Don’t Forget Tax Day

Today is April 15th, Tax Day! It is one of the few times each year when everyone collectively thinks about their personal finances.

If you owed a significant amount this year, take the time to understand why. That way you can either take steps to reduce the bill or be prepared for it next year. Reading my article “Shocked by Your Tax Bill?” is a great starting point.

Remember, owing the IRS money isn't a bad thing. But being surprised by a huge tax bill definitely can be.

For those who still need more time, you can file an extension both federally and at the state level until October 15th. You will still need to pay your estimated tax bill on April 15th though, which requires you to do 98% of the work needed.

I personally sent in my checks before heading off on vacation—and filed an extension as I am still waiting on a few more forms to arrive.

3 Biggest Tax Mistakes FAANG Workers Make

I am fairly confident that most tech workers are absolutely capable of filing their own taxes. Especially if you just have a W-2 job with RSUs and 1099s. It is basic data entry with a few things to keep an eye on. The available software out there will walk you through everything step by step. But there are a few gotchas that FAANG workers in particular should look out for that are easy to trip up on.

The Holy Trinity of Common FAANG Tax Filing Mistakes:

#1 Incorrect Backdoor Roth Entry

This has tripped me up twice! If you do backdoor Roth IRAs (this doesn’t include Mega-Backdoor Roth), be extra careful when entering this information into the software. Keep an eye on the "estimated amount owed" in the software as you enter the information. A Backdoor Roth that is properly entered should result in $0 in additional taxes. If your taxes increased after entering it, there is a submission error. See How to Properly Enter a Backdoor Roth into TurboTax.

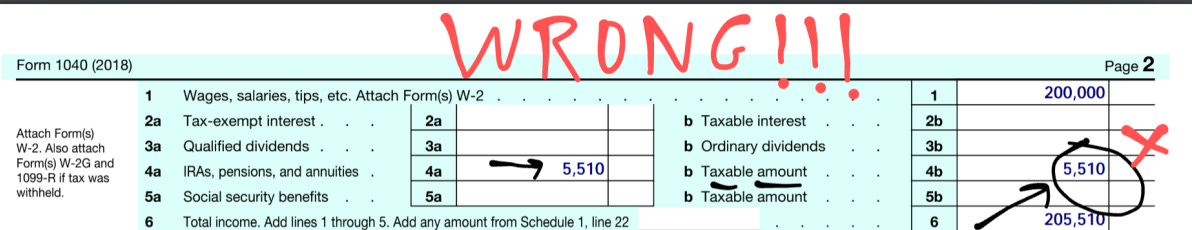

Quick way to check past returns: Look at your 1040, field 4b. If it is $0 you are good. If it isn’t you may have made this mistake.

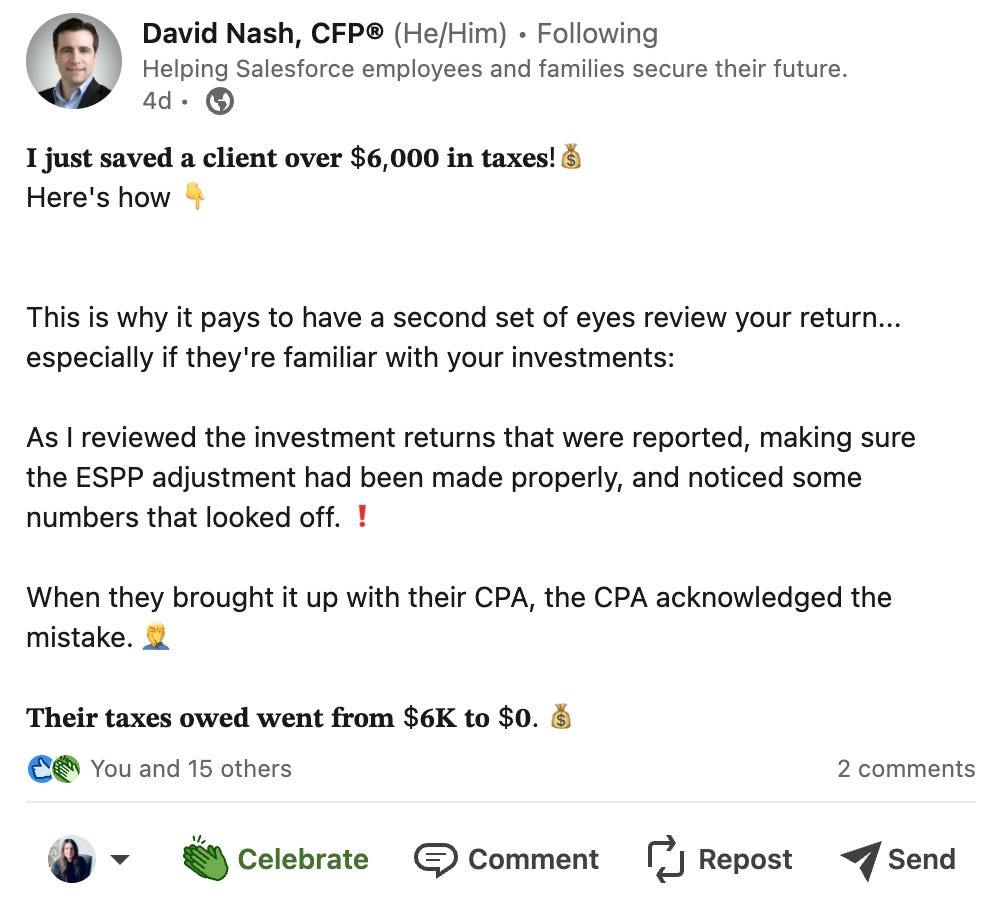

#2 Missing ESPP Cost Basis Adjustments

If you sold ESPP shares, the income from the discount is included in your W-2. Then, your broker will also show your cost basis with the discounted purchase price resulting in being double taxed on the discount! See How to Properly Enter ESPP Sales into TurboTax.

Quick way to check past returns: If your W-2 includes ESPP income check to see if the adjustment is made on IRS Form 8949.

#3 RSU Cost Basis is $0

When importing your 1099 from your broker on your RSU selling on some occasions the cost basis incorrectly is reported as $0. This will result in the tax software thinking the entire RSU sale is a 100% a gain, resulting in significantly more taxes. This is becoming less common, and tax software is getting better at warning you about this.

Quick way to check past returns: Scan through your 1099 Cost Basis column for any $0 values.

You should look for these 3 mistakes whether you file your taxes yourself, OR if you utilize the services of a CPA (sometimes even the pros make mistakes).

If you make one of these mistakes, remember you have three years from the date you file to correct them. Don’t run off and give your CPA a hard time on April 15th.

Also, to be clear, I deeply value CPAs, particularly when your tax situation is more complicated than just W-2s and 1099s or you experienced a significant change.

Now that I have income from 1:1 Coaching and this newsletter, I’ve been researching self-employment taxes—a world that I am simply not very familiar with. This year might be the first I engage with a CPA to ensure I’m doing everything correctly and not leaving money on the table due to lack of knowledge—if you have any recs, send them my way.

Have you run into a different tax filing error in the past? Did you catch one of these on your return? Do you have any recommendations for me on CPAs who are strong in tech and self-employment?

-André

Backdoor Roth IRA has definitely tripped me up especially when I did prior year contributions. Note to self: don’t procrastinate backdoor roth! Just make the contribution in the correct year