Volatility Is Back on the Menu

Note: This post was originally drafted August 5th 2024. By the time I was ready to post the market had recovered! Well, what do you know. One month later we are seeing another bout of volatility, so I wanted to revisit this post.

The main takeaway I want you to have is: Beware of those peddling fear, uncertainty, and doubt. Create a plan you can stick with. Focus on your long term goals. Most of the short term stock market movements will look like small blips a decade from now.

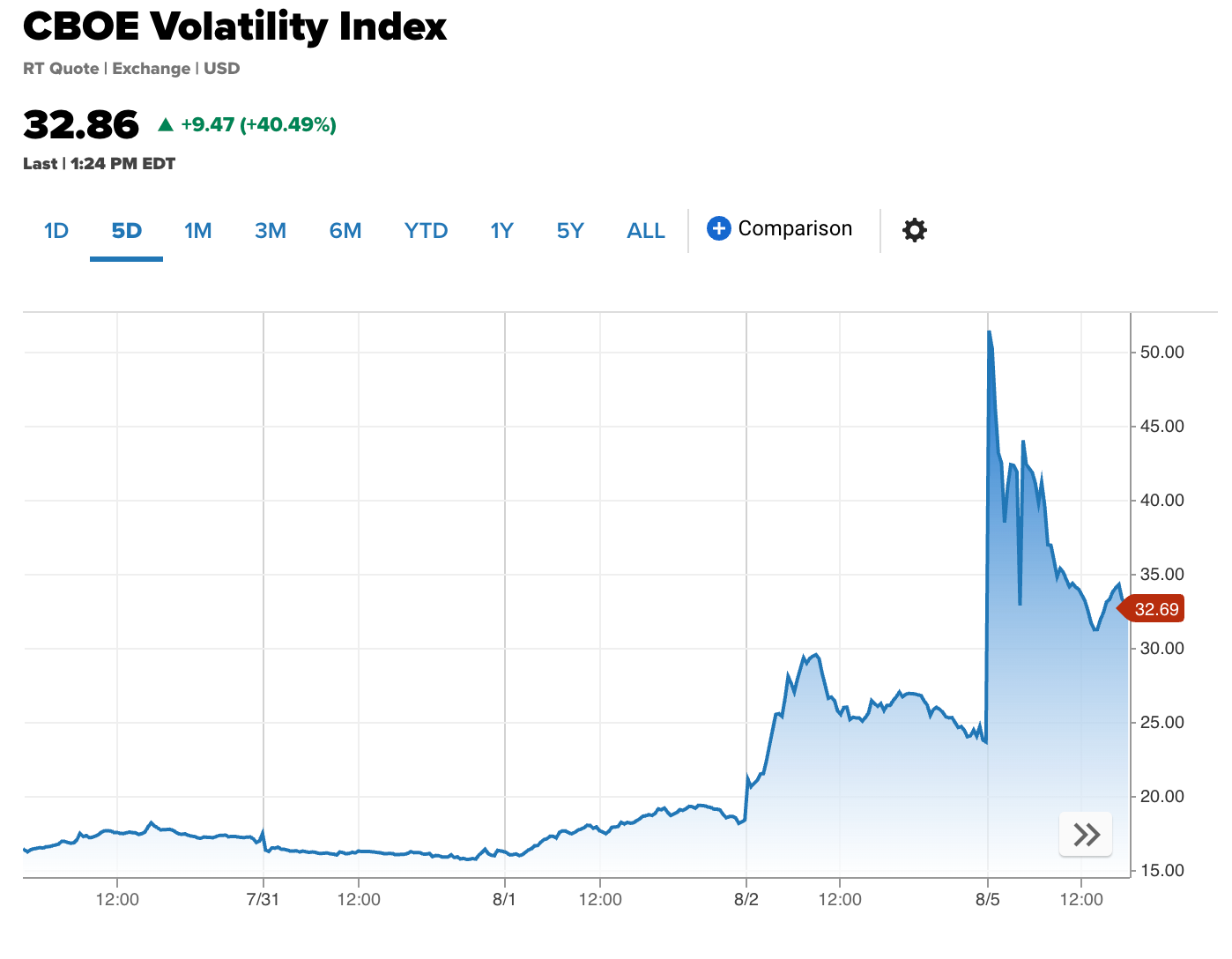

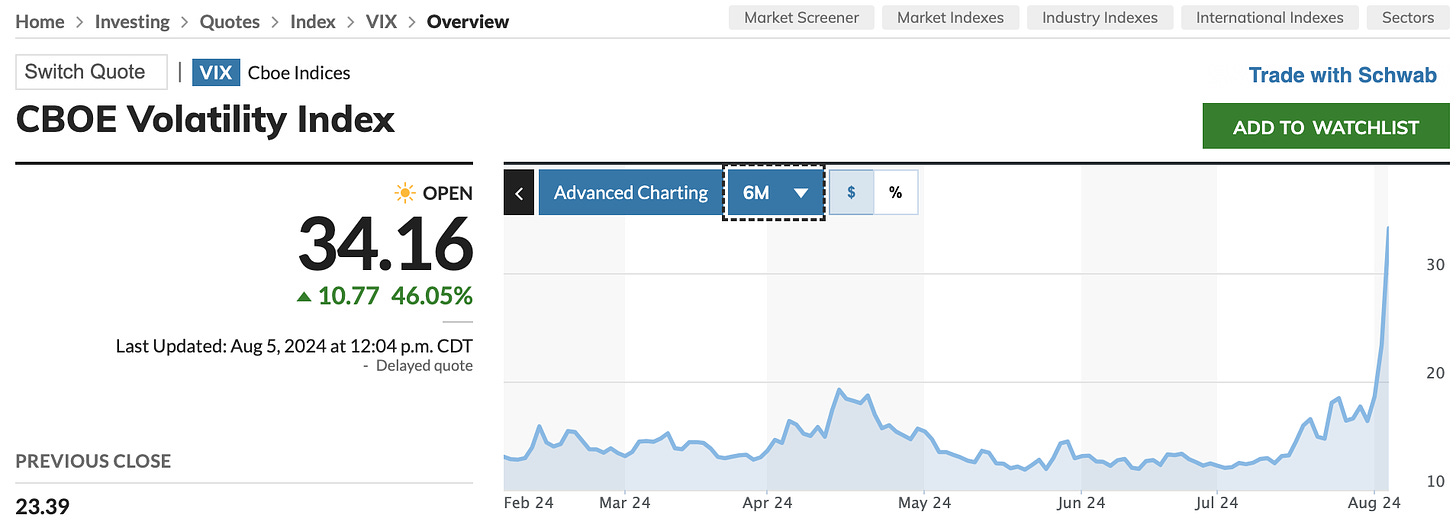

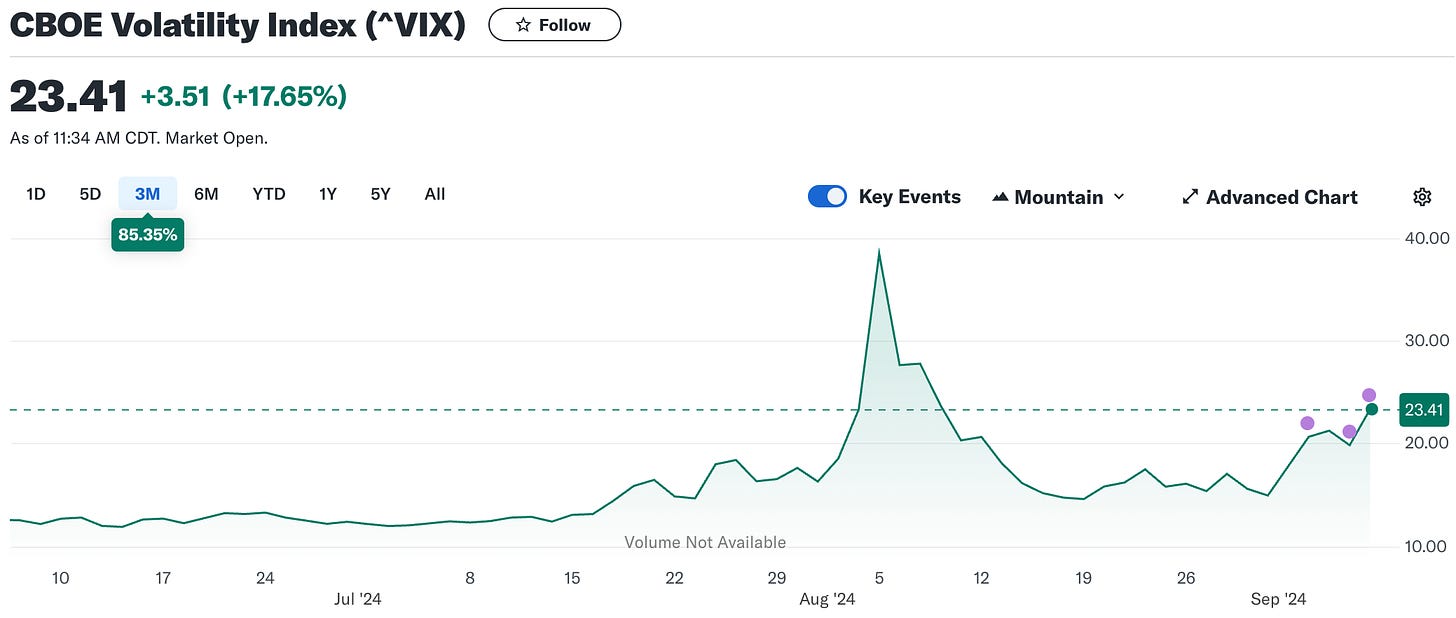

It looks like volatility is back on the menu. Think of volatility as large fluctuations in stock prices, both up and down. One measure of this volatility for the S&P 500 is the “VIX”.

The VIX explained: “The Volatility Index or VIX is the annualized implied volatility of a hypothetical S&P 500 stock option with 30 days to expiration. The price of this option is based on the prices of near-term S&P 500 options traded on CBOE.” -TD.com

It’s often called the “fear index” because it tends to rise when investors expect market turmoil.

This morning the VIX touched on highs it hasn’t seen since the covid pandemic:

So what is a FAANG FIRE follower to do?

If you are a true practitioner of FAANG FIRE, nothing changes. This is simply another day. Acknowledge the feeling, we are human after all, and try to make sure you are thinking about the big picture.

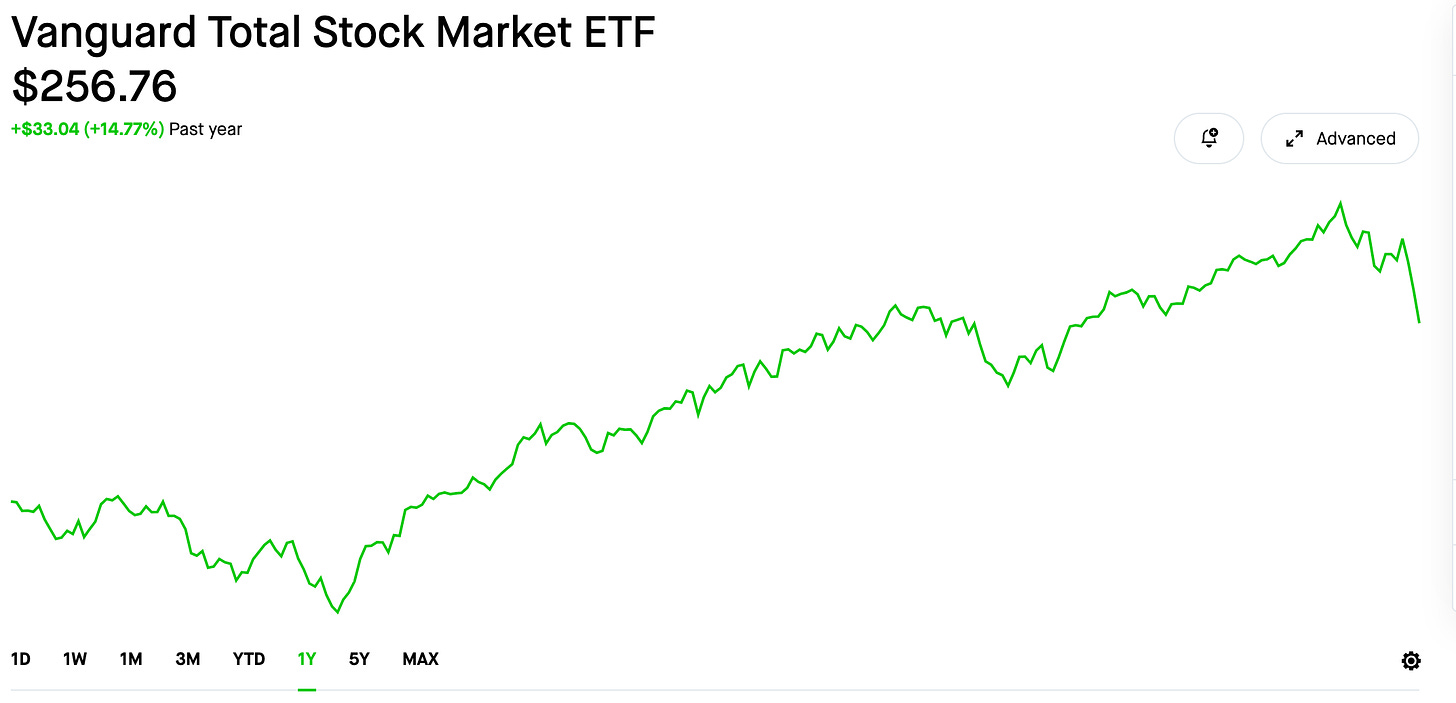

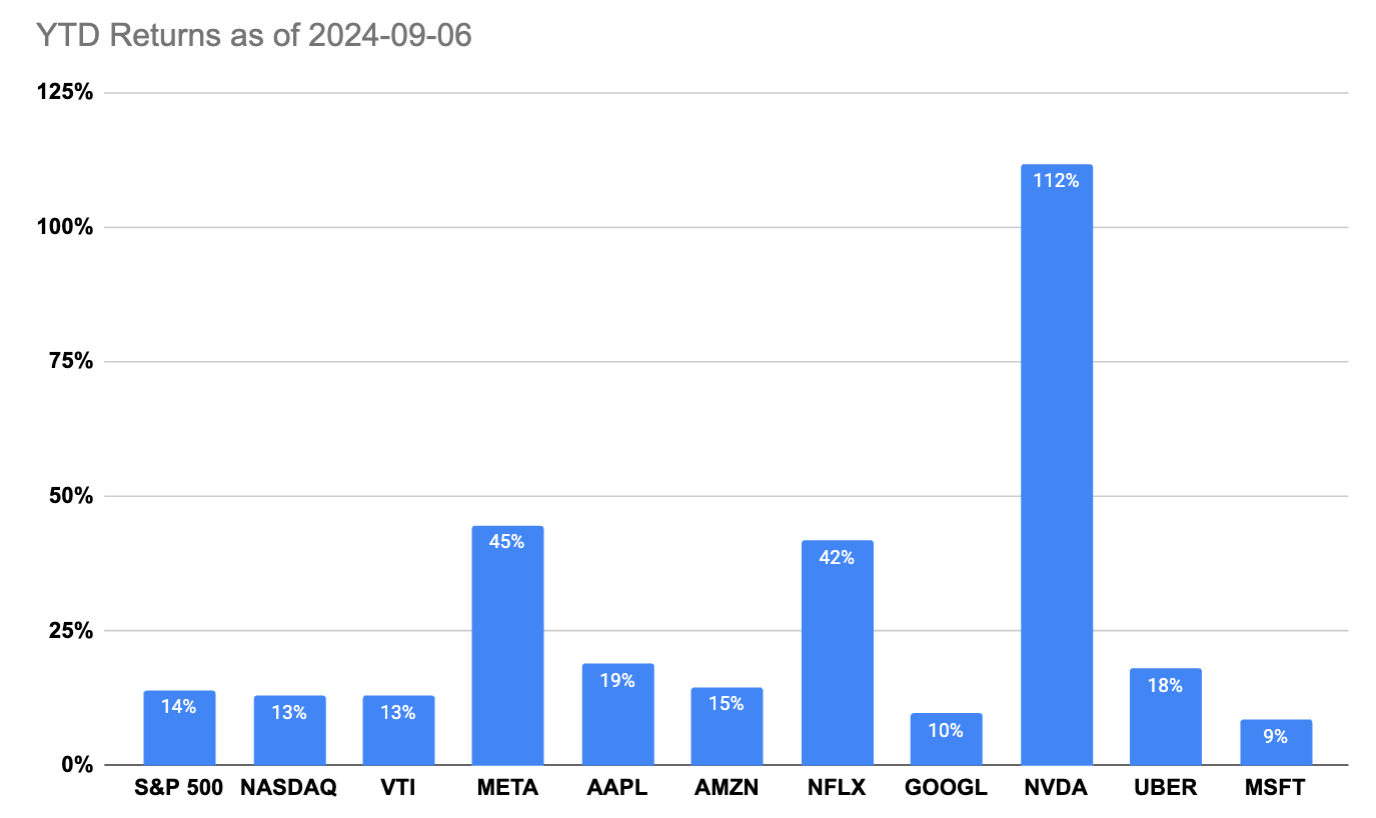

This starts with Zooming Out! So far, 2024 has been a pretty great year for stocks.

Vanguard’s Total Market Fund, VTI, is still up more than 14% on the year.

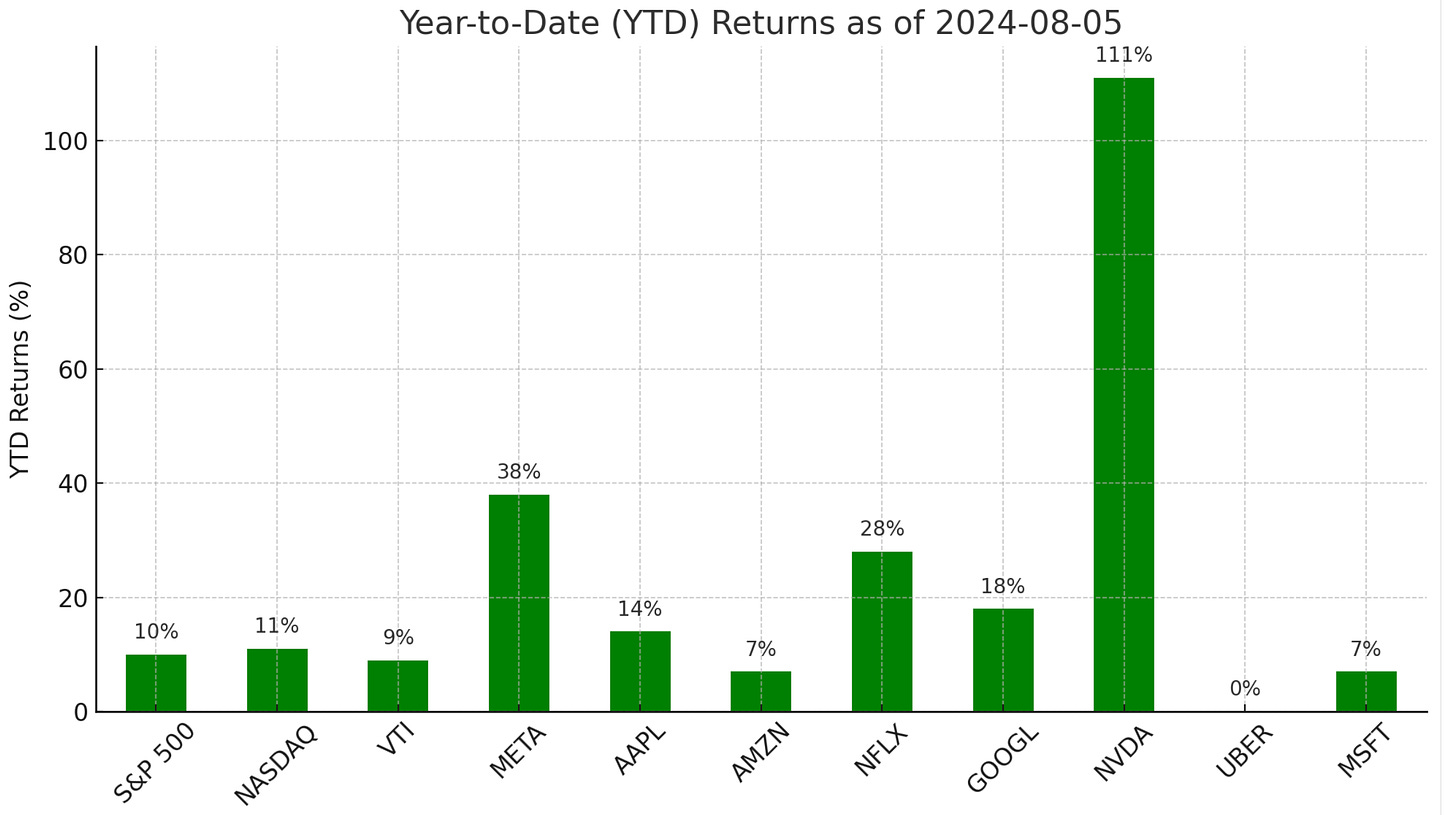

Since most of my readers are within tech (FAANG heavily represented), the Year to Date returns are also broadly positive.

That doesn’t mean it feels good to see more than your annual salary whipped off your overall net worth in a single day. To see your upcoming RSU vest decreasing in value every single day.

It is in moments like this, where we might be feeling punched in the gut, when you really can assess your risk tolerance. Being highly concentrated in a single stock makes you feel like a rock star when things are going well. When things fall off the cliff even faster than they increased, you feel less well.

I just caution you not to fall into the trap of “The Panic Approach” to selling your RSUs.

The Panic Approach is what happens when someone is doing the Sell Nothing approach but realizes that after their company stock drops 50%, they need to do something. They then sell everything while the stock is down, but once the stock starts going up again, they go back to the Sell Nothing approach. -5 different approaches to selling RSUs

Come up with a plan that you can stick to!

September 6th Updates

A few updated graphs:

Worth noting that every single company is higher than they were a month ago other than Google.

I don’t have a crystal ball. I don’t know what the market will do in the short term. I do believe that we will see a lot of volatility for the rest of 2024, with spikes both up and down. We have a presidential election, constant stream of mixed economic signals, interest rate cuts, another round of earnings in November.

Beware of those peddling fear, uncertainty, and doubt. Create a plan you can stick to. Focus on your long term goals. Most of the short term stock market movements will look like small blips a decade from now.

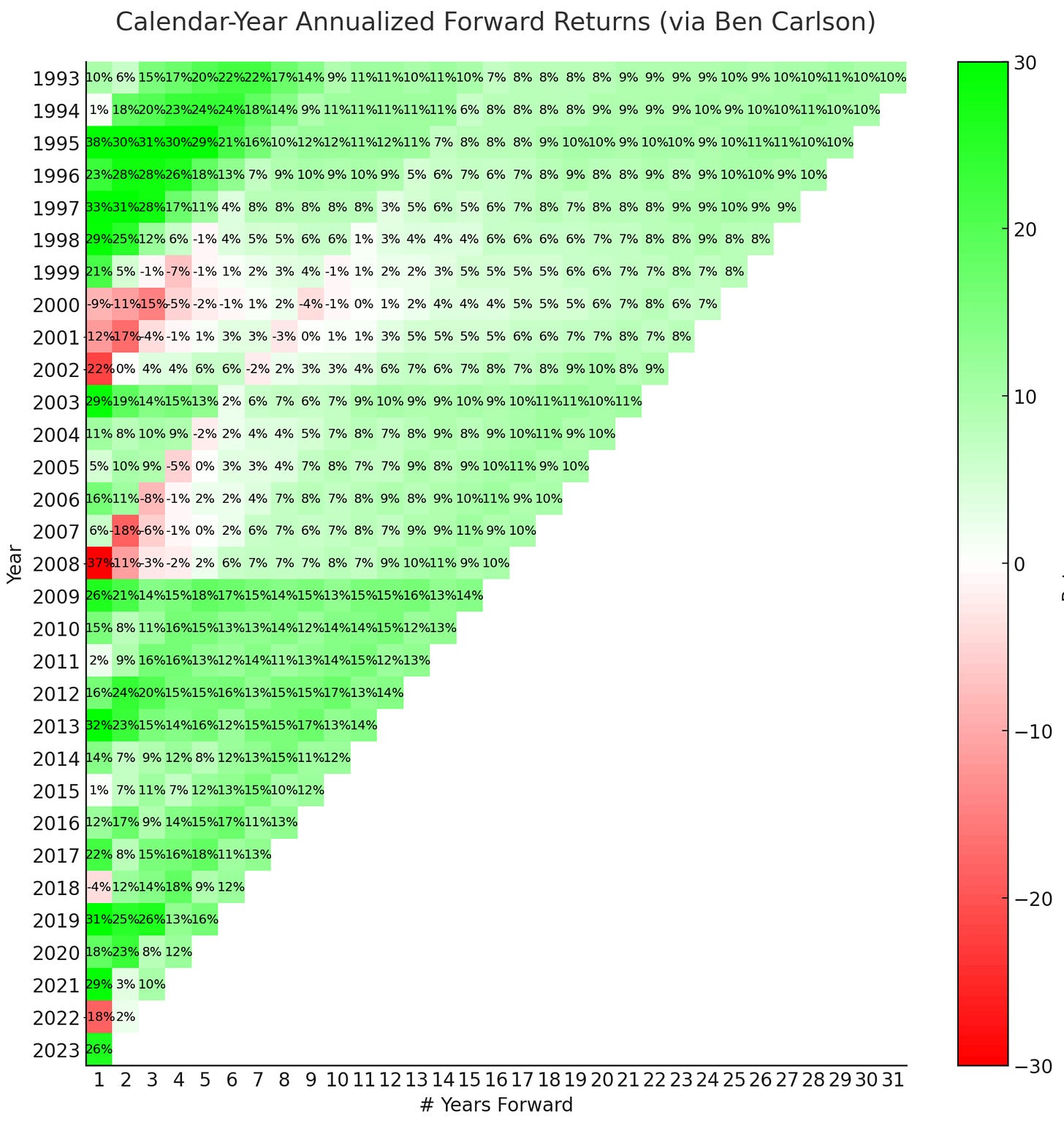

I’ll close with 31 years of S&P 500 returns. This is a slight modification to Ben Carlson, CFA's chart for his post from his excellent A Wealth of Common Sense blog.

"I don’t know what the returns will look like over the next three decades. But I am confident there will be plenty of risk, downturns, geopolitical crises, scary headlines and economic contractions. Regardless of what returns the stock market produces in the future, thinking and acting for the long-term remains the most sane strategy for investors."

-Ben Carlson

Keep thinking long term.

-Andre