Holding Vested Stock vs Diversification Look back

An analysis into holding your company vests vs instantly diversifying

I have always instantly sold my FB shares as soon as they vested. When asked why, my answer was always “I sell it as soon as they give it to me and toss it into index funds. I believe in the future success of the company, that is why I work here. All my unvested shares continue to ensure I have significant skin in the game. Plus, I work in tech. My wife works in tech. We live in San Francisco, which skews heavily influenced by tech. I sleep better with the reduced volatility that comes from diversification.”

But man did I still have that FOMO. Especially when I saw FB pass $350, all I could think about was my initial grant of $66 shares. I had multiple friends over the years mention never touching their vests. They all must have vastly outperformed my boring index fund strategy. Or have they? I wanted to actually run the numbers to see how much I might be missing out on. As usual I created a Google Sheet that you can use to compute your own scenario.

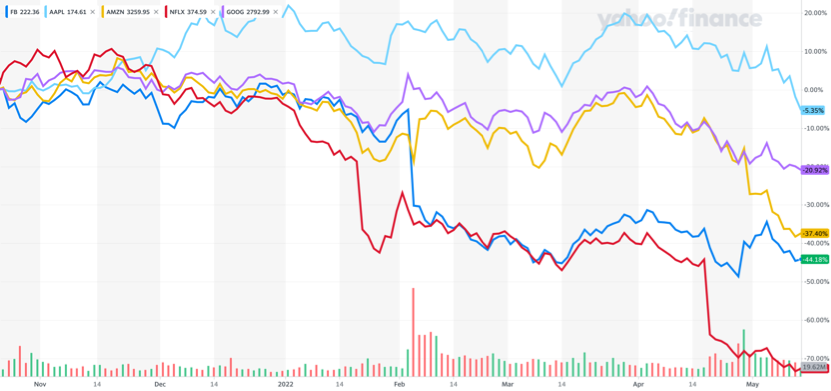

Obviously tech stocks across the board have taken a beating this year. None of the FAANGs were safe (some have fared better than others, looking at your Apple!). I didn’t only look at this year, I took it back to when I first started at Facebook in 2014. I also did the same for my partner’s Uber equity for another comparison.

Before you jump into the spreadsheet I would appreciate it if you subscribed. After you subscribe you can reply back to your email confirmation number with any questions you had or if you needed help running this for your own situation. I would love to be able to include a few more companies.

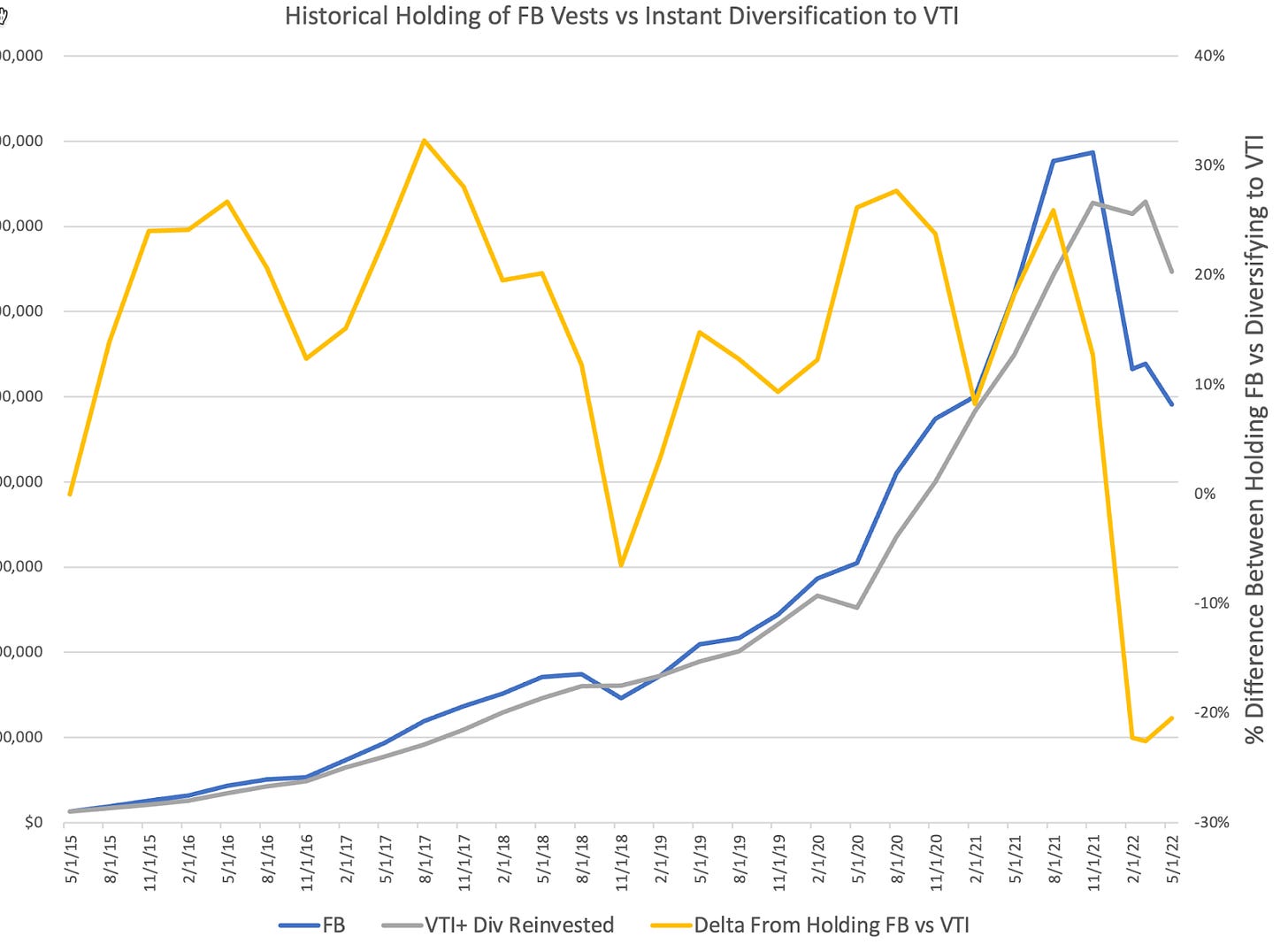

My Personal Equity: VTI vs Diamond Hands with FB

When I first joined FB in 2014 my starting equity grant was based on a share price of $66 (FB currently trades ~$200). At the time RSU grants had a 1 year cliff where 25% of the grant would vest, followed by the remaining grant vesting quarterly. Facebook updated things in 2018 where all grants instantly begin vesting quarterly. Each year I would receive a “refresher” which would increase as I became more senior. It hasn’t always been the smoothest ride but I can’t complain too much about the trajectory.

Overall FB Performance during my tenure.

Let’s take a look at how I did by instantly diversifying.

Boom! I out performed those diamond hands by 20%, as long as I don’t look at 80% of this graph my FOMO is gone.

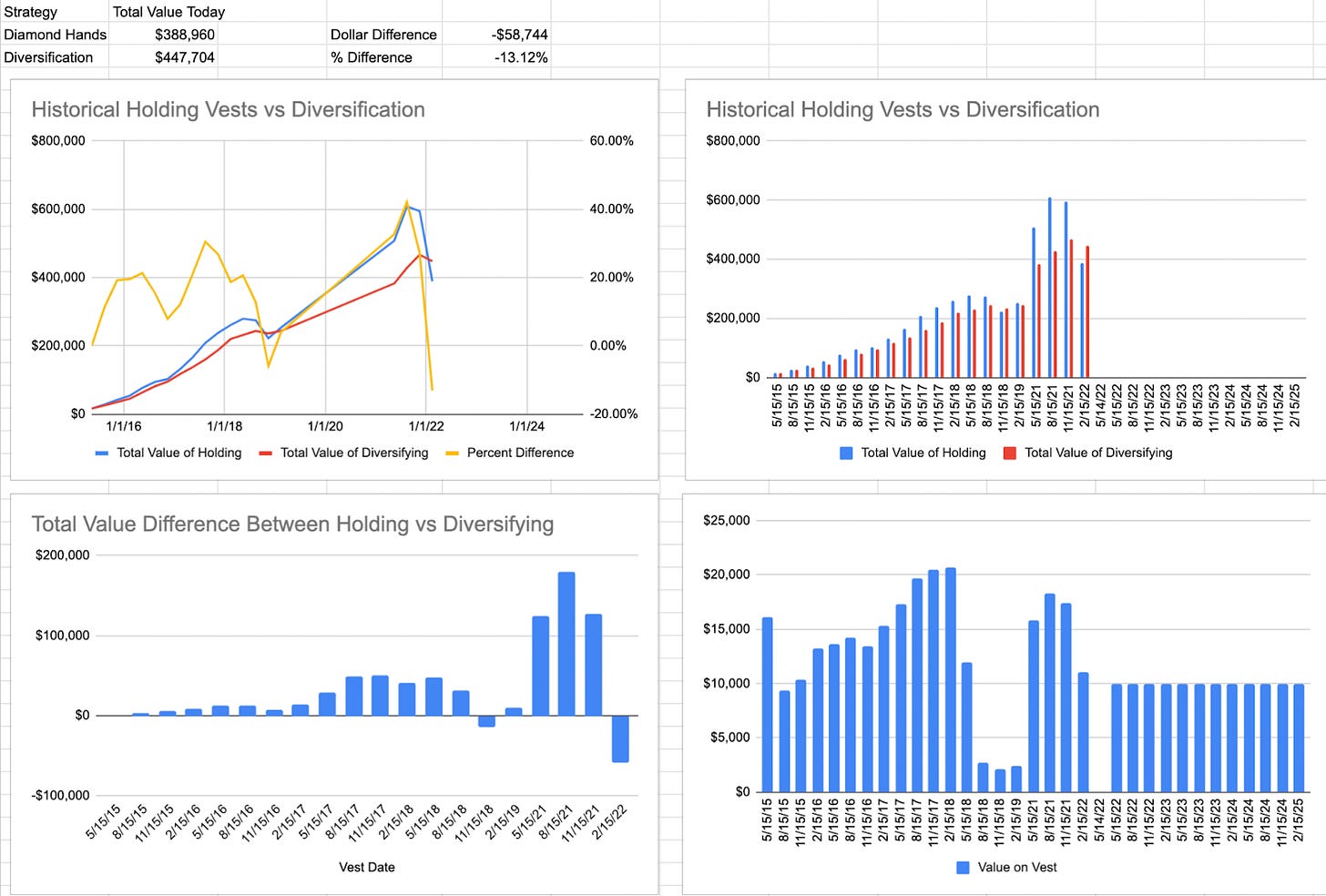

The left axis shows the total value if I never sold my FB shares each vest vs instantly selling and buying VTI, a ETF by Vanguard representing a low cost total market fund. The right axis is the % difference between the two strategies. As you can see, historically the strategy to hold FB out performed my diversification strategy by ~20% on average. Things have flipped beginning in mid-2021 where the diversified strategy began to overtake FB. 2022 kicked the tech industry hard and as of right now the diversification strategy is outperforming by 20%! For a $1,000,000 FB balance that would mean a $1,250,000 VTI equivalent.

These numbers are very specific to my personal situation. These results could look very different even for another Meta employee due to differing equity grants. Also in the above scenario I did include dividend reinvestment, however in my sharable spreadsheet I didn’t since it added considerable complexity. Dividend reinvestment for my personal situation increased the total amount by ~4.5%.

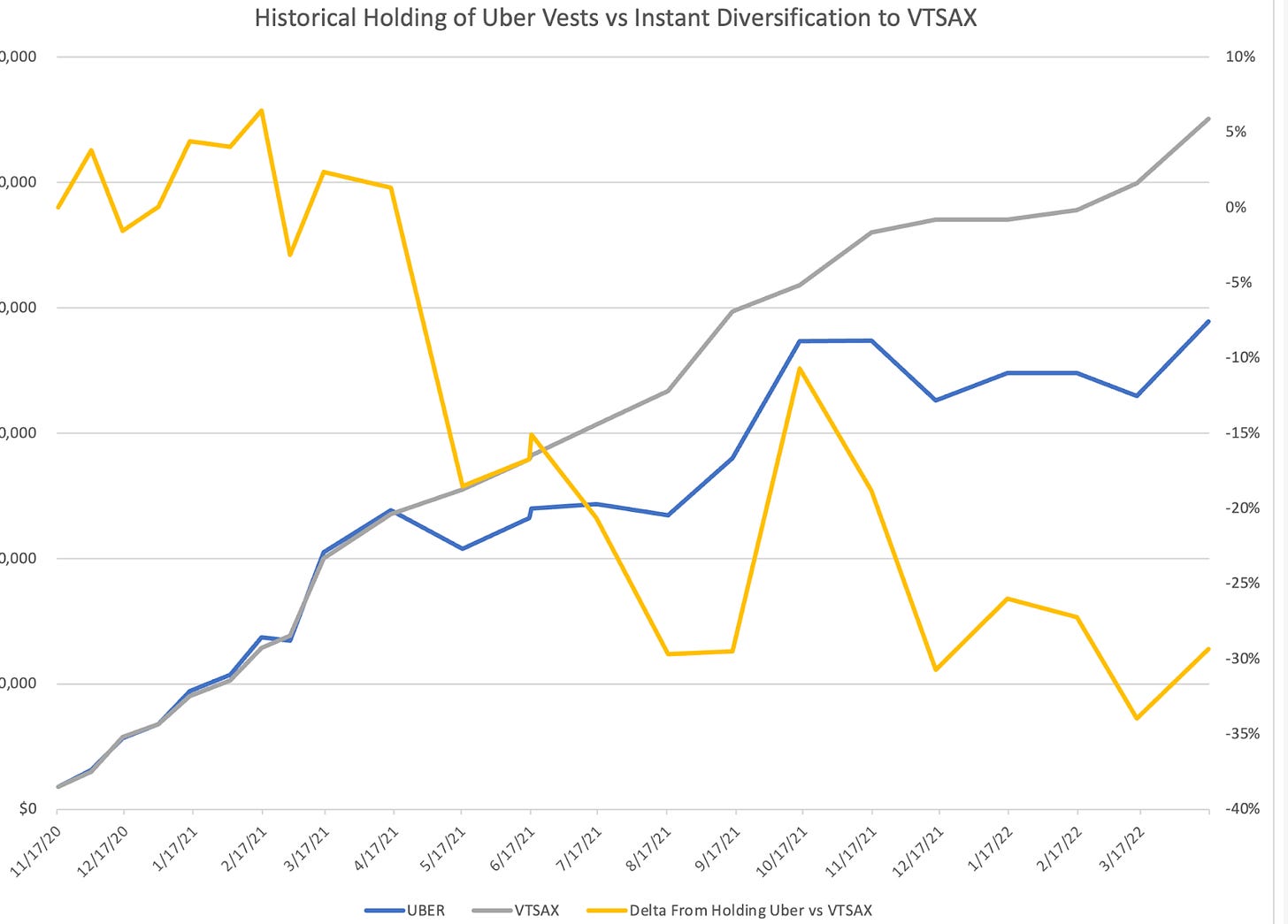

What About My Partners Uber Vests?

My wife has been with Uber >5 years, thus joining before the IPO. Let’s just say that their stock has behaved with a little more volatility.

Let’s just say that the pandemic impacted Uber’s share price disproportionately relative to the broader market. In this case the diversification strategy would have yielded 30% more. This calculation doesn’t factor in dividends.

Compare Your Scenario

November 2022 Update! I refreshed the Hold vs Diversify dashboard and made it even more powerful by creating a full RSU Dashboard.

Want to calculate this for yourself? Make a copy of my RSU Hold vs Diversification Google Sheet and update it with your personal vests.

Example Output with some Realistic Dummy Data:

To get the output above all you need to do is update doc with your vests and the workbook should do the rest. This is my first time in awhile playing with Google Query plus there is definitely some janky logic that could break. If you run into issues or have questions just reply back and I can take a look.

Looking for 1:1 FIRE coaching?

Partner with me to identify your FIRE goals and create an action plan on how to achieve it. Over the course of 4 sessions we will outline your personal goals, how to make a plan to reach those goals, create a 2 year projection of your income and savings personalized for you.

Articles from around the web:

Vested shares usually takes 24 - 48 hours to show up in your account. Is that the case with yours too, Andre? I heard if you sell on the same day, you can avoid being taxed at the short-term rate, but given vested shares don't show up immediately in the account, I wonder what your tax strategy is. I'm also interested in the ESPP vs. vested RSU diversification approach.

Having worked at Uber, I can resonate with the second half of your article. It's going to be a while before the share price is back at the initial $40

Quick note: I joined Facebook in 2017, and I still had a one year cliff. It was updated during 2018 for employees joining after Jan 1, 2018 (I clearly remember how annoyed my teammate that joined in December 2017 was about this).

Separately, I really wish there were low cost ways to reverse custom index (basically buy VTI minus $FB), since it would theoretically let people salve their FOMO without losing as much diversification. Tools definitely exist for custom indexing, but AFAIK they haven’t made their way down to the low fee world yet.