel compelled to hold a lot of cash on the sidelines for any additional tax you could owe at tax filing. The more precise you can get about what you owe ahead of time, the better you can put your capital to use throughout the year, whether that's simply investing more, or buying property, renovating, etc.

Penalties are only calculated against the safe-harbor limits and not the actual taxes owed, right? If my estimated payments + w2 payments are within 110% of prev year's taxes then there is no penalty right?