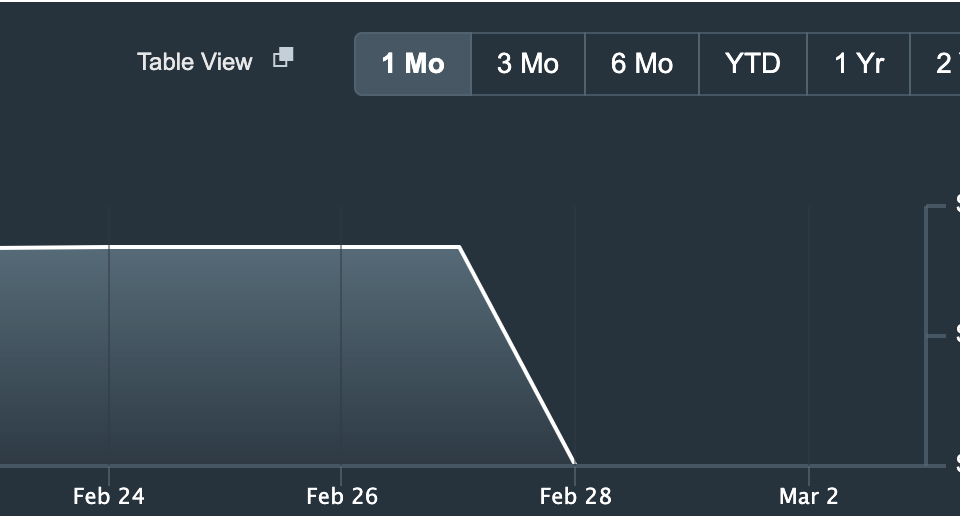

Last week as the Facebook/Meta trading window was closing I went into Schwab and sold every single share I owned. I now own ZERO Facebook shares outside of whatever is included in the index funds I hold.

Why did I do this? Don’t I believe in the long term vision of the company? No, it isn’t that. It is because this is what I always do. Every quarter when my Facebook shares vest I sell them immediately. I have done this each quarter for the past 7+ years only missing a handful of times where life got busy and I missed the trading window.

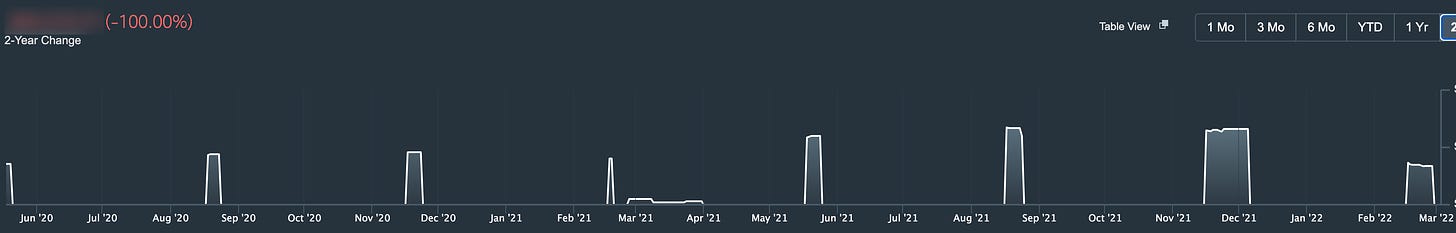

Take a look at the two year history of my Schwab account. Like clockwork. Facebook gives it to me, and then I sell it. (The funny movement in March 2021 was me moving some money into Schwab so I could then take advantage of the free wire transfers my account has.)

My reasoning is three-fold

1. The Real Question

Every single vest I ask myself the question “If Facebook gave me this exact amount in cash, would you use that cash to buy Facebook shares?” My answer to that question has consistently been “No, i’ll buy index funds”.

2. The Tax Angle

From a financial/tax perspective if I were to hold the shares of FB after a vest I would be saying “Yes” to the previous question. An RSU (Restricted Stock Unit) vest is treated just like salary from a tax perspective (with the exception of how much tax is automatically withheld, see “Shocked by Your Tax Bill” for more details on that distinction). Many people seem to get confused by this point and think they need to hold the stock for a year before saving on taxes.

Example

If you vest $10,000 worth of FB stock, that $10,000 is treated as income which you pay taxes on just as if it were part of your salary. If you sell that stock on vesting day for $10,000 you have exactly $0 additional gain/loss and wouldn’t need to pay any additional tax. If the price of the stock increased between when it was vested and when you sold it, you would then need to pay capital gains tax on the difference. For example if it increased to $10,100 you now have a $100 gain. This is where I think the 1-year tax confusion comes in. If you held the stock less than 1 year you pay “ordinary” tax rates, essentially just like your income. If you hold the shares for >1 year you instead pay long term capital gains tax rates which are between 15-20% for a FAANG worker.

3. My Meta Commitment

I still have a tremendous amount of buy-in in the form of unvested stock, which they refresh every single year (vesting quarterly over 4 years). In addition to my entire salary being tied to their ability to continue to perform well. I am happy with that level of exposure while using the RSU vesting as an opportunity to diversify away some of that concentrated exposure. I am not selling because I don’t believe in Meta and the vision. The reason I have been here nearly 8 years is a testament to that. I really think this is a company that isn’t afraid to completely re-invent themselves and continuously innovate.

At the end of the day it is a very personal decision, but I would encourage you to make sure you are thinking about it from a logical perspective.

What is your philosophy on equity vesting? Do you hold forever or sell everything?

That's how I do it too!

I prefer to avoid concentrating my income and wealth with my employer and diversify. The double whammy of the stock going down and the risk to my job is something I can't stomach.

That's a great topic! I think what's you're doing is perfectly rational. I sell 80% every vesting cycle to minimize my regret :-) on aggregate it worked well for me the last 10 years as fb/Google (my two employers) outperform the market substantially, but it also means that I have huge exposure to tech... So net net probably just better to do what you do and autoinvest it